Tesla Soars After Beating Expectations As It Burns Another $900MM In Cash

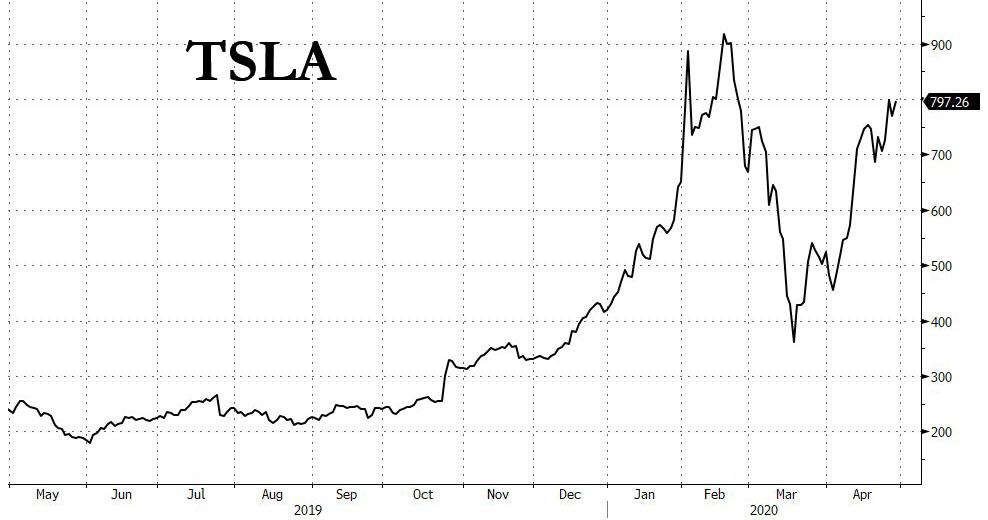

With Tesla stock staging a remarkable comeback from its March crash lows, and after doubling in the past month now trading at $800/share…

… a market cap just shy of $150BN which makes Tesla bigger than every other car company in the world except Toyota (which is where it is because the BOJ is buying its stock)…

… has prompted two questions: i) are Tesla retail investors simply unfazed by the coronavirus panic, and ii) what continues to cause Tesla’s stock price to soar over the last couple of weeks while the company has been completely idled.

One thing is certain: unlike all of its automaker peers, the coronavirus pandemic has for some inexplicable reason not had an any effect on Tesla’s stock price. While analysts and institutional investors remain focused on Tesla’s 2020 cash flow and potential ideas for boosting demand, but it appears retail investors simply don’t seem to fear the virus’s impact on the company.

So with Tesla reporting earnings today, there is some hope to get some answers whether Tesla is indeed priced to perfection, and whether Tesla is indeed somehow immune to the pandemic, here are the results:

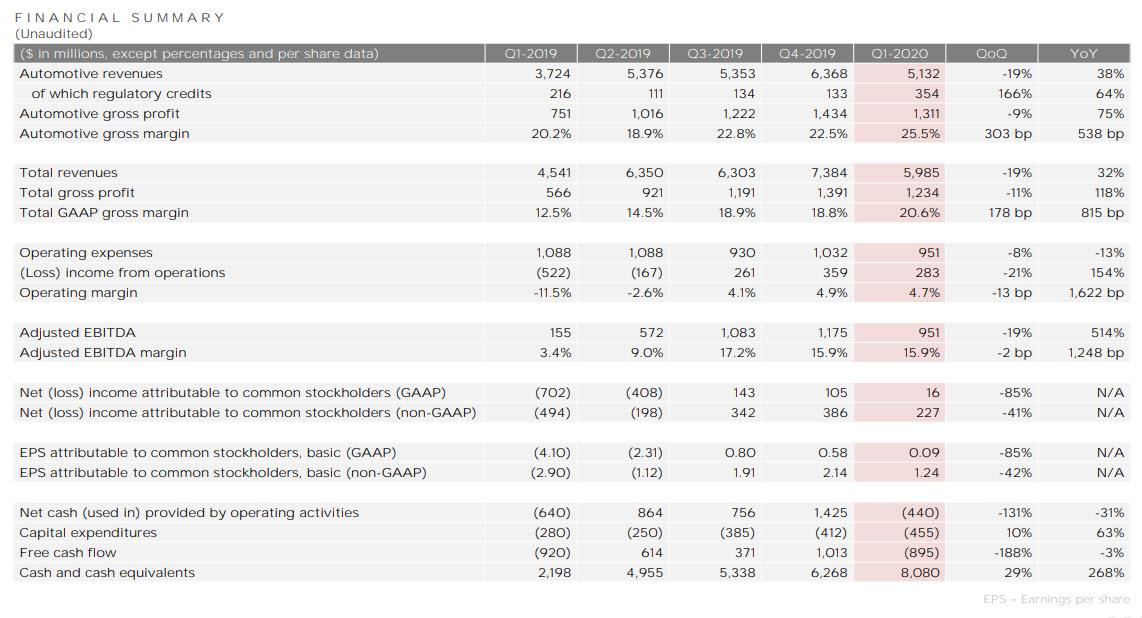

- Q1 Rev. $5.985BN, beating the estimate of $5.81BN, and up 32% Y/Y largely thanks to the Model Y and Shanghai deliveries.

- Q1 GAAP operating income of $283MM; 4.7% operating margin

- Q1 GAAP net income of $16M; $227M Non-GAAP net income (ex-SBC)

- Non-GAAP Q1 EPS $1.24, beating the estimate Loss of ($2.90), even though basic EPS was just $0.09

Here are the results summarized:

And visually:

Commenting on its revenue, in Q1 Tesla reached its “highest ever revenue for a seasonally slower first quarter as our total revenue grew 32% YoY.” Sequentially, revenue was mainly impacted by lower deliveries, with Tesla explaining that this was driven primarily by limitations on our ability to deliver vehicles towards the end of the quarter. Tesla’s ASP declined further as the mix continues to shift from Model S and Model X to the cheaper Model 3 and Model Y.

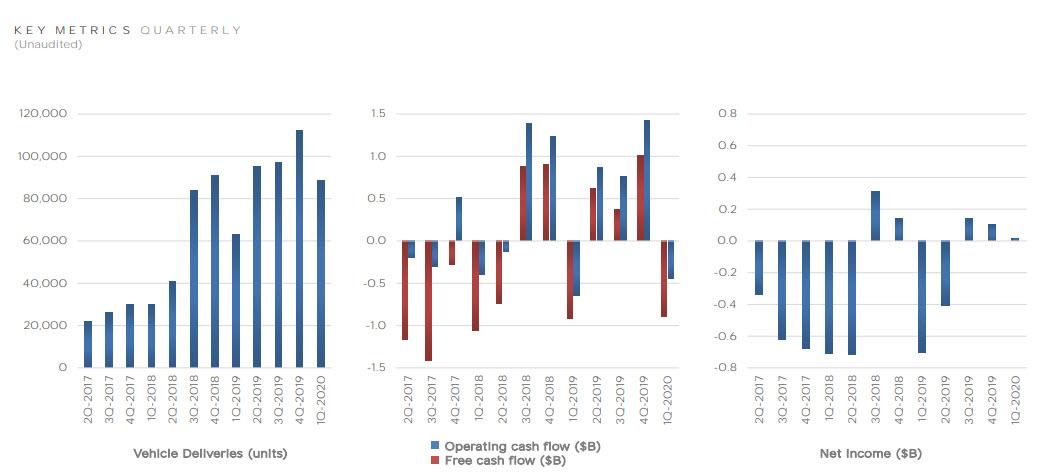

Tesla also announced that this was the quarter in which for “the first time in our history that we achieved a positive GAAP net income in the seasonally weak first quarter. Despite global operational challenges, we were able to achieve our best first quarter for both production and deliveries.”

The reason for the profit: Gigafactory Shanghai, with the company saying that “further volume growth resulted in a material improvement in margins of locally made Model 3 vehicles. In addition, Model Y contributed profits, which is the first time in our history that a new product has been profitable in its first quarter.”

As a reminder, the company said back in 4Q 2019 it was expecting to be positive GAAP net income going forward. However, the impact of COVID-19 seems to have changed that. From the earnings release:

It is difficult to predict how quickly vehicle manufacturing and its global supply chain will return to prior levels. Due to the wide range of potential outcomes, near-term guidance of net income and free cash flow would likely be inaccurate. We will again revisit our 2020 guidance in our Q2 update.

That said, of the company’s $16MM in GAAP net income $354MM was from regulatory credits (a big jump from $133MM in Q4), so excluding those, the company actually had a $338MM loss.

Looking ahead, Tesla didn’t reaffirm its previous guidance but did not give a new number either, blaming suppliers for any potential shortfalls:

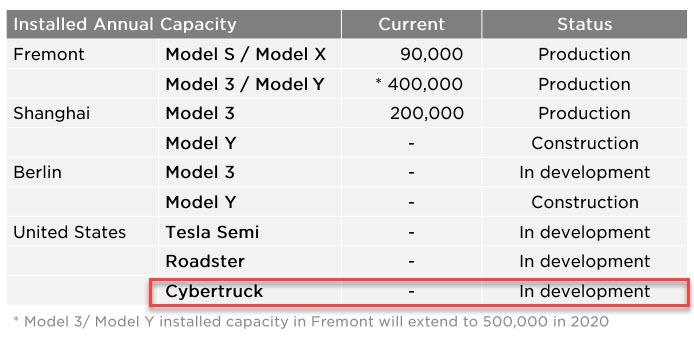

“We have the capacity installed to exceed 500,000 vehicle deliveries this year, despite announced production interruptions. For our U.S. factories, it remains uncertain how quickly we and our suppliers will be able to ramp production after resuming operations.”

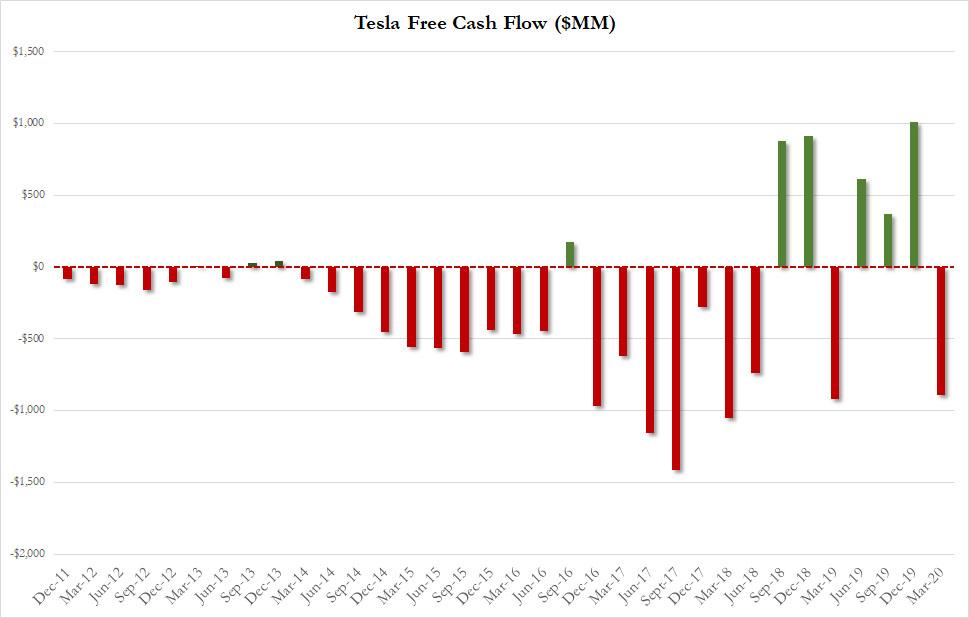

On to more important things, such as the company’s historic cash burn, unlike last quarter when in its earnings presentation Tesla for the first time added a chart proudly showing vehicle deliveries juxtaposed against Free Cash Flow, this time there was no such chart for one reason: the company’s cash burn made a triumphant return, with the company reporting $895 in negative cash flow in Q1.

Commenting on the cash burn, the company said that “sequential inventory growth impacted our operating cash flow negatively by $981M, which was primarily attributed to the interruption of our operations at the end of the quarter.“

Despite the cash burn, Tesla said that thanks to the $2.3BN capita raise, the company set another record high cash balance at $8.1 billion.

And speaking of cash flow, the company said that its “near-term cash flow guidance is currently on hold” even as it continues to “significantly invest in our product roadmap and long-term capacity expansion plans as we have sufficient liquidity. Model Y production lines in Shanghai and Berlin remain our most important near-term projects.”

A quick note on something bizarre: there was not a single mention in Tesla’s investor letter of either coronavirus or covid. Perhaps the company really is immune to both the virus and any mentions thereof. There was however a passing reference to the pandemic:

“It is difficult to predict how quickly vehicle manufacturing and its global supply chain will return to prior levels.”

“For our US factories, it remains uncertain how quickly we and our suppliers will be able to ramp production after resuming operations. We are coordinating closely with each supplier and associated government.”

Commenting on its product suite, the company said that it expects that production of both Model Y in Fremont and Model 3 in Shanghai will continue to ramp gradually through Q2, and is “continuing to build capacity for Model Y at Gigafactory Berlin and Gigafactory Shanghai and remain on track to start deliveries from both locations in 2021.” Lastly, Tesla said it is shifting its first Tesla Semi deliveries to 2021 which is odd since the company hasn’t even selected a factory for Semi production.

Tesla also provided an update on Gigafactory Berlin: the company says it’s about to break ground on the construction phase of the site. The company says it’s on track to start delivering Berlin-built Model Y SUVs in 2021.

Oh, and as for that Cybertruck, well there was just one mention: in the company’s installed annual capacity table.

Commenting on the company’s earnings, Wedbush analyst Dan Ives said it’s all about profit. Ives concedes uncertainty remains around COVID-19, but says Tesla investors are looking beyond the near term and through to the June quarter. Courtesy of Bloomberg:

“Musk and his red cape did it again. The profitability picture is much stronger than feared. The missing piece in the puzzle was around profitability and around the fundamental profile, given the COVID headwinds. The bulls could take this and run. You could likely see a four digit stock. It’s true. No one knows what the next ten minutes will be let alone the next few months. Tesla investors are looking past the June quarter. That’s how Tesla investors are playing this stock.”

Gene Munster chimed in too, tweeting that “Tesla surprises on gross margin. GM improvement is a sign that Tesla is building a sustainable business. Auto gm ex credits of 18.6% beat expectations 16.8%. Reason is Shanghai made in China Model 3 improved since Dec-19, and now are “approaching level of US made in Model 3.”

Tesla surprises on gross margin. GM improvement is a sign that Tesla is building a sustainable business. Auto gm ex credits of 18.6% beat expectations 16.8%. Reason is Shanghai made in China Model 3 improved since Dec-19, and now are “approaching level of US made in Model 3.”

— Gene Munster (@munster_gene) April 29, 2020

Following the earnings results, which at least superficially beat all expectations, the stock initially tumbled then surged,c and was up more than $60/share at last check, rising to $862.

Tyler Durden

Wed, 04/29/2020 – 16:38

via ZeroHedge News https://ift.tt/3aV5ZyM Tyler Durden