China PMIs Expand For 2nd Month After February Crash, But Real-Time Indicators Paint Different Picture

And just like that, China’s February swoon is ancient history.

After Beijing reported a dramatic rebound in March PMIs from the February crash which saw both the manufacturing and service PMIs tumble to record lows, it was virtually guaranteed that the April data would confirm a continuation of China’s “solid recovery” trend.

After all, it has now become a political race between China and the US over whose economy is more unscathed as a result of the coronavirus pandemic as the Global Times editor in chief Hu Xijin made abundantly clear today when in response to the latest US GDP print, tweeted “Already fell 4.8% in Q1, will definitely be worse in Q2. How will President Trump explain? I guess he would say the figure is better than expected and is so much better than any other country in the world.When China sees positive growth rate in Q2,he would say the number is fake.”

Already fell 4.8% in Q1, will definitely be worse in Q2. How will President Trump explain? I guess he would say the figure is better than expected and is so much better than any other country in the world.When China sees positive growth rate in Q2,he would say the number is fake. pic.twitter.com/PN10JicZKI

— Hu Xijin 胡锡进 (@HuXijin_GT) April 29, 2020

Well, Trump certainly wouldn’t be the first to accuse China of fabricating numbers, especially in light of the latest official PMI numbers of out China which showed manufacturing dip from 52.0 to 50.8, missing expectations of 51.0 yet still in expansion territory; at the same time the Nonmanufacturing PMI printed at 53.2, up from 52.3, and well above the 52.5 consensus estimate.

But would Trump be right if accusing China of also fabricating its PMIs which show the economy now well in expansion territory for a second month? For the answer we go to real-time activity trackers which have become so popular ever since the breakout of the coronavirus pandemic. What they show is anything but an economy that is expanding.

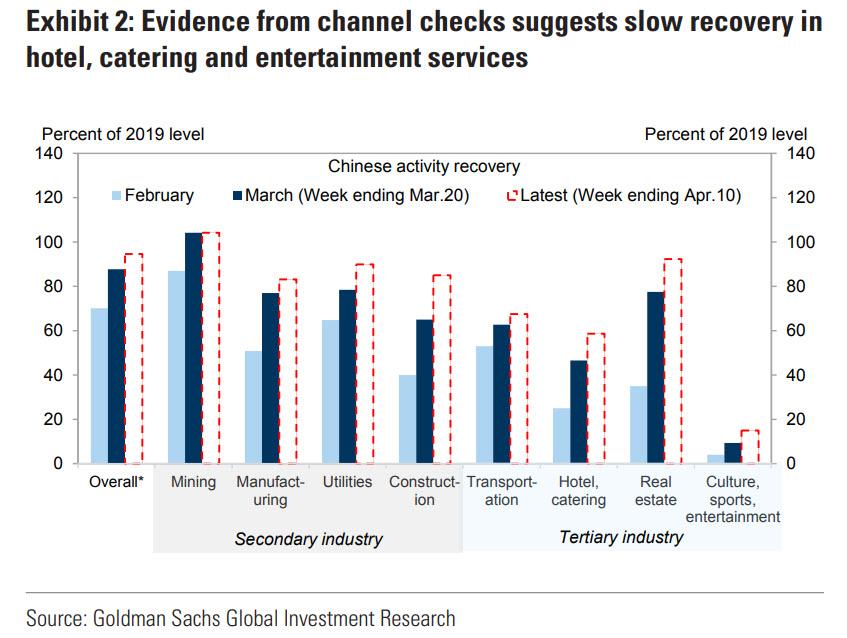

First, according to channel checks, we can clearly see that the latest activity in such sectors are hotels, catering and entertanment is running far below indicative 2019 levels, with just mining and real estate roughly comparable to year ago levels.

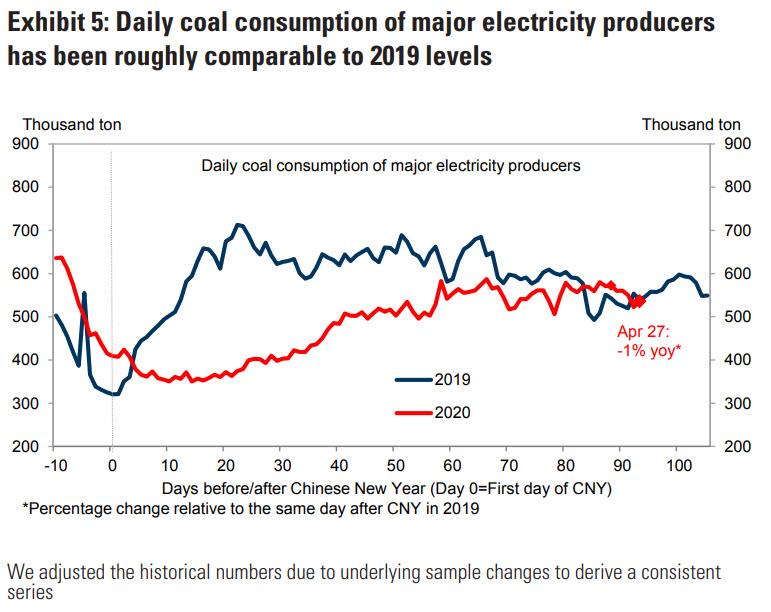

To be sure, while daily coal consumption is indeed on par with 2019…

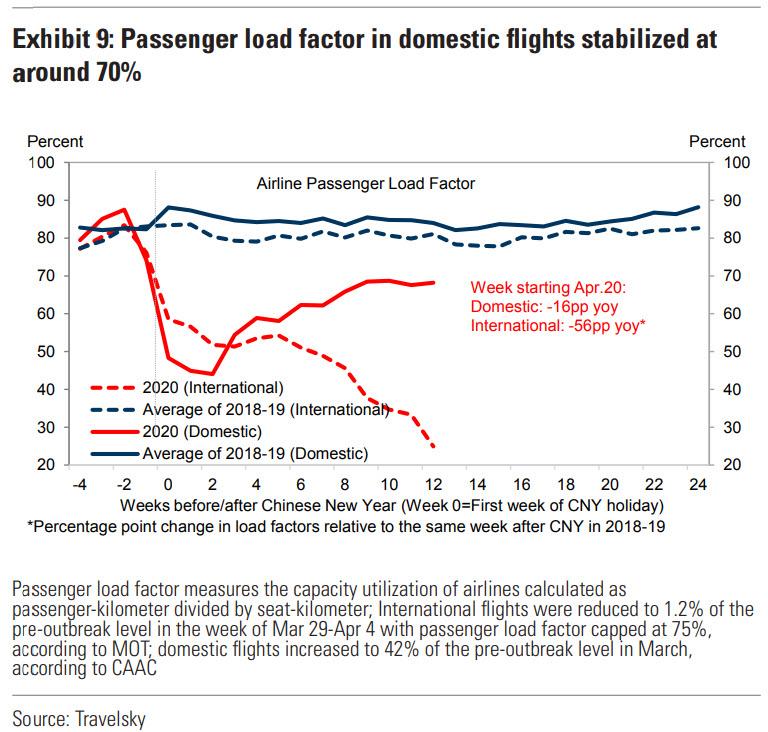

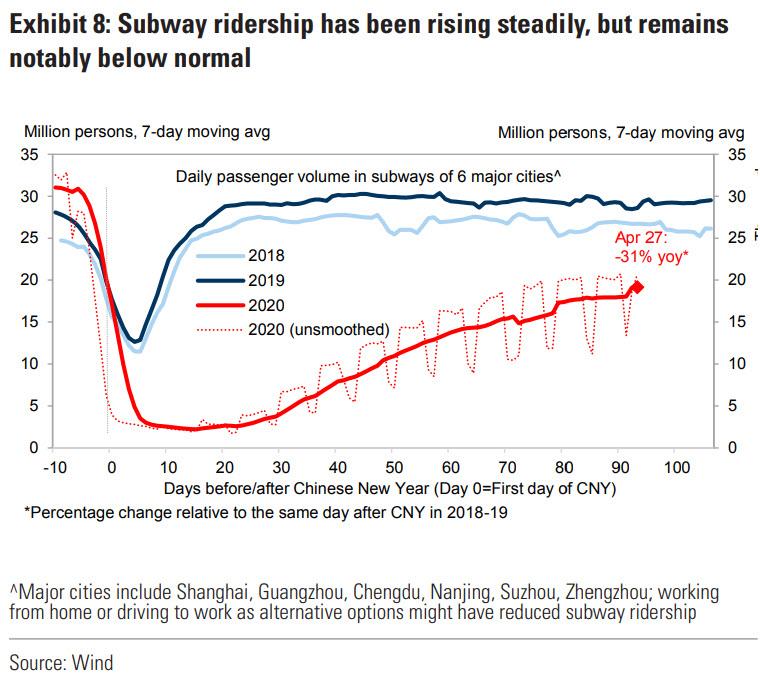

… transportation – both ground and by air – across China remains a pale shadow of 2019 levels.

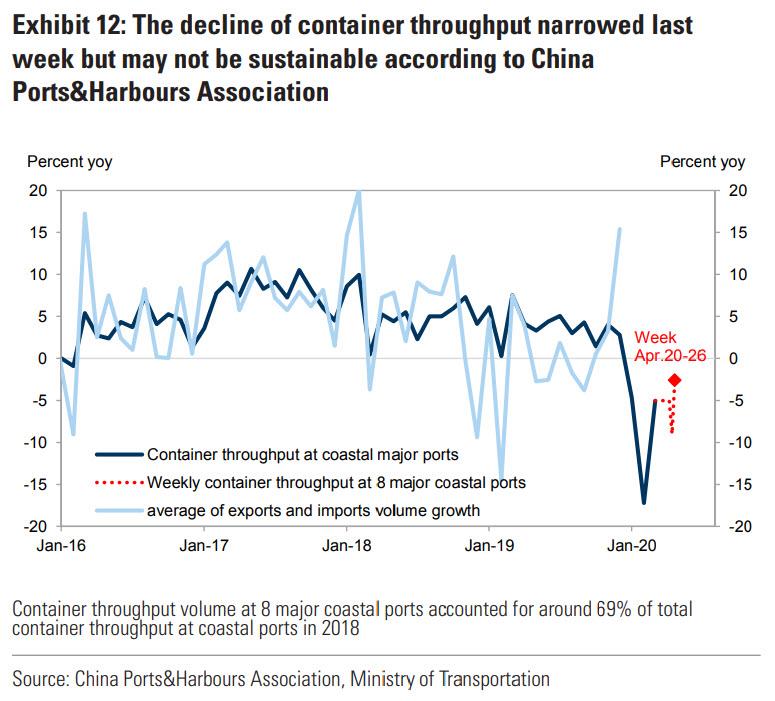

More ominously, the all-important for China’s trade economy container throughput at major port appears to still be far below last year levels.

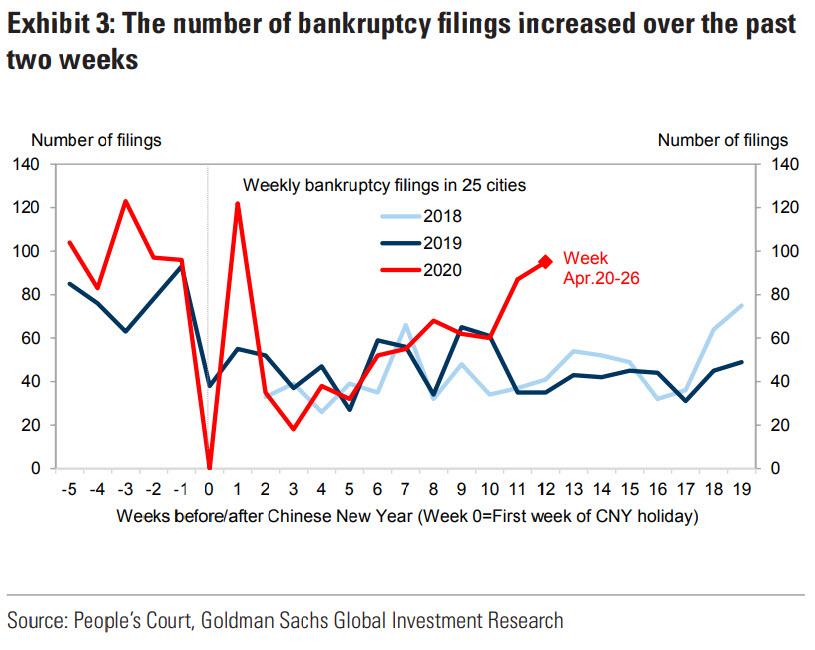

And most concerning of all for the country that still barely has a functioning bankruptcy process, is that the number of bankruptcies filings is surging:

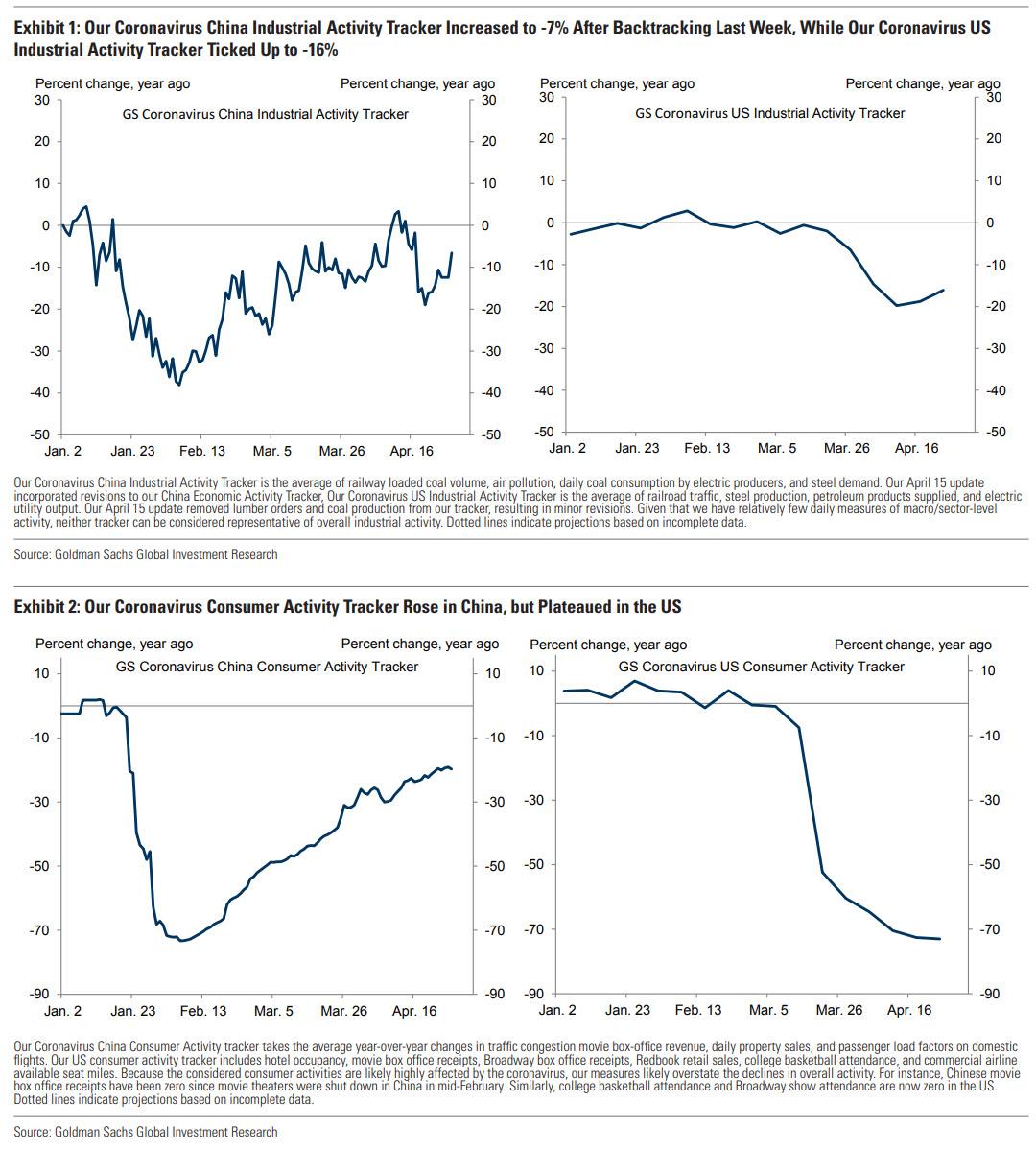

Superimposing China and the US in industrial and consumer activity shows that while China is well ahead in terms of activity recovery, it has a ways to go before it catches up to 2019 levels. As for the US, it certainly has a ways to go.

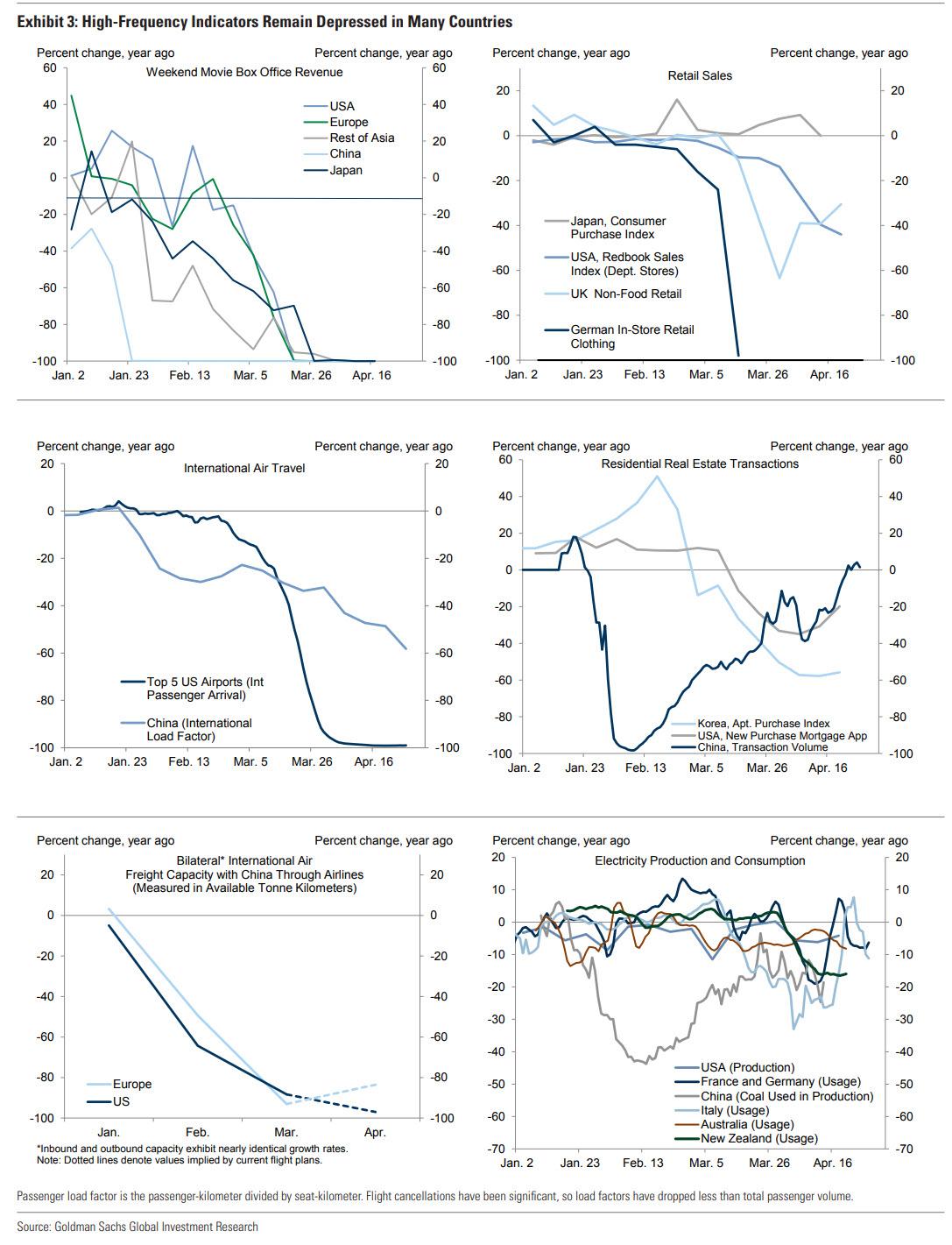

The final proof that China has a ways to go before it recovers, let alone is in “expansion”, come from a handful of other high-frequency indicators as shown below.

Conclusion: China’s official PMI numbers are about as credible as its coronavirus “data.”

Tyler Durden

Wed, 04/29/2020 – 21:42

via ZeroHedge News https://ift.tt/2Wfz4iO Tyler Durden