China Manufacturing Employment Contracts, Demand Disappoints Despite Headline PMIs Beat

Tyler Durden

Mon, 06/29/2020 – 21:25

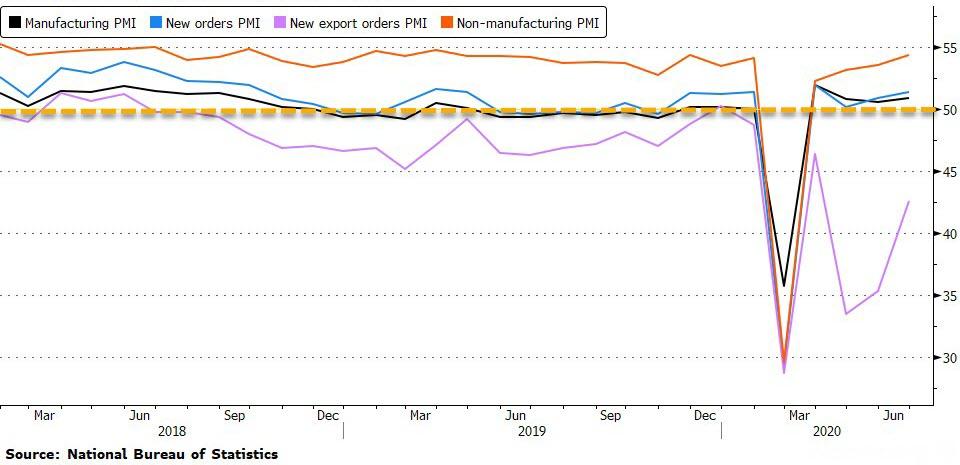

In a sign that China’s massive stimulus injections as the nation reopens are working, tonight’s PMIs both rose from May and beat expectations.

-

The government’s official Manufacturing PMI rose from 50.6 to 50.9 (beating expectations of 50.5)

-

The government’s official Services PMI rose from 53.6 to 54.4 (beating expectations of 53.6)

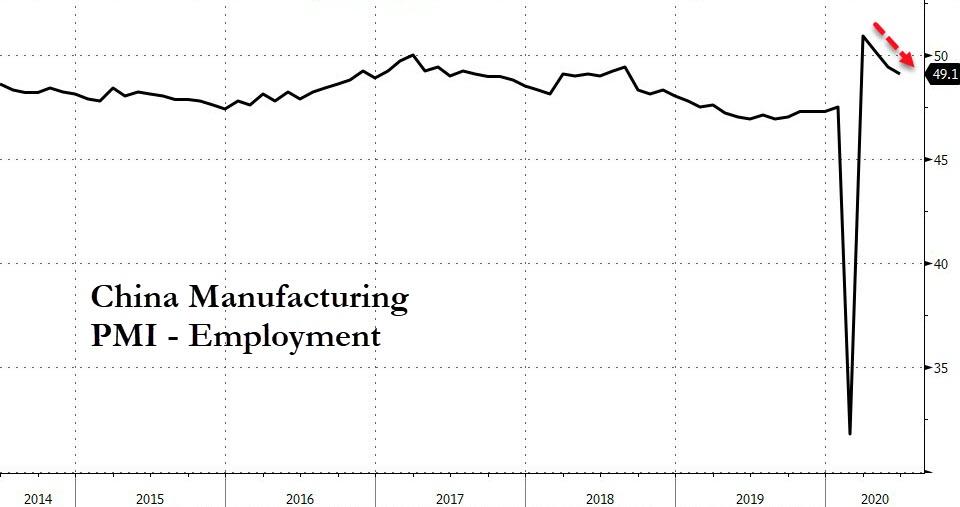

However, as Bloomberg report, while parts of the economy have recovered from the virus shutdowns, there’s an apparent divergence between demand and supply – factories and companies have returned and output is growing again, but exports and domestic retail sales are shrinking (and manufacturing employment fell back into contraction at 49.1).

“While work restart levels are high, the recovery of demand has been slow, weighing on the pace of improvement in industrial production,” Lu Zhengwei, chief economist at Industrial Bank Co in Shanghai, wrote in a report this week.

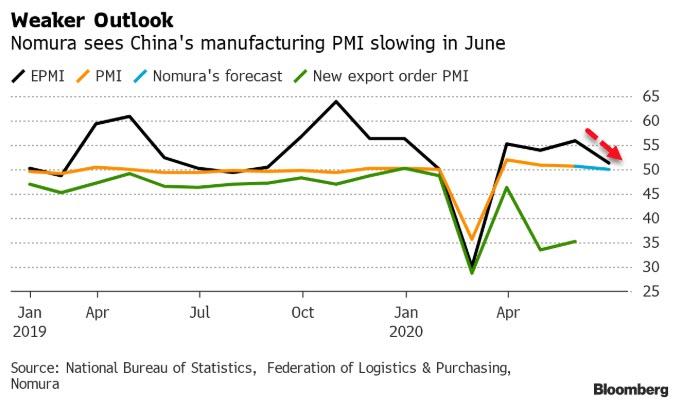

Additionally, a separate PMI indicator that gauges China’s high-tech industries slowed significantly this month. The Emerging Industries Purchasing Managers’ index fell to 51.4 this month from 55.9 in May, according to the bank, citing a research firm connected to the Federation of Logistics & Purchasing that compiled the data.

“The new export orders sub-index remained low at 32.6 in June, unchanged from May and April, suggesting sustained headwinds from overseas markets,” Nomura economists led by Lu Ting wrote in a report.

The surge in exports of coronavirus-related medical supplies is largely due to price rises, which is “likely unsustainable,” they wrote.

“We expect a bumpy recovery path filled with uncertainty, as China is caught between domestic policy stimulus, remaining social distancing rules and slumping external demand,” according to the report.

One possible caveat for the lack of momentum is that severe flooding in southern China may also have slowed the pace of production in some areas, and a recent flare-up of the coronavirus has also hit confidence.

via ZeroHedge News https://ift.tt/2CUrcNR Tyler Durden