The Fate Of The Pound Sterling

Tyler Durden

Sat, 10/31/2020 – 07:00

Authored by Alasdair Macleod via GoldMoney.com,

This is the third in a series of articles focused on the outlook for major currencies. The first concluded that the US dollar is already on the path of monetary hyperinflation. The second concluded that the euro system is close to collapse as a consequence of a combination of the failure of commercial banks and the TARGET2 settlement system, likely to collapse the currency itself.

With its systemic exposure to the Eurozone, sterling is likely to be a casualty of the failure of the euro system and shares the monetary hyperinflation characteristics of the dollar. The Bank of England is copying US monetary policies and will find it increasingly difficult to prevent the pound from escaping the same fate as the dollar.

Main points

-

Adjusting out QE of £300bn since last March tells us that measured in 2019 pounds the UK economy contracted by 34% in 1H 2020, not the 9.3% headline figure. A further round of QE and government spending will be deployed in an attempt to support the private sector economy through a second covid wave, which will almost certainly be greater than the initial £300bn—£317bn so far.

-

The Bank of England has now accepted that a second round of stimulus is required and is exploring the possibility of introducing negative interest rates. It has yet to factor in the deterioration in the outlook for global trade which will force it into further rounds of QE, irrespective of the path of the virus.

-

Britain’s banks, themselves exceptionally highly leveraged on a market capitalisation to balance sheet assets basis, are heavily exposed to the Eurozone’s banking system, which as I showed in last week’s article is could collapse in the near future. Rescuing British banks will require the government to underwrite at least a further £5.3 trillion in balance sheet assets at a time of mounting bad debts in the economy.

-

Since the Lehman crisis the banks have supported zombie businesses rather than face crippling write-offs. These zombies, epitomised by the desire of the industrial establishment to remain in the EU customs union rather than grasp the opportunities offered by free trade, are the principal beneficiaries of yet more government support. The moment that that support falters, Schumpeter’s creative destruction will hit the UK economy with a vengeance.

-

The impending economic failure triggered by waves of covid will doubtless be incorrectly blamed on Brexit. Nevertheless, the government and the Bank are committed to ensuring the economy does not slump. This will lead to yet more monetary inflation, setting the UK’s pound on the same hyperinflationary course as that of the dollar.

Introduction

There was a time when the British pound bestrode the world. More correctly, it was the gold standard behind it, the pound acting as a gold substitute between the end of the Napoleonic Wars and the outbreak of the First World War. Its sound money was extended throughout the British Empire through commerce. Admittedly, the government financed a series of small wars, but these were never to conquer territory — rather they were to subjugate rebellion, mainly from forces that wanted to substitute power for commerce. Today it would be called US-style peacekeeping, but modern historians with an anti-imperialist axe to grind call it colonial oppression.

But the fact is that Britain brought civilisation and improved living standards to many people whose technology had not even advanced to the wheel. Following the First World War, Britain then began its decline and fall with a succession of weak socialistic governments which could only hang onto America’s coat tails until throwing her lot in with the Common Market. It has been the longest and most notable decline from prosperity and global commercial dominance in modern times — longer even that the failure of Soviet communism. For Britain the hundred years from the Great War to date have seen the reversal of the fortunes of the previous hundred years.

It is not as if this is a trend fuelled by ignorance — we know from our past how to become wealthy and successful. Margaret Thatcher knew it, and so did Boris Johnson. But both were overwhelmed by the system, Boris considerably more rapidly than Margaret. Already half forgotten, Boris’s plans were decent: the reduction of state bureaucracy, the creation of free ports and the restoration of Britain as an entrepôt — an acknowledgement of low taxes, free markets, and the opportunities of Brexit. They were quickly overwhelmed by fear of covid-19. Fear that the state health service, full of wonderful, dedicated people working in a bureaucratic organisation would be unable to cope.

The bureaucrats did what they always do, prioritise the organisation above its purpose. The dysfunctional national health system was eulogised with rainbow paintings and a weekly clap-for-carers. But because there were not enough masks, the public was told they were ineffective, while the NHS took for itself what was available. The surge in hospital numbers was managed by the sick being billeted in private sector care homes, infecting and killing their residents.

In the full knowledge of the likely economic consequences of the mismanagement of the pandemic there has been no suggestion that the state should rein in its spending. One would have thought that when the people are forced to economise, the state should as well to reduce its burden on the people. But no; to save the state’s employment record, spending on supposedly important causes with the intention of preserving jobs has gone off the Richter scale.

Civil servants in the Treasury, which has been brought under the Prime Minister’s direct control, still dream of a balanced budget, achieved not by cutting government spending, but by raising taxes. But others see that raising taxes too early risks destroying what’s left of the tax base. Meanwhile, the list of supplicants with good causes and their hands out for more and more money from the state grows even longer. The government’s problem is that after a hundred years of increasing socialism it finds itself accelerating on the road to yet more socialism instead of turning the tide towards Boris’s libertarian ideals.

Attempts to steer the economy back towards free markets and sound government finances were always going to be difficult. Boris is no de Gaulle, prepared to place national liberty and culture above foreign relations. Nor is he in a strong enough position to emulate Ludwig Erhard, who was empowered to ditch the status quo with a clear vision of the future. It is not necessarily Boris’s fault; it is the political reality.

If nothing else, covid has exposed Boris as relying on his advisors instead of ploughing his own furrow. It has exposed the British public’s wishful belief that a magic money tree exists ready to be defoliated, and that any government which doesn’t make full use of it is being monstrously unfair.

Covid is a crisis which has exposed the inadequacies of state planning. But the unsavoury fact is that given the scientific advice, from the political point of view the government had little alternative to locking down the entire nation on 23 March. Now that Europe and the UK are entering a second wave of the virus, all thoughts of a rapid return to normality have been debunked. The V-shaped recovery upon which financial and economic predictions were predicated has gone out of the window, and the establishment is only just realising it.

Brexit and continuing European ties

For the establishment there is the added pain of Brexit, where Britain can no longer hang onto its European nurse, for fear of something worse. As the habitual robber of its electorate’s freedom, the British establishment itself cannot easily come to terms with the prospect of its own freedom from Europe.

Brexit has already happened and the transition period, during which trade and other arrangements were meant to be finalised, ends on 31 December, so far without agreement. But at long last, the EU’s negotiating team realises that Britain means business over the remaining issues, principally fishing and sovereignty. From the British point of view, an understanding of proper economics tells us she should grasp the free market option, refuse to accept any trade deal and withhold any funds agreed as part of the withdrawal settlement. But the Westminster and Whitehall establishments, wooed by and in the pocket of vested interests, is wholly unable to embrace the sensibility of that outcome.

Whether it ends up with a trade deal or WTO terms is less relevant than the fact that with the exception of some cabinet ministers, Whitehall (civil service) and Westminster (politicians) establishments are solid Remainers — terrified of the economic consequences of Brexit. They are in the company of industry lobbyists, with their established European links and reluctance to explore new trade opportunities elsewhere. Any descent into a business slump will almost certainly be wrongly blamed on Brexit, ignoring the inadequacies of British business and the need for its fundamental reform — a need that can only be satisfied by allowing zombie businesses, mainly tied to European protectionism, to go to the wall and for capital of all forms to be freed and redirected towards profitable use.

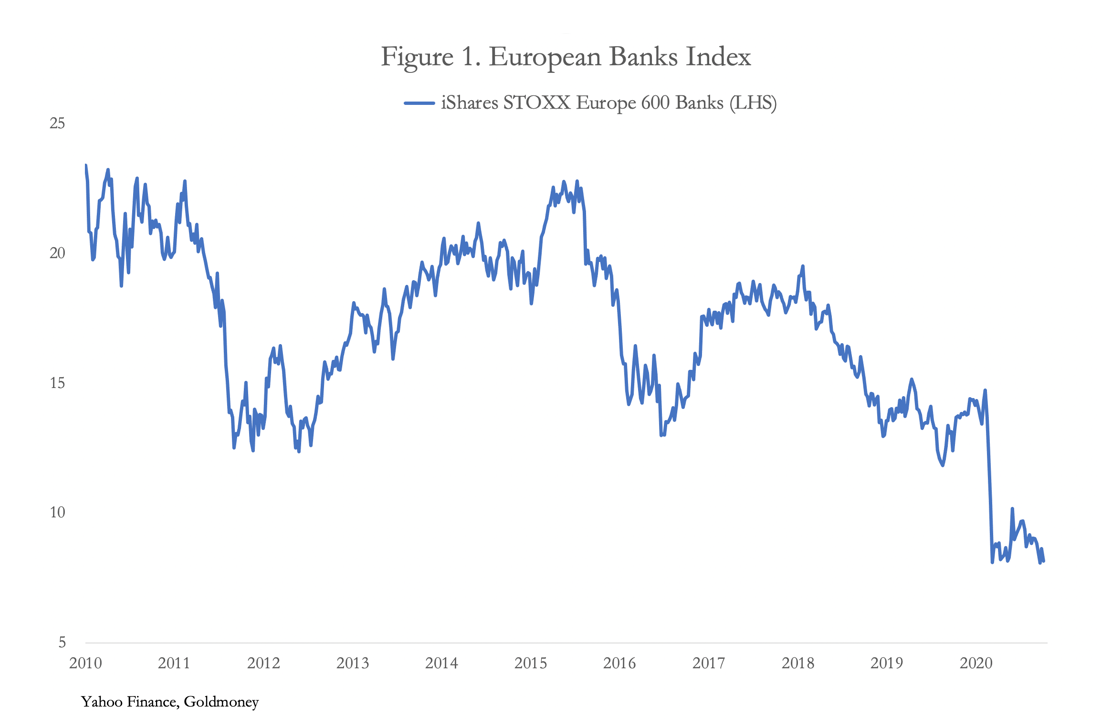

Whatever the outcome of Brexit, the ties with the EU will not suddenly cease. In the event of a financial and systemic failure, extra financial obligations will arise, and there are considerable counterparty risks between European and British banks. See here for my recent analysis of the Eurozone’s banking and monetary system. The likelihood of a Eurozone banking collapse is now a virtual certainty and could transpire any moment. Figure 1 shows the scale of the collapse in their share prices. And as measured by the STOXX Index Europe 600 banks, the sector is on the verge of setting new lows.

The STOXX Europe 600 banks includes Eurozone, British and other European banks. Over this calendar year, the index has fallen by 43% at a time when equities recovered strongly following the FOMC’s announcement of unlimited QE on 23 March 2020.

The severe actual and relative weaknesses in Eurozone banks come at a time of similar weakness in the British banks, and a banking failure in the Eurozone or elsewhere would collapse British banks like so many dominoes. The Treasury and Bank of England will then be forced to underwrite their banking systems with unlimited credit, supporting balance sheets amounting to more than £5.5 trillion — over twice UK GDP. Furthermore, the fig-leaf concealing monetary inflation through QE would be blown away, exposing the ghastly reality of government finances.

This is a global problem to which the UK is exceptionally exposed. Every ten years or so the cycle of bank credit expansion ends: that was first evidenced perhaps in September 2019 when the repo market in New York failed. The Fed had already begun to cut its funds rate the previous month; its antennae having detected a change in credit market conditions. By then, it was evident that international trade had stopped expanding, due to the trade tariff war between America and China. And because global trade is dollar based, the first impact was bound to affect US banks, their balance sheets and their lending policies.

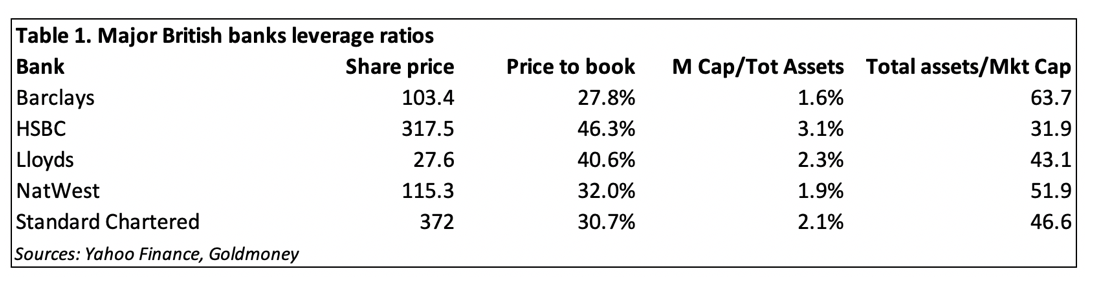

As the second most important international finance centre, London was bound to follow suit. In addition to the Eurozone exposure, and with the financial conflict between America and China escalating over Hong Kong, London faces risks from HSBC and Standard Chartered, two major British banks most of whose business is centred in Hong Kong and the Far East. And at over £2.6 trillion, these two banks have combined balance sheet liabilities that exceed Britain’s contracting 2020 GDP by nearly 40%. The full horror of the position of Britain’s banks is illustrated in Table 1 below.

By including the market’s rating of these banks (the price to book ratio), we end up with a better estimate of risk than by relying on balance sheet equity alone. This is because, for example, in the case of Barclays, the market is telling us that in a liquidation, shareholders will receive less than 28% pence in the pound: less, because in any share price there is also an enterprise value to consider as well as the option value of limited liability and unlimited upside. Even not allowing for these factors it is clear that none of the British banks, with combined balance sheet assets totalling £5.3 trillion, are in a position to withstand a Eurozone banking crisis.

Essentially, that was the position before covid wreaked its financial havoc, a factor which has only increased the certainty of a systemic banking crisis.

The financial and economic consequences of covid

In common with other nations the UK government moved quickly to prevent a surge in unemployment, fuelled by the belief that after lockdowns and with the right support from government the post-pandemic economy would quickly return to normal. The Bank of England stepped up to the plate with £300bn of quantitative easing, amounting to 13.6% of 2019 GDP and the equivalent of 34% of previously planned government spending.

At this juncture, it is important to understand something to which macroeconomists are generally blind: GDP is the sum total of all transactions, which without the addition of extra money is a static figure. Economic progress, or the lack of it, which is what GDP purports to measure cannot be measured, and an increase in GDP is simply an increase in the quantity of money in the economy. This is confirmed in Figure 1, where the quantity of UK broad money supply (M4) closely tracks annualised GDP, that is until this year, when the coronavirus hit — more about this divergence follows later in this article.

Another way of looking at the relationship is to understand that, apart from some minor variations in money retained for liquidity purposes, all money and profits earned are spent or saved, the latter being deferred consumption, supplying investment capital. With no change in the quantity of circulating currency there can be no change in the total spent and saved, and it is these totals that make up GDP, whether accounted for from the production or consumption sides. Therefore, if the central bank buys assets thereby pushing more money into the economy, or commercial banks expand credit out of thin air, GDP will rise accordingly by the amount of money created and credit expanded.

We can now consider the effects of monetary expansion on the UK’s national accounts. Since the Lehman crisis, which led to an emergency one-off £75bn round of QE, The BoE has been unable to resist the temptation of further rounds of inflationary financing, amounting to £745bn to date, which on a base of 2008’s nominal GDP of £1,589bn is an additional 47% of monetary inflation. [All GDP quantities in this analysis are of current price, or nominal GDP.]

By the end of 2019, annual GDP had increased to £2,214bn, including £445bn of QE, indicating that from 2008 the difference was made up by bank credit expansion totalling £180bn:

£1,589bn + £445bn + £180bn = £2,214bn.

In the first half of 2020, GDP was £1,031bn, after an injection of £300bn in QE. Putting to one side changes in levels of bank credit, without the £300bn QE, implied GDP in the first half of 2020 would have been £1,031bn less £300, or £731bn. This is an annualised rate of £1,462bn, implying an adjusted fall in annualised nominal GDP of 34%.

We can therefore conclude that the first wave of covid-19 reduced the monetary value of total transactions in the economy by 34% measured in pre-covid pounds, not the 9.3% headline figure, which includes the additional covid-related £300bn of QE. This leaves the question posed in Figure 1 about the relationship between a contracting GDP and increasing broad money supply, which we must now address.

Government lending schemes

As mentioned in the introduction, the government responded to the covid crisis by taking measures to restrict the effect on the level of employment. Clearly, with much of the economy locked down and running at only two-thirds of last year’s GDP there is a massive overhang not yet recorded in the 4.1% unemployment statistic. Furlough and other schemes to delay the impact were predicated on the hope that after the covid crisis things would quickly return to normal.

The normal to which the British planners hope to return is a post-Lehman crisis normal, where the ten-year expansion of bank lending has predominantly supported zombie businesses, which should have been allowed to fail[i]. Therefore, the government’s covid response is to extend zombie support by underwriting a range of bank loans for large, medium-sized and small business and relieve them of taxes and business rates. Banks are indemnified against all or most of the potential losses when acting as agents for government loans. Otherwise, it is clear that the banks would rather reduce their balance sheets at a time of escalating credit risk.

That explains why broad money, reflecting bank credit expansion of £243bn as well as £300m of QE, has increased. The difference with a contracting GDP exists because it has not yet worked through to prices, GDP itself being the product of the quantity of goods and services purchased and the prices paid. The bulk of covid support has been applied to business, the public sector and business tax reliefs, with only an estimated £83.7bn of the combined total of bank credit expansion and QE ending up in households, basically funding consumption.

If the money had been helicoptered into consumers’ bank accounts, the price effect would be more immediate. As it was, during the shutdown people were being paid somewhat less than they were earning before to do nothing, a condition of the furlough scheme, so overall consumption has declined, and so, therefore, has production.

So far, covid related government spending has led to an increase of government borrowing estimated £317.4bn[ii], slightly more than the Bank of England’s QE of £300bn. Before we move on to the effects of the second covid wave, we should note that the portion of bank credit not underwritten by the government will tend to contract. Already, there has been evidence of banks charging usurious rates of up to 40% on arranged overdrafts for individuals and the cutting of unused credit card limits. The squeeze on consumers’ and small businesses’ spending is bound to intensify. Businesses not qualifying for government support will find revolving credit virtually impossible to obtain, and businesses which have already drawn down on government guaranteed loans will find there is little further financial support available.

To the extent that the monetary stimulation from the Bank’s QE and government support schemes to the private sector is not neutralised by subsequent contractions of bank credit, the monetary inflation from these sources will lead to higher prices as the additions to broad money supply M4 circulates more widely. Furthermore, we can expect to see nominal GDP recover to close most of the gap between it and the level of M4 money supply as shown in Figure 1 above. While that will give the impression of economic recovery to slavish followers of statistics, it will misinform them. The reality is both production and consumption volumes and the purchasing power of the pound will have all declined.

Enter the second wave…

While statistically understating the negative effects of the inflation of money and credit on the general level of prices and of nominal GDP, there will be the additional effects of the second covid wave to consider. Already, plans to end the support given to business and households have been deferred with new support arrangements being introduced. As yet, these have not been fully disclosed and costed. But with the wreckage of the first round of shutdowns still in the works, the second covid round is likely to encourage the government into a second round of stimulus that will have to be greater than the first.

The government currently hopes that a refined version of complete lockdowns will limit the economic damage likely to be caused by the second wave. But pessimism mounts: only this week expectations that the second wave will lead to even greater strains on hospitals than those of the first wave have been reinforced by surging infection rates in Europe. “Second wave forecast to be more deadly than the first” was the lead story in yesterday’s Daily Telegraph.

It is becoming increasingly obvious to the government and the keeper of its money tree that the economic consequences are going to be at least as destructive as those of the first wave. In budgetary terms, The Institute for Government’s estimate of covid costs to September at £317bn will almost certainly be exceeded by a fair margin in the coming months.

Unsurprisingly, the Bank of England is preparing for yet more QE and in an attempt to lessen the impact on business is paving the way for negative interest rates. Commercial banks have been asked to report whether their systems are able to operate in a negative interest rate environment, and so far, only NatWest has replied that its systems cannot operate at or below the zero bound, but the deadline for replies is not until 12 November. The bigger issue is the sheer desperation that has led to the Bank to plan for their introduction.

The Bank of England plans unlimited inflation

While the committee’s members’ opinions vary, it is clear that the Monetary Policy Committee is collectively clueless — the MPC sets the bank rate and is the equivalent of the Fed’s FOMC. While firmly stuck on the belief that an interest rate is the cost of borrowing and not a reflection of time preference, the planners appear to ignore the fact that negative interest rates are a tax on the banks and their deposits, another form of wealth transfer from an embattled private sector to a voracious state. Then there is the hidden agenda of making limitless government borrowing affordable and thereby unleashing the prospect of unlimited monetary inflation.

The damage wreaked by negative rates is surely evident from the lack of their effectiveness in stimulating economies elsewhere, particularly that of neighbouring Euroland. If they were able to learn anything, the neo-Keynesians on the MPC would have understood that the interest rate structure can only be decided by free markets, and that as a committee they are therefore functionless. But if they have achieved anything, they have bought off the realities of a failing economy, overburdened by zombie businesses. And every day these realities are defrayed, the worse the eventual consequences become.

These are the endogenous economic and monetary realities. The exogenous ones, particularly the systemic risks of the Eurozone banking system, are factors no one appears to be taking seriously. The consequences of the contraction of global trade triggered by the tariff wars between America and China have rarely been taken into account.

So far, the foreign exchanges and general public, which ultimately decide the purchasing power of the state’s unbacked currency, only see the government’s response in terms of a currency which is fundamentally unaltered. A second round of QE, which is likely to exceed the first in terms of its size, can be expected to ring alarm bells, at least initially on the foreign exchanges, whose participants will then consider if the monetary dilution will be enough, and how much more will be needed to rescue the economy from a deepening slump. How these factors are reflected in dollar and euro exchange rates will depend on how similar factors affect those currencies. But it is easy to envisage, in the absence of the systemic risks mentioned above, sterling declining with the dollar, and its fall through parity with the euro being blamed on Brexit by Remainers in the establishment and the media. All currencies will then face the prospect of a slump in global trade being magnified by depreciating currencies measured in commodities, goods, and importantly essentials such as food.

If this leads to monetary inflation pushing up the general level of prices beyond the control of CPI methodologies, which seems certain to be the case, markets will take control of interest rates away from the MPC and America’s FOMC. The overt bankruptcy of the UK government will be reflected in a wider public rejection of faith in the currency, to the point where it will be disposed of rapidly for goods not necessarily needed immediately, in a crack-up boom.

That is the likely outcome of developments accelerated by the covid crisis and is in accordance with likely consequences for the dollar and the euro. It will take the characteristics of a monetary implosion instead of a quantity-related decline. In any event, sterling is already in a state of hyperinflation, which I have defined as the condition whereby monetary authorities accelerate the expansion of the quantity of money to the point where is proves impossible for them to regain control.

via ZeroHedge News https://ift.tt/321U3JL Tyler Durden