Nomura: US Stock Markets Are “Stuffed To Death On Options Gamma”

It may not feel like it, but the market is pretty much dead: as we noted last night, Tuesday’s consolidated volume just tumbled to the lowest of 2021, while total options volume yesterday was 540,000, which was less than Christmas Eve and also the lowest volume of 2021.

What’s going on here?

Well, according to Nomura’s Charlie McElligott, the “chokeheld” market is acting frozen because it is “stuffed to death on options Gamma”, with a ton of vol selling seen so far this week particularly in single names, whether via covered call overwriting and put underwriting, as well as due to “perpetual SPX strangle selling“, coupled with the ongoing slow bleed of of VIX ETN longs monetization into the latest “inflation scare” vol spike. Some more details:

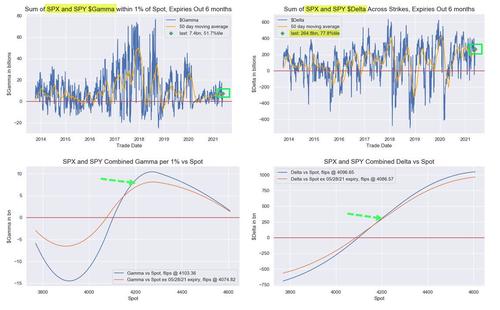

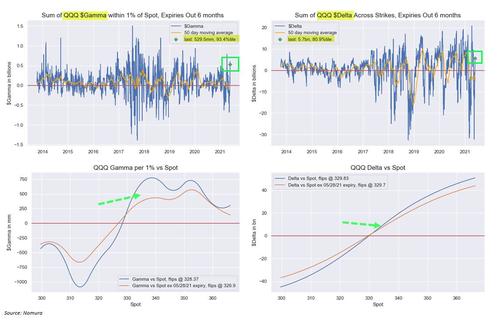

SPX gamma is $7.4BBN, which ranks 52nd %ile, while $Delta is +$264.8B, or 78%ile; Gamma vs Spot flips down at 4,103 vs 4,199 ref so we have a ways to go before we go negative gamma

QQQ Gamma is +$530MM, or 93rd %ile, while Delta is +$5.7B, which is 81st %ile; Same as with SPX, QQQ Gamma vs Spot flips “waaaay down” at 328.37 vs 334.10 ref

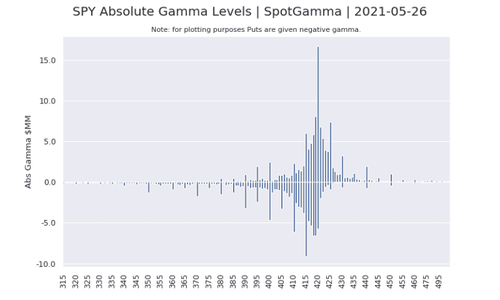

Picking up on this “gamma gravity” tractor beam, our friends at SpotGamma also look at the current snapshot of SPY gamma, shown in the chart below, which highlights a very large amount of gamma tied to the 420 level. And with SPX having a similar chart, the takeaway is that 420/4200 area has a big pull and it will likely take some options rolling or decay for markets to pull away.

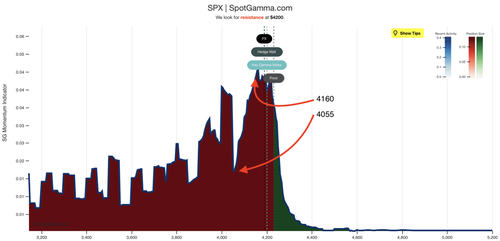

The Combo Strike charts are shown here in which you can see the thick band of resistance from 4211-4230 which is why SG has suggested it as a high gamma resistance “area” as per resistance “strike”.

That said, should spoos somehow get knocked lower and breach the gamma gravity, SG cautions that there is a “void” that has formed below 4175. It would take a break of 4160, at which point gamma changes quite sharply down to 4055. According to SpotGamma, this sharp gamma change would act as “volatility fuels” and would likely lead to a fast move to 4055 if 4160 breaks.

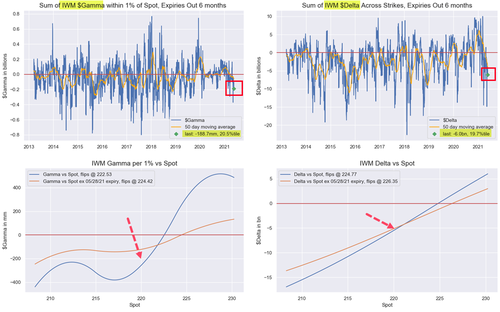

Hypotheticals aside, the one place where there is some potential action now is small caps: as McElligott notes, IWM is worth watching for chase-y moves, as it remains extremely short gamma and short delta vs spot, and is also an extremely sensitive and potentially price-binary to any surprise with tomorrow’s US data, as a pure-play “cyclical value”/”reflation” proxy.

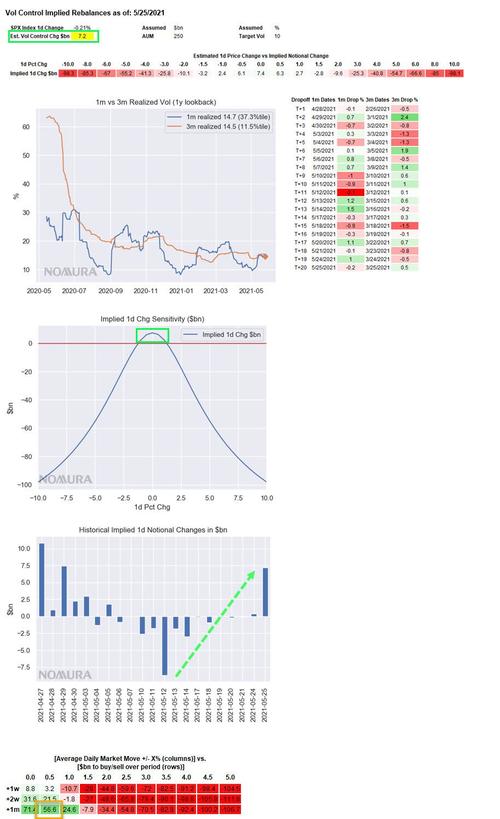

And with both implied (VIX has slumped again this week) and realized vol again collapsing (SPX 5d realized from 28.1 on 5/14/21 to today’s 10.8), Nomura estimates that Vol Control was a large buyer yday at +$7.2B of SPX (91ST %ile 1d add), which will likely continue in the weeks ahead if daily moves remain “insulated” as per the current long Gamma long Delta environment (i.e. daily 50bps +/- daily change would be +$21.5B over 2w / +$56.6B of exposure to buy back over the next 1 month).

Adding to the bullish narrative, the CTA model similarly shows an addition of +$12.7B of Global Eq “net exposure” over the past 1w (almost entirely on the Nasdaq flip back to “+100% Long” signal), with Russell continuing to “chop” around its signal on a smaller notional position, but it too would go back to “+100% Long” on a close above 2208.

McElligott’s summary punchline: “the US Equities Vol space has seen an important inflection this week, as SPX upside Call Skew has finally caught a semblance of “bid” (1m now 50th %ile rank from 21st %ile last Friday on 2Y lookback horizon), while downside Put Skew comes off the boil (2w down to 80th %ile yday from 91st %ile last Friday).”

Tyler Durden

Wed, 05/26/2021 – 11:55

via ZeroHedge News https://ift.tt/3umHy6T Tyler Durden