Wage Growth Stagnation Hits Men Harder Than Women, What’s The Cause?

Authored by Mike Shedlock via MishTalk.com,

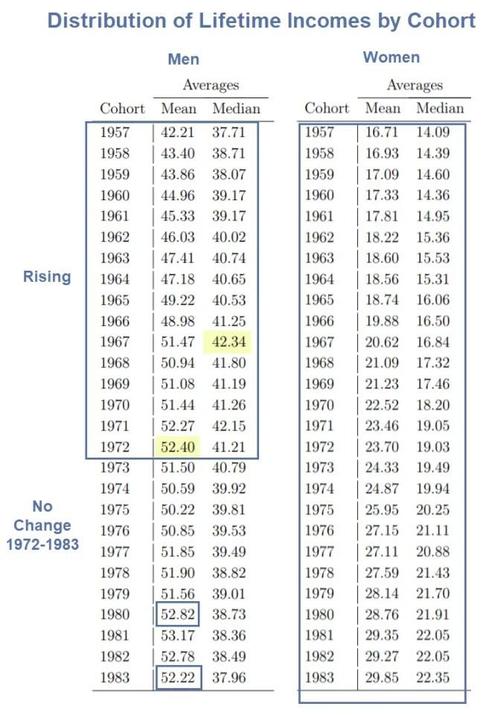

Lifetime real earnings of the median male worker declined by 10% from those who entered the US labor market in 1967 to those in 1983, or roughly a loss of $136,000.

A study on Lifetime Earnings in the United States over Six Decades is worth a close look.

The study shows the United States shows a “wage stagnation of average earnings and a rise in income inequality since the 1970s.” The charts are based on US Social Security Administration (SSA) records over 57 years.

The charts are more than a bit confusing unless one carefully dives into the details.

The lead chart is titled “Median Lifetime Earnings” but shows instead annualized real (inflation adjusted) annual wages, not lifetime or real lifetime earnings.

Lifetime Definition

-

Lifetime earnings means earnings between the age of 25 and 55 inclusive.

-

Annualized lifetime earnings as depicted in the chart is the sum of real annual labor earnings from ages 25 to 55, divided by 31.

When nominal earnings are deflated by the personal consumption expenditure (PCE) deflator, the annualized value of median lifetime wage/salary earnings for male workers declined by $4,400 per year from the 1967 cohort to the 1983 cohort, or $136,400 over the 31-year working period.

The lifetime earnings of the median male worker declined by 10 percent from the 1967 cohort to the 1983 cohort. Further, more than three-quarters of the distribution of men experienced no rise in their lifetime earnings across these cohorts.

Cohort Definition

As used in the article, cohort means all of those who turned 25, 35. 45, etc. in a particular year.

Key Notes

A download of the Working Paper PDF provides these insights.

-

Median initial earnings fell from $33,300 for the 1967 cohort to $29,000 for the 1983 cohort (PCE adjusted in 2013 dollars).

-

The analogous figures at age 55 were $55,900 for the former cohort and $54,100 for the latter, a decline of $1,800, showing no sign of catch-up over the life cycle.

-

Median initial earnings for men was only $24,400 in 2011, virtually the same level as in 1957.

-

Cohorts of female workers have seen robust and steady gains, on the order of 22% to 33% for the median female worker. However, because these gains started from a very low level of median lifetime earnings for the 1957 cohort, they were not large enough at the aggregate level to offset the losses by men.

-

Using the CPI rather than the PCE to convert nominal earnings to 2013 dollars lowers lifetime earnings growth for both men and women.

Inflation Adjustments

The two most commonly used price indexes are the personal consumption expenditure (PCE) deflator from the Bureau of Economic Analysis (BEA) and the consumer price index (CPI) from the Bureau of Labor Statistics’ (BLS). The (older) CPI and the (newer) PCE differ in several ways that are by now well understood.

The PCE is generally accepted to be the superior index for measuring the overall price level and its evolution over the business cycle. It is thus the standard choice in aggregate (macro) economic analyses. However, for more micro work, such as the analyses in this paper, the CPI has some advantages. In particular, the CPI aims to capture the price level faced by the typical household for its out-of-pocket expenses and is thus based on a detailed survey of U.S. household expenditures, whereas the PCE is based on business surveys and also includes purchases made by others on behalf of households. Consequently, relative to the PCE, the CPI places a lower weight on health care prices (since a large fraction of total expenditures is paid by Medicare/Medicaid and insurance companies) and a much higher weight on housing and transportation.

In our empirical analysis, we choose the PCE as our baseline measure for deflating nominal earnings because it implies a lower cumulative inflation over this period than the CPI. We report all values in 2013 dollars.

Lifetime Earnings for Men and Women

-

From the 1957 to the 1983 cohort, annualized mean lifetime earnings for men rose by around $10,000, from $42,200 to $52,200. This rise corresponds to a cumulative increase of 23.7%, or an average increase of 0.82% between two consecutive cohorts.

-

However, the bulk of these gains—21.9% of the total 23.7%—accrued to only the first 10 or so cohorts. From the 1967 to the 1983 cohort, mean lifetime earnings increased by only 1.5% cumulatively.

-

Median lifetime earnings for men has barely changed from the 1957 cohort to the 1983 cohort, increasing by only about $250—or less than 1%.

-

Across almost the entire distribution of males, there have been either trivial, or even negative, gains in lifetime earnings.

-

Women, on the other hand, have seen increases in lifetime earnings throughout the entire distribution. Median lifetime earnings increased nearly monotonically from $14,100 for the 1957 cohort to $22,300 for the 1983 cohort.

-

This steady increase in lifetime earnings for women has been broad-based, with all parts of the distribution experiencing consistent lifetime earnings growth across cohorts.

-

Median lifetime earnings for women grew at an average rate of 1.8% per cohort for the 27 cohorts from 1957 to 1983, with almost the exact same annualized growth rates for the 10 cohorts from 1957 to 1967 and the 16 cohorts from 1967 to 1983.

-

Looking at the population as a whole, we find that the trends for men and women combine in sometimes offsetting ways.

Closing the Gender Gap

The chart looks severely dated but cohort means the year in which someone turned 25.

Figure 3 plots the ratio of the mean lifetime earnings of females to that of males

In 1960, median inflation adjusted wages for women aged 25 were less than 40% of males. But fewer women than men were working and fewer women than men were college educated.

After 1965, the gap started to close quickly (showing an almost linear trend), and by the 1983 cohort (working women who turned 25 in 1983), the lifetime earnings of women reached more than 60% of their male counterparts.

To the extent real median wages have risen in aggregate, it is because of the headway made by women relative to men.

Decline of Men vs Women

The mean lifetime income for men rose until 1972. The median topped out a bit earlier in 1967 albeit by an arguably meaningless 0.13 percentage points.

Those who turned 25 in 1983 were 55 in 2014. Thus the study misses the last 7 years.

Even Worse Than It Looks

The charts and findings are even worse than they look.

The PCE measure of inflation is understated relative to the CPI.

Both are severely understated since 1999 relative to housing. Housing-adjusted real wages have been hammered in aggregate, and even more so for men.

For discussion, please see Fed Sponsored Speculation: Real Interest Rates Are -4.1 Percent, Lowest Since 1980.

Placing the Blame

The Fed with tremendous help from Congress seeks to destroy the dollar. They have succeeded. Yet the Fed rails against income inequality.

The Fed, Congress, and Progressive need to look in the mirror to see who is to blame for falling real wages.

“It costs only a few cents for the Bureau of Engraving and Printing to produce a $100 bill, but other countries had to pony up $100 of actual goods in order to obtain one,” accurately quipped American economist Barry Eichengreen.

Trade Distortions and Wage Distortions

1. Real wages are a function of global wage arbitrage.

2. GWA is a function of Nixon closing the gold window, allowing deficits to explode.

3. Factor in the Fed inflating assets for the benefit of the wealthy

4. Factor in bailouts by Congress

5. Assign Percentages https://t.co/gRXeovQwN3

— Mike “Mish” Shedlock (@MishGEA) May 28, 2021

In addition to trade distortions inaccurately blamed on NAFTA, real wages is another data series that goes back to Nixon closing the gold window in 1971.

For details, please see Nixon Shock, the Reserve Currency Curse, and a Pending Currency Crisis.

Is the Fed Trying to Destroy the Dollar?

A friend asks “Is the Fed Trying to Destroy the US Dollar?”

The answer is yes, to repeatedly bail out the banks at the expense of consumers.

Be my guest at assigning percentage blame.

Tyler Durden

Sat, 05/29/2021 – 11:10

via ZeroHedge News https://ift.tt/3uGUiFP Tyler Durden