North Sea Oil Floating Off Europe Could Signal Weak Asian Demand

Authored by Charles Kennedy via OilPrice.com,

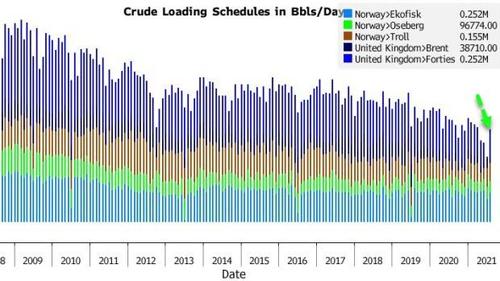

Around 6 million barrels of crude of North Sea’s key grades have been kept in tankers offshore Europe for up to three weeks, which could be a sign that demand in the world’s top oil importing region, Asia, could be softer than the paper market suggests, Bloomberg reported on Monday, citing ship tracking data it had compiled.

Five oil tankers with 6 million barrels of North Sea crude are sitting off the shores of Europe, including two supertankers chartered by the world’s largest independent crude oil trader, Vitol Group, according to the data compiled by Bloomberg.

Considering that the current crude oil futures structure is in backwardation, the state where the prices of the nearer futures contracts are higher than those further out in time, this sure isn’t an incentive for traders to keep oil in floating storage.

Therefore, Bloomberg notes, the possible reason for tankers sitting loaded with North Sea crude off Europe could be a sign of weaker demand from Asia. Independent Chinese refiners, the so-called “teapots” and typically eager buyers of the Forties crude grade, have scaled down purchases in recent weeks, waiting for the government to issue its second batch of allowed crude oil import quotas for this year, according to Bloomberg.

Another reason for potentially weaker demand for North Sea crude in Asia could be the low refining margins in the region amid a fuel glut, as the COVID resurgence have resulted in restrictions not only in India, but also in Malaysia.

Rallying oil prices could also be a reason for price-sensitive buyers to stay away from purchases.

In March this year, traders and market sources told Bloomberg that the rising premium of North Sea’s benchmark Brent over Dubai crude was making shipment of Brent-linked oil to Asia more expensive and likely to reduce in the coming months.

Tyler Durden

Wed, 06/09/2021 – 05:00

via ZeroHedge News https://ift.tt/3xdfyVf Tyler Durden