10Y Yields Plunge Below 1.50% As Record Short Squeeze Accelerates

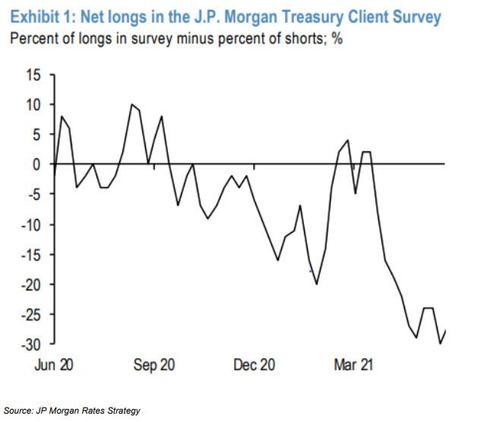

With the recent JPMorgan Treasury Client Survey showing that self-reported Treasury net longs were at record lows (and by extension, shorts were all time high) understandably perhaps ahead of an inflation print that is expected to be among the highest on record, there were virtually no traders left to short Treasurys, with all bears already on board.

This meant that as a result of a massive position imbalance, the risk was for a raging short squeeze on even a whiff of deflationary news, and that’s precisely what we have seen in recent days, starting with last Friday’s disappointing payrolls report which sent 10Y yields lower by 8 bps, and continued with the collapsing odds that a Biden infrastructure plan will pass, amid a breakdown in GOP talks and opposition by centrists such as Manchin.

The squeeze, which started with last Friday’s big payrolls miss, has continued through this morning, when the 10-year Treasury yield fell as much as 4bps, sliding below 1.5% for the first time since May 7 – which was also a kneejerk short covering burst following last month’s even bigger payrolls miss – as traders scrambled to unwind record short positions.

The 10-year yield peaked at about 1.77% in March and has since fallen as low as 1.46% on May 7 after the release of April’s dismal payrolls report. It dropped more after last week’s slightly less dismal May jobs report.

The sudden drop in yields takes place before a closely watched 10Y auction of notes at 1pm today and ahead of key U.S. inflation data due Thursday.

While Bloomberg claims that there was no clear catalyst for the latest move lower, “suggesting a potential shift by the market’s large short base ahead of the U.S. data and a European Central Bank meeting Thursday”, Rabobank suggests that the move is “related to the headline that talks between President Biden and Republicans over his proposed infrastructure spending bill have collapsed. Recall that on matters of spending in the US, “The President proposes, and Congress disposes”. And that with the Senate 50-50, and Democratic senators Manchin and Sinema opposed to using Budget Reconciliation to ram stimulus through, and to the removal of the Senate filibuster to allow stimulus to proceed on a straight up-down vote, there is no way that this spending can happen – unless something changes.”

As Rabo’s Michael Every explains, “this implies that while inflation pressures will still rise from here near-term because of the ongoing Bullwhip Effect, they will then decline again further out. Indeed, this bullwhip is bearish for the real economy if you caught the surprise drop in German industrial production yesterday, where key auto output fell sharply even as demand spiked.”

What little hope TSY shorts have remains in getting an even bigger than expected CPI surge tomorrow, however, has likely been priced in by now: “I don’t think even a slightly stronger number changes the narrative too much for the June Fed meeting, which is one where they will start to talk about talking about tapering,” wrote NatWest Markets strategist John Briggs in a note this week about the upcoming data.

The drop in yields was not confined to the U.S., with German bunds also sliding to the most negative level in a month.

“Rates markets appear remarkably robust,” said ING strategists including Antoine Bouvet. “It is clear that the market is pricing in the extension of the ECB’s accelerated asset purchase pace as a base case.” The ECB’s pandemic bond-buying program targets around 20 billion euros ($24 billion) a week.

Tyler Durden

Wed, 06/09/2021 – 08:41

via ZeroHedge News https://ift.tt/2RBJPxF Tyler Durden