Ruble Surges To 5-Month Highs After Russia Unexpectedly Slashes Rates By 300bps

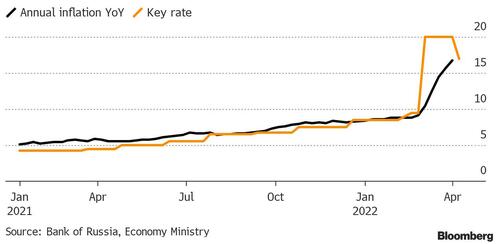

While the rest of the world is engaged in tightening monetary policy to tame the self-inflicted inflation beast, Russia’s central bank unexpectedly cut its key interest rate the most in nearly two decades last night in an attempt to stave off a domestic recession and bolster confidence in the economy.

Taking the market completely by surprise, the central bank slashed rates by 300bps (from 20% to 17%) at an unscheduled meeting overnight and said further cuts could be made in the months ahead if conditions permit.

As Bloomberg reports, it’s a policy pivot that echoes Governor Elvira Nabiullina’s surprise 200 basis-point rate cut in 2015, which reversed an emergency hike made weeks earlier. At the time, Russia was entering an economic contraction following the first round of sanctions over Ukraine and the collapse in oil prices.

“The central bank wants to be a locomotive of the economic rebound, not a brake,” said Luis Saenz, head of international distribution at Sinara.

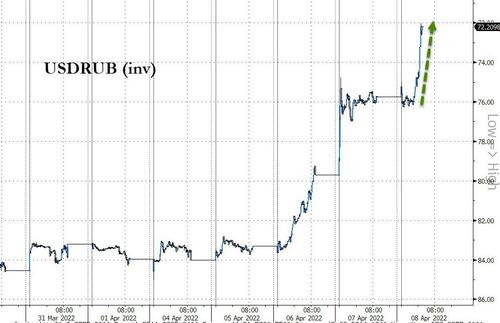

What is even more surprising to many is that the Ruble – previously dismissed as “rubble” by President Biden – actually strengthened further on the rate-cut, surging to 72/USD.

Source: Bloomberg

Additionally, yields on government ruble bonds tumbled 83 basis points to 11.19%

The Bank of Russia’s emergency rate hike in February and restrictions on foreign-exchange transactions were sufficient to lower risks for the financial system, according to Sova Capital economist Artem Zaigrin. It’s now having to react quickly to an unfolding crisis, he said.

“Thanks to these actions, the central bank was able to stop the outflow of funds from the banking system and restore the attractiveness of deposits,” he said.

“At the moment, the growing level of uncertainty in the economy and the sharp decline in demand have become prevalent.”

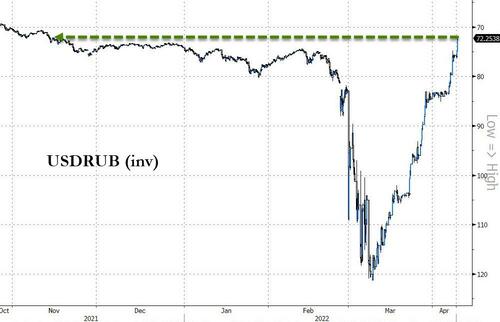

The latest rally in the Ruble lifted the Russian currency to its strongest against the dollar since Nov 2021…

The media are claiming that the strength of the ruble “may be illusory” or that Russia has exploited a “loophole” in the sanctions and used “financial alchemy” to “rescue the ruble”.

Interestingly as Kit Knightly reminds us, in 2014, when the west sanctioned Russia over the Crimean referendum, the ruble lost almost half its value.

It recovered slightly in 2016, and has since stabilized, but has never come close to its pre-Crimean worth:

So, presumably the earlier sanctions didn’t have a “loophole” in them, and/or the Russians either weren’t aware of this “financial alchemy” back then, or simply decided not to use it.

Of course there is one key difference between 2014 and 2022 – the oil market.

As we have written before, in 2014/15 the US and Saudi Arabia flooded the market with cheap oil and crashed the price. Russia (and Iran, and Venezuela) all suffered huge economic damage from this move.

But far from repeating this tactic, Saudi Arabia has increased their prices.

It’s a different world now…

Tyler Durden

Fri, 04/08/2022 – 08:23

via ZeroHedge News https://ift.tt/eZmzGLE Tyler Durden