S&P, Nasdaq Break Key Support As Goldman Says “Significantly” Higher Rates Needed

The morning has not started well as yesterday afternoon’s BTFD ripfest has been erased with Nasdaq leading the charge lower….

This plunge has pushed the S&P back below its 200DMA (and key 4500 ‘gamma’ support) and Nasdaq is back below its 50DMA…

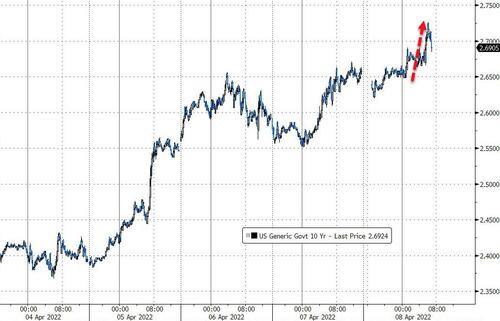

Yields are higher once again with 10Y back above 2.70%…

And gold is bid…

No major catalysts for this selling pressure but some desks are pointing to comments from Goldman’s Chief Economist Jan Hatzius that The Fed may need to raise interest rates “significantly” higher than it currently expects to cool an overheated U.S. economy…

“If the economy does not slow and if we, in particular, don’t get a pretty substantial slowdown in employment growth, then you’d be looking at something that could go significantly higher, to the 4%-plus range,” he said in an interview on Bloomberg Television.

Tyler Durden

Fri, 04/08/2022 – 09:59

via ZeroHedge News https://ift.tt/tn6kLTf Tyler Durden