European Markets Freak Out As Odds Of Le Pen Victory In French Presidential Elections Jump

Ahead of last weekend’s Hungarian parliamentary election, the pollsters were predicting a landslide loss for the loathed by the western/EU establishment current president, the pro-Putin Viktor Orban. Well, there was a landslide, just not in the direction the so-called experts predicted (which begs the question: why do people still listen to polls after 2016, but we digress), and in the latest humiliation for Brussels, Orban was re-reelected in a huge victory, steamrolling the opposition alliance. So with all eyes on this weekend’s French elections which pit Davos crowd pet and former Rotschild banker Emanuel Macron against outspoken nationalist Marine Le Pen. Here too, fears are growing that what until recently was seen by the always wrong pollsters as a “done deal” and blowout victory for Macron, suddenly is looking very shaky.

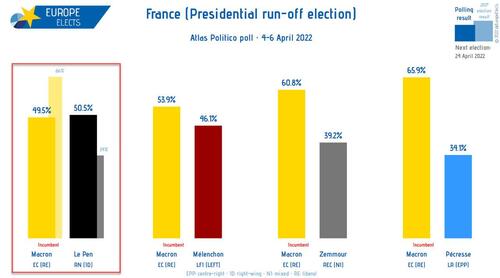

With French voters taking to the polls on Sunday, the race is suddenly wide open because while Macron’s lead over Le Pen had been narrowing in recent weeks, a shock poll released yesterday by Atlas Politico showed that Le Pen (50.5%) now has a slight advantage over Macron (49.5%).

A little background: the first round of the French presidential election will take place on Sunday (April 10). The two candidates gathering the most votes will qualify for the second round of the election, which will take place on Sunday, April 24. Incumbent President Macron still enjoys a comfortable lead in the polls at over 25% of voting intentions, although this is down marginally from the early-March highs. Voting intentions for far-right candidate Marine Le Pen have increased to about 20% (from about 15% a few weeks ago), placing her as the most likely candidate facing Macron in the second round.

Macron, who had sought to put himself at the center of European and US efforts to end the crisis in Ukraine since late last year with dismal results so far, only began campaigning in earnest about a week ago. The calculation was that he’d benefit from the image of peacemaker and seasoned statesman, and that his handling of the pandemic and a strong economic rebound would be enough to keep him in the Elysee.

Until recently, polls suggested that was true… but suddenly the unthinkable appears possible, and a big reason for that is the exploding inflation across France. More on that in a second.

The problem, as Bloomberg notes, is that foreign policy rarely wins elections in France, and an appearance of complacency fueled the perception that Macron is arrogant and out of touch – which of course is true on both counts – is opening the way for Marine Le Pen.

Unlike the caviar-slurping Davos jet-setter, Le Pen realized long ago on that voters already struggling with high energy and food prices were more likely to care about purchasing power or lack thereof. And so, what was a 12 point gap between her and Macron has narrowed dramatically as she toured towns and villages, casting herself as the defender of the “little ones” against Macron’s reputation as the “president of the rich.” She pledged to slash gasoline prices and tax big energy companies.

Of course, this won’t be Le Pen’s first attempt to dethrone Macron. Or second. On her third attempt to clinch France’s top job, Le Pen has become a familiar face. Her efforts to appear more mainstream got an unexpected boost from the candidacy of Eric Zemmour, a far-right former media pundit sanctioned three times for hate speech also known as the French Trump.

People close to Macron have been warning that his victory isn’t assured. “Of course Ms. Le Pen can win,” Edouard Philippe, a former prime minister in Macron’s government, said last week according to Bloomberg. But for that to happen, Le Pen would have to build an anyone-but-Macron coalition in the second round on April 24 and left-wing voters would have to abstain, or vote for her.

To be sure, a Le Pen victory over Macron, the self-styled successor of Angela Merkel, and defender of the European project, would be a shock for the European Union on a par with Donald Trump’s U.S. election victory and the Brexit vote in 2016. Armed with a veto on most EU initiatives, she could bring the bloc to an abrupt halt and could effectively spell the end of the EU, one of the core Western alliances in a thunderous win for Putin.

There’s one more wildcard in this race: Far-left leader Jean-Luc Melenchon. On his third shot at the presidency, he’s polling six percentage points after Le Pen, and could convince left-wing voters to rally behind him on Sunday.

As Bloomberg puts it, “voter support for her means that immigration would remain central to her agenda. A win would cap the far-right in France, pointing the country on a nationalist, nativist path.”

In any case, even if Le Pen doesn’t pull it off, Macron would win by a far smaller margin than last time the two went head-to-head in 2017. The nationalist would emerge empowered in either outcome while Macron will be left with a weak mandate that could make it difficult to implement his economic and social reforms, depending on the outcome of legislative elections scheduled for June.

That said, a victory would be a stunning accomplishment for 53-year-old: it took Le Pen a year to recover from her defeat to Macron in 2017, but she held tight and looked to Viktor Orban, who just won a fourth-straight term as prime minister in Hungary, and Matteo Salvini in Italy for inspiration.

She changed her party’s name to appear less aggressive and also intensified a strategy to soften her image, sharing personal stories about her life as a single mother with three children and her Bengal cats. She dropped a plan to ban dual citizenship – a calling card of the far right – and disavowed Russian President Vladimir Putin after his invasion of Ukraine.

“She’s made progress — she’s opened up to other people and listens to criticism,” said Robert Menard, the mayor of Beziers, who backs her and talks to her once a week. “Before, we didn’t speak, we just argued.”

Le Pen has been focusing on social welfare since taking over her father’s party in 2011, essentially inching the movement that was economically liberal in the 1980s closer to the left, increasingly attracting less well-off people and the young working class.

On March 10, Le Pen cast herself as the candidate of the “little ones” against the “big ones” in the poorer Northern France region, slamming Macron for “giving everything to big companies.” She also pledged that gasoline prices would go down if she’s elected — a key issue for voters in rural areas who rely on their cars — with tax cuts on fuel, and new taxes on oil majors.

By contrast, Zemmour’s program veers more to the right. He wants the French to retire later, reduce welfare and cut taxes on companies and real estate owners. But at the end of the day, his supporters will likely back Le Pen in a runoff against Macron, according to an analysis by Gilles Ivaldi, a Sciences Po researcher.

“By pushing a social-populist agenda long before the war and increasing her rhetoric after the invasion, Le Pen is gambling,” Ivaldi wrote in a recent opinion piece. “So far, polls appear to be proving her right.”

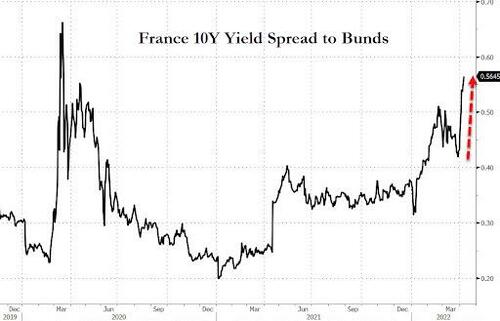

Indeed they are, and the market is starting to freak out: holders of French debt have been dumping it ahead of what could be a shock outcome this weekend, pushing benchmark yields up to as high as 1.25%, a level last seen in 2015. That took the spread over their German equivalents — a measure of investors’ perception of risk — to the widest since March 2020, the onset of the pandemic.

Consistent with the evolution of polls, further election risk premium has been priced across assets during the course of this week. In our view, the French presidential election has more European rather than domestic implications.

In a note previewing the French election, Goldman strategist Peter Oppenheimer (note available to pro subscribers), writes that consistent with the evolution of polls, further election risk premium has been priced across assets during the course of this week as “the French presidential election has more European rather than domestic implications.”

As Oppenheimer details, “since the invasion of Ukraine by Russian forces, equities and peripheral sovereign spreads have been resilient despite the deterioration of the growth/rate mix and the repricing of tighter monetary policies. Part of this resilience likely lies in the swift and homogeneous response of European leaders in terms of diplomatic and fiscal policies, with President Macron being a key player in proposals for further EU integration.”

But a change in the French presidency or rising odds of a Le Pen victory is likely to trigger market stress, pushing some sovereign risk back to the forefront and raising the equity risk premium.

If Le Pen were to be elected, Goldman expects 10y OAT-Bunds to land at 60-75bp, 10y BTP-Bunds at 180-210bp and EUR/USD to trade 2% lower. In the equity space, the risk premium could rise by 30bp, which implies a 7% price drop for the SXXP. This is consistent with what the equity derivatives market is currently pricing.

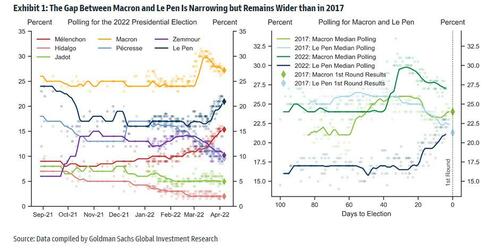

In any case, with 2 days to go, President Macron still enjoys a modest lead in most polls, with a handful of exceptions, at over 25% of voting intentions, although this has declined marginally from the early-March highs (Chart 1, left). The recent polls also confirm that the next two leading contenders are far-right candidate Marine Le Pen (Rassemblement National) and far-left candidate Jean-Luc Mélenchon (La France Insoumise). In France, polls this close to the election have tended to be relatively accurate, with mean polling errors shrinking by close to 1pp a fortnight before the first round, and a rematch of the 2017 contest between Macron and Le Pen therefore looks highly likely (Chart 1, right).

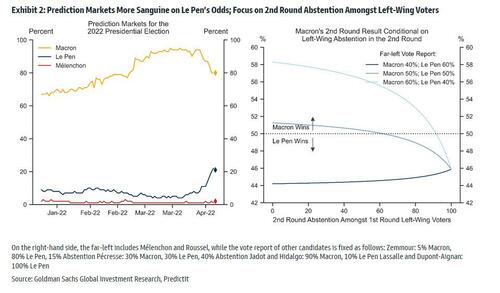

Where things get shaky is that second-round polls have recently shown President Macron’s lead over Ms. Le Pen narrowing to historical lows. Although prediction markets still foresee a victory for President Macron, they have repriced Ms. Le Pen’s odds to 20% up from 5%.

In that respect, Goldman argues that the key risk stems from the participation rate of moderate voters. In a simple exercise, assuming that Zemmour voters largely vote for Le Pen and that Pécresse voters equally split on supporting Le Pen, Macron and abstaining in the second round. Varying the participation rate amongst left-wing voters in the second round (i.e., who voted for Mr. Mélenchon, Hidalgo or Jadot in the first round), Goldman finds that 60% of 1st round left-wing voters would need to abstain for Le Pen to be elected president if the far-left was to split itself equally between Macron and Le Pen (Exhibit 2, left).

As such, the bank will carefully monitor (i) unsuccessful candidates’ voting guidelines, if any, and (ii) sub-polls showing 2nd round voting intentions conditional on the 1st round vote. We will also look for major public figures—including former presidents and prime ministers—to persuade 1st round abstainers and voters whose candidates did not advance to regroup behind the mainstream candidate (likely Mr. Macron) so as to form the so-called Front Républicain.

Tyler Durden

Fri, 04/08/2022 – 10:50

via ZeroHedge News https://ift.tt/Wi7s34T Tyler Durden