Soaring Inflation Brings $300 Million Profit For Goldman Traders

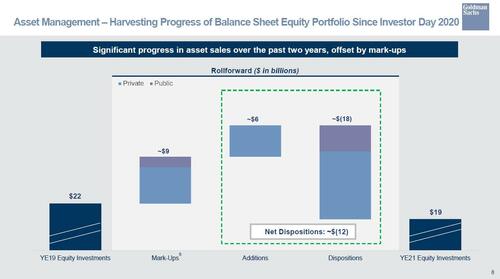

In a time when Goldman was aggressively telling its retail clients to come on in, the water is nice and warm, and buy stonks, keeping its 5,100 year-end price target for the S&P (before cutting it to 4,900 and then again to 4,700 as chief strategist David Kostin was “shocked” to learn that the Fed will hike and hike and hike to crush the soon-to-be double digit inflation) even as it was selling billions of stocks for its own account…

… the bank was also taking the other side of its client trade by aggressively capitalizing on inflation – the same inflation that tends to send stocks sharply lower – with Bloomberg reporting this morning that Goldman traders made “hundreds of millions of dollars from inflation trading so far this year”, as the Wall Street giant benefits from the war-fueled surge in European consumer prices which as we reported last week, soared past analysts’ forecasts to 7.5%, the highest year-on-year rate in the history of the single currency.

According to Bloomberg, Goldman generated about $300 million in the first quarter from dealing in bonds and derivatives tied to inflation, double the same period a year ago, with much of the money made from euro-based transactions, an already-surging market that has jumped to unprecedented levels since Russia’s invasion of Ukraine.

While the post-lockdown, post-Ukraine war surge in consumer prices since last has spawned a global cost-of-living crisis and sent Democrat approval ratings in the trash, it has turned into a goldmine for traders who have correctly predicted the arrival of the highest inflation in decades. Goldman Sachs made about $450 million from the business for all of 2021, double what the firm made in previous years, Bloomberg reported in February.

As Goldman crushed it on the back of inflation, European households and businesses have been slammed with hikes in energy costs as the Russian invasion roils the continent’s access to oil and gas, worsening a crisis in the cost of commodities that set in last year. The rise in prices has forced governments across the bloc to spend billions of dollars on aid programs, with much of the proceeds ending up indirectly in Putin’s pocket. The European Central Bank may raise interest rates to deal with inflation that’s now more than three times its 2% target. In France, Marine Le Pen has targeted the issue in her campaign to oust President Emmanuel Macron in elections that begin this Sunday.

On the other hand, for Goldman the geopolitical volatility sparked by the ongoing war in Ukraine has meant much more profit, and according to Bloomberg, Nikhil Choraria, who helps oversee the inflation-trading business in London, has thrived by predicting the surge in the continent’s prices.

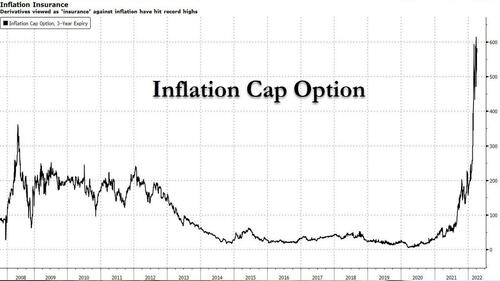

According to the report, Choraria’s profit has come from derivatives tied to short-term or “front-end” inflation. This market became increasingly volatile during the first quarter as Russian tanks rolled into Ukraine, according to Michael Riddell, who manages about $8 billion at Allianz Global Investors. This kind of uncertainty can make traders a lot of money, he said. Indeed, the cost of options that pay out if inflation climbs above 2% have climbed to previously-unseen levels, generating returns that leave bitcoin in the dust.

“It’s not uncommon for bank trading desks to make money when you have big volatility events, although a few can also lose money too if they get caught on the wrong side,” Riddell said. “Front-end inflation markets were as volatile as it gets.”

Of course, if you can get your own clients to take the other side of the trade – as Goldman did ahead of the credit bubble bursting when it could barely find enough superlatives to describe all those amazing RMBS it was selling – it helps.

Tyler Durden

Fri, 04/08/2022 – 12:25

via ZeroHedge News https://ift.tt/aSFXQkW Tyler Durden