Don’t Blame Big Oil For High Gasoline Prices

Authored by Tsvetana Paraskova via OilPrice.com,

-

The single biggest component – out of four – in determining the price of gasoline in America is the price of crude oil on international markets.

-

Sales taxes, along with taxes applied by local and municipal governments, can have a significant impact on the price of gasoline in some locations.

-

Big oil executives rejected claims of price gouging in a congress hearing on Wednesday.

The Biden Administration’s insistence that oil companies are ripping off Americans at the pump while lining their own pockets culminated in this week’s hearing at the House Committee on Energy and Commerce, at which CEOs at the biggest oil corporations in America were grilled about their role in setting the gasoline prices. While Democrats continued to accuse oil companies of price gouging, the top executives of Exxon, Chevron, BP America, Shell USA, Devon Energy, and Pioneer Natural Resources found themselves explaining the basics of economics and how crude oil production and fuel distribution work in a free market.

Crude Oil Price The Single Most Important Factor In Gasoline Price

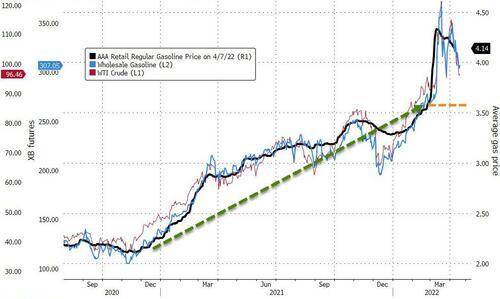

The single biggest component—out of four—in determining the price of gasoline in America is the price of crude oil on international markets. In February 2022, the price of crude made up as much as 61 percent of the price American drivers paid for a gallon of regular gasoline, per EIA data. In the decade from 2012 to 2021, crude prices made up 54.8 percent of the price of a gallon of gasoline, EIA data showed.

The other three components influencing the price of gasoline are taxes, refining costs and profits, and distribution and marketing costs and profits.

As of January 1, 2022, total state taxes and fees on gasoline averaged 31.02 cents per gallon. Sales taxes, along with taxes applied by local and municipal governments, can have a significant impact on the price of gasoline in some locations, the EIA says. State taxes also impact gasoline prices, and as the national average price rose above $4 per gallon, some states have moved to temporarily suspend taxes, and others consider doing so to bring relief to American customers, who are very sensitive to gasoline prices and often tie their approval for a president to the price of gasoline they are paying.

Refining costs and profits, as well as distribution and marketing costs, reflect seasonal and local factors, including gasoline demand in peak/off-peak season, the cost of ethanol, the location of the individual gas station, state and local fees, or state regulations on gasoline formulations to reduce air pollution.

Moreover, the biggest oil companies own few of the retail gasoline stations in the United States, and fewer than 40 percent of the country’s 145,000 fueling outlets carry branded fuel of one of the five major oil companies—Exxon, Chevron, Shell, BP, and ConocoPhillips/Phillips 66.

The price of gasoline Americans pay right now is a function of several factors, the biggest of which is the price of crude. Big Oil, or any other oil company operating in a free market such as that of the United States, have very little or nothing to do with how much a gallon of gasoline costs.

“We Do Not Control The Market Price”

“I have seen statements in the press suggesting that Chevron and other oil and gas companies are responsible for the increase in fuel prices. I want to be absolutely clear: we do not control the market price of crude oil or natural gas, nor of refined products like gasoline and diesel fuel, and we have no tolerance for price gouging,” Chevron’s CEO Michael Wirth told the hearing on Wednesday.

House Committee on Energy and Commerce Chairman Frank Pallone, Jr. opened the hearing with, “We are here today to get answers from the Big Oil companies about why they are ripping off the American people.”

Though some 8,000 gas stations around the country bear Chevron brands, the vast majority are privately owned and operated and set their own prices for the fuel they sell to consumers. Chevron owns and operates only about 300 gas stations in three states, Chevron’s Wirth said.

“And while the price of crude oil might dip more quickly, it frequently takes more time for competition among retail stations to bring prices back down at the pump,” he said.

Executives at the other companies present at the hearing shared similar views.

Darren Woods, Exxon’s CEO, said:

“No single company sets the price of oil or gasoline. The market establishes the price based on available supply, and the demand for that supply. Continued investment in new production to offset depletion and meet growing demand is the only way to achieve balanced markets and more affordable prices, bringing real relief at the pump.”

Woods also recalled that government policies creating certainty for investments are essential to ensure more supply and bring relief to gasoline prices in the medium term in what appeared a call on the Administration to adopt policies encouraging American oil and gas supply.

“Consistent, efficient, and effective permitting processes, whether for leases, drilling, or infrastructure such as pipelines, or export applications, will help spur further investment in U.S. oil and gas production,” Exxon’s CEO added.

“Pioneer is a “price-taker.” We do not set the sales prices of our products. Rather, our oil and other commodities are sold based on index prices determined by international supply and demand fundamentals and global markets,” Pioneer Natural Resources CEO Scott Sheffield said.

Gretchen Watkins, president of Shell USA, noted that “Because oil is a global commodity, Shell does not set or control the price of crude oil. Similarly, Shell does not set or control the price that consumers pay. Indeed, it would be illegal for Shell to do so because nearly all Shell-branded retail stations in the United States are owned by independent operators who set their own prices in the marketplace.”

According to NACS, the Association for Convenience & Fuel Retailing, only about 0.1 percent of the fueling outlets in the country are owned by a major oil company.

“So, when you see announcements about profits or earnings reports of oil companies, don’t confuse them with your local/neighborhood convenience store that’s competing for your business every day to fuel your vehicle,” Jeff Lenard, NACS vice president of strategic industry initiatives, wrote earlier this month.

Tyler Durden

Fri, 04/08/2022 – 13:24

via ZeroHedge News https://ift.tt/HMdPoWz Tyler Durden