Bonds & Stocks Battered As Hawkish Fed Flexes, Europe Panics

The reality of a looming recession appears to be striking home for stocks this week as ‘Defensive’ stocks hugely outperformed ‘Cyclicals’…

Source: Bloomberg

After an exciting start to the week (when Nasdaq spiked and Small Caps puked on Monday as the ‘QE trade’ kicked back in with ‘growth’ bid), its been a one way street lower since as The Fed issued its most hawkish Minutes since Volcker. Small Caps and Nasdaq were the week’s biggest losers…

Trucking, airlines and railway stocks were among the worst performers on the S&P 500 Index this week, with the Dow Jones Transportation Average staring at its worst weekly run since June 2020, as fears of an economic slowdown gripped investors. Since the start of April, Dow Transpoorts are down 11%!! (Dow Industrials are basically unch)

The Majors all trod water around key technical levels…

Bonds were clubbed like a baby seal this week with the long-end drastically underperforming (led by a 33bp rise in 10Y Yields)…

Source: Bloomberg

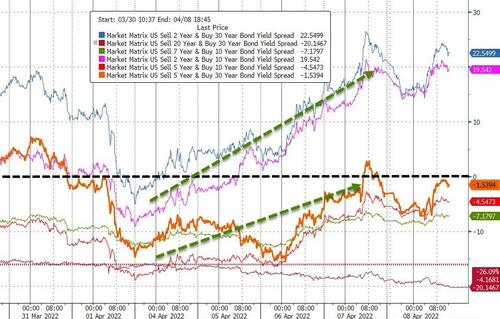

2s30s and 2s10s uninverted this week (as did 5s30s briefly before closing the week at -1.5bps), which is actually the recession signal (as opposed to the inversion)…

Source: Bloomberg

Meanwhile, European elites are panicing as euro-redenomination rears its ugly head as peripheral sovereign yields started to surge (and The ECB quickly said it ‘had tools’ up its sleeves to save the world)…

Source: Bloomberg

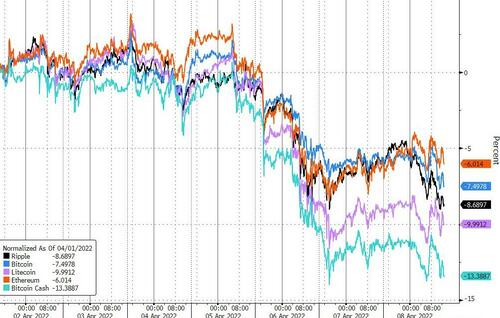

Despite The Miami Bitcoin Conference (or perhaps because of it), crypto had a rough week

Source: Bloomberg

The dollar took out the FOMC spike highs and is trading back at its highest against its fiat peers since July 2020…

Source: Bloomberg

Gold and Silver rose on the week (despite a strong dollar) but it was Palladium that really soared as the London Platinum & Palladium Market has suspended both Russian refineries from its good delivery list. This effectively cuts off Russian palladium and platinum to the west…

Source: Bloomberg

Oil dropped for a second week in a row, holding above the pre-invasion levels still though, but WTI settled below $100. Both a very hawkish Fed and the increasingly stringent lockdowns in China weighed on demand

Finally, forget the ‘r’-word, it’s the ‘s’-word that should really scare you!!!

Source: Bloomberg

The central planner’s nemesis is back…

Tyler Durden

Fri, 04/08/2022 – 16:01

via ZeroHedge News https://ift.tt/T1dALef Tyler Durden