Nomura: Everyone Is Waiting For This “Final” Shoe To Drop Before The All-Clear Signal

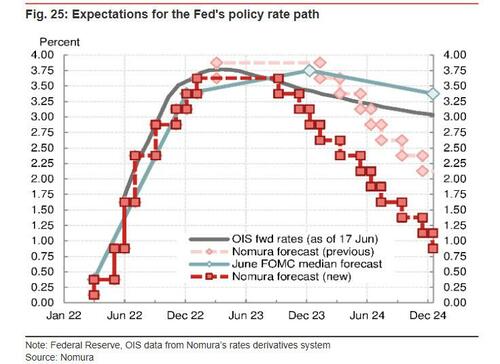

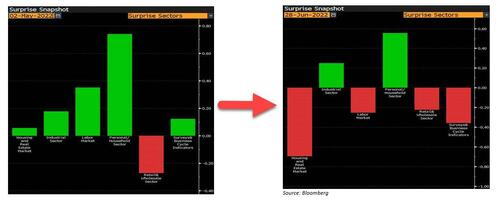

Having come back from a brief vacation, Nomura’s cross-asset guru, Charlie McElligott looks back at last week’s action and finds that just as we observed recently, “bad news was good news” again, as markets turned focus from “high inflation” to “deteriorating growth”, manifesting in a very significant re-pricing of “hard-landing” odds from perceived “CB policy-error >> Recession” meme (more evidence, as per global PMIs joining the “wrong way” growth data parade) which then dictated a powerful “reversal blast” of monetization in prior “trend trades” (a rally in heavily-shorted Bonds and Equities versus a selloff in Commodities and USD “longs”). As a result, markets removed a whopping 1.5 hikes for this Fed cycle, and pulling-forward the “end of Fed tightening” by as early as 4Q22 / 1Q23 (FFZ2FFH3 shows removal of 32.5bps of implied Fed hiking over the past two weeks alone, with the market now expecting Fed cuts next year off the back of the economic slowdown (as we described in detail in “Fed Rate-Hikes To End This Year, Followed By 3% Of Rate-Cuts & QE“).

This, as McElligott notes, meant big shocks across trend trades, with “winners” blasted lower and “losers / shorts” powerfully squeezed higher, and proceeds to highlight the following unique feedback loop:

- This “risk of a Recession” hammered Commodities and Inflation Expectations (e.g. Breakevens continuing their recent collapse off highs… ->

- Which lowered currently perceived Inflationary pressures… ->

- Which is viewed as allowing the Fed to be less aggressive… ->

- Which means we “cut the left tail” of a hard-landing recession!

Said another way, markets “leapt” at the opportunity provided by weakening growth, lower inflation expectations and collapsing commodities momentum to “anticipate the anticipators” and jump the “dovish” gun—again trying to “call the bluff” of Central Bankers who remain overly sensitive to a “growth > inflation” prioritization / reaction-function conditioning.

McElligott next notes that, beyond these constructive macro “qualitative” tailwinds for Equities, we also saw

- Big covering of grossed-up shorts that led to a “net-up” of exposure, while the Spot rally saw Puts hammered and a thus, a massive amount of Short Delta hedge to unwind;

- Street feedback continues to indicate monster corp buyback flows ahead of the “blackout” (75% of SPX mkt cap in blackout by july 4th);

- Expectations of robust positive Equities rebal flows ($30BN) into Month / Qtr–end; and

- The big quarterly Put Spread Collar roll, where the low strike of the PS removed mkt downside and suppressed Vol on our worst recent levels, where now, there is a lumpy amount of Vega sold and Delta bot as we approach Jun30—hence the “fear of the right tail” rally continues to trump “crash,” as there still isn’t a lot of positioning on to hedge.

With that in mind, the market now awaits the commencement of the much-discussed negative earnings revision “clearing” event, as the “final” shoe to drop following what the YTD drawdown that has been almost entirely due to the Rates impact on the multiple.

Here, echoing Morgan Stanley, Bank of America (and even Goldman), McElligott notes that a flush down to 3300-3400 is the perceived “all-clear” on the valuation case for Equities, with the whole world seemingly bid “out loud” down there for size, which means it either

- doesn’t happen and we don’t trade low enough, or conversely,

- we do trade down there, but the supposed size demand doesn’t materialize, and we get the puke through 3k.

In the meantime and after the “trend trade” reversal shocks of last week, yesterday saw the resumption of the “recession trade” in US Equities: 1) Energy 2) Utilities 3) Healthcare 4) Staples, which tells you that the said economic contraction concerns are driving the ongoing “Defensive” / “Low Risk” / “Quality” posture.

Fixed-income also again reversed to prior footing and is weakening with ongoing volatile gaps, partially due to Energy stabilization as China reduces quarantine times in half (one step closer to full re-open) and Ukraine / Russia “calm” narrative seen over the past week and half looks increasingly iffy.

Yet, as Charlie notes, at the same time, we see more signs of CB indecisiveness and noting their seeming “perpetually asymmetric conditioning” as it relates to “growth” concerns remaining tantamount over all others “scar tissue,” as old habits die hard. The latest case in point: ECB’s Lagarde from Sintra this morning, “who is yet-again confusing and vacillating with almost dovish messaging, which comes just weeks after her and the council’s hawkish pivot!”

Charlie here hands over the mic to his Nomura colleague Marco Brancolini who captures the latest absurdity, which only again creates confusion and front-end rates volatility, with CB’ers kowtowing to growth and market concerns, despite their inflation disaster sitting at the root of those issues:

Lagarde is flip-flopping, signalling a resurgent concern for growth. The focus on “optionality” will leave the front end unanchored and highly volatile. Her words appear to suggest that only Sep is data-dependent, but it will be hard to receive July anyway until a week before the meeting, as headlines and data can push the market around.

Confusingly, after the June pivot, Lagarde’s speech hails back to the framework of the May blog, noting that “in this environment, it is imperative for policymakers, within their respective mandates, to address the risks to the economic outlook”. I am not sure this is a u-turn in framework: there is a high chance that she may be simply trying to reassure markets after last week’s chatter of recession. I still think the Council will give primacy to inflation over growth, even at the cost of ending up with a recession.

The “optionality principle” is spelt out: “If the inflation outlook does not improve, we will have sufficient information to move faster. This commitment is, however, data dependent.” My understanding from the transcript is that such data dependency, however, only applies to September – in contradiction to what Kazaks told Econostream. July is at 32bp – as it’s been the case all year, it is hard to trade ECB dates on a fundamental basis until a week or ten days before the meeting, and it will be especially hard to stay received into this week’s inflation data. I will be happy to receive July ECB from the 10th onwards, not earlier.

Lagarde emphasised again “gradualism” and “optionality” – so expect limited visibility beyond the second meeting, as the ECB will remain data-dependent. The trigger for more aggressive tightening action are “higher inflation threatening to de-anchor inflation expectations, or signs of a more permanent loss of economic potential that limits resource availability”.

The ECB already pencils in “wage growth above 4% in 2022 and 2023 and at 3.7% in 2024” – this is a level compatible with inflation higher than 2%, so clearly wage data will be front and centre when we talk about ECB data dependency.

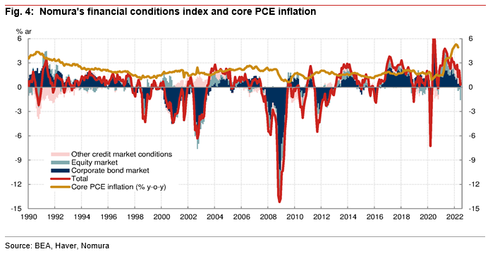

This, as McElligott notes, is the problem: you have to hold the line and see the hikes through now…otherwise, reflexive markets front-run this indecisiveness and ease financial conditions, which is counter-productive to inflation breaking efforts.

We all get the joke: Central Banks can only pull the “demand” lever and attempt to weaken inflation via labor mkt impact on consumption, unable to address the supply-chain issues and both structural and idiosyncratic energy / commod market dynamics…hence the never-ending stream of memes:

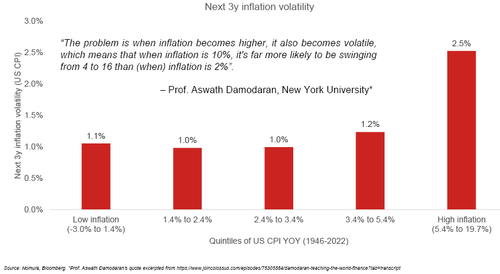

But at the end of the day, it’s the inflation volatility which will keep the front-end unstable and behind cross-asset moves…

… as event-weightings around monthly data (and reactive CB’s thereafter) keep us lunging:

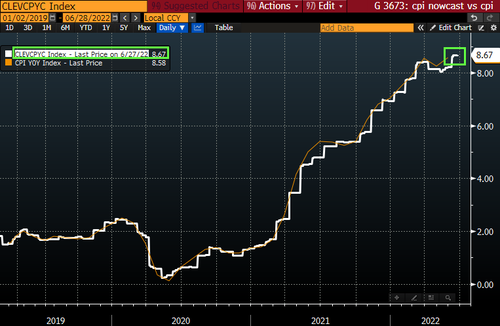

- Inflation will continue to surprise in its “stickiness” and strength over the upcoming months, particularly as it moves into “Services”

- Cleveland Fed Inflation Nowcast currently projecting fresh highs for CPI YoY

- “High inflation means volatile inflation” and “inflation tends to trend” as local headwinds for sentiment, positioning and risk management

Concluding his recap, Charlie writes that for now “this ongoing tilt in ‘upside’ inflation data, and persistently reactive Central Bank “hawkish impulse” thereafter, will continue to reinforce negative impact in the rate / credit –sensitive parts of the economy…effectively “self-fulfilling” a recession”…

… as consumer sentiment plummets and broad activity loses momentum.

Which of course, is the best case scenario for stocks because as Rabobank noted earlier, the market endlessly wonders how long until we cut rates and restart QE again. The answer: a recession should do it.

Tyler Durden

Tue, 06/28/2022 – 13:25

via ZeroHedge News https://ift.tt/WtDEHYw Tyler Durden