Pentagon Moves To Wrest Rare Earths Control From China

Authored by Greg Isaacson via The Epoch Times,

The battle for control of the global rare earths supply chain is heating up, with the U.S. Department of Defense investing in a new processing plant in a bid to challenge China’s chokehold over the critical minerals.

The Pentagon has agreed to fund the entire $120 million cost of a heavy rare earths separation facility to be built in Texas by Australia’s Lynas Rare Earths, advancing a program launched in 2020, the company announced on June 14.

Located on the Gulf Coast, the new facility will give the United States access to domestically produced heavy rare earths that are essential to industries such as electric vehicles, wind turbines, and electronics, according to the company, which is the largest processor of rare earths outside of China.

The Texas facility that landed Pentagon funding will process heavy rare earth carbonate mined in Australia, forming a production cycle that bypasses China entirely. Lynas Rare Earths plans to combine the upcoming plant with a proposed light rare earths separation facility that is being co-funded by the company and the Defense Department.

The project was first announced in July 2020 as part of the U.S. government’s strategy—under a 2017 executive order signed by former President Donald Trump—to reduce dependence on foreign imports of critical minerals. The Pentagon is also funding a heavy rare earths processing and separation facility in Mountain Pass, California.

China’s Dominance in Rare Earth Production

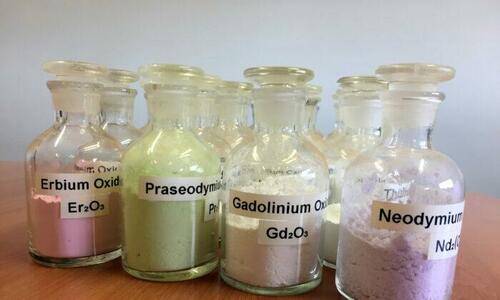

Rare earths are a group of 17 elements with unique properties used in virtually every piece of modern technology, from smartphones to jet engines. Although the United States pioneered the industry during World War II, China now controls over half of global rare earths mining and 80 to 90 percent of intermediate processing.

China’s dominance of the industry represents a major risk to the United States, which currently has only one active rare earths mine—the Mountain Pass mine in California—and zero commercial-scale processing capability. America’s dependence on Chinese rare earths processing gives the Chinese Communist Party (CCP) dangerous leverage over the U.S. economy and military.

For example, the Chinese regime obliquely threatened to limit exports of rare earths to the United States after Washington placed Chinese telecom giant Huawei on a trade blacklist in 2019.

“It is believed that if the U.S. increasingly suppresses the development of China, sooner or later, China will use rare earths as a weapon,” the state-run Global Times newspaper warned in May of that year.

It’s unclear how much damage Beijing could do if it chose to pull the trigger on that threat. A Chinese embargo would send shockwaves through the global market—as happened in 2010 when China temporarily restricted exports of rare earth minerals to Japan over a territorial dispute.

A 2021 study by the U.S. Department of Energy found that a one-year export ban on rare earths by China could cause a 40 percent drop in magnet production outside of China as metals would become harder to obtain. Dysprosium oxide, a key component of the neodymium magnets used in a vast array of technologies from wind turbines to electric vehicles, is particularly vulnerable to price shocks from a Chinese embargo, the study found.

But China’s ability to harm the U.S. economy by weaponizing the rare earths supply is probably more limited than its industry dominance would suggest. A research note published by investment bank Raymond James in 2019 argued that the impact of a Chinese embargo on rare earths exports to the United States would be “mild,” according to a report by CNBC.

The analysts pointed out that the United States spent only $160 million to import rare earths for manufacturing in 2018 and accounted for only 9 percent of global demand for rare earth inputs in the manufacturing process. Most of the high-tech products that would be affected by a rare earths embargo—including PCs, electric vehicle batteries, and fiber optics—are manufactured in Asia rather than the United States.

….

The U.S. military’s dependence on Chinese rare earths is a far more serious vulnerability. The defense supply chain relies heavily on rare earths, from disk drive motors in tanks to fin actuators in missile guidance systems.

…

The United States, in recent years, has begun to piece together a strategy for addressing the national security concerns involving rare earths.

…

Tyler Durden

Tue, 06/28/2022 – 15:45

via ZeroHedge News https://ift.tt/2qLchMs Tyler Durden