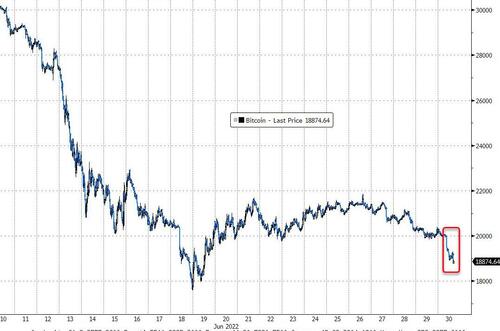

Bitcoin Breaks Below $19k, SEC Rejects Spot ETF (Again), JPM Says ‘Deleveraging Well Advanced’

Bitcoin broke back below $19,000 this morning to end its worst first-half of a year ever (and worst quarter since Q3 2011…

The (mostly negative) headlines keep mounting as JPMorgan’s Nikolaos Panigirtzoglou warns that deleveraging continues to reverberate throughout the crypto ecosystem.

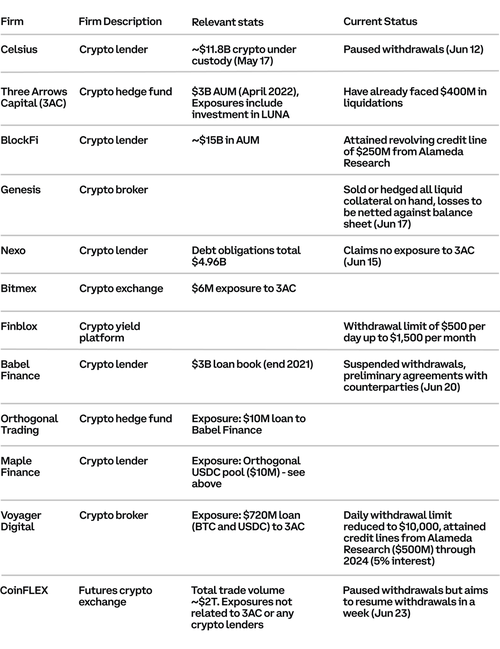

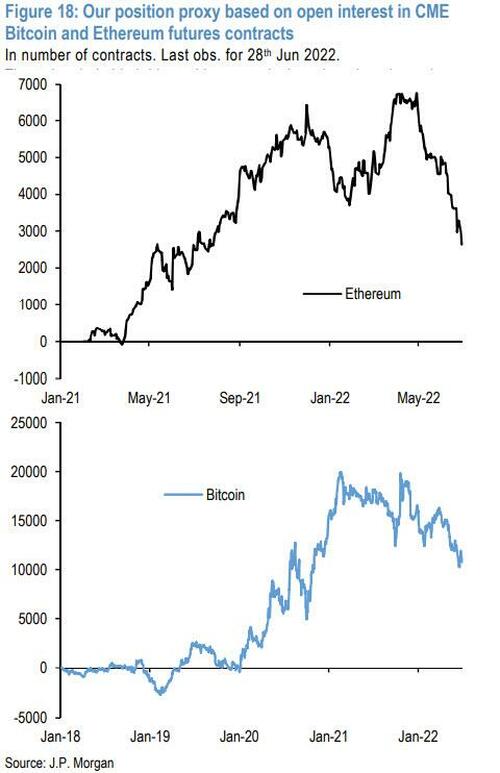

Multiple failures among crypto companies should not be a surprise in the current backdrop of deleveraging, given the crypto market lost 70% of its capitalization cumulatively since last November. The entities that employed higher leverage in the past are now the most vulnerable. Whether it is miners having borrowed to expand operations using their bitcoins as collateral, or corporates such as MicroStrategy having borrowed in the past to invest even more heavily into bitcoin, or hedge funds using futures to lever their positions, or retail investors borrowing via margin accounts to invest into various cryptocurrencies. Three Arrows Capital’s failure is a manifestation of this deleveraging process, a process that appears well advanced, making the bottom formation process in crypto markets more volatile.

In the current phase of deleveraging, the weakest crypto entities, i.e. those with high leverage and low capital appear to be most challenged, while the ones with the strongest balance sheets seem most likely to survive and emerge stronger once the current deleveraging phase is over. How much more deleveraging needs to still happen is hard to assess.

But indicators like our Net Leverage metric suggest that deleveraging is already well advanced.

And we find two additional reasons to believe that the current deleveraging cycle may not be very protracted:

1) The fact that crypto entities with the stronger balance sheets are currently stepping in to help contain contagion and;

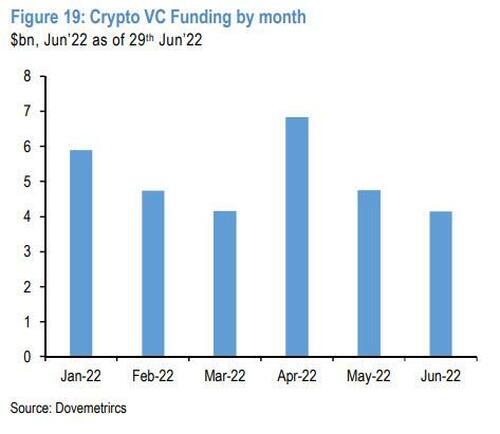

2) VC funding, an important source of capital for the crypto ecosystem, continued at a healthy pace in May and June.

Still, the crypto ecosystem took another modest blow last night as The SEC rejected Grayscale’s application to convert its Grayscale Bitcoin Trust to an exchange-traded fund late Wednesday, citing concerns about market manipulation, the role of Tether in the broader bitcoin ecosystem and the lack of a surveillance-sharing agreement between a “regulated market of significant size” and a regulated exchange, echoing concerns the regulator has expressed for years in rejecting other spot bitcoin ETF applications.

GBTC responded by suing the SEC, as CEO Michael Sonnenshein said the company was “deeply disappointed” and “vehemently disagree” with the SEC’s decision to deny their application.

“Over 11,400 investors, academics, business leaders, trade associations, and other key stakeholders submitted comments to the SEC in support of Grayscale’s ETF proposal,” wrote Sonnenshein.

As of June 9th, over 99.9% of those comment letters were supportive of the cause.

As CoinTelegraph reports, Grayscale announced that its senior legal strategist, former U.S. solicitor general Donald B. Verrilli Jr., had filed a petition for review with the United States Court of Appeals for the District of Columbia Circuit.

Verrelli stated that the latest decision shows that the SEC is acting “arbitrarily and capriciously” by “failing to apply consistent treatment to similar investment vehicles” and will be pursuing a legal challenge based on the SEC’s alleged violation of the Administrative Procedure Act (APA) and Securities Exchange Act (SEA).

Grayscale Investments, which has $12.92 billion of assets under management in its GBTC, announced its intentions to transition the fund into an ETF in April 2021. A formal request to do so was then submitted later that year, in October. Since then, Grayscale has mounted many efforts to properly inform the public of its intentions and to meet all regulatory requirements.

Essentially, the company will argue that the SEC has to allow products that are like other products already trading, in this case bitcoin futures ETFs.

By changing the trust into a spot Bitcoin ETF, Grayscale hopes to correct Grayscale Bitcoin Trust’s “discount” and allow the investment firm to charge lower fees, making it easier to move money in and out of the fund.

The SEC’s ongoing negative response to a spot Bictoin ETF prompted many reactions across social media with some accusing the SEC of “holding GBTC hostage.”

According to Twitter user Ann, since the SEC approved an ETF that shorts Bitcoin, the SEC may be working to “suppress the price of Bitcoin.”

The Twitter user argued that this is not the role of the SEC.

Ironically, on the same day that the SEC rejects GBTC, CoinTelegraph reports that major Dutch stock exchange Euronext Amsterdam, a part of the pan-European marketplace Euronext, is debuting its first Spot Bitcoin ETF.

The Jacobi Bitcoin ETF is positioned as the first spot Bitcoin ETF launched in Europe, Jacobi founder and CEO Jamie Khurshid told Cointelegraph.

“Our product is the first spot or physical-backed Bitcoin fund, and the fund is not allowed to lend, stake or leverage any of the assets it owns. For the first time in Europe, investors buying an exchange-traded Bitcoin product will own the units that own the Bitcoin,” Khurshid said.

“There are other exchange-traded products in Europe but no other spot BTC ETF,” he added.

In other news, The Block reports that FTX looked at a deal with Celsius but in the end walked away, citing two people with knowledge of the matter.

FTX held talks with Celsius about providing financial support or making an acquisition but did not proceed to looking at Celsius’s finances. Celsius had a $2 billion hole in its balance sheet and FTX found the company difficult to deal with, one of the sources said.

Finally, we note that, as Anita Posch writes at BitcoinMagazine.com, crypto lending scheme implosions make bitcoin stronger.

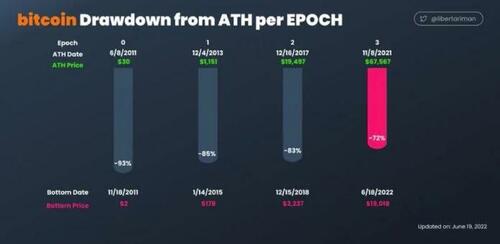

As you can see in the graph above, the recent bitcoin price drawdown is not the first of its kind in the history of Bitcoin. It’s not unusual that the price reaches a low in between two halving events, when the amount of newly-minted bitcoin is split in half, which occurs every four years.

Reckless lending practices brought the whole crypto-lending system down. These centralized services take customers’ bitcoin and promise monthly returns. They lend it out to other DeFi projects, which is risky in the first place, and, on top of that, they lend out more money than they hold in assets. This is essentially a practice that led to the global financial crisis of 2008, which was a reason that Satoshi Nakamoto released the Bitcoin software in the first place.

Now, the cryptocurrency industry is building the same over-leveraged financial products and one has to ask: Did they not learn? Did they think they found a solution to magically make profits, where there is no underlying economic activity?

The failure of these yield-searching companies brought the whole market and bitcoin down in the last weeks. It’s a great reminder that one should have all assets in self custody and that there is no magical solution to money making by over-leveraging. Hopefully, investors and businesses learn from these busts.

Bitcoin is a decentralized technology which is unstoppable. No government nor any bank can change or control it. No one can take it away from you. This is especially important if you live in a country with authoritarian leaders or a broken banking system. Bitcoin has been declared dead several times, but it has been producing new blocks every 10 minutes anyway. It’s unstoppable, like a clock.

Tyler Durden

Thu, 06/30/2022 – 13:25

via ZeroHedge News https://ift.tt/uSb3ehV Tyler Durden