Record Trade Deficit Hitting Korea Won Foreshadows More Weakness

By Ken McCallum, Bloomberg markets live reporter and commentator

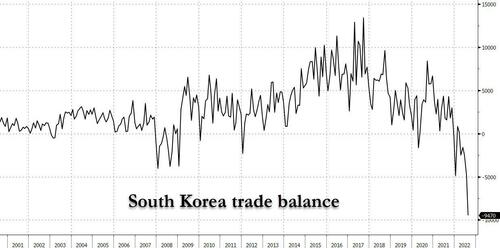

The Korean won’s drop after the nation’s trade deficit widened even more than expected to a record suggests that bearishness toward the currency will stay intact for now.

Signs of Korea’s economic woes may help push the dollar-won convincingly above the psychological level of 1,350, which it’s been briefly breaching this week. Morgan Stanley analysts have said that a break above that level may pave the way for a move toward 1,370, while Korea Investment & Securities Co. sees a rise to 1,380 in the second half of the year, compared with around 1,348 today.

There’s a vicious cycle feel to the won’s weakness: Korea’s reliance on energy imports means that a stronger dollar may increase costs and fan more inflation, further undermining the won. Korea has the largest fuel and food deficit as a share of gross domestic product in Asia, according to Natixis (also, Korea’s share of net exports as a contributor to economic growth is the highest in the world at a mind-blowing 70% of GDP, which in turn is the 10th largest in the world).

And it’s not only the trade deficit that weighs on the won. Other negatives include a downturn in the semiconductor market, economic slowdown in a China–the biggest destination of Korean exports, and the Bank of Korea’s likely inability to match the Federal Reserve’s jumbo rate hikes due to concerns about the pain it will cause for households weighed down by massive debt.

Tyler Durden

Wed, 08/31/2022 – 23:20

via ZeroHedge News https://ift.tt/w0aE8I3 Tyler Durden