Futures Rise After House Passes Debt Deal, Europe Boosted By Weaker Inflation

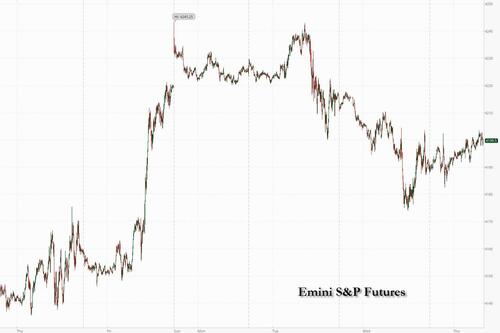

US futures edged higher after the House passed a deal to avert a US default (with more Democrats voting for the “McCarthy” deal than Republicans) and Fed officials hinted at a pause in interest-rate hikes. Globally, the Caixin China PMIs beat expectations (not to be confused with the catastrophic official PMI print) and Euro Area CPI printed dovishly, aiding a global risk-on tone. As of 7:45am ET, S&P 500 futures added 0.2% and were again trading right around 4,200 ironclad resistance, while Nasdaq 100 contracts were 0.1% higher. The Dollar slumped to a three day low as the euro rallied after data showed underlying inflation in the euro zone dipped by more than expected in May, though that may not stop the European Central Bank from raising rates. Treasury yields edged higher, mirroring moves in Europe and the UK. Gold and Bitcoin fell, while oil climbed for the first time in three days. Today’s macro data focus includes ADP, Jobless Claims, ISM-Mfg, and Construction Spending. As the market moves past the debt ceiling, the focus shifts to the Fed and the macro narrative.

In premarket trading, a rally in companies exposed to the development of artificial intelligence-related products continued to cool in US premarket trading. Software maker C3.ai Inc. plunged as much as 22% after a disappointing sales outlook. Nvidia, whose meteoric rise had fueled the rally, was steady after losing some ground on Wednesday. Among other individual movers, Salesforce Inc. slumped abut 6% after it gave a lackluster outlook for future sales. Advance Auto Parts Inc. extended a decline after cutting earnings and sales guidance. Here are some other notable premarket movers:

- Alteryx rises 5.6% in premarket trading as BofA moves to buy from neutral in note, citing three reasons supporting its upgrade for the software company.

- Chewy shares jump 16% in US premarket trading as analysts said the online pet supplies retailer topped expectations across the board, with a beat on its key customer metric the highlight.

- Lucid shares drop 8% in US premarket trading, after the electric-vehicle maker said it’s raising about $3 billion in a common stock offering, with the majority of the money coming from its Saudi owners. The fundraising reduces expectations for Lucid to go private anytime soon, Bloomberg Intelligence notes.

- Nordstrom shares rallied as much as 7.8% in premarket trading, after the department-store chain reported better-than-expected quarterly revenue and profit. Analysts were optimistic about the improvements at the retailer’s off-price Rack stores.

- Okta shares fall as much as 19% in premarket trading on Thursday, after the application software company reported its first- quarter results and analysts noted weakness in the outlook for current remaining-performance obligations (cRPO) as a concern.

- Salesforce shares fall as much as 6% in premarket trading, after the software company reported its first-quarter results and gave a forecast showing the company isn’t growing as fast as it used to. Analysts noted, in particular, the slowdown in contracted sales.

- Veeva Systems quarterly results beat expectations, with the application software firm’s billings a beat. Notably, analysts said it appears to be navigating well through the macro weakness which had impacted its peers. Veeva shares rose 7.1% in after-hours trading.

Passage of the debt-ceiling deal struck by House Speaker Kevin McCarthy and President Joe Biden means the bill will be sent to the Senate where it will be promptly signed well before the June 5 default deadline. The signs of optimism were helped along by comments from Fed officials who backed the possibility of holding rates unchanged the next meeting, and some encouraging economic data out of China.

“Finally, some good news is driving today’s optimism,” said Ludovica Scotto di Perta, a structured-product specialist at Swissquote Bank SA. “US raising the debt ceiling and sentiment that the Fed will pause are boosting risk appetite. It might only be temporary but we will take anything at this point.”

“A June swoon may be in the cards as the S&P 500 struggles to clear key resistance at 4,200,” said Adam Turnquist, chief technical strategist at LPL Financial. “While a deal in Washington could be a catalyst for a breakout, overbought conditions in the technology sector and mega-cap space — the primary drivers of this year’s market advance — could make this a high hurdle for the market to clear on a near-term basis, especially without broader participation.”

Meanwhile, hopes for a Fed pause were partly pared back after Wednesday’s JOLTS jobs report for April showed more than 10 million openings, the highest in three months and above consensus estimates. But Fed Governor Philip Jefferson said the central bank is inclined to keep interest rates steady in June to assess the economic outlook. His remarks were echoed by Philadelphia Fed President Patrick Harker, who said, “I think we can take a bit of a skip for a meeting.”

Attention turns next to US jobless claims data due later Thursday, before Friday’s nonfarm payrolls.

European stocks rose amid a wider risk-on sentiment after the House passed debt limit deal, and were on course to snap a three-day losing streak after US lawmakers took a step closer to averting a default. The Stoxx 600 is up 0.7% with media, banks and carmakers among the leading performers as data showed euro-area inflation slowed more than analysts’ estimates in May. Adnoc Logistics & Services, the maritime logistics unit of Abu Dhabi’s main energy company, soared as much as 52% on its debut after a hugely oversubscribed initial public offering. Airbus SE gained after Reuters reported a rise in aircraft deliveries. Here are the most notable European movers:

- Neste shares gain as much as 4.4% after being raised to buy from neutral at UBS, with the broker more optimistic on the outlook for renewable fuel products beyond the key Swedish market

- Recordati gains as much as 5% and leads gains on Italy’s FTSE MIB benchmark, after Equita added the Italian drugmaker to its best picks selection, citing better-than-expected 1Q results

- Johnson Matthey rises as much as 2.1% after Bloomberg reported the British industrial conglomerate is planning the sale of its medical device components business

- Wolters Kluwer rises as much as 4.1%, after BNP Paribas Exane raises its recommendation to outperform, seeing professional information providers such as Wolter Kluweras potential AI winners

- Lonza gains 1.6%, after the drug-ingredient supplier announced its acquisition of early stage biotech Synaffix. Morgan Stanley welcomes the move, saying it gains access to ADC technology

- ITM Power rises as much as 4.4%, after the clean-fuel firm said it is making good progress against its 12-month plan, with net cash set to be ahead of guidance and the adjusted Ebitda loss within

- Remy Cointreau trades flat, having initially jumped as much as 6%, after the French distiller reported FY current operating income that beat estimates

- Dr. Martens slumps 14% at the open after the bootmaker’s FY profit missed expectations. Morgan Stanley analysts called the sales forecast “ambitious,” while RBC sees double-digit downgrades ahead

- Auto Trader shares slip as much as 2.5%, with analysts predicting limited changes to consensus estimates following results and guidance that largely matched expectations

- Pennon shares fall as much as 2.3% as worries over the ongoing Ofwat investigation into sewage pollution overshadow the utility’s EPS beat, with Jefferies flagging lack of detail in the guidance

Earlier in the session, most Asian benchmarks rose, though gains in Chinese stocks faded as investors studied mixed readings on the country’s manufacturing activity. Caixin manufacturing data for May showed an expansion, exceeding forecasts for a small contraction. The numbers followed official figures Wednesday that showed a further contraction in activity.

- Hang Seng and Shanghai Comp. shrugged off the early indecision and were boosted after the Chinese Caixin Manufacturing PMI data partially atoned for yesterday’s weak official PMI readings.

- Japan’s Nikkei 225 was marginally supported by data releases including business capex which grew at its fastest pace since Q3 2016 and with Japanese firms logging their largest recurring profits for Q1.

- Australia’s ASX 200 was choppy in early trade but ultimately gained after stronger-than-expected capital expenditure and the improvement in Chinese Caixin PMI.

- Key stock gauges in India fell for a second day, led by losses in financial services and communication companies. The S&P BSE Sensex fell 0.3% to 62,428.54 in Mumbai, while the NSE Nifty 50 Index declined 0.3% to 18,487.75. The MSCI Asia-Pacific index climbed 0.4% for the day. Nifty Financial Services and Nifty Bank index were the worst performing sectoral indexes falling 0.6% and 0.8%, respectively. Out of 30 shares in the Sensex index, 18 rose, while 12 fell.

In FX, the Bloomberg Dollar Spot Index is flat while the Swiss franc has outperformed its G-10 peers slightly. The Norwegian krone is the worst performer, falling 0.8% versus the greenback. Crude futures decline with WTI falling 0.3% to trade near $67.90. Spot gold falls 0.2% to around $1,958. Bitcoin drops 0.7%. The euro rallied against the dollar after data showed underlying inflation in the euro zone dipped by more than expected in May, though that may not stop the European Central Bank from raising rates. European Central Bank Governing Council member Olli Rehn said the bank won’t contemplate lowering borrowing costs before core consumer-price growth slows in a continuous manner.

In rates, treasuries are lower with US 10-year yields rising 3bps, while two-year borrowing costs climb 4bps as stock futures partly bounce from Wednesday’s drop. 2s10s, 5s30s spreads are flatter by 1bp and 1.8bp on the day while 10-year yields are around 3.67%, cheaper by 2.5bp and lagging bunds and gilts by 0.5bp and 1.5bp in the sector. Bunds and gilts are also in the red with the former showing little reaction to data showing a larger than expected slowdown in euro-area inflation. US session focus turns to data, including ADP employment, jobless claims and ISM manufacturing. Fed’s Harker also due to speak after urging a June pause Wednesday.

In commodities, WTI futures lower by 0.75% on the day. Industrial metals climbed from six-month lows, led by copper and nickel. China’s sluggish economy has been a key driver of weakness demand for raw materials.

Bitcoin is softer on the session, though only incrementally so, and remains in close proximity to the USD 27k mark which itself is towards the mid-point of sub-1k parameters.

To the day ahead now, and the data highlights include the flash CPI release from the Euro Area for May, as well as the unemployment rate for April. Otherwise in the US, there’s the ISM manufacturing release for May, the ADP’s report of private payrolls for May, and the weekly initial jobless claims. In addition, there’s the global manufacturing PMIs for May, along with April data on German retail sales and UK mortgage approvals. From central banks, we’ll hear from ECB President Lagarde, the ECB’s Knot and Villeroy, as well as the Fed’s Harker. The ECB will also be releasing the account of their May meeting.

Market Snapshot

- S&P 500 futures up 0.2% to 4,197.25

- MXAP up 0.3% to 158.90

- MXAPJ little changed at 501.17

- Nikkei up 0.8% to 31,148.01

- Topix up 0.9% to 2,149.29

- Hang Seng Index little changed at 18,216.91

- Shanghai Composite little changed at 3,204.64

- Sensex little changed at 62,620.45

- Australia S&P/ASX 200 up 0.3% to 7,110.81

- Kospi down 0.3% to 2,569.17

- STOXX Europe 600 up 0.9% to 455.89

- German 10Y yield little changed at 2.30%

- Euro down 0.1% to $1.0675

- Brent Futures up 0.3% to $72.81/bbl

- Gold spot down 0.4% to $1,955.07

- U.S. Dollar Index little changed at 104.39

Top Overnight News

- China’s Caixin manufacturing PMI for May came in at 50.9, up from 49.5 in April and ahead of the Street’s 49.5 forecast. RTRS

- China has only modestly expanded its energy ties w/Russia, suggesting Xi is cautious about embracing Moscow as Putin becomes a larger int’l pariah. SCMP

- The ECB has gone through most of its monetary policy tightening to bring inflation back to its medium-term target of 2%, though the cycle is not quite over yet, ECB Vice-President Luis de Guindos said on Thursday. RTRS

- The head of UK chip designer Arm met Chinese officials in Beijing on Monday as the group sought to resolve issues over its plan to sell shares in New York. While Arm has tried to wash its hands of its problematic Chinese joint venture, Beijing has so far refused to process paperwork confirming the transfer of its stake to owner SoftBank. FT

- A rare ECB warning about the bond market risk of a Bank of Japan policy change comes at a time when Japanese outflows from the region are already at record levels. Investors from the Asian nation offloaded 5.4 trillion yen ($38.7 billion) of European bonds in 2022, the most according to Bloomberg-compiled data going back to 2005. While Japanese funds have been net buyers so far this year, they’ve spent a mere 81 billion yen on purchases — the lowest amount for a first quarter in six years. BBG

- Eurozone CPI for May undershot the Street, coming in at +6.1% Y/Y on the headline (down from +7% in April and below the Street’s +6.3% forecast) and +5.3% core (down from +5.6% in April and below the Street’s +5.5% forecast). BBG

- The debt ceiling bill passed the House by an overwhelming amount Wed night (the final vote was 314-117, including 149-71 for Republicans and 165-46 for Democrats). NYT

- Federal Reserve officials signaled they are increasingly likely to hold interest rates steady at their June meeting before preparing to raise them again later this summer.

- WSJ

- US crude stockpiles rebounded 5.2 million barrels last week after a big drop in the prior period, the API is said to have reported. Stocks at Cushing rose for a sixth week. More oil: OPEC+ faces a divided market when it meets this weekend. The group has never cut within three months of similar action. BBG

- Overseas sales of U.S. oil and refined products have surged. Exports of crude have jumped twelve-fold since December 2015, when Washington nixed crude-export restrictions…(WSJ)

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly positive after the US House passed the debt ceiling bill to avert a default which now moves to the Senate and with sentiment helped by the surprise expansion in Chinese Caixin Manufacturing PMI. ASX 200 was choppy in early trade but ultimately gained after stronger-than-expected capital expenditure and the improvement in Chinese Caixin PMI. Nikkei 225 was marginally supported by data releases including business capex which grew at its fastest pace since Q3 2016 and with Japanese firms logging their largest recurring profits for Q1. Hang Seng and Shanghai Comp. shrugged off the early indecision and were boosted after the Chinese Caixin Manufacturing PMI data partially atoned for yesterday’s weak official PMI readings.

Top Asian News

- US official said fewer US companies are applying to export sensitive tech to China amid growing government scrutiny of the flow of goods to the country, especially those with potential military applications, according to WSJ.

- Taiwan’s government said it expects to sign the first deal under the new trade talks framework with the US on Thursday, according to Reuters.

European bourses are firmer across the board, Euro Stoxx 50 +1.0%, as sentiment continues to improve after the US House vote and strong Chinese Caixin PMI. Note, limited sustained reaction was seen following the EZ Flash PMIs given they very much chime with the skew from the regional metrics released in recent sessions. Sectors are predominantly firmer with Energy outperforming after recent marked pressure while Real Estate names lag across the region. Stateside, futures are essentially flat as we await the debt ceiling’s progression into the Senate and particularly the prospect of amendments sending it back to the House, ES +0.2%. Nvidia (NVDA) CEO is to meet TSMC (2330 TT/TSM) and Foxconn (2354 TT) executives on Friday; adds that TSMC has immense capacity and incredible agility.

Top European News

- ECB’s Lagarde says today inflation is too high and is set to remain so for too long; we will keep moving forward – determined and undeterred – until we see inflation returning to our 2% medium-term target in a timely manner. Speech published after the EZ CPI print.

- ECB’s Rehn says core inflation must slow for the ECB to consider easing. Monetary policy journey has not concluded yet. Remarks made before the EZ CPI print

- ECB’s de Guindos says recent data on inflation are positive, still far from the inflation target. Still someway to go on rates Remarks made before the EZ CPI print

- ECB’s Knot says there is a need to reconsider which banks should be considered systemic, time to reconsider liquidity buffers after the SVB collapse.

- BoE Monthly Decision Maker Panel data – May 2023: 1-year ahead CPI inflation expectations ticked up to 5.9%, up from 5.6% in April.

FX

- Buck bases after downside in wake of Fed’s Harker and Jefferson backing June FOMC rate skip, DXY sits tight within 104.150-500 confines ahead of more NFP proxies, final US manufacturing PMI and ISM.

- Yen retreats towards 140.00 vs Dollar as UST-JGB differentials widen.

- Euro capped just shy of 1.0700 and raft of upside option expiries against the Greenback amidst mixed EZ data and manufacturing PMIs.

- Aussie underpinned around 0.6500 vs Buck after stronger than expected Capex, but Yuan remains week sub-7.1000 on US-China angst rather than 50+ Caixin Chinese PMI.

- PBoC set USD/CNY mid-point at 7.0965 vs exp. 7.0964 (prev. 7.0821)

Fixed Income

- Bonds retreat after pre-month end squeeze awaiting Senate debt ceiling passage, a busy June 1st US agenda and NFP on Friday.

- Bunds, Gilts and T-note are all underwater within 136.17-135.60, 96.74-34 and 114-16/01 respective ranges.

- French OATs and Spanish Bonos soft in the wake of multi-tranche issuance.

Commodities

- WTI and Brent are incrementally firmer though off earlier best levels which occurred around the Chinese Caixin PMI overnight; since, specifics have been limited as we approach the weekend OPEC+ gathering and after multiple sessions of pronounced pressure.

- Industrial metals benefit from the mentioned Chinese data while spot gold is little changed but has been on a slight upward trajectory towards the neutral mark in recent trade.

- US Private Inventory (bbls): Crude +5.2mln (exp. -1.4mln), Cushing +1.8mln, Gasoline +1.9mln (exp. -0.5mln), Distillate +1.8mln (exp. +0.9mln).

- Russian plans to halve subsidies for oil refiners may be postponed until September, according to Interfax citing sources. However, the Russian Finance Ministry said no final decision on oil and gas sector subsidies has been taken yet.

Geopolitics

- US Defence Secretary Austin told Japanese Defence Minister Hamada that he looks forward to deeper cooperation between the US-Japan alliance and with South Korea and Australia, while he stated that North Korea’s launch was dangerous, destabilising and violates international law, according to Reuters.

- North Korean leader Kim’s sister said no one can deny their right to launch a satellite and vowed to ramp up military surveillance efforts, while she added that North Korea’s spy satellite will soon enter orbit to perform its mission and that North Korea will do everything to enhance its war deterrence. Kim also stated that North Korea should work harder to develop reconnaissance tools and the Foreign Ministry urged the US to halt joint military drills, according to KCNA.

- NATO SecGen Stoltenberg says all allies agree that Ukraine will become a member of the alliance and that Russia does not have a veto on enlargement. Will speak with Turkey soon about Sweden’s accession.

US Event Calendar

- 07:30: May Challenger Job Cuts 287%, YoY, prior 175.9%

- 08:15: May ADP Employment Change, est. 170,000, prior 296,000

- 08:30: 1Q Unit Labor Costs, est. 6.0%, prior 6.3%

- 1Q Nonfarm Productivity, est. -2.4%, prior -2.7%

- 08:30: May Initial Jobless Claims, est. 235,000, prior 229,000

- May Continuing Claims, est. 1.8m, prior 1.79m

- 09:45: May S&P Global US Manufacturing PM, est. 48.5, prior 48.5

- 10:00: May ISM Manufacturing, est. 47.0, prior 47.1

- 10:00: April Construction Spending MoM, est. 0.2%, prior 0.3%

DB’s Jim Reid concludes the overnight wrap

Welcome to June and another day I feel blessed that I have a job as half term sees the family going to a heaving Harry Potter World today. I’ve tried to read the first book three times and the movies several times more. I don’t see what all the fuss is about. My wife and the three kids on the other hand are obsessed. So it’s a good division of time today. Back here in Muggle Land, since it’s the start of the month, we’ll shortly be releasing our monthly performance review of how different assets fared in May. Overall it was an eventful time, starting off with the closure of First Republic Bank and renewed concerns about financial turmoil. We then had another set of rate hikes from the Fed and ECB, negotiations around the US debt ceiling, serious excitement about AI, along with some increasingly downbeat data releases outside the US. With all said and done, that left most assets negative for the month, with losses across equities, bonds and commodities, despite a few key outperformers like tech stocks. See the full review in your inboxes shortly.

The main news last night came from the House of Representatives, which voted 314-117 in favour of sending the debt ceiling bill over to the Senate. The bill as currently written would suspend the debt ceiling until January 1 2025, with federal spending capped until 2025. In terms of timing for the Senate vote, Senator Thune noted that the deal could pass the upper chamber by Friday night. The Congressional Budget Office estimates that spending will have to reduce $64 billion in the next budget, as both parties still have to negotiate a separate spending package by the end of September.

That vote in the House took place after US markets had closed, as a downbeat risk session helped the S&P 500 shed -0.61%. Those losses were driven by several factors, but the biggest was a succession of data releases that all raised fears of an upcoming recession. For instance in the US, the MNI Chicago PMI for May came in beneath every economists’ expectation at 40.4 (vs. 47.3 expected), and that followed on the heels of the weaker-than-expected China PMIs earlier. As we’ll see later the Caixin PMI this morning actually unexpectedly rose so a complicated picture is emerging.

The complications were present yesterday as well as the JOLTS job openings report for April, contained more bad news from the Fed’s perspective. The main headline was a big increase in job openings, which unexpectedly rose to a three-month high of 10.103m (vs. 9.4m expected), and the previous month’s openings were revised up as well. In turn, this meant that the ratio of vacancies per unemployed people went back up to 1.79, having been at a 16-month low the month before. So that’s further evidence that the US labour market remains very tight by historic standards.

The release meant that investors initially dialled up the chances of another rate hike from the Fed in two weeks, with fed futures pricing in a 70% chance of a hike shortly after the JOLTS release. However comments from policy voters Philadelphia Fed President Harker and Fed Governor Jefferson – who recently was nominated to be Fed vice chair – caused investors to cut their bets for a rate hike this month down to a 33% chance from 59% the day before. That is the lowest chances since May 25. Governor Jefferson noted that, “skipping a rate hike at a coming meeting would allow the Committee to see more data before making decisions about the extent of additional policy firming.” President Harker noted that he was “definitely in the camp of thinking about skipping any increase at this meeting,” before adding that “If we’re going to go into a period where we need to do more tightening, we can do that every other meeting.” Investors still expect another rate hike this cycle as fed futures are pricing in a 83% chance of a rate hike through the July meeting, but after the comments yesterday it is clear that there is more weight on July over June. Treasuries rallied with 10yr yields down -4.4bps, as investors focused on the more negative longer-term outlook, which was seen as raising the likelihood of rate cuts further out. This morning in Asia 10yr yields (+2.29 bps) have reversed around half of yesterday’s gains, trading at 3.67% as we go to print.

Outside of the Fed-speak yesterday there was also the release of the Fed’s Beige book which indicated that while the economy was indeed slowing as hiring and inflation eased, there was still signs that the economy remained too hot. The Fed’s report said that while employment increased in most districts, it was “at a slower pace than in previous reports.” Similarly, the report noted “prices rose moderately over the reporting period, though the rate of increase slowed in many districts.” The Fed’s report also pointed to growing divides as “high inflation and the end of Covid-19 benefits continued to stress the budgets of low- and moderate-income households, driving increased demand for social services, including food and housing”. All together the report based on anecdotal data from the 12 regional banks seems in-line with the broader economic data that shows while the economy is slowing at the margins, inflation appears to be settling above the Fed’s target with core services inflation the root cause.

Overall sentiment landed on the negative side with equities and other risk assets like HY credit and oil struggling. For instance, the S&P 500 (-0.61%) posted its biggest decline in a week as the more cyclical sectors led the decline and defensives like telecoms (+1.5%), utilities (+1.0%), and healthcare (+0.9%) rallied. Over in Europe, the losses were more severe and the STOXX 600 (-1.07%) closed at a 2-month low, with others including the DAX (-1.54%) and the FTSE MIB (-1.97%) losing significant ground as well. Even tech stocks (one of the few to post gains in May) pared back some of their recent advance, with the NASDAQ (-0.63%), FANG+ (-0.92%), and the Philadelphia Semiconductor (-2.71%) indices all lower. Even Nvidia fell -5.7%, it’s biggest fall since January 30th.

Whilst European equities were a significant underperformer, there was a major rally among their sovereign bonds after the German and French CPI prints came in beneath expectations. In Germany, CPI fell to +6.3% in May using the EU-harmonised measure (vs. +6.7% expected), which was the lowest since February 2022. And in France, it fell to +6.0% (vs. +6.4% expected), which was the lowest since May 2022. That raised hopes for the Euro Area-wide print that’s out today, and yields on 10yr bunds (-6.0bps), OATs (-5.8bps) and BTPs (-7.0bps) all moved lower on the day. The only exception to this inflation pattern was in Italy, where CPI only fell back to +8.1% (vs. +7.5% expected).

With those inflation prints in hand, investors moved to slightly dial back the amount of rate hikes expected over the coming months. Significantly, overnight index swaps are now pricing in slightly fewer than 50bps more hikes, suggesting at least some doubt about whether the ECB will go on to deliver a move beyond the one that’s widely anticipated in two weeks from now. In the meantime, there were also some fresh tailwinds on inflation from commodity prices, with Brent crude oil (-1.20%) losing further ground to close at $72.66/bbl.

Asian equity markets are broadly trading higher this morning after the debt ceiling bill was cleared in the US House of Representatives and on better China data (see below). Risk appetite across the region has solidified with the Hang Seng (+1.02%) leading gains and rebounding from near a six-month low on expectations of a Chinese stimulus to revive growth. Stocks in mainland China are also trading in the green with the CSI (+0.64%) and the Shanghai Composite (+0.37%) nudging higher. Elsewhere, the Nikkei (+0.29%) held on to its gains while the KOSPI (-0.22%) is slightly down so far in the session. In overnight trading, US equity futures are fluctuating with those on the S&P 500 (+0.04%) just above flat while those tied to the NASDAQ 100 (-0.15%) are inching lower.

Early morning data showed that China’s factory activity bounced back to expansionary territory in May as the latest Caixin manufacturing PMI rose to 50.9 in May from 49.5 in April, contradicting the official PMI data yesterday that showed further deterioration in factory activity for May. Separately in Japan, factory activity expanded for the first time since October 2022 after the final estimate of the au Jibun Bank manufacturing PMI stood at 50.6 in May from the prior month’s reading of 49.5.

Wrapping up the data over the last 24 hours and another release yesterday came from Germany, where unemployment rose by +9k in May (vs. +13.5k expected). That left the unemployment rate at 5.6% as expected. Elsewhere, Italy’s economy grew by more than expected in Q1, with the latest estimate revised up a tenth from the initial reading to +0.6%.

To the day ahead now, and the data highlights include the flash CPI release from the Euro Area for May, as well as the unemployment rate for April. Otherwise in the US, there’s the ISM manufacturing release for May, the ADP’s report of private payrolls for May, and the weekly initial jobless claims. In addition, there’s the global manufacturing PMIs for May, along with April data on German retail sales and UK mortgage approvals. From central banks, we’ll hear from ECB President Lagarde, the ECB’s Knot and Villeroy, as well as the Fed’s Harker. The ECB will also be releasing the account of their May meeting.

Tyler Durden

Thu, 06/01/2023 – 08:03

via ZeroHedge News https://ift.tt/Dmi3vKd Tyler Durden