Outside Of AI, Stocks Are Beginning To Flag A Recession

Authored by Simon White, Bloomberg macro strategist,

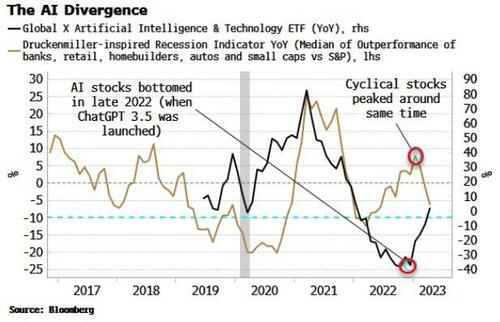

The huge outperformance of AI stocks is obscuring the increasingly recessionary message coming from an indicator based on cyclical stocks inspired by investor Stan Druckenmiller. Equity indices are now wholly reliant on AI-hype persisting and compensating for the decline in cyclical sectors.

AI ebullience is supercharging the market. But this is masking the increasingly voluble message from cyclical stocks. Druckenmiller once said “the inside of the stock market is the best economist I know”.

Based on previous comments he has made, we can build a “Druckenmiller indicator” of highly cyclical sectors such as housing, autos and retail.

As the chart below shows, this indicator has been turning down and is closing in on a zone that has previously preceded a recession.

But you might not know it given the steroidal impetus from AI stocks. If we add an AI ETF to the last few years of the above chart, shown below, we can see the regime change in AI began in early 2022, when AI stocks kept falling despite the rise in cyclical sectors.

Semiconductor firms especially were getting bogged down in the US’s clampdown on semis’ technology and know-how going to China, while tech firms in general suffered from being high duration in an elevated-inflation environment.

But late last year, OpenAI publicly launched Chat GPT 3.5 in a “Sputnik moment” that shook rivals and galvanized a race to catch up. AI stocks bottomed and accelerated higher, while cyclical stocks started to turn down, reflecting the weakening pulse of the broad economy.

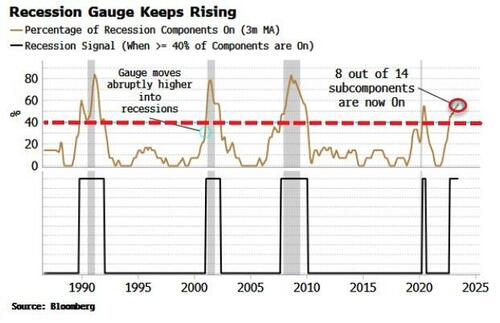

The Druckenmiller indicator is not standalone given it has had false positives in the past. Instead it should be used with a broad range of recession indicators, as encapsulated by the Recession Gauge shown in the chart below.

This, along with the deterioration in the Druckenmiller indicator, is consistent with the US economy entering a recession in the very near future (if it is not already in one).

Tyler Durden

Thu, 06/01/2023 – 08:46

via ZeroHedge News https://ift.tt/M13p4GP Tyler Durden