Banks, Big-Tech, Bitcoin & Black Gold Breakdown As Beijing Barfs, Builders’ Belief Busts

In a surprise overnight, China cut rates to pre-emptively distract from the pig-ugly China macro data (everything missed). That weakness trumped a surge in Japanese GDP (which itself hid problems with domestic spending) and then US retail sales beat, while homebuilder sentiment disappointed. In other words, decoupling…

Source: Bloomberg

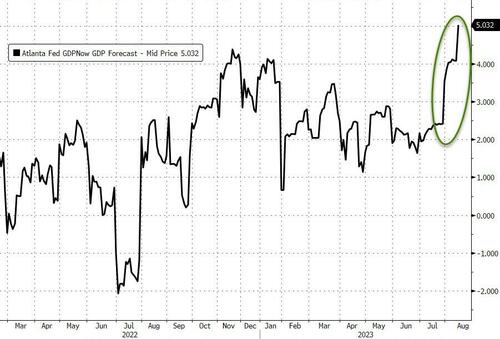

But in the US, strength in the Retail Sales Control Group lifted GDPNOW – The Atlanta Fed’s best-guess at this quarter’s GDP growth – soaring above 5% today (after China’s shitshow of macro data overnight, but Japan’s renaissance)…

Source: Bloomberg

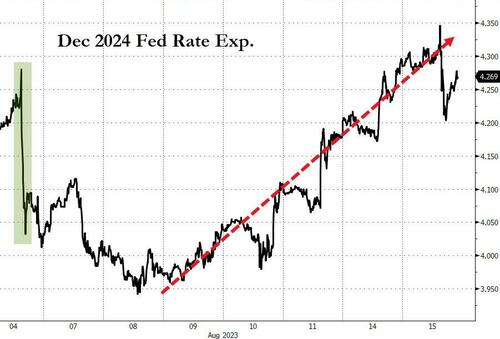

Doesn’t exactly reinforce the case for a Fed pause – in fact this kind of growth bolsters the case for hawkish-for-longer monetary policy, which would weigh on equities and bonds. Rate-hike expectations are nudging hawkishly higher…

Source: Bloomberg

The expectation for rate-cuts next year is also shifting hawkishly…

Source: Bloomberg

However, homebuilder confidence took a kicking today (first drop this year) as reality set in that mortgage rates aren’t going down anytime soon…

Source: Bloomberg

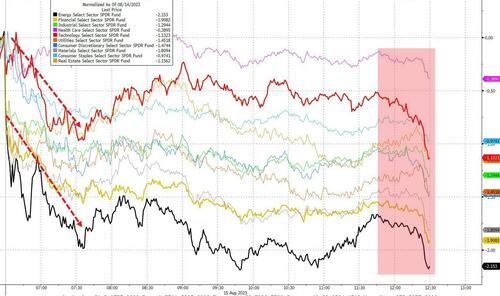

…and after a squeezey day yesterday, the market’s negative gamma re-awakened and the US majors were all clubbed like a baby seal with some notable weakness in the last hour…

Some are suggesting the late day weakness was impacted by the fact that Fidelity clients were offline…

We are aware that customers are experiencing issues with https://t.co/turmsHS3YJ, Active Trader Pro (ATP), and our mobile apps. We are working urgently on resolving the issues. We apologize for the inconvenience and appreciate your being a customer.

— Fidelity Investments (@Fidelity) August 15, 2023

S&P bounced off its 50DMA early on but was unable to hold it. Small Caps and Nasdaq also closed back below their 50DMA…

All the S&P sectors were red led by Energy and Financials but big-tech tumbled late on…

Source: Bloomberg

Banks were battered on more chatter of ratings downgrades (this time from Fitch)

Homebuilders refuse let the dream go – even as the floor disappears below their reality…

Source: Bloomberg

Bonds were mixed today with the short-end outperforming (2Y -2bps, 30Y +3bps)…

Source: Bloomberg

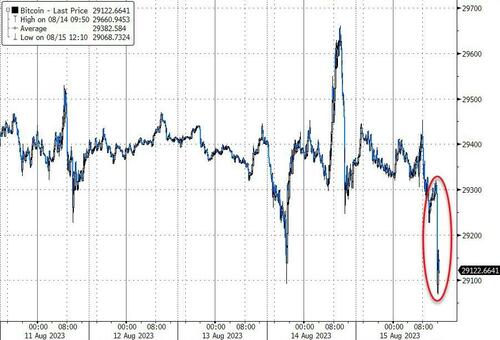

Bitcoin saw yet another puke…

Source: Bloomberg

The dollar rallied once again, holding gains at its highest close since June…

Source: Bloomberg

China’s offshore yuan weakened to Nov lows against the dollar…

Source: Bloomberg

Gold fell for the 9th day of the last 10, testing down to its 200DMA…

We do note that gold found support at its 200DMA…

Oil prices slipped once again, not helped by China’s data throwing doubt on demand…

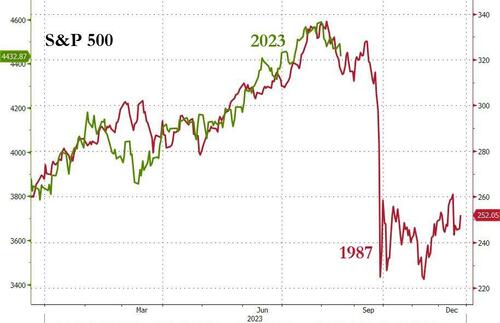

Finally, there’s no way it can happen again, right?

Could Jackson-Hole be the catalyst?

Tyler Durden

Tue, 08/15/2023 – 16:00

via ZeroHedge News https://ift.tt/ShVOlkU Tyler Durden