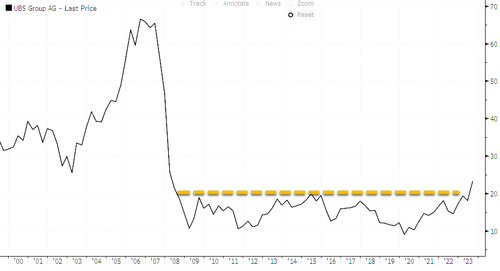

UBS Soars To 2008 Highs After Biggest-Ever Quarterly Profit For A Bank, Job Cut Announcement

UBS Group AG soared to the highest level since October 2008 after the lender posted a second-quarter income of $29 billion – the biggest-ever quarterly profit for a bank – due to the negative goodwill from the historic emergency takeover of Credit Suisse. Besides the mammoth profit beat, the Zurich-based lender also announced thousands of layoffs and billions of dollars in cost-savings as analysts say these developments are “promising.”

A Reuters poll of analysts had initially projected a net profit of $12.8 billion for the three months to the end of June. UBS smashed that with a record profit of $28.9 billion in the second quarter, thanks to $28.9 billion of negative goodwill associated with the Credit Suisse acquisition. This was possible by the accounting difference between the $3.8 billion price UBS paid for Credit Suisse and the value of the acquired lender’s balance sheet. The bank expects Credit Suisse’s local unit will be fully absorbed into the parent company by 2025.

UBS Chief Executive Officer Sergio Ermotti appeared on multiple financial news networks Thursday morning. He told Bloomberg, “We are executing on the strategy, we are making very good progress,” while referring to the absorption of Credit Suisse in one of the largest mergers ever in global finance.

Ermotti said, “We will have around 3,000 jobs that will be made redundant over the next years.” This is the first time the CEO has put solid numbers on how many jobs will be axed due to the merger of the banks. UBS’ acquisition of the 167-year-old institution increased its workforce by 45,000 to 120,000. Thousands of jobs are considered “redundant” and are on the chopping block.

Ermotti told CNBC’s Joumanna Bercetche:

“When people look into those numbers, they will clearly understand that this negative goodwill is the equity necessary to sustain $240 billion of risk-weighted assets and the financial resources to go through a deep restructuring that is necessary at Credit Suisse, because our analysis has proven that the business model was not viable any longer.”

He continued:

“Credit Suisse has excellent people, clients, and product capabilities, but the business model was not sustainable any longer and needs to be restructured.”

Here are more details from the earnings report:

- Underlying profit for the first combined UBS-Credit Suisse quarter came in at $1.1 billion.

- UBS saw net new money inflows of $16 billion in the quarter

- Credit Suisse outflows slowed to 39 billion Swiss francs ($44.4 billion)

- Bank sees pick-up in client activity, expects new asset inflows to continue

Wall Street analysts were pleased with the results, with shares up more than 7.2% in Zurich on Thursday — the highest level since the financial crisis in 2008.

More comments from analysts (list courtesy of Bloomberg):

JPMorgan (overweight)

- Kian Abouhossein says Credit Suisse’s wealth management franchise is intact as the flows are better than expected both for UBS and CS in 2Q23 as well as 3Q

- Notes the limited details on payout and bad bank profit & loss impact

- “Overall, the results are less messy than expected even so more details are needed”

Kepler Chevreux (hold)

- Nicolas Payen sees stock gaining today, notes faster than expected franchise stabilization

- Sees these results as positive overall, adding there is lower than expected badwill but decision to retain CS Swiss business is welcome and there is higher than expected costs savings

Mediobanca (underperform)

- Adam Terelak says there is “plenty to digest,” but targeting CET1 of 15% at the current multiple of 1.15x CET1 “seems expensive,” even if the picture at Credit Suisse is improving

- “There’s definitely enough in flows/deposit picture in 3Q for the bulls. That said, targets show how far this thing has already run”

Vontobel (buy)

- Stabilization of flows, the new financial targets and the outlook statement are all positive, says analyst Andreas Venditti

- UBS still “faces a huge task” in restructuring Credit Suisse, integrating staff and retaining clients, among other things, which will require “significant time and management attention”

RBC (sector perform)

- Anke Reingen says a number of large non operational items overshadow underlying performance which appears at an underlying level at both UBS and CS to be slightly below estimates

- Integration seems to be done faster and expected cost savings are higher than previously communicated

- Adds comments on generally improved client sentiment are positive and in line with peers

- Writes prospect of an update on buybacks with FY23 results might imply that buybacks could resume earlier than expected

Citi (buy)

- Andrew Coombs says the better capital print and net new money outlook, plus the additional welcome disclosure and new financial targets, should be enough to continue to provide support

ZKB (outperform)

- Michael Klien says confidence has returned with strong net new money at UBS global wealth management

- Capitalisation appears solid with a CET1 ratio of 14.4% and a tangible book value per share of USD 24.6 at the end of 2Q23

Jefferies (hold)

- Results are supportive, says Flora Bocahut, with slight tangible book value per share miss offset by stronger CET1

- Adds that the integration path remains “long, challenging and likely bumpy”

Deutsche Bank (buy)

- Benjamin Goy says results after the Credit Suisse acquisition are overall positive

- “Clearly the group remains a construction site in the near term; however we believe this set of results and announcements should give confidence in the mid-term bull case”

The lender also said two-thirds of Credit Suisse’s investment banking offices would be closed. At least 8,000 Credit Suisse staff have been fired, that number is expected to accelerate in the quarters ahead.

Tyler Durden

Thu, 08/31/2023 – 07:20

via ZeroHedge News https://ift.tt/xYOGFqX Tyler Durden