Is Subprime Credit-Card Crisis Looming?

Last month, Macy’s announced what some suspected to be a canary in the credit coal mine; credit card delinquencies had taken a huge bite out of results in the second quarter. In a call with analysts, execs warned that the resumption of student loan payments could compound the problem.

Now, MarketWatch asks; Is there a subprime credit-card crisis on the horizon?

According to new data from VantageScore, Generation Z, Millennials, GenX and Baby Boomers with a credit score between 300 and 600 (subprime) experienced a delinquency rate of 10.6% (for those 30 – 59 days past due), in July of this year – up from 9.3% last year.

For primer borrowers, the delinquency rate was just 0.15% in July, up from 0.14% in July of 2022.

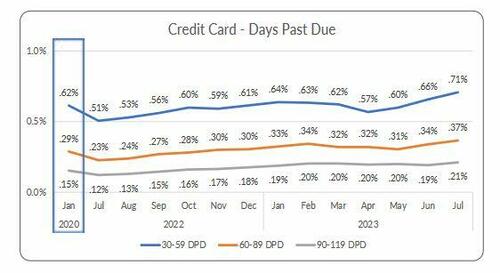

When looking at 13 months of delinquency rate data, short, medium and term delinquencies are all trending higher.

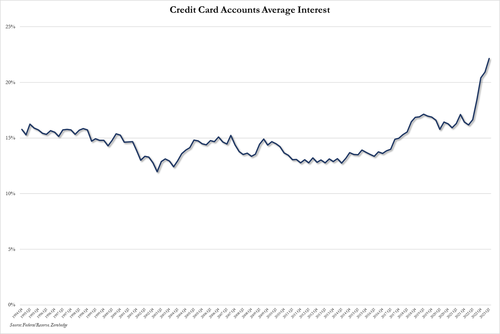

Meanwhile, the average interest paid on credit card debt is reaching insane levels.

And when one looks at the average delinquencies among small banks, more disturbing data emerges.

Among the top 100 banks, the delinquency rate was 2.63% in the second quarter vs. 1.71% a year ago, according to the Federal Reserve Bank, which notes that more than 80% of consumers in the US had credit cards last year. Of that, nearly half (48%) were carrying a balance.

“We’ve seen a huge increase in credit-card delinquencies,” according to Balbinder Singh Gill, an assistant professor of finance at the Stevens Institute of Technology’s School of Business in Hoboken, NJ, in a statement to MarketWatch. “In the U.S., we only seem to fix things when there is a crisis. I’m very worried about delinquencies, especially as these are impacting households with low wages.”

The percentage of credit card debt more than 30 days past due is up for 6 straight quarters.

Delinquency rates have nearly doubled since their recent lows and now stand at their highest since 2020.

All as credit card debt crossed $1 trillion for the first time in history.… pic.twitter.com/zTHWTlfDww

— The Kobeissi Letter (@KobeissiLetter) August 15, 2023

According to Gill, given the 24% APR on credit cards, falling behind could force lower income workers into bankruptcy.

What’s worse, consumers could end up paying late-payment fees of up to $35 per month if they default on their payments, and an APR of up to 30%, according to LendingTree.

One theory: some smaller banks loosened credit requirements after the recession in 2008 to lure customers and increase deposits. In 2018, Congress rolled back part of the Dodd-Frank Act in 2010 — which was designed to strengthen the banking system — further easing credit-requirement rules for smaller banks.

All of this comes at a bad time. Consumers, particularly low-income Americans, are under pressure. Student-loan repayments resume in October after the pandemic-era moratorium and interest rates are at a 22-year high. While the Fed has signaled it’s not likely to raise rates again imminently, inflation is still above the Fed’s 2% target rate. -MarketWatch

“Wages are not increasing at the same rate as inflation,” said Gill. “People want to have the same standard of living. They want to buy the same food, but it’s impossible as their wages are still low, so they’re using their credit cards. That’s OK for the short term, but at the end of the day, you have to pay off the debt.”

What’s more, total credit card debt surpassed $1 trillion in Q2, with the average credit card balance in the same quarter rising by 20% to $5,947 – the highest level in a decade, according to a recent TransUnion report.

Bankrate’s Ted Rossman sees “pockets of trouble” emerging.

“Half of credit-card holders pay in full every month, and avoid interest and life is great. They get rewards and buyer protections and all these benefits,” he said, “But the other half, more or less, is carrying debt at an average interest rate north of 20%, which is the highest we’ve ever seen. That can be a big deal at the household level.“

Tyler Durden

Tue, 09/05/2023 – 14:00

via ZeroHedge News https://ift.tt/uNtFL1z Tyler Durden