Stocks Jump… Everything Else Dumps

Once again the fact that WW3 didn’t actually break-out over the weekend sent VIX lower (after surging into the weekend for the 3rd week in a row), smashing stocks higher and havens/hedges such as oil, crude, bonds, the dollar, and bitcoin all declined.

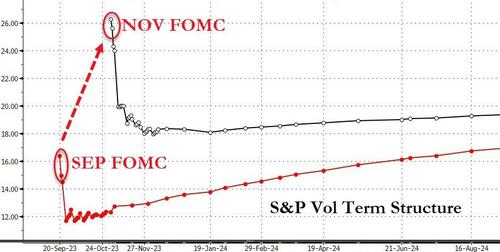

But, with the tsunami of potential catalysts for chaos this week such FOMC and payrolls (excluding geopolotical ones), the market’s expectations for volatility are dramatically higher than they were at the September FOMC…

Source: Bloomberg

The compression in VIX prompted gains in stocks (more hedge unwinds than short-squeeze) with The Dow leading and Small Caps lagging. Some late-day selling wiped a bit of lipstick off this overall pig but a solid day (that admittedly felt very fragile)

Financials outperformed (while Energy stocks lagged) on the day with the KBW Bank Index rallying to erase Friday’s losses…

While tech outperformed, TSLA was trounced on battery demand fears (and some chatter about X’s valuation). Back below $200 to its lowest since May…

0-DTE traders fought the downtrend all day once TSLA hit its Put Wall around $200…

Today was not really driven by a short-squeeze as ‘most shorted’ stocks ended flat (admittedly after an opening jump)…

Source: Bloomberg

Was today the start of something bigger?

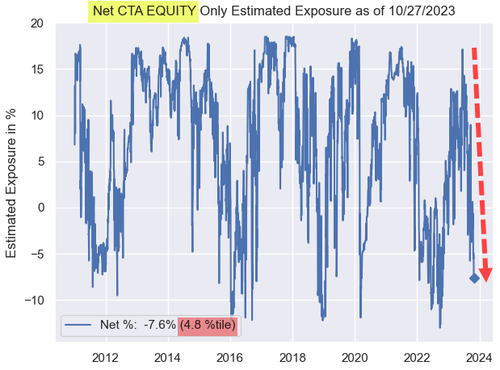

As Nomura’s Charlie McElligott pointed out, the trick now is whether all this YE performance management “Net Down” de-risking and monetization incentivization” positioning has further room to run – because if it does NOT and sellers have already completed de-risking, a Beta rally melt-up would be an awful outcome for funds without enough exposure on.

As a reminder, Systematic positioning in Equities has been slashed on the realized Vol grind and downside price momentum:

McElligott fears a vicious feedback loop for a rally into YE: if we get

1) a big “Puts monetized” theme…

2) Vols bleed further from “rich” current iVol levels,

then there’s 3) $Delta to BUY as hedges get unwound, and from there,

you have 4) potential waves of “Synthetic Short Gamma,” as Funds both Active and Systematic become the dreaded “buyers higher” and have to add-back Exposure the more we rally

Maybe, or as UBS’ trading desk pointed out, maybe not. Mega cap tech, consumer cyclicals and banks are outperforming side by side which makes me wonder if what we are seeing Monday is also a reversion of the year-end tax trade with only one trading day left for Oct. year-end funds, similar to what was seen at the beginning of October after investors sold both winners and losers in late September. Usually by November, investors are starting to look for opportunities to play reversion when it comes to the tax trade.

The Oct 31 mutual fund year-end tax-loss selling is over.

— zerohedge (@zerohedge) October 30, 2023

Nasdaq rallied up to its 200DMA today…

The S&P 500 moved into “correction” territory on Friday, down over 10% from the July highs. Meanwhile the benchmark small-cap Russell 2000 index went through its June 2022 lows and back to levels last seen in November 2020, around the time that Pfizer announced the first successful Covid-19 vaccine trials. In fact, it’s now back to levels it first breached in November 2018.

Source: Bloomberg

When you factor in the huge inflation over this period, that’s some serious real-adjusted declines. So for all the optimism surrounding US equities this year it really is only a handful of huge companies that’s skewing the positivity.

And speaking of companies skewing performance, if one strips away the Mag 7 stocks, the non-tech heavy SPW, NYA, CWI, RTY equity indices are now all at or below 200wma and down for the year.

Source: Bloomberg

The Treasury Refunding announcement (smaller than expected for this quarter) prompted yields to jump lower briefly, but the following quarter was increased and yields started to leak back higher. By the close, bond prices were lower across the baord (yields up with the belly underperforming)…

Source: Bloomberg

30Y yields dropped twice to 5.00% and bounced today…

Source: Bloomberg

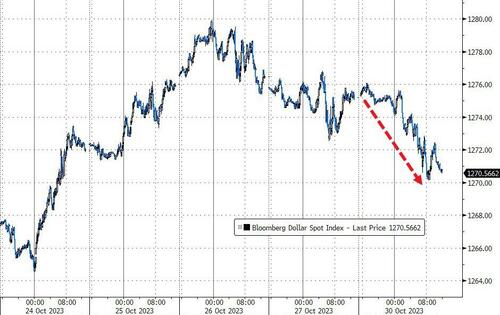

The dollar slipped lower on the day…

Source: Bloomberg

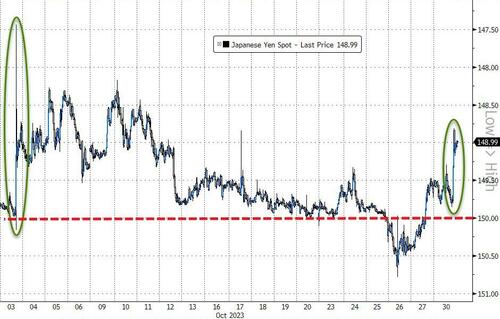

The yen spiked (yen strengthened against the dollar) after headlines on the BoJ considerinag djustemnts to its YCC program tonight…

Source: Bloomberg

Spot gold prices fell back from their spike on Friday, holding around $2,000 (up from just over $1,800 before the attack on Israel)…

Source: Bloomberg

Oil prices tumbled with WTI down over 4%, erasing all of its post-Israel-attack gains (not helped by weak German economic data)…

Finally, financial conditions continue to tighten – now at their tightest in a year…

Source: Bloomberg

When, if ever, will these tighter financial conditions start to weigh on the macro-economy?

Tyler Durden

Mon, 10/30/2023 – 16:00

via ZeroHedge News https://ift.tt/il7sjb5 Tyler Durden