Mo’vember Marks Best Month For US Bonds In 40 Years; Global Markets Add Over $11 Trillion

Remember, remember, the surge of November…

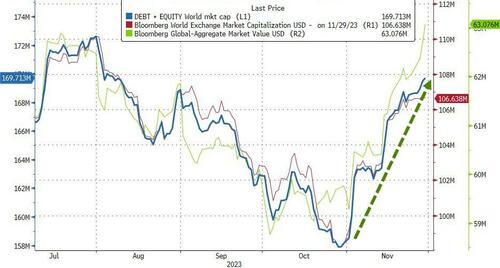

Global bond and stock markets added over $11 trillion in capitalization in November. That is the second biggest monthly gain in history (Nov 2020 added $12.5 trillion)…

Source: Bloomberg

Who could have seen that coming?

1. Dealer gamma turns deeply positive

2. $5BN in daily buybacks until mid-Dec

3. CTAs buying up to $200BN in global stocks over next month

4. Hedge Funds least net long since 2011

5. Seasonals pic.twitter.com/Rv3U1HLGHx— zerohedge (@zerohedge) November 3, 2023

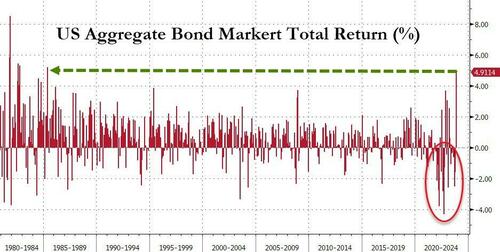

Global bonds had their best month since Dec 2008 with US bonds soaring to their best month since May 1985…

Source: Bloomberg

…and back into the green for the year…

Source: Bloomberg

For context, that is a 60bps or so collapse in yields for Treasury bonds on the month (with the short-end underperforming)…

Source: Bloomberg

Despite bull-steepening in the last few days, the yield curve (2s30s) is flatter (more inverted) for the second straight month…

Source: Bloomberg

“There’s a little bit of the fear of missing out,” said Ed Al-Hussainy, a rates strategist at Columbia Threadneedle Investment.

“Suddenly 5% yields on the 10-year Treasury have become a distant memory.”

No fear here in stock-land as all the US majors rallied almost non-stop (up around 8-10% on the month) led by Nasdaq…

Source: Bloomberg

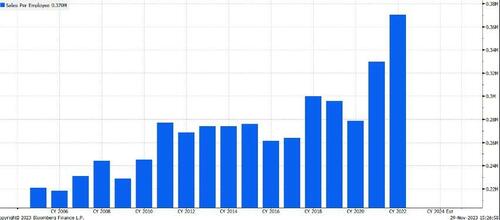

Random but interesting… the sales per employee in the Russell 2000 (where people expect job cuts) has never been higher.

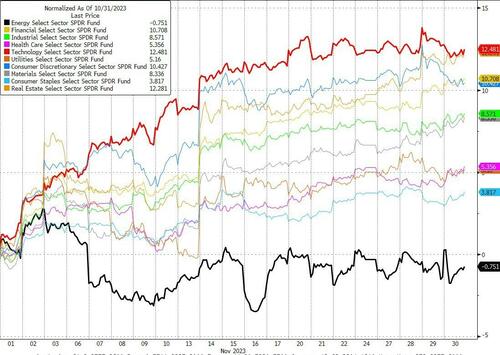

The energy sector was the only one to end the month red while Tech and Real Estate were the big winners…

Source: Bloomberg

And VIX plunged to a 12 handle – its biggest absolute monthly decline since Nov 2022…

The rally in bonds and stocks sent financial conditions dramatically looser…

Source: Bloomberg

In fact, October saw the biggest absolute monthly loosening of financial conditions in history (back to 1982)…

Source: Bloomberg

The dollar index tumbled 3% in November – its biggest monthly decline since Nov 2022 (and 2nd biggest since July 2020). Note that today’s bounce ripped up to its 200DMA and stalled…

Source: Bloomberg

Bitcoin rallied for the 3rd month in a row, back above $38,000…

Source: Bloomberg

Ethereum soared over 12% in November – its best month since March and its first monthly outperformance of BTC since May – but as is obvious from the chart, it has stalled since the early surge…

Source: Bloomberg

Gold rallied for the 2nd straight month, back up to record highs…

Source: Bloomberg

Silver also soared back above $25…

Source: Bloomberg

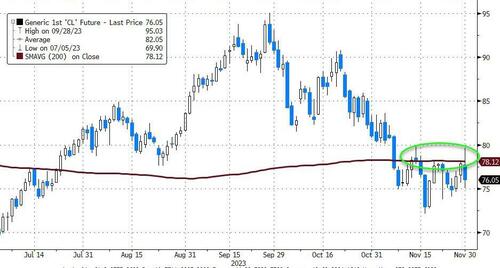

Oil prices fell for the second straight month, with WTI finding resistance at the 200DMA for the last week (including a stop-run that failed today)…

Source: Bloomberg

Finally, November was truly a month of “bad news” being “good news” for stocks…

Source: Bloomberg

‘Hard’ data hits a 14-month low as stocks surge back near record highs.

“We’ve been getting economic data recently that reinforces the idea of the Goldilocks slowdown,” said Rebecca Patterson, former chief investment strategist at Bridgewater Associates.

“Inflation is coming down, and at the same time it hasn’t been unduly impinging growth.”

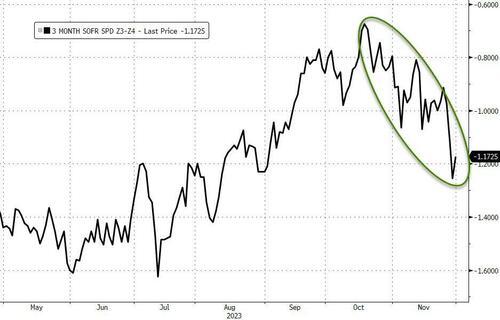

But be careful what you wish for – if financial conditions loosen much more, The Fed will be forced to jawbone some reality back into market as November saw the biggest increase in rate-cut expectations for 2024 since Nov 2022.

Do investors really think anything but a NOT-soft-landing would spark 5 x 25bps rate-cuts in an election year!

Tyler Durden

Thu, 11/30/2023 – 16:00

via ZeroHedge News https://ift.tt/VyMeGKW Tyler Durden