Hedge Fund Icon: “We’re Just Two Years Away From A US Debt Sustainability Crisis, Sparking A Major Global Market Event”

By Eric Peters, CIO of One River Asset Management

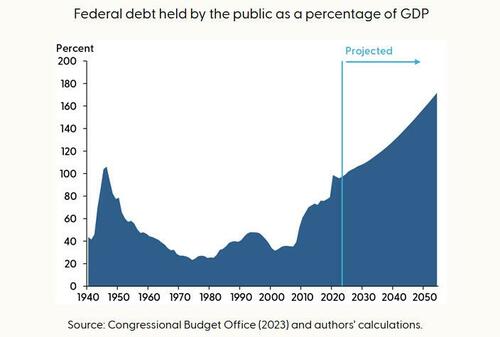

“The last time the debt as a share of GDP was this large was in 1945-1946, at the end of World War II,” wrote Daniel Wilson and Brigid Meisenbacherat from the Economic Research Department at the Federal Reserve Bank of San Francisco. I was grinding through my stack, piled high with white papers. “Over the following three decades, the debt-to-GDP ratio steadily fell, reaching roughly 25% by 1975,” continued the San Fran Fed report [see here].

I have growing conviction that in the coming 2-5 years we’re going to face a US debt sustainability crisis, sparking a major global market event. I’ve observed that when people from within our institutions raise an alarm, knowing it would be far easier for them to remain quiet, we’re getting closer.

“That 30-year decline contrasts sharply with the projected 30-year increase in the debt-to-GDP ratio, reaching 172%, over 2024 to 2054, according to the latest current Congressional Budget Office projections.” Wilson and Meisenbacherat point out that the Fed projects a longer-term real Fed Funds rate of 0.50%.

And their median projection for long-run real GDP growth is 1.8%. They highlight that the CBO, however, forecasts a lower 1.5% real GDP growth rate, and a longer-term real interest rate on US debt of 2.0%.

“In this case, slow economic growth relative to interest rates would exert modest upward pressure on the debt ratio, primarily from higher interest payments,” they wrote.

“The main source of the long-run upward pressure on the primary deficit is spending on mandatory programs such as Social Security and Medicare. Current legislated formulas used to determine spending per recipient for Social Security benefits and government health-care programs, especially Medicare, combined with the projected aging of the population, point to large increases in spending for these programs as a share of GDP. This pressure was absent after WWII because the overall US population was younger and because Medicare was not enacted until 1965.”

And with no political party willing adjust these programs, it is increasingly likely the market will force change.

Tyler Durden

Sun, 03/10/2024 – 22:10

via ZeroHedge News https://ift.tt/NlU4Ia7 Tyler Durden