The Only Deep Value Left In This Bloated Circus Of A Market

Submitted by QTR’s Fringe Finance

I was looking at charts of uranium stocks and Bitcoin last night—both of which have performed extraordinarily over the last year—and was thinking to myself that I could easily remember a time in the not-so-distant past where both of these asset classes were completely unloved.

Which reminds me of another asset class that right now is in the midst of waves of hatred and disapproval from the market, but I think similarly could wind up outperforming in the coming years.

It isn’t going to surprise anybody that I’m talking about precious metal miners — gold miners specifically. (And you’ll have to bear with me, I wrote most of this over the weekend before gold and the GDX’s rip on Monday — but, long term, that shouldn’t make a difference).

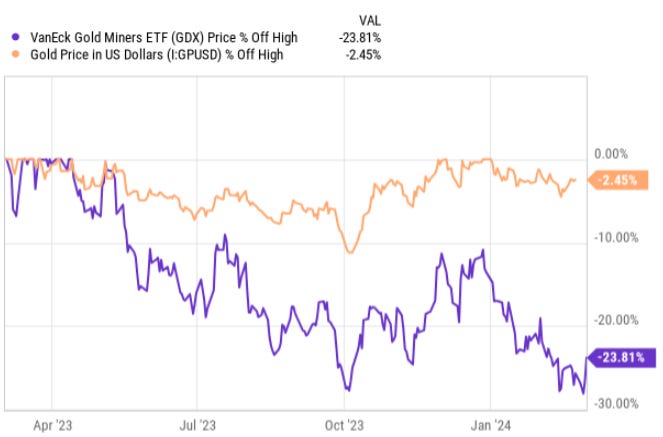

Anyway, as has been harped on by people like Peter Schiff and Larry Lepard, gold miners have been taken out back and shot, especially when compared to the price of spot gold, which sits near all-time highs. The VanEck Gold Miners ETF (GDX), for example, is 23.8% off its 1 year high while gold is just 2.45% off its 1 year high.

This move lower in miners is despite the fact that the underlying spot price of gold is near all-time highs and—if you’re a believer in technical analysis, which I consider nonsense—looks as though it is getting ready to rip even higher.

Lepard and Schiff will tell you that the reason miners are trading at such a low multiple is because the models used to predict their future cash flows are still using a predictive gold price in the future of less than $2000 per ounce. I’ve heard Larry Lepard say some models, when you look on a Bloomberg terminal, are still predicting that the price of gold will be $1800 an ounce in a couple of years. You and I, and even the Bitcoin community, know that this isn’t going to be the case. At some point, these models will update—or the market will force them to—and it’ll become extraordinarily evident that gold miners represent some of the only value stocks left in the entire stock market, which, as a whole, is grossly overinflated and overvalued.

Miners are also getting a lot of hatred nowadays because of how well Bitcoin is doing. I hear Peter Schiff talk a lot about how people are pulling their money out of gold miners and putting it into Bitcoin. At first, it sounds like he’s just making excuses (or as the bitcoiners say ‘coping’), but I’m sure this is what’s happening. If you look on social media, or you watch financial media, the hype is around Bitcoin as a safe haven asset, not gold. It is reasonable to assume that money is coming out of precious metals and moving into Bitcoin, even by investors who are just rejiggering their allocations and not necessarily abandoning gold altogether.

At the same time, the arrogance and hubris coming from the Bitcoin community that I have railed against for years (as recently as a couple days ago), even though I am now a bull, casts off gold as a relic of the past that simply will no longer be used as a store of value.

🔥 50% OFF SUBSCRIPTIONS FOR LIFE: If you are not yet a subscriber, you can take 50% off for life by using this link: GET 50% OFF

To believe that the whole world is going to abandon 5000 years of financial standards and reliance on the precious metal that has done its job as a safe haven is extraordinarily foolish, I don’t give a shit how bullish you are on Bitcoin.

I don’t believe that for Bitcoin to be successful, gold has to fail. There are going to be markets for both of them, and as I have said in numerous interviews and articles I’ve written over the last two months, gold still remains the bedrock underneath the world of finance for me.

Sure, there are things Bitcoin can do that gold can’t. For example, you can’t transport $1 billion worth of gold anywhere in the world easily, and you can’t send $1 billion worth of gold across the world easily. I’ve conceded that these are all great points that work to the advantage of Bitcoin. But the idea that Bitcoin is going to replace gold, and that gold will simply revert to its value as an industrial metal and no longer as a safe haven, is outright wrong in my opinion.

There’s going to be plenty of excess inflation and liquidity to go around as the Fed continues down the path of pushing forward its flawed monetary policy three ring circus. There will be more than enough lunacy for both the gold and Bitcoin buckets to catch some of this liquidity as safe havens.

FOMC Meeting, oil on canvas, 2024

Ergo, as the freak show persists, I believe that gold prices have nowhere to go but up. We are on the precipice of the next big financial crisis, even if it is one where prices go up instead of down, and the market spikes instead of crashes. One way or another, something is going to have to give at the Federal Reserve because rates absolutely cannot stay this high in perpetuity. Once the Fed starts easing again, and perhaps after we have our first post-cut crash or volatility, the resulting quantitative easing is going to ensure that anything with a fixed supply—from Bitcoin to gold to real estate to donuts—is going to spike.

As this becomes clear to the knobheads who are making the future price of gold lower in their models, miners will start to catch a bid. If they don’t catch a bid by retail, major investors or other corporations will start scooping them up and buying them outright. At some point, the sector becomes simply too much of a value to ignore. In other words, spoiler alert: the GDX is not going to $0. Armed with this airtight logic, I continue to buy the GDX as it falls. I also have been buying Newmont Mining (NEM) as it makes 52-week lows at the very same time that gold prices are nearing all-time highs.

If Monday’s rally has you worried you’ve missed the start of the rally, take this as a vote of confidence: while bitcoin, gold, silver and miners all ripped, mid-day Monday there was nary a mention of any of them on the front page of CNBC.com.

That is what I mean by gold being unloved.

And so the divergence between spot and miners means that either the price of miners is going to have to rocket higher at some point or the price of gold is going to have to move lower. I’m betting on the former and with the market and even the sound money crowd feeling like they are at peak hatred for gold, and specifically miners, I continue to be a motivated buyer, and continue to believe that this price, and any move lower in the miners, if gold remains at or above where it is now, could be generational buying opportunities.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. I didn’t double check any numbers or figures in this piece and am generally lazy with my research. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. Contributor posts and curated content are posted either with the author’s permission or under a Creative Commons license. This is not a recommendation or solicitation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. Sometimes I just lose money by misplacing it. I’m generally irresponsible. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. Do your research elsewhere. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it numerous times because it’s that important that you know.

Tyler Durden

Wed, 03/13/2024 – 11:25

via ZeroHedge News https://ift.tt/hRbmnQj Tyler Durden