“Guys, I F**ked Up” – SLERF Developer Accidentally Burns Millions As Memecoin-Mania Grows

Authored by Prashant Jha via CoinTelegraph.com,

Traders want to make their millions on Solana memecoins, but crypto proponents believe this is risky and would benefit the industry if it ends sooner rather than later…

The Solana blockchain has become a hub for new memecoins as the new bull season kicks off with several new memecoins reaching market capitalizations in the billions of dollars within days of launching.

One memecoin that has grabbed the crypto community’s attention is Slerf. The creator behind the project mistakenly burnt over $10 million in Solana before the launch, however, despite that the memecoin was launched and reached $500 million market cap within hours.

The developer raised 535,000 Solana tokens to launch the memecoin but accidentally burnt $10.4 million worth of Solana tokens while trying to clear their wallet.

Jeremy Arnold (@jdotarnold) provided a play-by-play on the farce on X…

This guy and a small team created a new memecoin called Slerf. It has something to do with sloths? Who knows. Anyway they pre-sold half the tokens for ~$10m to some 25k buyers. Then the other half were supposed to go on sale starting a few hours ago.

Except the guy who created them accidentally burned (deleted) the pre-sale tokens while releasing the new ones. (Don’t ask me how this works. I have no idea.) He’d also already revoked his ownership of the coin, so he couldn’t mint any replacements. Permanent deletion.

The outcome was that the $10m got vaporized. Everyone who bought in early lost their deposits and got no Slerfs in return.

Here is his initial post on X after realizing he screwed up…

Developer burns $10 million of SOL. Source: Slerf on X

“It’s not my project anymore,” the dev continued.

“Obviously I don’t have $10 million in my pocket to refund everybody, otherwise I’d 100% do it. That is what I’m working on.”

But this mistake was very good for attention, and attention is the true value of any memecoin.

So the obvious thing happened and the new tokens that were released shot up around 5,000%.

(This was partially because people realized no existing holders had any coins to sell to drive the price down.)

As of the latest data over $1.5BN in volume has been traded on SLERF.

The Slerf team later went to an X Spaces to elaborate further on the situation.

“I’m sick to my stomach,” team member Slorg said in a Space on X.

“I’m literally about to throw up.”

“I’m lost for words,” they added.

“I don’t know what to do.”

But the developer found a silver lining…

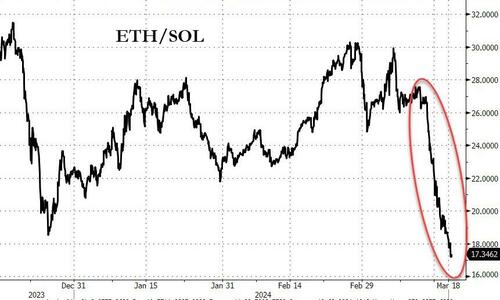

The impact on Solana itself can be seen here…

As TheBlock.co reports, the latest mishap follows a weekend rife with Solana-based memecoin presales, during which various random projects emerged and received significant funding, often amounting to millions of dollars.

The memecoin frenzy has led to comparisons with the Ethereum initial coin offering (ICO) era bubble of 2017 when several crypto projects raised millions of dollars but many failed to deliver.

It appears traders are swapping from ETH to SOL to jump on the memecoin mania

Memecoins are cryptocurrencies stemming from an internet meme or having some other humorous characteristic, but they lack any real-world use case other than being a pop culture reference. These cryptocurrencies are highly speculative and supported by some enthusiastic online communities.

Dogecoin is considered the OG memecoin and received support from Elon Musk during the 2021 bull market. In 2024, multiple memecoins, some barely a week old, have reached billions in market capitalization, creating new crypto millionaires by the hour.

The recent comparison to the ICO presale era of 2017 comes amid many influencers managing to raise millions of dollars in presales to launch new memecoins.

Users on X compared the current memecoin offerings (MCOs) to the Ethereum ICO bubble in 2017 when several crypto projects promised to deliver only to vanish after raising funds. A 2018 report indicated that over 90% of ICO projects failed.

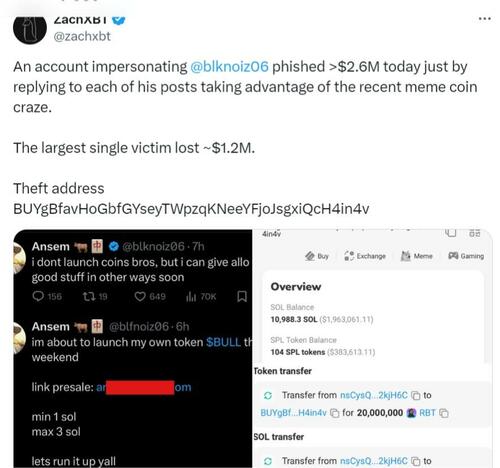

Similarly, there have been several instances where influencers have run away with the presale money or have dumped it on the market right after the launch.

One user on X said the memecoin mania is a more honest version of the 2017 ICO craze and the 2021 nonfungible token/crypto-art bubble, as projects “no longer have to pretend to deliver on a fake white paper and investors no longer have to pretend to be in it for the art.”

Scammer defrauding people during thememecoin frenzy. Source: ZachXBT on X

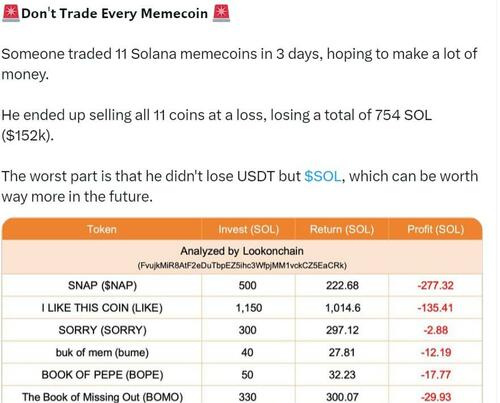

Stories of a few traders making millions of dollars in a couple of days often attract several others to try their luck. However, on most occasions, they lose a significant chunk of their investment.

A trader’s memecoin portfolio. Source: Elja on X

Crypto proponents claim the memecoin bubble will eventually liquidate millions of new users who blindly put their money into technology with no utility.

Tyler Durden

Mon, 03/18/2024 – 10:50

via ZeroHedge News https://ift.tt/tc2A71W Tyler Durden