Global Bond Market On Verge Of Selloff As Commodities Reawaken

Authored by Simon White, Bloomberg macro strategist,

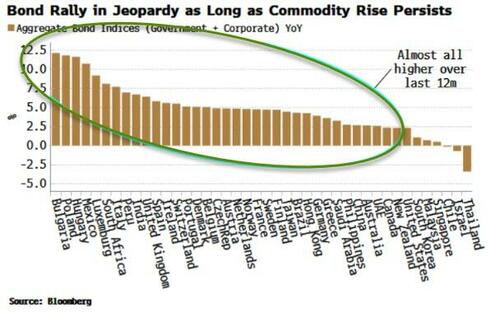

Aggregate bond indices are up in most countries on an annual basis. But the broadening commodity rally threatens to feed into global inflation and kickstart another bond selloff.

A year ago almost all aggregate (corporate + government) bond indices were on the back foot. But throw in a dash of optimism, a soupçon of disinflation and a helping of less hawkish central banks and almost all indices are up over the last year. Thailand and Israel’s indices are the only two real exceptions; the rest are higher by anywhere from 2% to over 10% in Poland and Hungary’s cases.

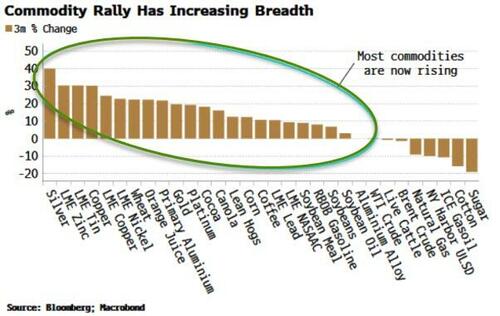

Commodities are on the march though. Indices such as Bloomberg’s Commodity index are close to breaking out of their 12-month ranges, while Bloomberg’s Spot Commodity Index, which does not include the cost of rolling future positions has already broken out.

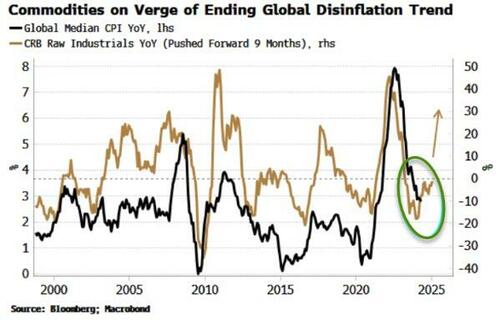

Non-exchange traded commodities, such as burlap, wool tops, tallow and rubber – as captured by the CRB Industrials Index – have also started rising. The CRB Industrials leads global median CPI – the median of almost 50 countries’ headline CPI indices – by around six months. The rise in commodities points to the end of the global disinflation trend.

The commodity rally looks set to persist. Excess liquidity remains buoyant and is supportive for risk assets. Further, the rally is broadening. The majority of exchange-traded commodities have risen over the last three months, with only a few laggards such as sugar and cotton.

The fragile recovery in global bonds after their rout in 2021/22 – ultimately triggered by a commodity shock – may be on the verge of playing out again.

Tyler Durden

Wed, 05/22/2024 – 10:45

via ZeroHedge News https://ift.tt/aJd1srg Tyler Durden