Canada’s Uranium Mining Boom Positions It To Overtake Kazakhstan As Top Producer

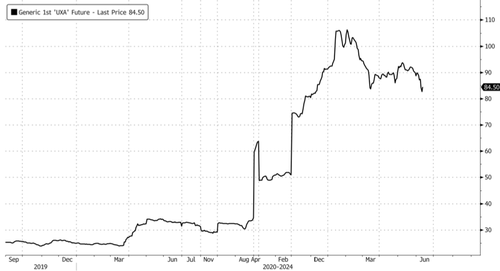

Canada was the world’s top uranium producer for years until Kazakhstan dethroned it in 2009. Fast forward to 2022, and Canada held the second spot, pumping out 15% of the global supply. By 2023, Canada became the top uranium supplier to the US, delivering 27% of total deliveries. With uranium prices soaring in the last several years, primarily because of the ‘Next AI Trade’ theme (laid out for pro subs), Canada’s uranium mining boom could lead it to reclaim the top spot.

A new report from Bloomberg highlights that Canada’s Saskatchewan province is the epicenter of the country’s uranium mining boom:

What Saskatchewan has, though, is uranium. Lots of uranium. The bedrock is so loaded with it that the area around just one stretch of the lake, it is believed, could generate enough nuclear energy to power more than 40 million homes for a quarter century.

Cameco and Cameco/Orano operate several active mines in the commodity-heavy region, and there are also a number of new mines under development.

According to the World Nuclear Association, Canada is poised to overtake Kazakhstan as the largest uranium producer as new mines come online in the years ahead.

Prime Minister Justin Trudeau has made a hard pivot, embracing nuclear power to achieve Canada’s net-zero emissions goals. This marks a major reversal after years of promising to move the economy away from commodity extraction.

Let’s revisit our December 2020 note titled “Buy Uranium: Is This The Beginning Of The Next ESG Craze” and, more recently, “The Next AI Trade.” In these notes, we argue that nuclear power is the cleanest and most reliable energy source for electrifying America.

Thank AI data centers for the consumption surge in power.

A ChatGPT search requires 10x as much power as a traditional Google search pic.twitter.com/khdSbvxsOH

— zerohedge (@zerohedge) May 19, 2024

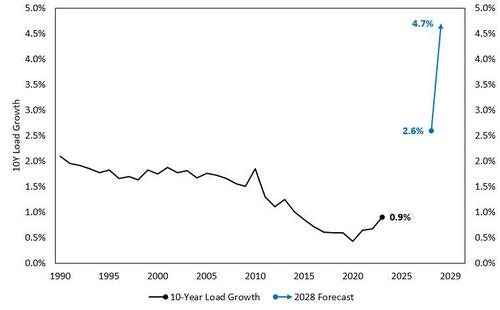

Goldman’s forecast of cumulative electricity growth shows that over the next five years, electricity growth is expected to jump from 2.6% to 4.7%, driven by major utilities revising their estimates higher.

Wall Street finally jumped on the nuclear power bandwagon earlier this year. From Goldman to BlackRock, everyone is piling into the powering-up America theme with nuclear energy.

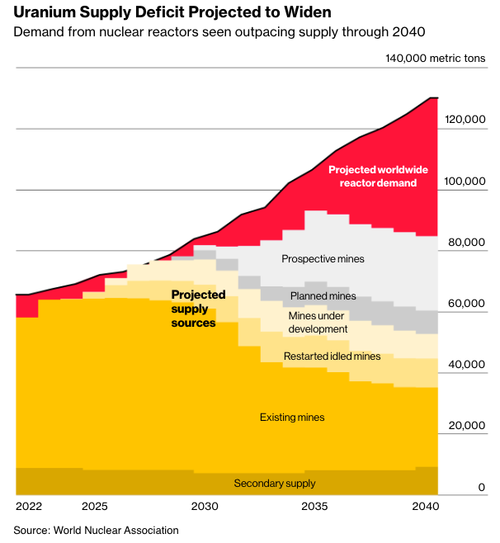

Given this hot trend, projections from the World Nuclear Association show that global uranium supply deficits will explode in the 2030s as new plants come online.

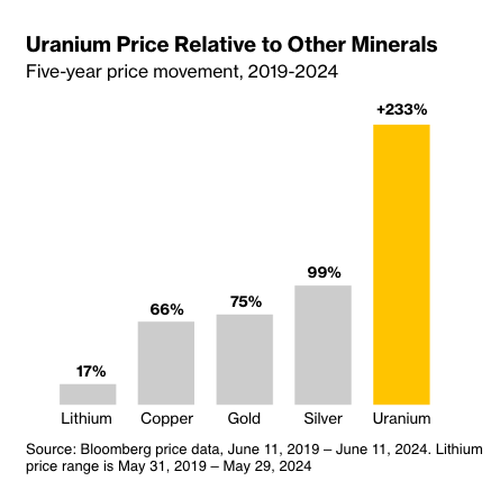

Due to tightening supply and higher demand, uranium prices have soared over the last five years, up 233%, outpacing silver, gold, copper, and lithium.

Recently, BofA’s Lawson Winder provided clients with a transcript of a panel discussion with some of the world’s top uranium executives…

The biggest takeaway: “Many institutions are still learning the role of uranium in the energy transition, suggesting upside to money in the space.”

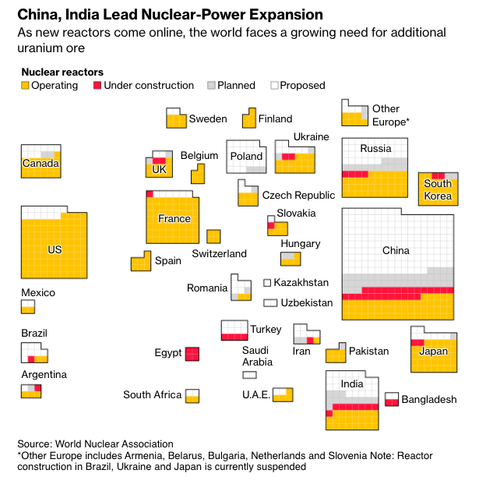

Most of the nuclear power expansion currently occurs in the Eastern Hemisphere, mainly in China and India. However, with the Biden administration finally getting serious about atomic power, a significant reversal in the US is underway with the recent historic restart of the Palisades nuclear plant in Michigan.

“Today, there are 61 nuclear power plants under construction globally. Another 90 or so are in the planning stage and more than 300 have been proposed,” Bloomberg said.

The US receives 19% of its electricity from 93 nuclear power reactors. In the years ahead, more retired reactors will be restarted, which will increase the number.

Russia controls about 46% of global enrichment capacity, while the US controls only 9.5%. The US’ reliance on Russian uranium is a major problem in a world that is fracturing into a dangerous multi-polar state.

The mining boom in Canada signals that the country could soon reclaim its spot as the world’s top producer while breaking the US’ dependency on Russian uranium.

Tyler Durden

Fri, 06/14/2024 – 04:15

via ZeroHedge News https://ift.tt/NSbYvE3 Tyler Durden