The StealthFlation Blog

Tis the season for exceptional economic greetings. The entire energy complex and base metals are in a ferocious free fall, whilst the juiced stock market apologists and U.S. exceptionalist pompom wavers are all out in force emphatically heralding a new found era of unabashed American consumerism which evidently is about to magically materialize.

Apparently, according to these cheerful dreamers, the well documented, severe slowdown of the three largest industrial economies on the planet, after the U.S. (China, Japan, Germany), has absolutely nothing to do with the continuous commodity crash. Not to mention that the 2nd largest economic bloc on the globe, the Eurozone, is mired in a metastasized morasse of malignant monetary malfunction. Just last week IMF director Christine Lagarde stated that a diet of high debt, low growth and high unemployment may yet become “the new normal in Europe”.

The world economy is undoubtedly standing at a precipice, and yet, all these wall street country club clowns can think about is the multitude of new iChristmas gifts that will undoubtedly be placed under their terrific twinkling trees.

The incessant equity cheerleading doesn’t stop there. Evidently, the fabulous frenzied flag waving is also trumpeting the jubilant re-coronation of King Dollar, which will keep the big box superstores sizzling with stupendous sales of cheap Chinese crap all season long. I suppose, the fact that a substantial portion of the meager U.S. GDP growth over the past 5 years, that has come in large part from a rehabilitated export sector operating under more favorable exchange rates, is totally immaterial, and which, by the way, is now fading as fast as green shoots on a vast frozen global economic tundra.

‘Mediocre’ growth plagues world economy

October 7, 2014: 9:40 AM ET

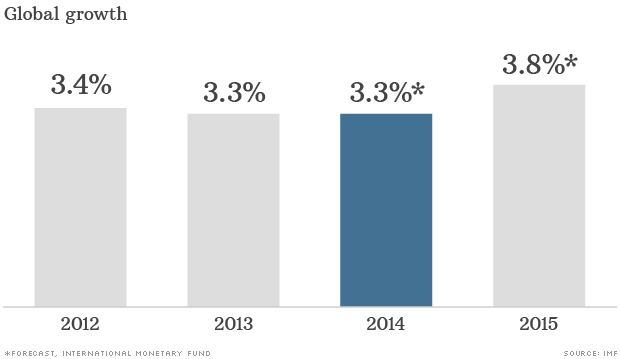

The record is stuck. The world economy will grow by just 3.3% in 2014, little changed from last year, or the year before that.

That’s the latest forecast from the International Monetary Fund, which just six months ago was expecting that growth would accelerate to 3.7% this year.

“World growth is mediocre, and a bit worse than forecast in July,” the IMF said Tuesday. It also shaved 0.2% off its forecast for 2015.

This is just the latest in a series of downward revisions over the past three years.

Trillions of dollars have been pumped into the world economy in the form of cheap central bank cash, boosting stocks and bonds, and real estate prices. That’s prompted warnings of potential bubbles and the risk they could burst.

Hate to be the Grinch that iced Christmas, however, there is a frigid, below freezing GDP level, winter blast of a blustery blizzard brewing out there. The real economic picture is melting like icicles hanging off an old beat up barn, and the only question is whether the roof will cave in first before they swiftly melt away, much like the monetized mountain of artificial liquid snow the FED has blown all over the frozen global economic landscape.

Make no mistake my friends, the rest of the worried weary world is looking at the U.S. as the abominable snowman. Growth has been put on ice, and thus it’s now a zero sum hockey game on the all world skating rink. The U.S. has certainly been ignobly and illegally abusing its world reserve currency status to leverage itself against an entirely stale shrinking global economic pie, insidiously printing vast amounts of funny money to sustain a synthetic utterly monetized economy, and the rest of the world is on to it.

China is pressing the IMF to promptly set up the new SDR multilateral monetary regime, and Putin has backed up the gold truck to establish a gold backed Ruble. Meanwhile, the Europeans all want their bullion swiftly repatriated out of NY. Who will buy our disingenuous diabolical debt once the currency is exposed for the deceitful fraud that it is? Remember, it’s not about today’s dollar and treasury safe haven bid, it’s about tomorrow’s confidence in our monetary system.

Enjoy the holidays fat and happy while they last, as a chilling New Year awaits. Just below is the real Christmas carol, and I highly recommend you memorize the stealth chorus lines…….

STEALTHFLATION: An intractable economic condition that inevitably arises as excessively issued fiat currency compulsively pursues non-productive wealth assets in a grossly overleveraged economy, which has been artificially reflated by monetary authorities in a misguided attempt to synthetically engineer growth via extreme monetization. (Money Printing & Interest Rate Suppression)

This effectively prevents the real economy on the ground from realizing the healthy normalization and natural balance of free market forces necessary for genuine capital formation, which is essential to generating legitimate and sustainable economic growth.

Under the imposition of StealthFlation, asset prices are inordinately inflated while the generative velocity of money is eviscerated. Worse still, the seeds of hyperinflation are sown as a direct consequence of the interminable monetization which the compromised economy becomes entirely dependent upon.

The hapless hairbrained FED has unwittingly eviscerated the time value of money, and by doing so has completely broken the free market transmission mechanism that drives healthy capital formation, which can only be legitimately generated from real bottom up earned savings. They are now utterly dependent upon top down liquidity injections via the wealth effect and asset price inflation to stimulate economic growth, and thus the interminable monetization will continue unabated.

Don’t kid yourselves happy retail revelers, today’s frosty deflation will soon be met by more of the same FED snow job. I can already hear them tinkering with their supersonic financial repression ZIRP-QE snow making machines as we speak. I highly suggest you place some Gold bullion in your family Christmas stockings this year. Get physical or get gang debased!

Money is stored labor. Labor is part of human life.

To devalue money is to debase life itself.

Happy Holidays from the StealthFlation Blog

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/u4GrYL495SU/story01.htm Bruno de Landevoisin