Millennials Are Now Putting Everyday Items, Like Shoes & Sweaters, On Payment Plans

In what is certainly a microcosm of how dire the consumer credit situation in this country has become, startups like Affirm are now offering credit to millennials who want to buy products priced much lower than those traditionally bought with financing, according to the Wall Street Journal.

Yes, installment plays and layaway – constantly the butt of jokes for those who were always far too broke to afford whatever they were buying – have now become an everyday reality. But not for big ticket items, for everyday purchases, like shoes.

Take, for example, Sean Gauthier. He recently used an offer from Affirm to buy a “pair of white, pink and green Nikes” and pay for them over 6 months. He says he could have bought them outright (sure he could have) but said that the $5 that the company charges in interest is worth it to be able to make flexible payments.

And these types of everyday installment purchases are being encouraged at merchants like Walmart, Urban Outfitters and H&M, all of whom will be offering payment plans at checkout.

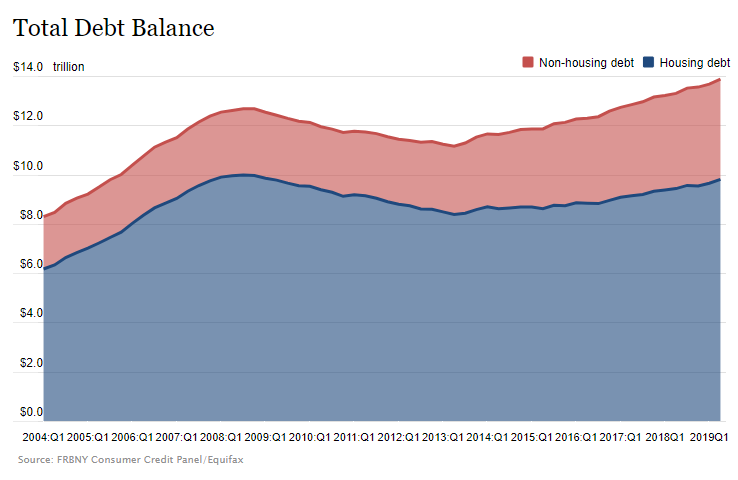

It’s a way for merchants to address a consumer debt bubble in the country that has grown significantly out of control, despite the “good economy”. Everyday consumers continue to rely on borrowing to fund their daily lives and consumer debt is higher than ever as a result of products and services getting more expensive while wages stagnate.

And growth for these payment plans is booming. Affirm’s point of sale loans have doubled to about $2 billion last year and are expected to double again this year. The market is tiny compared to the $450 billion in spending limits on new U.S. credit cards, but more than half of merchants surveyed this year said they plan on offering these installment options – or already do.

Meanwhile, about 40% of consumers surveyed “said the ability to finance a purchase at checkout made it more likely they would complete a transaction“.

And the big investment banks smell blood: JP Morgan, Citigroup and American Express are all introducing, or have introduced, payment programs for cardholders that resemble installment loans.

The Journal explained how Affirm works:

Say a borrower buys a $100 outfit. With a credit card, he will need to pay that off by the next due date or carry a card balance, which can last months if he makes only the minimum payments and racks up interest charges. With an installment loan, he pays a fixed amount with each payment—say, $25 each month over the following four months, or more depending on interest or other charges—and knows ahead of time what the total will be.

Some borrowers even claim that installment plans force them to be more disciplined to pay back the money. With this type of savvy financial acumen, we’re wondering why they never thought of not borrowing $50 to buy a sweater in the first place.

Guy Stephens, who has used Affirm, said:

“When you put something on a credit card, it vanishes into a big black ball of debt. There are balances I’ve had over time where I don’t even know what I bought.”

Larger purchases can require larger installment payments. For example, a $400 purchase, could require four $100 installments. With a credit card, the minimum due would be significantly lower. The plans are offered when customers are browsing products or about to purchase an item. Retailers hope the services will draw in new customers and – surprise – get them to spend beyond their means more.

The loans aren’t secured, which means that lenders have little recourse against a borrower who won’t pay. They can, however, be referred to debt collectors.

Some borrowers use the plans because they can’t get approved for credit cards – usually for good reason.

For example, Heidi Peyser said she was rejected for several credit cards because she stopped paying her bills. To Affirm, that is a perfect client. She was offered an installment plan to buy a mattress on Purple.com. “I thought ‘Well, let’s see how this goes,’ ” she said.

She has since signed up for 5 Affirm plans since 2017 to buy such crucial “must have” items like like woodworking tools and a gel to help with joint aches. She paid off her loans recently.

Another consumer, Erica Padilla, has used Afterpay 19 times.

“It makes it easier to think, ‘OK, I have to pay $25 now’ [rather] than spending $100 upfront,” she said, deluding herself as to the actual cost of items she was buying. She used the app over Christmas to buy “$75 of videogame T-shirts for her 13-year-old son at Forever 21 and $60 of rock-themed tops for her toddlers.” She, too, has paid off her balances.

Without Afterpay, she said: “We definitely would have bought less.”

Catherine Tabor, 24, has used the American Express arrangement nine times to buy such “much have” items like concert tickets and an opera house tour. She commented: “I’m not making a whole lot of money, so this is really helpful.”

Back in August of 2017, we reminded the world that millennials couldn’t afford anything without financing, reporting that they were financing purchases from airplane tickets to luxury bedsheets with loans from payment companies like PayPal and Aff