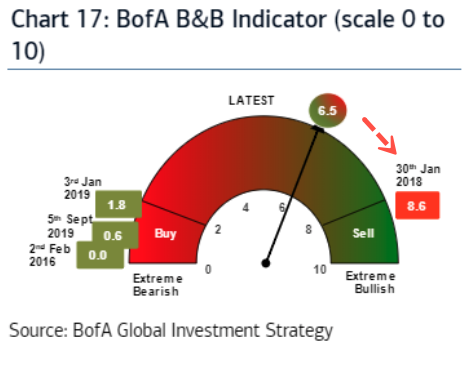

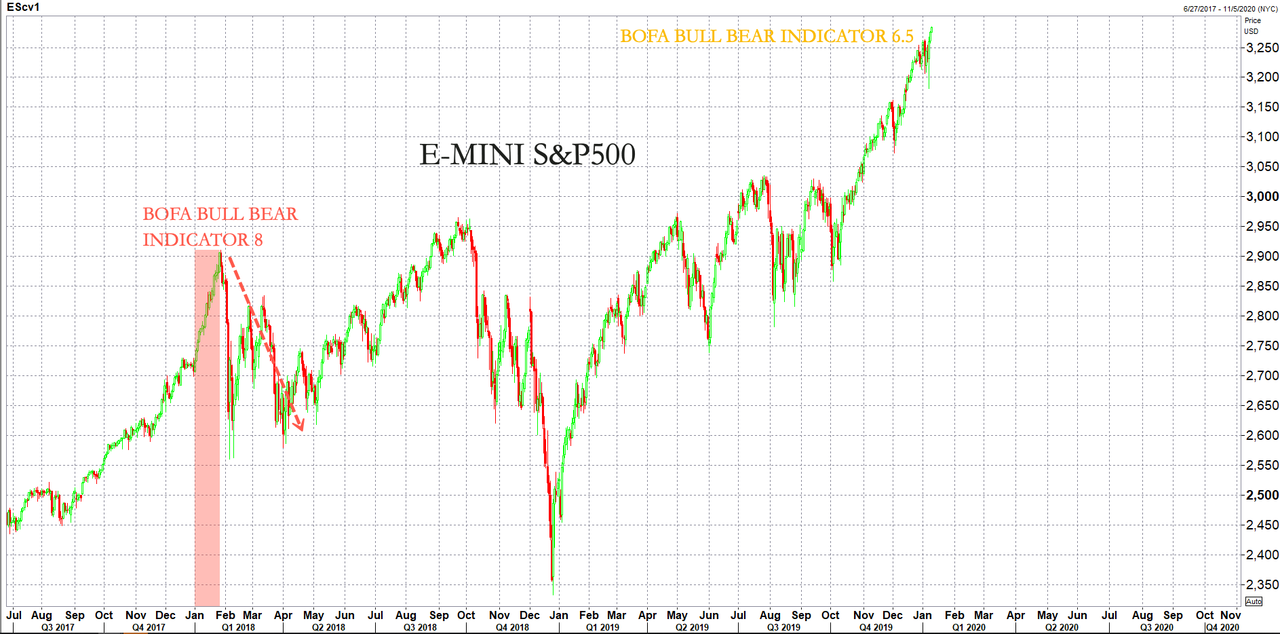

BofA Bull & Bear Indicator Approaching “Extremely Bullish” Levels

BofA Global Research published a new report on Friday detailing how the Bull & Bear Indicator would need to hit a signal of over 8 to trigger a sell.

For this to happen, there need to be at least $20 billion inflows into risky assets (HY, EM debt) by mid-February, new highs in HY corps versus US Treasures, a continued rotation into energy, industrials and financials, and hedge fund equity and commodity positioning to max bullish.

BofA said the “more interesting bull & bear arguments for risk assets in 2020; we believe asset upside will be very front-loaded in 2020.”

The BofA Bull & Bear Indicator currently prints at 6.5, the most bullish since March 2018 but not yet “extremely bullish.” To achieve maximum sell, the indicator would need to reach 8.

The report noted that “new year consensus shifting bullish on liquidity (Fed/ECB/BoJ QE annualizing stunning $1.1tn past four months; global central banks cut rates 80 times past 12 months) and reduced concerns of recession, default, inflation in 2020.”

BofA said “peak bullishness and dovishness” could be realized after the signing of the trade deal on Jan. 15 and the FOMC meeting on Jan. 29.

As for signs of a stock market top, the report said investors should monitor high yield bonds (HYG), semiconductors (SOX), homebuilders (XHB), banks (BKX) for underperformance

After four months of global central banks thr