Germany Announces “Limitless” Aid Program For Small Business: SBA Are You Listening?

To anyone who fell asleep some time in early February and woke up today, it will come as a shock that Germany – which until very recently was perceived as the fiscally stingiest nation in Europe, if not the world – is fast emerging as the most generous provider of government stimulus, and this morning we got confirmation of that when Angela Merkel’s government announced a new “limitless” aid program for small- and medium-sized companies (note: not a bailout of Germany’s mega corporations) as part of an effort to support Europe’s largest economy in the coronavirus pandemic.

Merkel’s government will provide guarantees of as much as 100%, German Finance Minister Olaf Scholz announced at a joint press conference with Economy Minister Peter Altmaier Monday, Bloomberg reports, adding that loans of up to 800,000 euros ($862,000) that will pay out very quickly will be available.

The existing program only provides for an 80% to 90% loan guarantee and banks have been reluctant to take on new risk as the economy falters. Private lenders have thus pressed the government to expand the existing program by guaranteeing 100% of the loans, which it now appears to be doing.

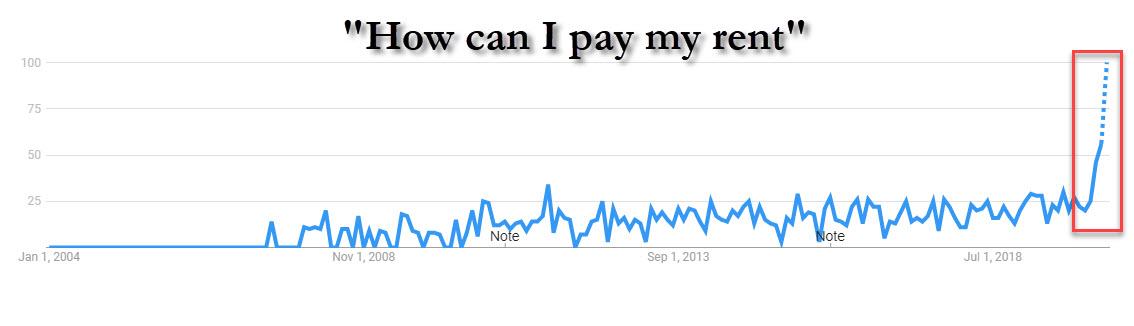

So… SBA are you listening? In light of the very strict limits on a similar program in the US where funding is limited to 2.5x the average monthly payroll of small and medium businesses, assuming it is disbursed which as we just reported it isn’t with BofA reporting just 100 loans have been actually funded, it is certainly time for the Trump administration, which unlike Germany has the benefit of the world’s reserve currency, to consider a similar “unlimited” program especially with the US economy rapidly sliding into depression.

The program for loan guarantees is the latest in a range of measures introduced by the German government, which said the economy might contract even more this year than the 5% drop caused by the global financial crisis in 2008 and 2009.

Of course, the question is whether companies will use the money to actually pay down debt/fund employment, or simply use it for stock buybacks. Indeed, so habituated is the market to stock repurchases that the news sent the DAX to session highs, some 5% higher.

Tyler Durden

Mon, 04/06