Will Consumers Bailout The Economy?

Tyler Durden

Thu, 07/30/2020 – 10:50

Authored by “The Progressive Ensign”‘s Patrick Hill via RealInvestmentAdvice.com,

Will Consumers Bailout the Economy?

“Absent any policy and behavioral changes…most likely (will lead) to an overall GDP contraction for 2020 in the 8% to 12% range, assuming no second round of infections in improving states such as New York. Moreover, the recovery of lost output would not be completed in 2021. And the uncertainty surrounding these predictions would notably increase, with the balance of risk tilted to the downside.”

– Mohammed El-Erian, Allianz, Chief Economic Advisor, 6/30/20

The nation faces the worst economy since the Great Depression. The National Bureau of Economic Research – NBER has declared that a recession started last February. Uncertainty is increasing as there are signals that the recovery is stagnating and the recession worsening not improving.

Over 35M workers are receiving unemployment assistance with 1 in 5 workers receiving government financial support. Corporate debt to GDP is at the highest level on record. The federal deficit is now at nearly the same ratio to GDP as the record federal deficit during WWII. Analysts look to the consumer to ‘start spending again to jumpstart the recovery’ in the hopes of bailing out the economy.

Will consumers bailout the economy? As consumer spending is 70% of GDP, resumption of robust consumer buying is crucial to shift the economy back onto a growth track. In this post we examine the status of the consumer, factors that are affecting spending and possible policy initiatives to ensure increased spending resumes.

We will offer an analysis of the following points to understand the likelihood of the consumer bouncing back and spending at pre-pandemic levels:

-

Two Key Megatrends – Driving Consumer Spending

-

Health & Spending – virus driving fear

-

Financial Insecurity – fear throttles spending

-

-

Outlook for Consumer Spending – Stalled Today, Future Decline Likely

-

Initiatives for Long Term Recovery – shift from relief transfer payments to investing in: long term infrastructure and job creation, economic bridges to increase trade, new business economic centers, and sick leave and child care

Consumer buying is composed of many factors, yet the core factor is confidence based on security. Let’s look at consumer psychology and how uncertainty is eroding confidence. Understanding the emotional and social factors buffeting consumers will inform our analysis of how their behavior has already changed and may change in the future.

Psychological and Social Factors Affecting Consumer Behavior

The pandemic has shocked people, changing almost everything and everyone in their lives. Workers lost their jobs. Shops closed their doors. Schools were closed leaving children at home. Children at home has created a dilemma for essential worker parents who must decide either to go to work and find scarce child care or stay home and lose income. If parents had a job that allowed them to work remotely, they could work online and stay home with their children. In a just a week or two, families had to learn how to live 24 hours a day at home, buy groceries, and manage children learning online while working at home. Most health services were suspended except emergency rooms and coronavirus treatment. Anxiety and stress increased for all workers but especially for first responders, healthcare workers, grocery clerks, gas station attendants, meat processing workers, and farm laborers.

Large crowd social activities that could reduce stress like sports events, concerts, church meetings, movie shows, and parties were closed or prohibited. Entertainment shifted into ‘at home’ versions of talk shows or variety shows. Production stopped in mid-season for some television programs and movies. Subscriptions to streaming services were substituted but are not the same as in person events.

Many things have changed in our lives. A continuous stream of out-of-the-ordinary things increase anxiety including: signs at stores telling us ‘to keep 6 ft apart and wear a mask’, wearing masks, store closures, shelves empty of basic paper goods and some meat products, lines of people in front of stores, social distancing Xs on sidewalks and in stores, plastic screens installed at counters, and roads being almost empty of cars and trucks. In addition areas where groups and crowds used to meet are closed for example: stadiums, movie theaters, churches, meeting rooms in bars and restaurants.

Added to these visual reminders are changes to social interactions such as: not traveling to visit friends or family, not hugging, or no handshakes, Face Time calls or Zoom chats replaced in person visits. Online multi-player games offered game enthusiasts 24 hour access to play day or night.

It is as if some tsunami of social change flooded our nation transforming every aspect of our life all at once. The social change from the virus pandemic has created deep psychological changes: for some, injuries and for others a loss of a family member or job. The psychological stress maybe similar to strains and losses of a generation during the Great Depression. The Great Depression changed attitudes, beliefs and values for decades afterward. The ‘greatest generation’ felt the need for increasing job security, having savings, working hard, and paying off debt. Plus, they saw the need to help each other, work as a team and dig in with self-sacrifice to turnaround their lives. Unfortunately, many of these values are submerged in the divisive narrative of our present society.

The pandemic is already changing how we interact, buying patterns, work attitudes, health and financial security. It will take time for people to get over the shock, the visual reminders of the threat to their health and job loss creating financial insecurity. The uncertainty surrounding all these emotional and social forces will undermine consumer confidence until they are mitigated or removed.

There are two key megatrends triggered by the virus that are driving the changes in our society and spending patterns. We look at these trends next.

Megatrends

Health & Spending – Virus Driving Fear

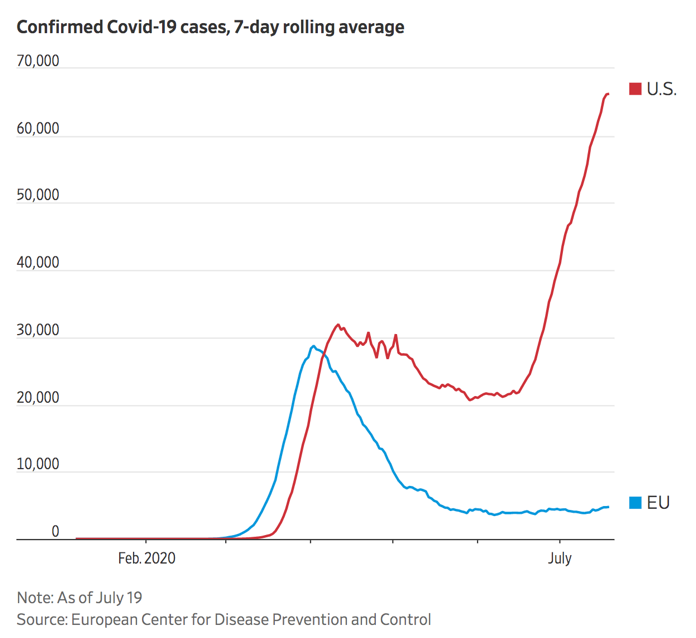

The threat of virus infection is driving uncertainty and fear to new heights as new infections and deaths continue to accelerate while still in the first wave. Yet, other countries like Germany and European Union members implemented national strategic containment programs which have successfully contained the infection’s first wave.

Sources: EU Center for Disease Prevention and Control, Bloomberg – 7-20-20

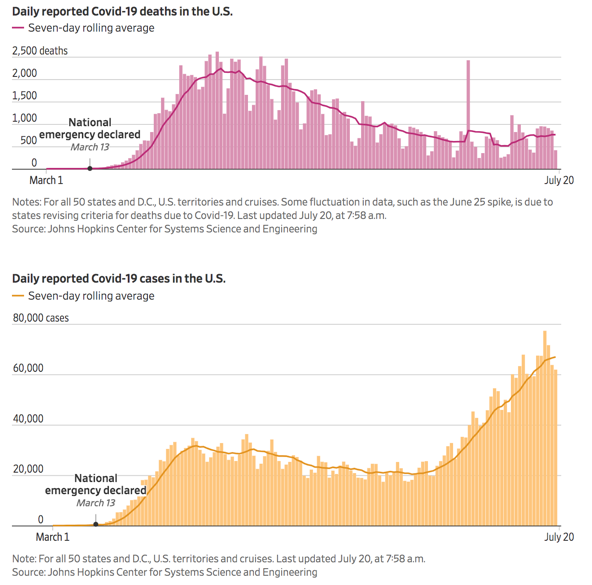

Sources: Johns Hopkins Center for Systems Science & Engineering – The Wall Street Journal – 7-20-20

Consider where the U.S. would be today if the virus was contained like the EU has done. Schools would resume classes, businesses reopen, workers return to their offices. More importantly, consumers would have confidence to begin spending, not at pre-pandemic levels but buying more. Plus, increased consumer spending gives executives’ confidence to reopen and begin recalling staff. While the EU has still prohibited super spreader events like sports games, concerts and conferences, for the most part social life is returning to some semblance of normal.

In the U.S. fear of becoming infected has transformed consumer behavior causing steep declines in retail location shopping, in-restaurant dining (in many areas is still closed) and travel in spite of reopening in many states.

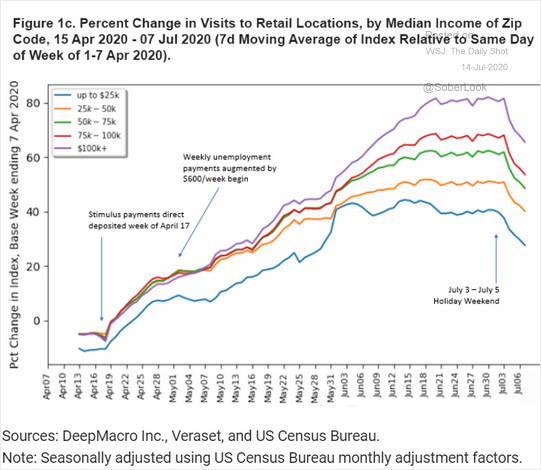

Sources: Deep Macro, Veraset, US Census Bureau, The Wall Street Journal, The Daily Shot – 7/14/20

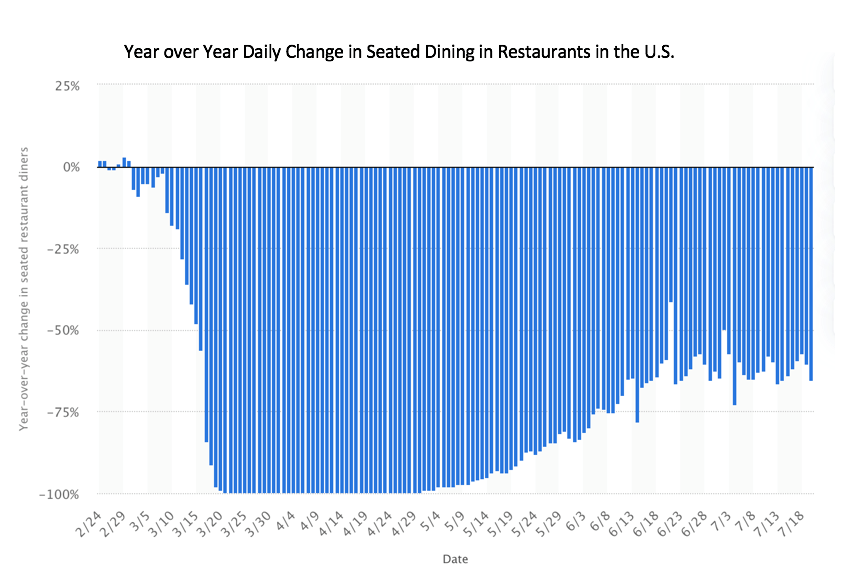

Source: Statista – 7/20/20

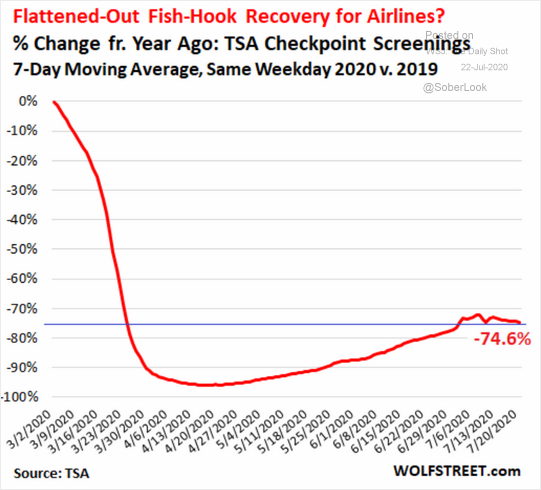

Source: TSA, Wolfstreet.com, The Wall Street Journal, The Daily Shot, 7/22/20

The lack of mobility means consumers are staying home due to fear about becoming infected, regardless of officials relaxing social distancing policies.

Consumer spending in some industry sectors has increased during the pandemic as fear of the virus created new demand. Used car sales increased by 16% from May to June, though the sales level was still 20% below the same month last year, according to ALG Inc. Many of these vehicle purchases were likely made by drivers looking for private transportation as public transit use has dropped by 80% nationwide. In a possible permanent shift in buying patterns most car purchases were made online, so dealerships had skeleton staffs. As families made plans for summer trips recreational vehicle sales have soared. Airstream sales increased by 11% in May compared to the same month last year with sales ‘going through the roof’ in June. In the stay-at-home market Netflix increased subscriptions in the first quarter by 16.1M and in the second quarter by 6.8M. Yet, the company forecasts a flattening of sales to 2.5M for the third quarter as the market for streaming services becomes saturated. The pandemic lockdown forced people to buy groceries versus going out to dinner. Thus, location grocery sales increased by 20% during the first three months of the lockdown with online grocery sales spiked by 35%.

Online shopping for general merchandise soared by 18% in the first 6 months of this year. However, general retail sales including auto and fuel categories is expected to drop by 10.5% for all of 2020, reports eMarketer. Home prices have increased in suburban markets as city dwellers leave the city permanently to get away from the densely populated cities where the virus was rampant. Also, some employers have allowed workers to permanently move out of the area and work from home. For example, San Francisco with the highest pre-pandemic rents in the country has experienced a 6.4% drop in rental prices from May to June as residents leave for the suburbs, or Sacramento where housing is 25 – 30% cheaper. In New York, the prices of homes in the Hamptons outside of New York City have soared to a 13 year high. Once resettlement has been completed for workers with income and wealth, we expect rental prices to fall. In the future we expect home prices to flatten or even decline as the number of qualified buyers dwindles. Many virus triggered consumer segments are likely to flatten or decline slowly as the virus comes under control.

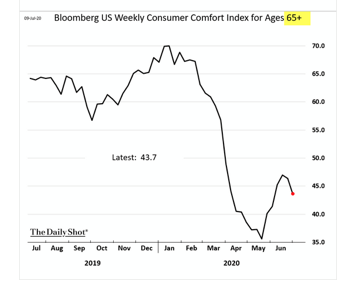

Finally, a key consumer segment, Baby Boomers are uncomfortable with the economy.

Sources: Bloomberg, The Wall Street Journal, The Daily Shot – 7/10/20

Boomers provide 31% of all consumer spending, according to Visa. Boomers are highly vulnerable to catching the corona virus and have a much higher mortality rate than other age groups. Most seniors are sheltering in place even in those areas that are reopening. Their reluctance to go out shopping, go to restaurants, take trips and just general sense of anxiety will cap spending until the virus is contained.

Even with some increases in spending in a few sectors, overall consumer spending is down about 10% from pre-pandemic levels. The lack of a national containment program has led states to develop containment programs of their own. New York has announced a quarantine requirement for all travellers from 31 states in the U.S. as officials become concerned about travellers from states causing increased infections. The quarantine requirement will significantly reduce tourism revenue. A few other states are considering quarantine requirements as well further restricting mobility and income from visitors. As long as virus infections rates are out of control, consumer fears will grow and spending will be throttled.

Financial Insecurity – Fear Throttles Spending

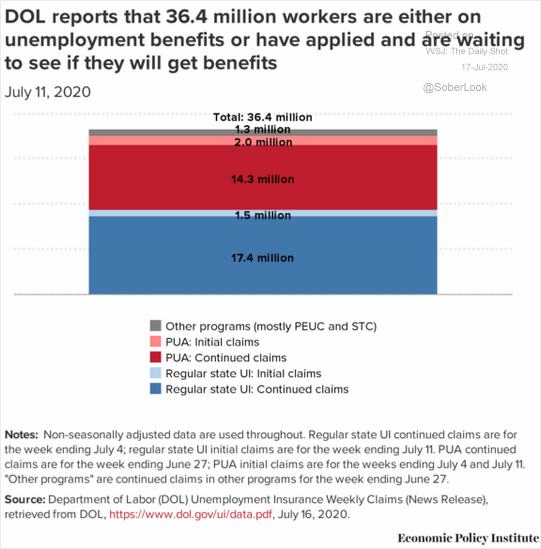

Consumers in the bottom 80% in income were struggling financially prior to the pandemic hitting theircommunities. Most workers in this segment were borrowing at record levels to sustain their standing of living and a Federal Reserve study showed many do not have $400 in saving even to pay for an emergency. The pandemic hit causing widespread layoffs and furloughs at rates not seen since the Great Depression. The Department of Labor reports that 36.4 million workers are on unemployment or have applied and are waiting for benefits.

Sources: Department of Labor, Economic Policy Institute, The Wall Street Journal, The Daily Shot – 7/17/20

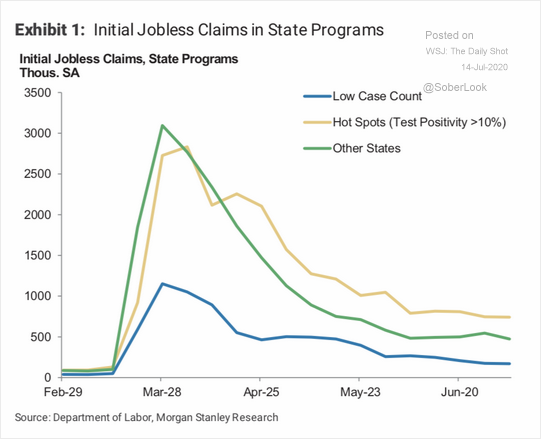

The virus infection rate continues to drive initial unemployment claim increases in many hotspots including Texas, Arizona, Florida and California.

Sources: Department of Labor, Morgan Stanley, The Wall Street Journal, The Daily Shot – 7/14/20

Rising virus infection rates will continue to drive unemployment claims as more workers are laid off permanently due to declining sales or companies closing. For the week ending July 18, the Department of Labor reports an increase of 109,000 initial claims to 1.4M. This is the first increase since March. This uptick in initial claims is another indication of increasing weakness in the labor market.

Consumers receiving unemployment insurance funds are anxious about whether their unemployment benefits will continue while they manage tight budgets. Making budgets tighter for households is the fact that states are slow in actually sending checks to unemployed workers. Bloomberg reports that over $100 billion of approved checks have not been sent to claimants as of July 24th. When the pandemic hit in March state unemployment departments were under staffed, using old computer systems and experienced funding cuts. The states were not ready for millions of claims to be filed in just days.

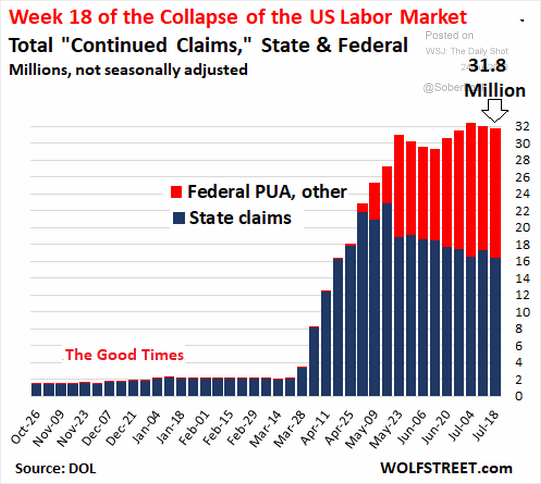

Over 31M Americans are receiving unemployment benefits or 1 of every 5 workers.The unprecedented lack of employment prospects drives extreme worker anxiety and stress.

Sources: Department of Labor, Wolfstreet.com, The Wall Street Journal, The Daily Shot – 7-24-20

Recent employment reports show the effects of the reversal of reopening efforts. The Census Household Pulse Survey between mid-June through mid-July showed there was a drop of 6.7M jobs due to jobs losses becoming permanent and possible shifting to white collar workers. Analysts are now expecting an increase in the number of initial unemployment claims in the coming weeks.

The status for many of 31M small businesses is fragile. A July survey by Alignable of 13,600 small businesses showed that without further aid 40% of business owners had only 30 days of cash left – even with Payroll Protection Program (PPP) funds and other pandemic loans. Confirming the small business predicament, a Goldman Sachs small business survey found 84% of business owners said they would not have enough money to keep paying staff after August 8th when the PPP loans end. In addition, 15% of small businesses or 4.65M businesses have shut down their operations either temporarily or permanently. These business owners and their employees could become the next wave of unemployed if they don’t receive relief fast.

Based on health and financial security trends we have developed an outlook for consumer spending based on present programs and ideas for new relief funding being discussed in Congress.

Outlook for Consumer Spending – Stalled Today, Future Decline Likely

The Federal Reserve moved swiftly when the stock market hit a low in late March and has continued to flood the economy with 12 different business relief loan and credit programs totaling nearly $4 trillion including QE cash injections. The federal government provided relief funding to businesses and consumers including: on-time direct payments of $1,200, Payroll Protection Program funding to small businesses, and enhanced unemployment of additional $600 with coverage for contract workers and sick leave benefits all totaling $2.1 trillion. To monitor the results of this $6.1 trillion relief effort Oxford Economics has developed the following recovery tracker:

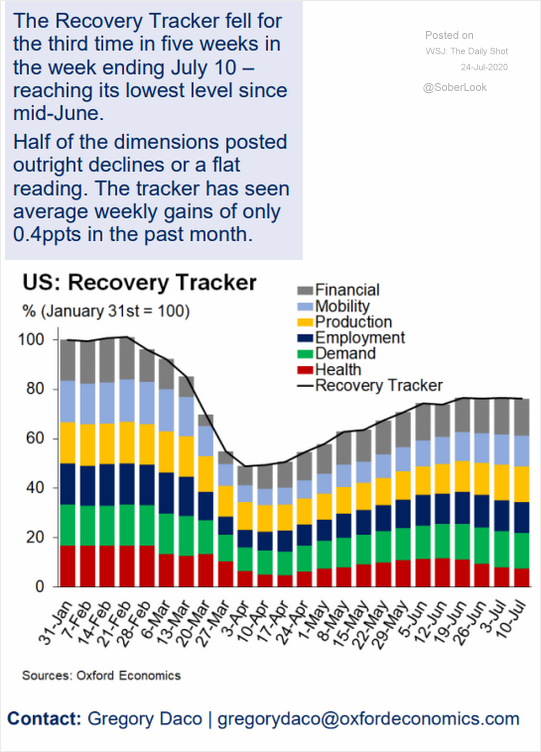

Sources: Oxford Economics – et al, The Wall Street Journal, The Daily Shot – 7/247/20

The economy fell by 50% in all six categories from the January 31st baseline, and has come back about 25%. Though the tracker is still 25% below January’s level. Of immediate concern, the Recovery Tracker shows three declines in the last five weeks. As we have noted recent indicators show a stall in consumer spending.

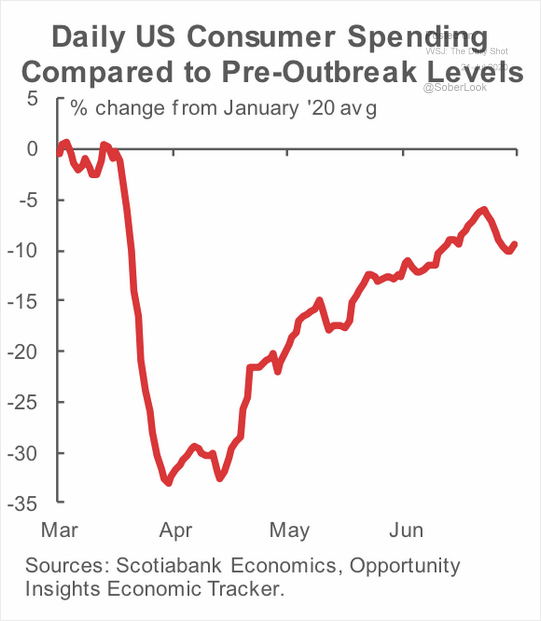

In the following chart, consumer spending bounced back from a dive of 35% and has begun to stall at minus 10%. The present 10% decline in spending below pre-pandemic levels is in line with the forecast we quoted in the introduction to this post by Mohammed El-Erian of a contraction of 8 – 12 % in GDP for 2020.

Source: Scotiabank, Opportunity Insights – 7/10/20

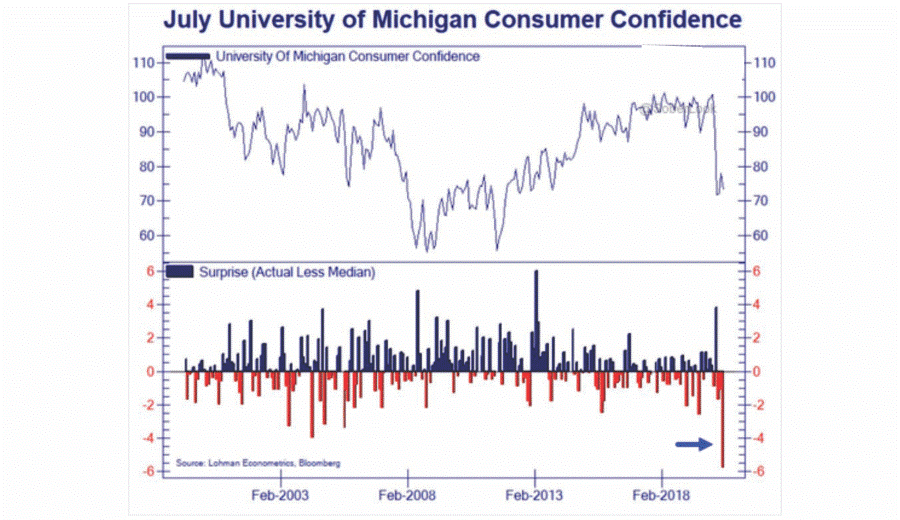

Consumer confidence levels track spending and shows how consumers have become a little more confident after March when the pandemic first hit. But recently, their economic concerns have grown. In the lower section of the chart, the magnitude of the drop is beyond the levels in the 2002 – 2003 recession.

Sources: University of Michigan, Lehman Economics, Bloomberg – 7/21/20

The confidence decline illustrates the heightened level of fear we noted related to the psychological and social fears the pandemic has triggered.

Congress is now considering a range of relief programs from the House proposal of $3.1 trillion to a Senate initiative for $1.1 trillion. The issue is that without effectively containing the virus these relief programs to keep consumers spending will likely fail to jumpstart a recovery. There are two fears: becoming sick and losing their job. The relief efforts will not in and of themselves overcome fear of virus driven job losses. Consumers and businesses will hoard cash until they feel the virus is contained and it is safe to resume normal activity. The emerging danger is that the lack of a strategic dedicated focus on virus containment will cause continued temporary spending which precludes the ability to invest in long term recovery initiatives.

Congress can help to alleviate the job loss issue with unemployment funding and related programs. The Federal Reserve can keep businesses operating with relief loan and credit programs. Yet, building a thriving economy will require a five to ten year perspective by making innovative investments today to meet the economic challenges of tomorrow.

Initiatives for Long Term Recovery

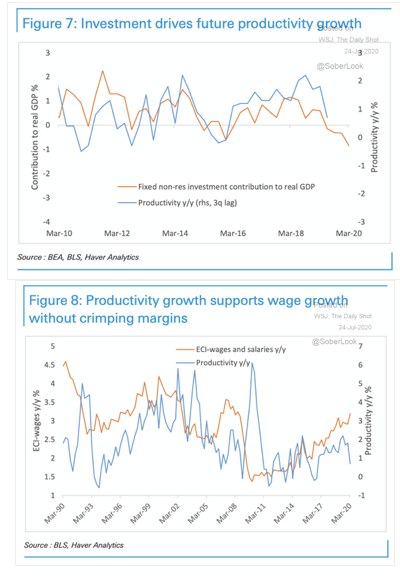

The way to grow the economy is through investment leading to productive investment that supports wage growth. Wage growth will lead to increased consumer spending. Investment will lead to building a solid foundation for a recovery.

Sources: Deutsche Bank – et al, The Wall Street Journal, The Daily Shot – 7/24/20

To spur wage growth here are a few investment ideas to build a solid foundation for recovery.

Shift From Relief To Investing

Relief programs only buy time to get the virus under control. Relief programs will support workers, employment and consumer spending only on a temporary basis. Companies and consumers are hoarding cash now due to the high level of uncertainty. To break this cycle, both executives and consumers need to see that our policy makers are serious about investing with a long term perspective. Initiatives like infrastructure spending have bipartisan support, but will need the political will to implement. Funding job training on a national scale to match unemployed workers with new jobs in information services, renewables, automation software, and health services. We need to build on vision that brings all workers into the mainstream of the economy, benefiting from a capitalist system.

Safety Net To Support Workers

Returning workers to their jobs will be challenging as child care may not be available during the day when parents are working. For example, in California the University of California surveyed child care centers and found 25% were closed and many others were losing money due to caring for fewer children. Reopening restrictions on ‘same groups’ and social distancing force care centers to care for fewer children. As a nation we need to support child care businesses and non-profits as part of the critical infrastructure for a solid recovery. Sick leave has become a major issue during the pandemic where workers were forced to decide between working and taking sick leave even though they had virus symptoms. We need our policy leaders to ensure that all worker have sick leave to make the right choice in a pandemic situation and stay home until they are not infectious.

New Business Innovation Infrastructure

Silicon Valley and other areas of the country have developed strong innovation ecosystems. These ecosystems establish a comprehensive supportive environment for new businesses to start and thrive. We can adapt the model by the federal government providing seed funding for innovation centers throughout the country as a priority. Center development should be focused on economically hard hit Mid