Nomura Warns “Broken” Equity Vol Complex “Feels Like An Accident Waiting To Happen”

Tyler Durden

Thu, 09/03/2020 – 10:30

US equity markets have been trading like penny stocks for a while and the last two days are perfect examples as they swing schizophrenically and violently on now news from one sentiment extreme to another…

The fact that liquidity in these markets is at or near record lows is not helping…

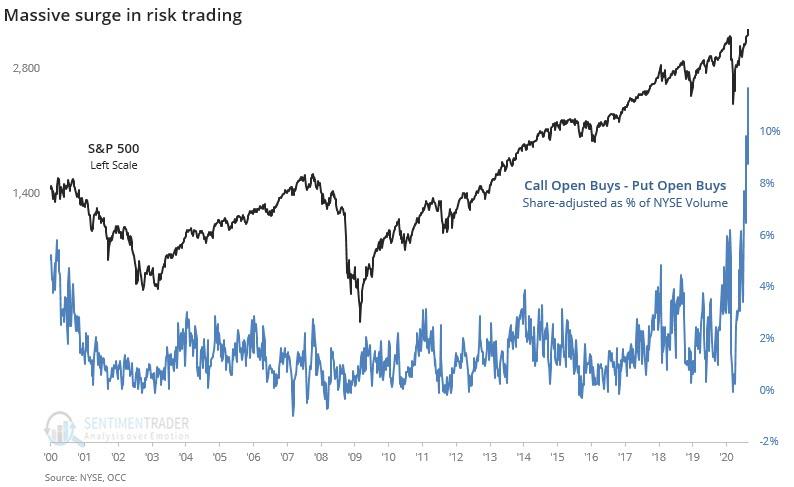

And an avalanche of “this is easy” retail muppetry is bidding levered long positions suggests none of this ends well.

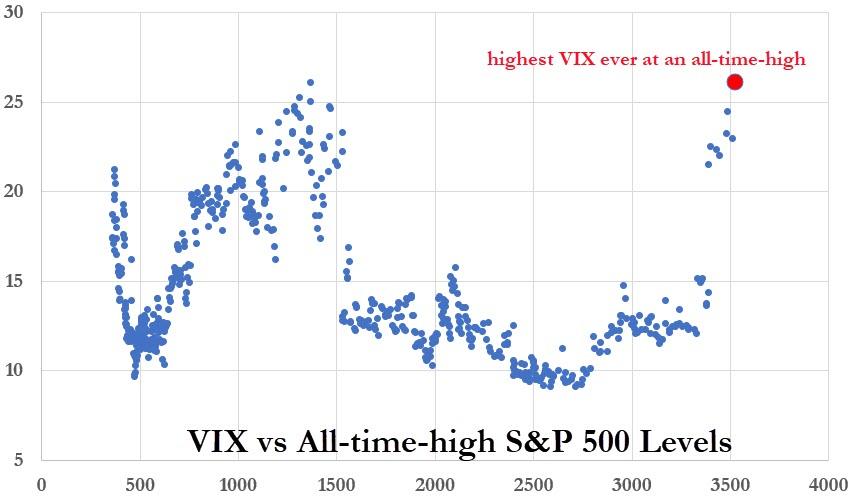

With VIX at a record high for any S&P 500 all-time high in history…

And that is the message – loud and clear – from Nomura MD Charlie McElligott:

The Eq Vol complex is acting “broken” and indicative that “something’s gotta give,” in-light of the aforementioned “(vol market) tail wagging the (equities market) dog” dynamic which sits at the core of this recent and mechanical “negative convexity” / “short gamma”-driven grab into market upside.

As McElligott’s note headline proclaimed:

“FEELS LIKE AN ACCIDENT IS COMING…BUT MARKET CRUSHING YOU IN THE MEANTIME”

It all adds-up to feel like a recipe for tears, i.e. “real” potential for a Nasdaq / SPX -6% to -8% single day in the next 1m-2m timeframe in my eyes as it all then turns the other way to the downside.

-

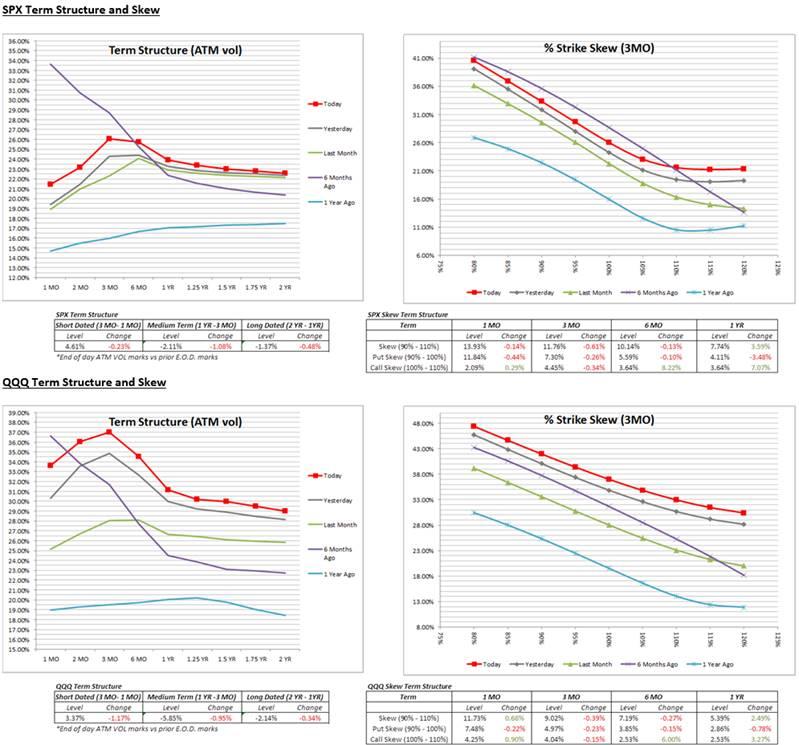

Spread btwn UX1 and UX2 at record highs (steep contango) while conversely, there is an enormous backwardation in mid- to long- end curve.

-

Ratio of 10d / 25d Put (Skew) hitting a new 2020 high, where even at prior all-time mkt highs in Feb, we didn’t see “downside” acting like this.

-

Massive premium of implied vol over realized (thx to the Tech upside premium buyer flows and concurrent Dealer “short gamma” hedging spillover), with QQQ 60d implied-realized spread still around ~ 99th %ile (10Y rel) and UX1 / SPX 30d realized vol spread currently ~2.5 SD’s over its 10 year mean (h/t AK)

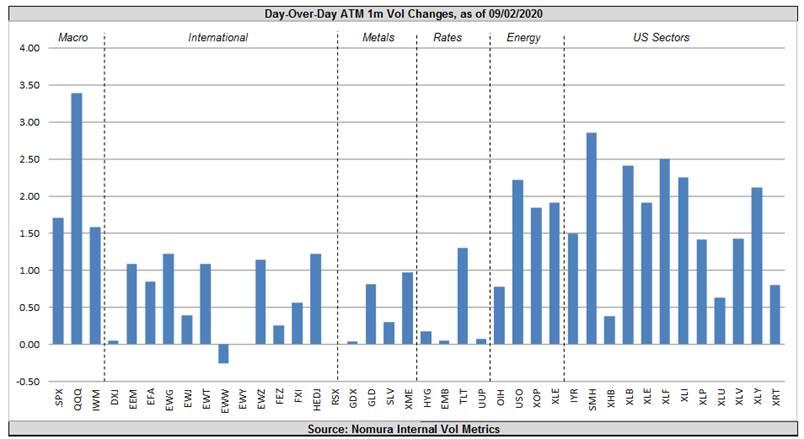

“Spot up, Vol up” continued again yesterday with both SPX and NDX again meaningfully higher-est (lol), but term structure again higher across both as well:

And then there’s the building election risk…

The Nomura strategist explains that in addition to the very high likelihood that large Street vol dealer desks will almost certainly be clamped down upon with regard to risk deployment (thus, poor mkt liquidity) around the event and protection of their strong year PnLs – combines to make it very difficult to imagine that the market is going to have the ability to “place” ongoing demand for “tails”

And this dynamic – though somewhat “far” away now – will likely keep vol of vol “sticky” (as we currently see VVIX back north of the finger-in-air 120 “tension” level), because the demand for wingy stuff (crash UP or crash DOWN) only builds the longer this “broken-ness” agitates under the surface… and that in itself is a sign that an accident could happen.

The big question McElligott says he gets from every client in the world it seems:

“when and how does this end?”

It certainly could be a “trade up into, trade down out of” an options expiration “trigger” (fwiw, the Tech flows have been Oct-Feb expiries).

Obviously, this September is a “Serial Expiry” (qtrly) and is suiting-up to be substantial, so in conjunction with something idiosyncratic (a macro “risk-off” catalyst, or perhaps even something innocuous like a stock sale or split from one of the Tech “high flyers”) which then is the “butterfly flapping its wings” event to start something more ominous.

Looking currently at the options-positioning “extremes,” we see some stuff:

-

SPX net $Delta at 99.1%ile

-

QQQ net $Delta at 100.0%ile, $Gamma 82.4%ile

But for now, it ain’t happenin’… because outside of the negative gamma knock-on buying in market, we also continue to see the US Equities market bot in SIZE by the “Vol Control” universe – as again, realized vols just continue to collapse under the weight of the prior trailing 1m or 3m periods.

via ZeroHedge News https://ift.tt/2QTceeC Tyler Durden