Bonds, Bullion, & Bitcoin Jump As Stocks Pump’n’Dump After CPI

A slightly weaker than expected CPI print prompted kneejerk panic-buying by the algos as it may delay The Fed’s taper. However, record-er and record-er highs in stocks is just as likely to trigger financial stability anxiety among some Fed members and as the US cash market opened, sellers appeared and erased all the un-taper gains. Small Caps were worst on the day, Nasdaq the least bad…

Today was the worst for Small Caps and The Dow since mid-July

Stocks are red for the month of September…

A “down” day… umm! (S&P 6th down day of last 7)

The Dow broke below its 100DMA…

The S&P tested down to its 50DMA once again – will this be a dip to buy, or is September’s back-half seasonality about to bite?

SpotGamma warned that 4440 was an important line in the sand today from an options/gamma persective…

Small Caps broke down below the 100DMA, heading to 200DMA support…

Apple investors seemed unimpressed by the new bright shiny objects… New iPad (same as the old one except faster, oh and smaller iPad mini), New Apple Watch (bigger display), Guided Meditation (seriously), and a new iPhone 13 (that looks exactly like all the other iPhones)

Financials underperformed today as yields tumbled and banks made headlines on trading volume outlook reductions and “normalization”. Healthcare was best today, managing to hold unchanged…

Source: Bloomberg

Defensive and Cyclical stocks both fell together today, no rotational flows…

Source: Bloomberg

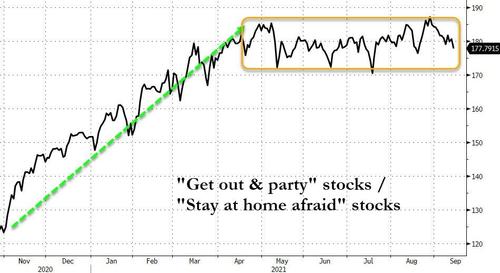

The stalemate between recovery and lockdown stocks continues…

Source: Bloomberg

Treasury yields were down notably across the board today, all bond bid aggressively from the CPI print…

Source: Bloomberg

30Y Yield tumbled to 6-week lows…

Source: Bloomberg

10Y Yield fell back below its 50DMA…

Source: Bloomberg

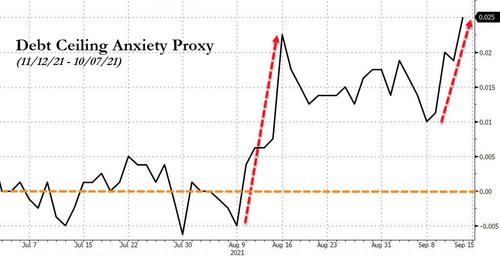

Debt Ceiling Anxiety continues to rise as McConnell said “Republicans are united in opposition to raising the debt ceiling”…

Source: Bloomberg

The dollar dived on the CPI miss, bounced back, scrambling to recover its losses as stocks legged down…

Source: Bloomberg

Bitcoin surged back above yesterday’s WMT/LTC spike highs…

Source: Bloomberg

Bitcoin is also on the verge of a ‘golden cross’ of its 50DMA above its 200DMA (for the first time since May 2020)…

Source: Bloomberg

Gold spiked back above $1800 today…

A choppy day left oil prices unchanged ahead of tonight’s API data…

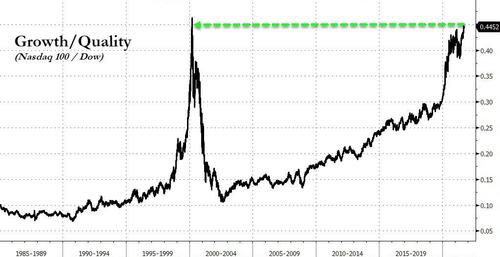

Finally, it feels like we are getting close… Nasdaq 100 (Growth) is back at record highs relative to The Dow (Quality)…

Source: Bloomberg

And no, investors aren’t hedged…