Paul Volcker And 1982. Why Now Isn’t Then…

Authored by Lance Roberts via RealInvestmentAdvice.com,

Jerome Powell isn’t Paul Volcker, and this isn’t 1982. As of late, market analysts are stumbling all over themselves, trying to outdo each other on the “why this time is different” related to the Federal Reserve’s ongoing inflation fight. One of the more interesting comparisons came from the always uber-bullish Tom Lee of FundStrat.

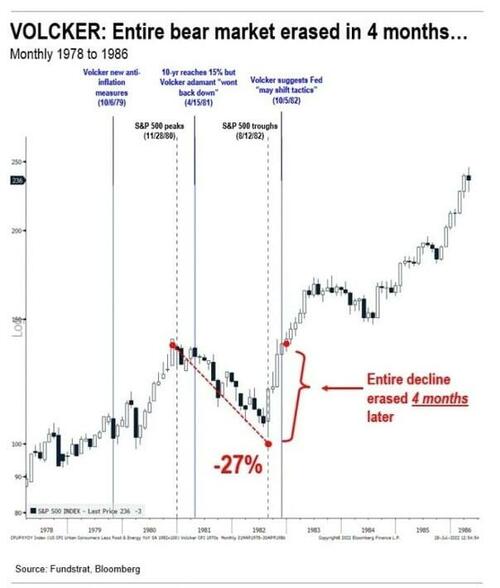

He argues that the market setup is similar to what investors experienced in August 1982. Then, a strong rally in equity markets took place as the Fed began to pivot away from its inflation fight. In the summer of ’82, the U.S. economy was in recession, and then-Fed Chair Paul Volcker had not yet signaled whether the Fed would ease up in its campaign to slow inflation. In October that year, Volcker signaled the Fed could temper efforts to slow inflation.

“The forces are there that would push the economy toward recovery. I would think that the policy objective should be to sustain that recovery.”

Two months before the pivot, markets sniffed out the Fed’s plans. Over the next four months, the losses from the 22-month bear market that saw the S&P 500 fall by 27% got reversed.

When it comes to the financial markets, Sir John Templeton once said:

“The four most dangerous words in investing are ‘this time is different.’”

While that is a true statement, particularly when it comes to excuses as to why bull markets can continue indefinitely, there are differences in historical comparisons. When an analyst “cherry picks” a random point in market history to base their investment thesis, one should take such with a “heavy dose of salt.” The reason is that “this time is different.” Every period is different due to the differences in the makeup of the economy, markets, consumption, production, debt, and a litany of other domestic and global factors.

To say 2022 is like 1982 is a dangerous statement, particularly when 1982 is taken entirely out of the context of what preceded it.

But, as Paul Harvey used to quip, “in a moment…the rest of the story.”

The Road To 1982

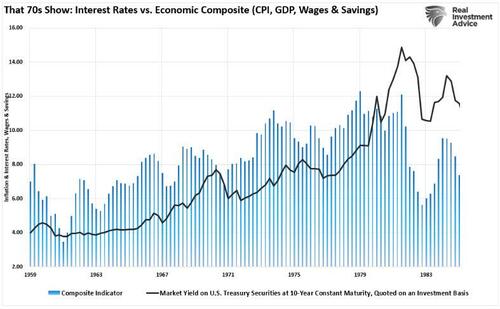

The road to 1982 didn’t start in 1980. The buildup of inflation was in the works long before the Arab Oil Embargo. Economic growth, wages, and savings rates catalyzed “demand push” inflation. In other words, as economic growth increased, economic demand led to higher prices and wages.

What is notable about that period is that it was the culmination of events following World War II.

Following World War II, America became the “last man standing.” France, England, Russia, Germany, Poland, Japan, and others were devastated, with little ability to produce for themselves. Here, America found its most substantial run of economic growth as the “boys of war” returned home to start rebuilding a war-ravaged globe.

But that was just the start of it.

In the late ’50s, America stepped into the abyss as humankind took its first steps into space. The space race, which lasted nearly two decades, led to leaps in innovation and technology that paved the wave for the future of America.

These advances, combined with the industrial and manufacturing backdrop, fostered high levels of economic growth, increased savings rates, and capital investment, which supported higher interest rates.

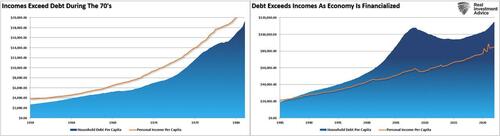

Furthermore, the Government ran no deficit, and household debt to net worth was about 60%. So, while inflation was increasing and interest rates rose in tandem, the average household could sustain their living standard. The chart shows the difference between household debt versus incomes in the pre-and post-financialization eras.

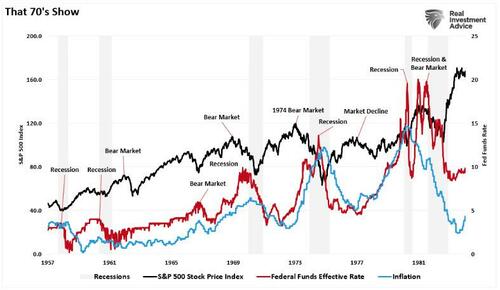

What was most notable is the Fed’s inflation fight didn’t start in 1980 but persisted through the entirety of the 60s and 70s. As shown, as economic growth expanded, increasing wages and savings, the entire period was marked by inflation surges. Repeatedly, the Fed took action to slow inflationary pressures, which resulted in repeated market and economic downturns.

Valuations Mattered

The road to 1982 was not a smooth one, but notably, while Mr. Lee suggests a Fed pivot would incite a similar market response, there is some additional history worth revi