Repo Madness: The Rest Of The Story

Submitted by Chris Whalen, The Institutional Risk Analyst

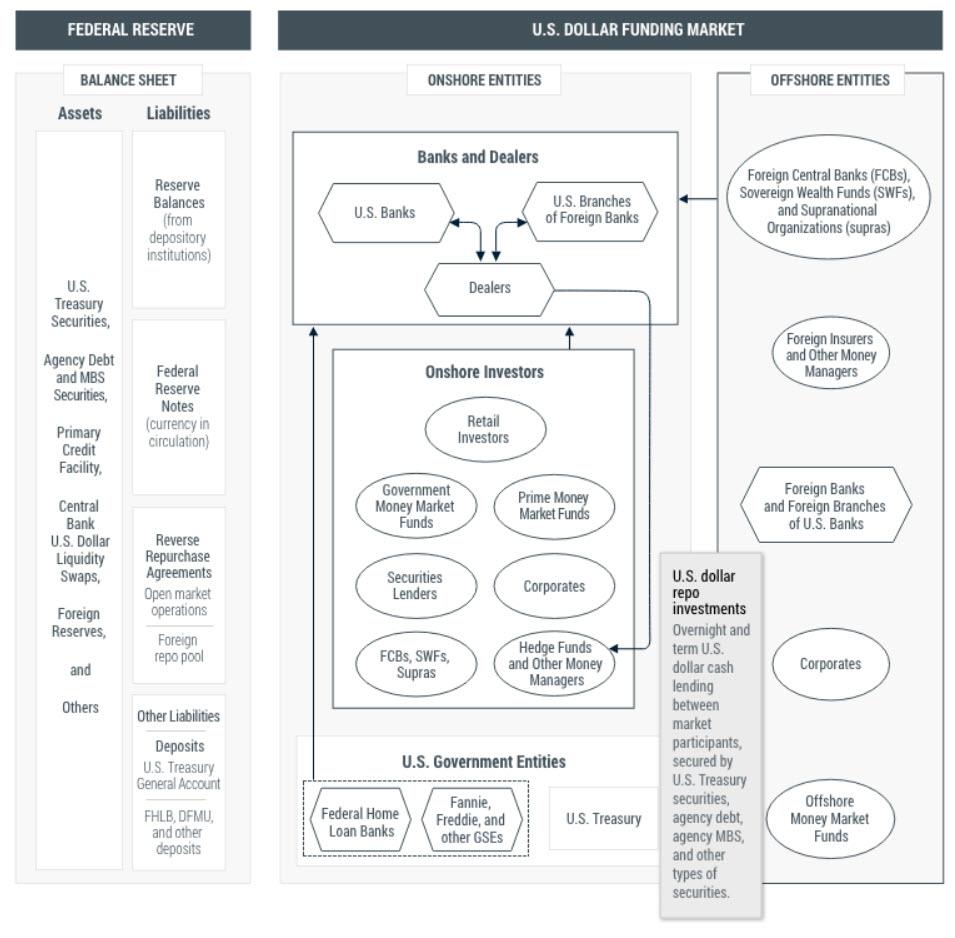

The Federal Open Market Committee cut the target for short-term funds another quarter point last night, raising the question as to whether the central bank can actually defend the 1.75% upper bound of the new policy range. Fact is, demand for short-term funding is pulling rates higher as the year draws to a close.

We got to dine with the risk committee this week, revealing new aspects of the recent repo kerfuffle that deserve mention. Chief among them was the idea of competition and, indeed, even conflict between the retail bank side of the house and the capital markets component inside the Fed’s primary dealers.

It seems that when the Federal Reserve Board was caught napping in mid-September, the bank treasury side of one of the largest US banks basically took a line from the 1990 Martin Scorsese film “Goodfellas” and told the bank’s capital markets side: “Fuck you, pay me.”

Under Regulation W, which implements what we traditionalists know as Section 23A of the Federal Reserve Act, transactions inside the bank holding co do not count against the bank’s statutory allocation for transactions with affiliates. But when market rates spiked, the retail treasury representing a very large insured depository, essentially told the traders to pound sand when it came to price. Reg W requires transactions with affiliates to be at market on an arm’s length basis, even with risk-free collateral supporting the trade.

The lesson here is that regulators do not want the cash-rich retail bank to give carte blanche to the traders, either with respect to the amount of liquidity or the price. The regulatory system worked – but also caused a new problem. A rush of fully motivated capital markets banksters suddenly turned outward and sought funding in the broader market for federal funds.

A squeeze ensued on or around September 16th, needless to say. Risk free collateral went begging for funding. Effective rates to finance Treasury and GNMA collateral spiked to double digits. So then, ask not whether one aspect of federal prudential regulations or another caused the liquidity squeeze seen last December and in June and later in September.

Ask instead why the Fed and other regulators cannot cooperate to tweak the system and fix da plumbing. December is just a month away. The reality, as F.A. Hayek described in his classic 1988 essay “Fatal Conceit: The Errors of Socialism” is that fine tuning the markets is an impossibility. The Fed suffers from the “fatal conceit” that “man is able to shape the world around him according to his wishes.”

Happy Halloween

Softbank Denies WeWork Control??

Meanwhile in the world of finance, a couple of notable events and comments occurred that deserve comment. PIMCO announced that it is reducing allocations to corporate debt, another data