The super rich are not only getting richer, they’re also getting younger.

According to a Bloomberg analysis, US investors with $25 million or more have seen their average age drop 11 years since 2014, to 47 years old, even as the average age of people with just $1 million is still 62, a data point that hasn’t changed in years. George Walper Jr., president of the Spectrem Group, who conducted the study, stated that a “vast generational transfer of wealth [is] just beginning.”

While the sample size of the study was small – it looked at only 185 Americans that had net worths higher than $25 million – and was highly unscientific, the findings from the study are consistent with other research that has been performed on the top 0.1%. The study found that more than a third of US wealth is held by those over 65 years old. This data point has not risen in step with the share of elderly Americans in the population, according to University of California Berkeley economists who examined the same data in 2016.

The paper concluded simply that the wealthiest Americans are getting younger.

So where are these nouveau riches coming from? The new money seems to be derived from both inheritances as well as self-made fortunes. “There may be more Mark Zuckerbergs at the top of the wealth distribution than in the 1960s, but also more Paris Hiltons,” the economists wrote in the paper.

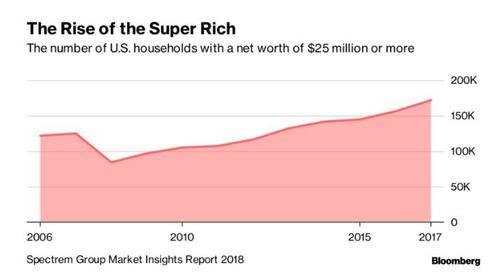

And the number of US households that have net worths of at least $25 million are up from 84,000 in 2008 to 172,000 this year.

9 out of 10 investors under the age of 38 said that their success came from inheritance and family connections, but the same proportion also attributed their success to hard work and running their own business. About 70% of the richest investors went on record as saying that they are still working.

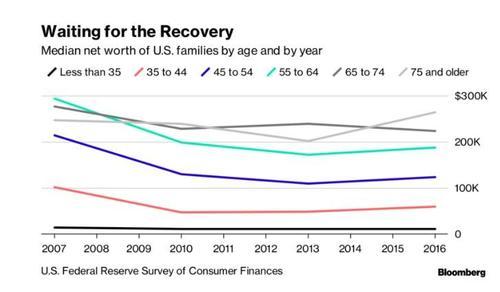

As more young people enter the top 0.1%, the vast majority of the remaining millennials and Generation X-ers are still struggling. Americans aged 35 to 54 saw their wealth from 2007 to 2016 – most of which was in housing – plunge by more than 41%.

The richest are still using complex estate planning in order to transfer their wealth to their children and future generations. 91% of those who are worth $25 million or more keep assets in a trust, according to the study, and half of those have three or more trusts set up.

Ironiclly, in a world swept by liberal guilt, a major loser along the way of everyone getting richer have been charities – although about 200 of the world’s richest people have signed The Giving Pledge, the study suggested that only 15% of those worth $25 million donate $100,000 or more annually.

via ZeroHedge News http://bit.ly/2HsVqJt Tyler Durden