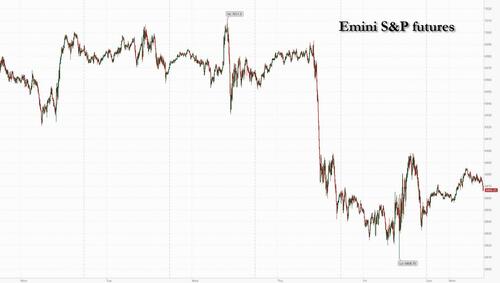

Stocks gained, bitcoin tumbled and bonds steadied after Friday’s cool CPI data reinforced expectations that the Fed will cut interest rates on multiple occasions this year. With US markets closed for the Presidents’ Day holiday and mainland China’s markets closed for Lunar New Year holidays, trading was muted on Monday. As of 9:00am ET, futures on the S&P 500 added 0.4% and Europe’s Stoxx 600 index rose 0.4% as banking shares rebounded from a sharp decline last week. German bunds and Treasury futures were steady after US yields touched the lowest since December on Friday.

The path of US interest rates remains in focus following Friday’s slower-than-expected US inflation print as traders fully price a Fed cut in July and the strong chance of a move in June.

“The backdrop for equities is positive post CPI,” said Andrea Gabellone, head of global equities at KBC Securities. At the same time, there could be “more dispersion ahead as sentiment around key AI-exposed sectors is still very critical,” he added.

That sentiment was echoed by other strategists seeking to distinguish between AI losers and winners.

A JPMorgan Chase & Co. team led by Mislav Matejka urged caution on stocks at risk of AI-driven “cannibalization,” including software, business services and media companies. Meanwhile, banks are developing baskets to capitalize on the divergence: as we first reported last Thursday, Goldman launched a new basket of software stocks that goes long firms that will benefit from AI adoption, while shorting the companies whose workflows could be replaced.

With AI disruption rippling through markets, a lot will come down to earnings resilience, in particular in the US.

“When you look at the current earnings season, the companies are showing 13% of growth,” Nataliia Lipikhina, head of EMEA equity strategy at JPMorgan, told Bloomberg TV. “Overall, this is the reason why we continue to be positive on the S&P.”

Later this week, traders will be watching for ADP private payrolls numbers on Tuesday and the minutes from the Fed’s January meeting on Wednesday for a fresh read on the economy.

European stocks gained with bank shares rebounding, after posting their biggest weekly decline since April on worries about disruption from artificial intelligence. The basic resources sector lags, with Norsk Hydro among Europe’s worst performers as both Goldman Sachs and RBC downgrade the stock. Stoxx 600 rises 0.4% to 620.26 with 253 members down, 336 up, and 11 unchanged. Here are some of the biggest movers on Monday:

- NatWest shares rise as much as 4%, the most since October, as Citi analyst Andrew Coombs raises his price target on the UK bank to a Street-high.

- Seraphim Space shares rise as much as 9.2%, briefly hitting a new all-time high, after the space tech investment firm said the valuations of its four largest holdings increased over the final months of 2025.

- AECI shares rally as much as 6.1%, the most since July, after the South African commercial-explosives maker shared improved 2025 headline earnings per share guidance.

- Orsted shares rise as much as 3.8% after analysts at Kepler raise the recommendation to buy from hold over the Danish renewable energy firm’s outlook, despite ongoing uncertainty for the industry in the US.

- Norsk Hydro shares fall as much as 4.4%, extending Friday’s 5.9% earnings-triggered drop, after being downgraded at Goldman Sachs and RBC over disappointments and pricing pressures in the Norwegian aluminum company’s downstream business.

- Galderma shares slip as much as 2.2% after naming Luigi La Corte as its new chief financial officer following the news back in July that Thomas Dittrich was departing.

- Pinewood Technologies shares tumble as much as 32%, the most since April 2024, after Apax Partners said on Friday it will not proceed with a possible cash offer for the car dealership software provider.

- FlatexDEGIRO shares drop as much as 7.2% after BNP Paribas downgraded the online brokerage firm to neutral from outperform, saying the price reflects too much optimism about its market position in Germany.

- Maurel & Prom shares slump as much as 12%, pulling back after ending last week at a 2015-high, after announcing it is not currently authorized to resume oil and gas operations in Venezuela.

- Barratt Redrow shares fall as much as 3.7%, leading a drop in British homebuilders after Rightmove said house prices are stalling.

Asian stocks slipped for a second day, led by declines in Japan as traders booked profits after last week’s post-election rally. Several markets were closed or held shortened trading sessions for the Lunar New Year holiday. The MSCI Asia Pacific Index was down 0.1%. Japan’s Topix Index fell 0.8%, with Mizuho Financial Group Inc. and Toyota Motor Corp. among the companies contributing to the index’s losses.In Hong Kong, AI model developer Minimax Group Inc. surged as much as 30% to more than four times its original listing price, while competitor Knowledge Atlas JSC Ltd. ended 4.7% higher. The market will be closed until Thursday. As investors across the region begin to reevaluate their bets on its artificial-intelligence-driven rally, traders in Japan cashed in gains driven by expectations of Prime Minister Sanae Takaichi’s proactive spending policies last week.Trading in Singapore ended early Monday and will be shut until Wednesday. Equity markets in mainland China, South Korea, Indonesia and Vietnam were closed.

In FX, the yen is the notable mover in currencies, weakening 0.5% against the dollar and pushing USD/JPY back above 153. The offshore yuan is one of the better performers against the greenback. The Bloomberg Dollar Spot Index rises 0.1%.

There is no cash trading in Treasuries due to the Presidents’ Day holiday. European government bonds are little changed

In commdities, gold dipped below $5,000 an ounce, as traders booked profits from a gain in the previous session. Bitcoin tried anf ailed to stage a modest rebound; it last traded around $68,275 after posting its fourth consecutive weekly loss, with the cryptocurrency struggling to find clear direction as a weekend rally fizzled once the momentum ignition algos emerged. WTI crude futures tread water near $62.90 a barrel.

Top Headlines

- President Trump said there will be voter ID rules in the mid-term elections this year, whether Congress approves it or not, and they will present a legal argument in an Executive Order. Furthermore, Trump said he has searched the depths of legal arguments not yet articulated nor vetted on this subject, and they will be presenting an irrefutable one in the very near future.

- Iran says potential energy, mining and aircraft deals on table in talks with US: RTRS

- Pentagon threatened to cut its ties with Anthropic over the company’s insistence that some limitations are kept on how the military uses its AI models: RTRS

- UK eyes rapid ban on social media for under 16s, curbs to AI chatbots: RTRS

- Rampant AI Demand for Memory Is Fueling a Growing Chip Crisis: BBG

- Warner Bros. Weighs Reopening Sale Negotiations With Paramount: BBG

- Companies Are Replacing CEOs in Record Numbers—and They’re Getting Younger: WSJ

- Europe aims to rely less on US defence after Trump’s Greenland push: RTRS

- DOJ Tells Lawmakers Epstein File Redactions Complied With LawL BBG

- For College Applicants, Pressure to Make Summers Count Has Gotten Even Worse: WSJ

- Fed’s Goolsbee (2027 voter) said on Friday that they are still seeing pretty high services inflation, and he hopes they have seen the peak impact of tariffs, while he added that the job market has been steady, with only modest cooling.

- The Break Is Over. Companies Are Jacking Up Prices Again: WSJ

Trade/Tariffs

- USTR Greer said the US and Ecuador expect to sign a trade agreement in the coming weeks.

- China will waive import value-added taxes on selected seeds, genetic resources, and police dogs through to 2030 to increase agricultural competitiveness and breeding capacity. It was also reported that China will grant zero-tariff access to 53 African nations from May 1st, according to Bloomberg.

- Chinese Foreign Minister Wang Yi told his French and German counterparts that China and the EU are partners, not rivals, while he added that China and the EU should manage differences, deepen practical cooperation and work together on global challenges.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week in the green but with gains limited following a lack of major fresh catalysts from over the weekend and amid thinned conditions owing to holiday closures in the region and North America. ASX 200 traded marginally higher with upside led by tech, although gains are capped by underperformance in the utilities, mining, materials and resources sectors, while participants also digested a slew of earnings releases. Nikkei 225 traded indecisively with the index constrained by disappointing Japanese preliminary Q4 GDP data, which showed the economy returned to growth but failed to meet expectations with GDP Q/Q at 0.1% (exp. 0.4%), and annualised GDP at 0.2% (exp. 1.6%). Hang Seng finished higher in a shortened trading session on Chinese New Year’s Eve but with upside limited by tech weakness amid some confusion after the Pentagon added several companies including Baidu, Cosco, BYD, Huawei, Nio, SMIC, Tencent, and more to a list of Chinese firms aiding the military on Friday, but then withdrew the updated list shortly after it was posted. Furthermore, price action was also restricted by the closure of mainland markets and the absence of stock connect flows, which will remain shut for more than a week. US equity futures kept afloat in quiet trade amid the absence of drivers and participants. European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with losses of 0.4% on Friday.

Asian Headlines

- Chinese President Xi called for the anchoring of economic growth around domestic demand as its main driver, in a speech during a key policy meeting late last year that was released on Sunday.

- China is to establish a permanent financial support framework to promote rural revitalisation and prevent a slide back into poverty, which represents a shift from transitional aid to long-term support.

- China’s market regulator summoned major online platform companies on Friday, including Alibaba, Douyin and Meituan, while it directed them to comply with laws and regulations, and rein in promotional practices, according to Bloomberg.

- US Secretary of State Rubio and Japanese Foreign Minister Motegi reaffirmed their commitment to deepen bilateral ties.

- Disney (DIS) sent a ‘cease and desist’ letter to ByteDance over Seedance 2.0 and alleged that ByteDance has been infringing on its IP to train and develop an AI video generation model without compensation, according to Axios. It was later reported that ByteDance said it would curb its AI video app following Disney’s legal threats, according to the BBC.

- RBI tightened rules for loans provided to brokers and proprietary firms in an effort to reduce market speculation

FX

- DXY eked slight gains in rangebound trade after a lack of major catalysts and with US participants away on Monday.

- EUR/USD was little changed amid the absence of any major macro catalysts and with light newsflow from the bloc, while comments from ECB President Lagarde and news that the ECB is to make its repo backstop available to other central banks across the world, did little to spur price action.

- GBP/USD held on to most of Friday’s spoils but with price action contained by resistance around 1.3650 and following comments from BoE’s Mann that the UK economy is sluggish and tepid, with consumers spending less due to being scarred by high inflation.

- USD/JPY edged higher and returned to above the 153.00 level in the aftermath of the weaker-than-expected preliminary Q4 GDP data for Japan.

- Antipodeans were mixed with little fresh macro drivers and a lack of tier-1 data from either side of the Tasman.

Fixed Income

- 10yr UST futures traded little changed and held on to last week’s spoils after returning above the 113.00 level in the aftermath of the softer US inflation data, while price action was contained to start the week by the closure of US cash markets for Washington’s Birthday.

- Bund futures lacked demand in the absence of any major catalysts and with light newsflow from the bloc.

- 10yr JGB futures were marginally higher following disappointing preliminary GDP data for Q4, but with gains limited after failing to sustain a brief reclaim of the 132.00 level.

Commodities

- Crude futures were rangebound amid light energy-specific newsflow from over the weekend and after last Friday’s indecisive performance, where attention was on a source report that noted OPEC+ is leaning towards resuming oil output hikes from April, but with no decision made.

- Slovak PM Fico said he has information that the Druzhba pipeline has been fixed after damage in Ukraine, although he believes that supplies to Hungary and Slovakia have become a part of political blackmail.

- Spot gold took a breather after edging higher in the aftermath of the recent softer-than-expected US inflation data, with price action also contained by the holiday closures across Asia and North America.

- Copper futures were subdued, with their largest buyer away for more than a week due to the Chinese New Year/Spring Festival holiday.

- Texas venture-backed startup Hertha Metal vowed mass production of steel with 25% cost savings, which could reduce US reliance on imports.

Geopolitics: Middle East

- US military is preparing for potential operations against Iran that could last for weeks if US President Trump orders an attack and the US fully expects Iran to retaliate, according to sources cited by Reuters.

- US President Trump told Israeli PM Netanyahu during a meeting in December that he would support Israel striking Iran’s ballistic missile program if the US and Iran are not able to reach a deal, according to CBS.

- Iran confirmed that indirect talks between the US and Iran will resume in Geneva on Tuesday under the mediation of Oman, while Iranian Foreign Minister Araghchi left for Geneva on Sunday.

- Iranian diplomat said Iran is open to nuclear deal compromises if the US discusses lifting sanctions, while it was also reported that Iran said potential energy, mining and aircraft deals are on the table in talks with the US.

- Israel’s cabinet approved the proposal to register West Bank lands as ‘state property’, while Palestinians condemned the ‘de facto annexation’ which Peace Now said likely amounts to a ‘mega land grab’.

Geopolitics: Ukraine

- US President Trump said on Friday that Ukrainian President Zelensky is going to have to get moving and that Russia wants to get a deal.

- US Secretary of State Rubio said they don’t know if Russia is serious about finding an end to the war in Ukraine and will continue to test it, while it was reported that he met with Ukrainian President Zelensky on security and deepening defence and economic partnerships.

- Ukrainian drones targeted Russia’s Taman seaport and fuel tanks in the Black Sea region.

- UK and European allies were reported on Friday to be weighing seizing Russian shadow fleet ships and tightening curbs on Russia’s economy.

- French Foreign Minister Barrot said some G7 nations have expressed a willingness to proceed with a maritime services ban on Russian oil, which they hope to include in the 20th sanctions package that they are actively preparing.

Geopolitics: Other

- European Commission President von der Leyen said that they face the very distinct threat of outside forces trying to weaken their union, while she added that mutual defence is not an optional task for the European Union; it is an obligation within their own treaty, and it is their collective commitment to stand by each other in case of aggression.

- Pentagon said the US military struck an alleged drug cartel boat in the Caribbean, which killed three people.

DB’s Jim Reid concludes the overnigt wrap

I hope you all had a good weekend. To stay in Winter Olympics mood the family watched “Cool Runnings” last night. I haven’t seen it for 32 years. Please don’t tell anyone but I had a few tears in my eyes at the end. I blamed it on the hay fever that has now started.

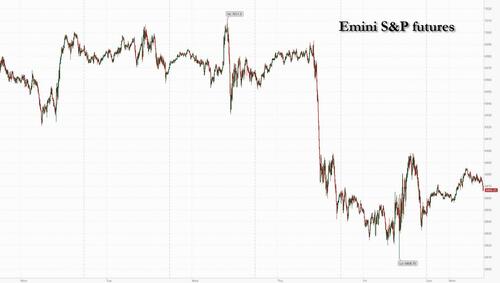

There will be a lot of tears out there in markets for other reasons at the moment. Just two weeks ago, the idea of AI-driven disruption still felt like an abstract, almost academic thought experiment—something we could safely revisit once we had clearer evidence of how AI would be deployed and integrated across the economy. Fast forward 14 days, and markets have wiped out well over a trillion dollars of global equity value on the fear that AI could fundamentally reshape business models and compress profitability across a wide range of industries, including software, legal services, IT consulting, wealth management, logistics, insurance, real estate brokerage and commercial real estate.

For months, my published view has been that nobody truly knows who the long term winners and losers of this extraordinary technology will be. Yet as recently as October, markets were implicitly pricing in a world where almost every tech company would come out a winner. Over recent weeks we’ve seen a more realistic differentiation emerge within tech—but that repricing is now rippling into the broader economy with surprising speed.

Some of the sell off in “old economy” sectors feels overdone to me. But as I argued in our 2026 World Outlook back in November, the real challenge is that even by the end of this year we still won’t have enough evidence to identify the structural winners and losers with confidence. That leaves plenty of room for investors’ imaginations—both optimistic and pessimistic—to run wild. As such big sentiment swings will continue to be the order of the day.

My instinct is that the reaction in things like commercial real estate, for example, has been particularly exaggerated. Markets seem to be extrapolating a scenario in which vast numbers of white collar workers are made redundant almost overnight, leading to a dramatic collapse in office demand. If that view turns out to be correct, we’ll be facing societal challenges far larger than anything currently being priced into equities. While trying to catch a falling knife may be too risky for many, beginning to cushion the descent could be sensible in many old economy sectors. Markets can’t sustain a disruption narrative across multiple sectors for months or quarters without concrete evidence — and that evidence is likely to take much longer to emerge. Fascinating times.

As for this week, today is a US holiday but inflation will remain in the spotlight at a global level after Friday’s slightly softer US CPI which helped contribute to a decent rates rally to end the week. Prints are due in the US (PCE – Friday), the UK (Wednesday), Canada (Tuesday) and Japan (Friday). Other economic highlights will include the FOMC minutes (Wednesday), Q4 GDP in the US (Friday), as well as the global flash PMIs (Friday). Earnings reports will feature Walmart (Thursday), Nestlé (Thursday) and BHP (today). It’s the earnings calm before next week’s Nvidia storm.

In the US, this holiday shortened week (President’s Day today) features a data calendar dominated by releases that were pushed back by last year’s government shutdown. The most consequential updates will land on Friday, when the advance estimate of Q4 GDP arrives alongside December’s personal income and consumption figures—key inputs for shaping expectations for the early part of this year.

Our economists expect real GDP growth to slow to 2.5% for Q4, a meaningful step down from the prior quarter’s 4.4% pace. A sizable portion of that deceleration—roughly 70bps—reflects the drag from the record long shutdown. Net trade is once again projected to make a strong positive contribution, driven mainly by subdued imports. December’s international trade report, due Thursday, will help refine the team’s call, as will the advanced goods trade data, which will also guide expectations for inventories—currently seen subtracting about 60bps from growth in Q4.

For markets assessing the underlying pulse of demand heading into 2026, private final sales to domestic purchasers (PFDP) will carry more weight than the headline GDP print. This indicator—closely monitored by Fed Chair Powell—is expected by our economists to slow to 2.0% from 2.9% in Q3, though risks appear tilted upward. One swing factor: Wednesday’s durable goods report, where modest gains outside of transportation could soften the deceleration. On the consumer front, real PCE growth is expected to cool to 2.5% after two quarters of outsized strength but should still signal ample momentum heading into the new year.

Friday’s income and spending report will also offer the latest reading on core PCE, the Fed’s preferred inflation gauge. Our economists expect another 0.4% monthly increase for December, lifting the year over year rate to 2.9%. Updated seasonal factors from last week’s CPI release suggest some mild downward pressure on inflation trends in the second half of 2025. Still, January’s CPI data, although softer than we anticipated, do not translate into equivalent relief for core PCE—in fact, our team currently sees another 0.4% gain for January’s release (delayed until March 13th). Depending on the strength of medical services, airfare, and portfolio management components in the upcoming PPI report, a 0.5% monthly rise cannot be ruled out, which would push the year over year rate toward 3.1%. So don’t get too excited about the softer CPI last week and the huge rates rally.

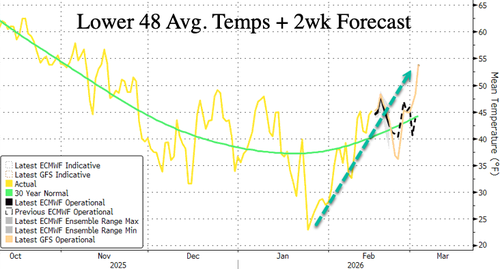

Additional releases this week will help clarify whether recent severe winter weather has disrupted factory sector activity. January industrial production, due Wednesday, should benefit from a jump in utility output, while weather effects may weigh on the Empire State Survey tomorrow and the Philadelphia Fed survey on Thursday.

Labor market data will also be in focus, particularly Thursday’s jobless claims, which line up with the survey week for the February employment report. As our economists have pointed out, private nonfarm job gains have averaged 103k over the past three months, slightly above the pace at this point in 2025 and matching the start of 2024. See their latest US employment chartbook here.

This week will also feature a dense lineup of Federal Reserve speakers which you can see alongside all the key global data in the day-by-day week ahead calendar at the end as usual.

Moving away from the US, inflation will also be in focus in Japan (Friday) and Canada (tomorrow). For the former, our Chief Japan Economist sees the January nationwide CPI showing a slowdown in both core CPI inflation ex. fresh food to 2.1% YoY (+2.4% in December) and core-core CPI inflation ex. fresh food and energy to 2.7% (+2.9%). Also important will be the global flash PMIs due on Friday as a health check on global growth. In Europe, the spotlight will be on UK inflation (Wednesday), with labour market data due tomorrow and retail sales on Friday. Our UK economist expects headline CPI inflation to drop to 3.0% YoY (3.4% in December) and core CPI also landing at 3.0% YoY (3.2% YoY). See more in his full preview here. In terms of key rate decisions, the RBNZ are expected to remain on hold on Wednesday.

In Asia this morning, things are relatively quiet with mainland Chinese and Korean markets closed for the Lunar New Year. The Hang Seng is up +0.52% while the Nikkei (+0.11%) is edging up after a lower start to its session. That came despite a decent downside miss on Japan’s Q4 GDP data overnight, which rose at an annualised pace of +0.2% versus expectations of +1.6%. S&P (+0.15%) and Nasdaq (+0.06%) futures are also a little higher on this US holiday session.

Finally, the Munich Security Conference wrapped up over the weekend, where key topics included Ukraine, Russia, and the fate of Greenland. And while US Secretary of State Marco Rubio’s speech was nothing like Vice President JD Vance’s at last year’s conference, which triggered a “wake-up” call for European leaders, Rubio reiterated the administration’s view that Europe needed to leave behind its focus on energy policies, trade and mass migration.

Recapping last week now, the tech volatility that has dogged markets since the start of the month broadened into a far more indiscriminate sell-off. The trough came on Thursday, marked by a sharp drop in software stocks, but the weakness extended well beyond tech. Companies across wealth management, real estate and financials suffered double digit declines, underscoring how widespread the pullback has become. Market breadth confirmed this shift as the equal weighted S&P 500 fell -1.37% on Thursday, though it managed to finish the week up +0.29% (+1.04% on Friday). Ultimately, the sell-off left the major US indices on the back foot: the S&P 500 slipped -1.39% (+0.05% on Friday), the Nasdaq lost -2.10% (-0.22% on Friday), and the Magnificent 7 slid -3.24% (-1.11% on Friday).

Although the AI scare dominated sentiment, a heavy slate of US data also shaped the market narrative. Early in the week, softer prints—including flat December retail sales, a dovish Q4 Employment Cost Index, and slower Q4 growth expectations from the Atlanta Fed—pushed Treasury yields lower across the curve. That picture shifted midweek after a stronger than expected January jobs report, which delivered the largest gain in nonfarm payrolls (+130k vs. +65k expected) since December 2024 and reinforced confidence that the US economy carried solid momentum into 2026. Then on Friday, January CPI came in below expectations, adding another dovish note. Although the data offered mixed signals at times, the overall takeaway was sufficiently dovish for traders to increase the number of expected rate cuts by December 2026 to 63.4bps (+7.7bps on the week). This helped drive the largest weekly drop in the 10 year Treasury yield since August 2025, down -15.8bps (-5.0bps on Friday) to 4.05%. The 2 year yield also moved sharply lower, falling -8.9bps to 3.41% (-4.8bps on Friday), its lowest level since 2022.

European markets, meanwhile, delivered a comparatively resilient performance. The STOXX 600 (+0.09%, -0.13% Friday), DAX (+0.78%, +0.25% Friday) and FTSE 100 (+0.74%, +0.42% Friday) all posted modest gains for the week. European sovereign bonds rallied as well, with the 10 year bund yield dropping -8.7bps—its steepest weekly decline since April 2025. That move was outpaced by gilts, which fell -9.8bps (-3.6bps on Friday) despite a sharp early week sell-off triggered by renewed questions surrounding Prime Minister Keir Starmer’s position.

Elsewhere, performance was mixed. Brent crude edged down -0.44% (+0.34% on Friday), while gold extended its upward run, rising +1.56% (+2.43% on Friday).

Will London’s half term week finally give us a quiet week in 2026? You’d probably have to guess at ‘unlikely’.