Submitted by Keirh Dicker of IceCap Asset Management, as excerpted from the May 2021 report: “Californication”

The Elephant in the Room

Since we now know the extreme monetary policy implemented by the Americans is actually less extreme when compared to the Japanese, the Europeans, the Chinese, the Canadians and others, then there must be something else happening to create all of this (nonsensical) drama about the US Dollar being on the verge of collapsing.

And this is where the reflation trade comes into play. Monetary theorists have always proclaimed that if you produce excessive stimulus via interest rate cuts, balance sheet expansion and especially when combined with excessive stimulus, then inflation is going to storm back with vengeance.

And since it has been over 40 years since inflation was a problem for the developed world, most have become either dismissive about the potential for inflation, or have simply become ignorant towards this monetary demon.

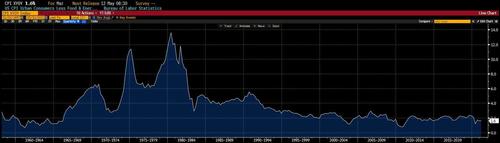

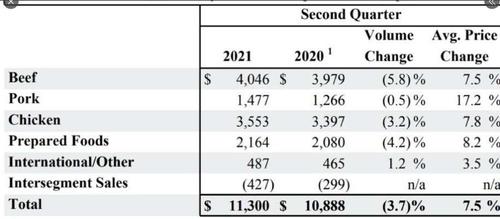

Here is the long-term showing core inflation in the USA.

Inflation isn’t everywhere.

It’s true how every picture tells a story, and this picture of American core inflation tells so many stories, that like many stories, they tend to become distorted over time.

For starters, economic purists will forever proclaim that inflation is a phenomenon created by monetary policies. In other words, if a central bank prints money or does other excessive things, then inflation is right around the corner. And since no one wants to run into anything around any corner – this must be bad.

Yet, a casual view of this US inflation chart clearly shows how from the late 1980s to present day, inflation has never been a challenge. And perhaps more importantly (or embarrassing for the inflation purists), inflation has not once jumped out from around any corner.

Absolutely there were times when inflation was maybe about to become a concern – but those concerns were quickly swished away, not by the magical, deep thinking, parlor smoking, cognac drinking central bank economists – but instead simply by the explosion of the global economy.

Yes, the great equalizer to any inflation concerns was globalization. The inclusion of increasing more emerging market economies into the manufacturing supply chains of the developed world did wonders for keeping prices lower.

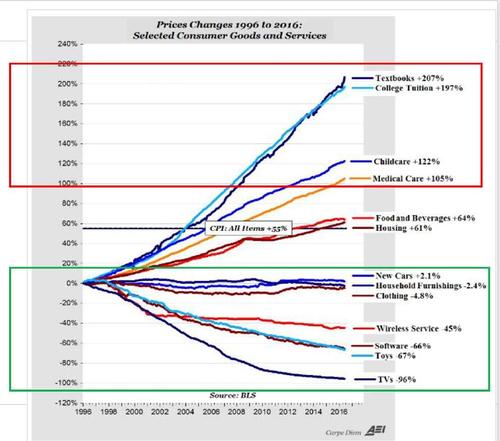

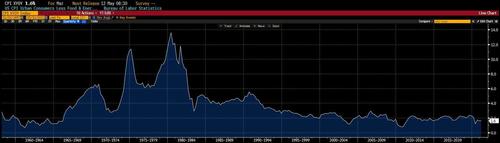

Have a gander at the chart next column.

Inflation can be complicated.

While the prices of some items have exploded upwards, the prices for other items haven’t budged. While some people dedicate their entire lives to studying inflation, and can support or refute any discussion about inflation – one incredibly important fact will always remain about inflation. The vast majority of people fall asleep at the mere mention of the word.

And since IceCap Global Outlooks are not in the business of putting people to sleep, we’ll cut straight to the chase.

To start with, and in our opinion, runaway inflation across the education and healthcare industries in the USA (and other countries) is a function of union powers for compensation and retirement packages across universities and colleges, and a function of the American approach to providing both private sector and public sector offerings across the healthcare sector.

Put another way – these two very large and vitally important economic services are structured to GENERATE strong inflation. Price increases in these sectors have little to do with low interest rates and quantitative easing. The remaining items in the chart clearly show a lack of inflation over time. While computer costs have mostly remained the same over the years, and this would be thought of as a positive contributor to inflation, the productivity powers within these computers have expanded exponentially. In other words, consumers are absolutely getting more bangs for their bucks.

This is also true for many other items within our shopping baskets.

At the same time, we are not oblivious to the obvious concerns with the exclusion of house prices from most inflation calculations.

For those who are not aware, the rapidly rising price of homes in your neighbourhood is excluded from inflation calculations.

Yes, you heard us right.

Economists have instead decided to use Owner Equivalent Rent (OER) as the factor to represent housing within inflation calculations. Let’s just say this metric kinda understates the true impact of housing on the average Joe’s wallet.

Another interesting inflation phenomenon is the central bankers’ keen focus on trying to foster an economy that produces inflation at an average annual rate of 2%. What we find so incredibly ironic about this 2% target is how it was calculated, or deemed to be appropriate. Despite extraordinary volumes of publications, millions of hours of lectures, armies of PhDs, and lifetimes of tobacco filled pipes and bourbon enjoyed near gentle simmering fires; the 2% target is simply a number magically created out of thin air.

The other interesting thing about our central bank power brokers, none of them can answer why inflation hasn’t been booming over the last 20 years.

Central banks have failed.

Since the 1999-2000 tech bubble burst, we’ve lived through nearly 15 out of 20 years with interest rates near 0%, while also having central banks implement quantitative easing.

Yet, during these same 20 years, core inflation has been greater than the magical 2% target rate a grand total of 3 years.

- Alan Greenspan failed.

- Ben Bernanke failed.

- Janet Yellen failed.

- Wim Duisenberg failed.

- Jean-Claude Trichet failed.

- Mario Draghi failed.

- David Dodge failed.

- Mark Carney failed (twice).

- Yasuo Matsushita failed.

- Masaru Hayami failed.

- Toshihiko Fukui failed.

- Masaaki Shirakawa failed.

- Sir Mervyn King failed.

- Mark Carney (again) failed.

Yes, all of these highly respected leaders of the central banks for USA, Japan, Eurozone, Canada, and Britain all failed to produce the 2% target rate of inflation. And just as these past central bankers failed with their primary objectives, it is highly likely their successors will also face an F on grading day.

The reason for our confidence is rather simple – in the eyes of these past (and now current) central bankers, the reason for this complete lack of monetary success was due to one thing – our central bankers simply didn’t cut enough rates or print enough money.

Yes, this is the point where Einstein would make a casual observation. In our minds, the IceCap observation is rather obvious – the reason inflation hasn’t soared to the moon is due to all of this central stimulus actually creating the opposite effect than what was intended.

Instead of historic stimulus resulting in companies and households going on historical spending and buying sprees, it has had the opposite effect – larger amounts of private capital has decided to not participate in the economy. The irony of central banks inability to generate inflation lies in their solutions to generate inflation.

For starters, central banks believe lower interest rates are good for everyone. Even suggesting otherwise will earn you scowls from those in charge. Yet, consistent and continuous low interest rates has absolutely massacred the risk-adverse saver’s ability to receive basic income levels to sustain their living standards.

Remember, there are two sides to every interest rate story.

One side is borrowing to either make a long-term investment, or to fund short-term needs – note that both actions are simply borrowing from future income streams.

Quantitative Easing explained.

The other side is receiving interest for lending to the borrower. For this individual, this represents cumulative past savings being used to fund current consumption. When these two sides are in equilibrium – it is adding value to the global economy. When these two sides are in disequilibrium – value is detracted from the global economy.

By stacking the interest rate deck in favor of borrowers over savers, central banks today have created a period of disequilibrium. In other words, it shouldn’t be a surprise that our economies and financial systems are acting in unusual ways. In addition to the zero % interest rates, there’s another elephant in the central bank room. And while most people are now aware of this large, slow moving and space eating animal, most do not understand just how destructive it has been on the global economy.

This elephant of course, is quantitative easing, or QE as the central banks like to say. In its very simple form, QE is an indirect attempt by central banks to suppress interest rates and keep them low everywhere for as long as possible. To achieve this non-capitalistic outcome, the following occurs:

- Government spends more than it collects in taxes

- Government must now borrow to make up the difference

- Government issues bonds which are bought immediately by the country’s largest commercial banks

- These large commercial banks, then immediately sell these very same bonds to the central bank.

This process achieves two immediate outcomes:

- Central banks are in effect (in)directly funding governments budget deficits (and debt rollovers)

- These central bank purchases are so large, that they influence the price of these bonds, as well as all other bonds in the world. The net effect is lower interest rates.

That’s not the whole story. There’s much more.

To start with, in order for central banks to “buy” government bonds from the commercial banks, it needs money.

Exactly where do they get this money? They simply create it out of thin air – they print it, using their keyboard. Now, this is the point where QE and money printing gets a bit confusing.

Many refer to them as being the same. This isn’t true, there is a difference. It is true the central bank “prints” money” out of thin air. Yet, it is untrue that this printed money is unleashed into the economy and intentionally create inflation.

Instead the following happens:

- Commercial bank buys new bonds from the government

- Central bank buys these same bonds from the commercial banks

- Central bank pays for these bonds by crediting the commercial banks’ RESERVE account at the central bank

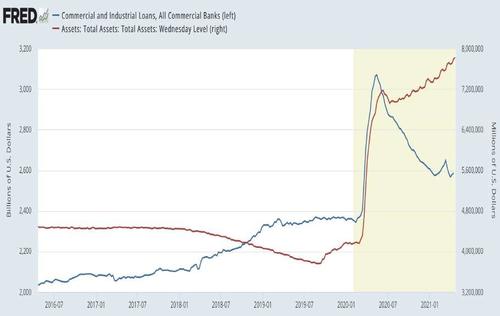

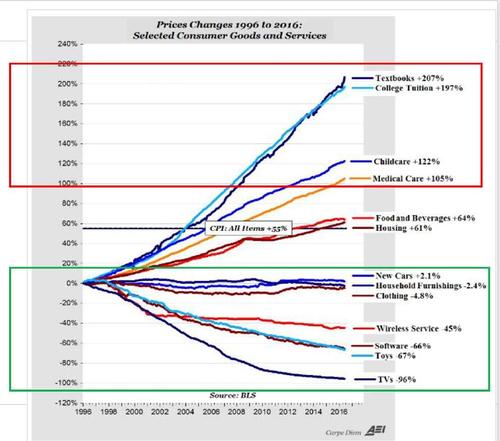

Credit Creation Remains Weak

Note that these new reserves cannot be withdrawn by the commercial bank. In effect, QE (or money printing) actually remains clogged in the banking system and can only be released by the commercial bank via new loans or credit creation.

It is this “clogged-up” portion of the entire QE process that makes us question whether the surging inflation story is really occurring due to QE.

If QE was working as intended, bank loans should be surging in line with QE. Instead, the opposite is happening. Of course, if QE is not being directly injected into the economy – what else is the reason for surging prices across housing, commodity and stock markets?

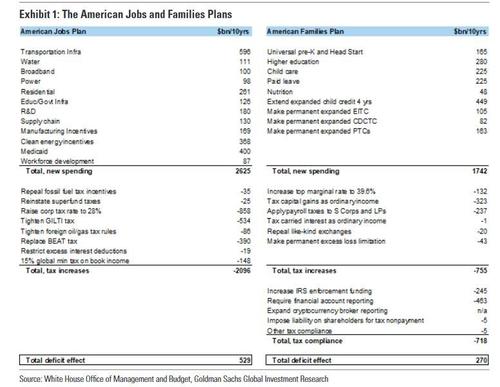

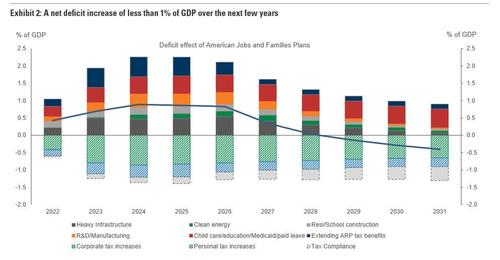

To begin with, one needs to look at the other side of the Keynesian Economic Theory gambit. By this of course, we are referring to the fiscal stimulus, or “stimmy” as it is now so un-eloquently known.

Yes, seemingly everyone around the world has either directly or indirectly received their stimmy from the government.

Initially, these checks were intended to act as income replacements due to the pandemic shutdowns. Yet, today it is now widely known that stimmy checks are actually for amounts greater than what people were receiving as wages for pre-pandemic work.

As a result, many stimmy checks have been spent (or invested) on housing, renovations, DoorDash food, stock markets and crypto currencies.

Supply chains have been greatly affected by pandemic shutdowns.

Make no mistake, this fiscal flood has been the driver of the rapid recovery. At the same time, pandemic shutdowns have also had the effect of stopping manufacturing and production of many items and goods needed for a normal economic cycle.

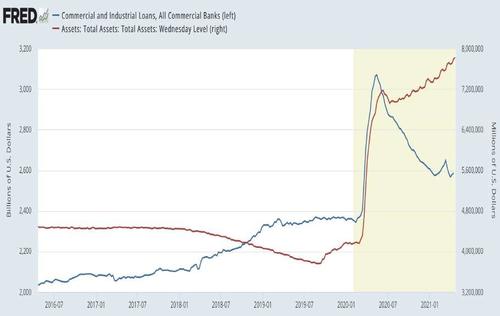

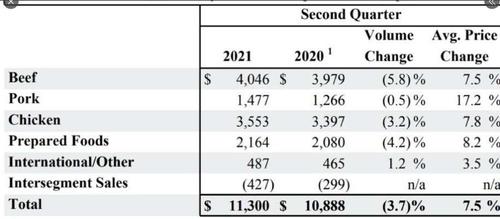

Here’s an example of price increases resulting from supply constraints. This table from Tyson Foods shows significant price increases, yet volumes are down across the board.

When the shutdowns are combined with the stimmy checks, the final outcome is lower supplies smacking directly into higher demand for goods and services. The result is increasing inflation.

The question of course is whether this is a temporary or permanent increase in inflation.

Currently, practically every investment house and market pundit is warning that inflation is about to sustain itself, not inline with the 1970s experience, but rather inline with the German Weimar experience from the 1920s.

And they claim it is all because of the US Federal Reserve printing money.

As markets always move in extremes, the question to ask is “what happens if higher or hyper inflation isn’t around the corner?”

The answer “a sharp reversal of the reflation trade.” Of course, another way to quickly offset all this talk and forecasts of inflation is a quick and sustained correction in equity markets.

A 20% decline would very quickly take the oomph out of the inflation expectations game. Any sudden loss in paper wealth can very quickly change all of those house purchases, renovations, and big ticket purchases.

The point we make is whenever the vast majority of the market is in agreement with any market movement, theme or future expected event – the probability of an unexpected event can very quickly create a scene where everyone is suddenly running towards the other side of the boat.

The story of the year

We acknowledge this whole inflation story is a bit unusual for many investors, yet it is absolutely THE story facing markets today. Let’s finish by squaring the inflation peg and how we believe this story will play out:

- central bank monetary policy is not creating inflation.

- Fiscal policy and especially stimmies, is creating inflation.

- Global shutdowns during 2020 April May June created disinflation and these data points will cause a base effect producing higher year over year inflation for these same months in 2021.

- Shutdowns and other pandemic responses has created supply disruptions. Unless these disruptions turn permanent, these effects will wane as supply comes back online.

- Any severe (-20% or more) equity market correction will have a negative wealth effect and will also reduce inflation expectations.

- Longer term Inflation will likely be driven by commodity prices and supply effects driven by non-pandemic factors.

Imagine a year ago, you were told there would be a pandemic so severe that the entire global economy would be completely shuttered for several months, and then not returning to normal capacity 12 months later. Also imagine, you were told that the social and political reaction to the pandemic was so severe that all travel for business, vacations and education would be effectively halted. As well, imagine you were told that all central banks reduced interest rates to 0% or negative %, printed unlimited amounts of money (quantitative easing) and bailed out federal, state, and provincial governments. And finally, take a few minutes to imagine you were told that governments would mandate temporary deferment of debt, rental and lease payments, while also paying workers who lost their jobs and businesses who closed their doors.

Considering the above, imagine you were then asked how would financial markets perform 1 full year out.

Most objective people would disbelieve how a pandemic could have this effect on the world. And these same objective people would believe global financial markets would be a rather unpleasant experience.

Instead, we have the opposite.

We have a non-financial world where many of the day-day changes in our lifestyles are slowly becoming the new (and expected) norm.

In addition, we have a financial-world where practically every market has gone parabolic.

Whereas many people refer to the year 2020 as the year from hell, 2021 may eventually be referred to as the year from disbelief. Maybe Dionysus, the Red Hot Chilli Peppers and Hank Moody actually did infiltrate our global economic and financial systems. Or maybe, we are all simply experiencing a cognitive dissonance.

More in the full May 2021 note below