Estimating The Shape Of The Coming Crisis

Authored by Alasdair Macleod via GoldMoney.com,

We don’t know what will trigger the crisis, but a likely candidate is foreign selling of US dollars combining with a collapse in the US government’s finances. Perhaps the coronavirus will turn out to be a catalyzing black swan event, but the underlying conditions for an economic and monetary crisis already exist.

This article looks at alternative outcomes. It concludes that the current situation bears a worrying resemblance to the collapse of John Law’s Mississippi scheme exactly 300 years ago. The key to understanding why this is so is because of the link forged between asset prices and fiat currencies. One fails, and they both fail, more rapidly than the most bearish bear might expect.

Introduction

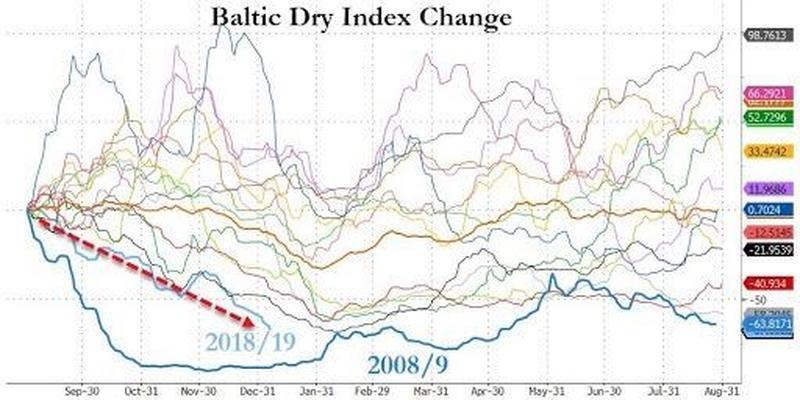

Ahead of a financial event it is a matter for educated guesswork to anticipate its course. In the last few weeks increasing signs of a global recession have been observed, telling us that the credit cycle is on the turn and a systemic crisis is due shortly. Adding to our woes, the coronavirus might turn out to be a plague of biblical proportions, at least that is the way the hype is going. If so, the economic damage will be immense.

A prescient analyst might deduce that one of the following outcomes is therefore likely:

1) The playbook outcome. A few banks get into trouble and are successfully rescued. Bankers become cautious in their lending and seek to withdraw loan facilities from riskier customers. A moderate recession ensues, unemployment rises, the inflation rate declines, and central banks respond by easing monetary policy. In time, the economy steadies and begins to recover. This is the neo-Keynesian expectation of economists and monetary planners employed by central banks, their government masters and the version currently believed in financial markets.

2) A systemic breakdown. In this version, banking problems are just the start of it. After the first few banks collapse and are rescued, banking problems appear elsewhere, and it is clear the global economy is in deep trouble. In the authorities’ attempts to keep control over the situation, the expansion of base money is on a far larger scale than that witnessed following the Lehman crisis, both to fund burgeoning government deficits and to build bank reserves. After a protracted period of time, the global economy stabilises, and the immediate threat is over, at some cost to the credibility and purchasing power of currencies. A currency reset might be used in an attempt to stabilise the situation.

3) A total collapse. A systemic breakdown leads initially to lower interest rates (already in progress), and after a brief pause to a vicious bond bear market, undermining financial asset values upon which the whole fiat money edifice is based. The unbacked nature of modern fiat money then comes into play, the principal consideration being that the collapse in bank collateral values exposes the illiquidity and bankruptcy of businesses and individuals alike. Tax income evaporates, along with all credibility in the government’s unbacked money, which eventually becomes worthless.

In an attempt to divine the most likely outcome we must assess the importance of the moving parts and their likely sequencing.

Cyclical considerations

It is a mistake to regard the ending of the current credit cycle in isolation from previous cycles. In the distant past, it was valid to view the expansion of bank credit and its subsequent contraction as a purely cyclical phenomenon whereby excessive expansion is broadly wiped out by the subsequent contraction. But ever since President Hoover’s tenure, successive American governments and their central banks have attempted to contain the effects of bank credit contraction. Consequently, failures have been increasingly institutionalised.

The piling up of failures has required further evils to maintain them. Governments have taken increasing control over free markets. Regulation has severely restricted competition in all but the newest of industries, which in turn become regulated over time. Consumers have been encouraged to spend their savings and go into debt to increase immediate consumption. Trade barriers, rightly seen as contributing to the 1930s depression, have been preserved and protectionism is now weaponised.

Budget deficits, being twinned with trade deficits in savings-free economies, have also been increasing, notably for America under President Trump. The American government is in a debt trap only alleviated by the Fed’s forced suppression of borrowing costs. Increasingly, government funding is by overtly inflationary means.

The evidence and consequences of inflationary financing have been hidden from the general public because statistics, particularly price inflation estimates, have been suppressed. This has allowed governments to fund themselves by expanding money quantities without apparent consequences for the general level of prices, and at the same time to give the illusion that real GDP is positive when properly adjusted for price inflation it would be negative.

With successive cycles not being permitted to clear bad and unproductive debt, the dollar has gone from $20.77 per ounce since President Hoover’s time to nearly $1600 today. Relative to gold, that is a loss of purchasing power for the US dollar of nearly 99% over the whole epoch of non-clearing credit cycles. With increasing quantities of non-productive debt in the global economy, it is plainly naïve to think it is a process that will continue indefinitely, when the odds favouring a grand crisis, undermining the whole fiat money system, are increasing over time.

Diligent students of history will have recognised that economic and monetary systems under the control of governments have always failed, eventually. There is no reason why this one will be different; the question is not if, but when.

Monetary debasement

At the core of the government illusion of control is money. Over successive credit cycles its expansion has reflected a ratchet effect, with an underlying rate of expansion being supplemented by alternate expansions and contractions of bank credit. That was the case before the Lehman crisis. At that time the rescue of the banking system involved an unprecedented expansion of the money supply. Last year, the Fed’s attempt at reducing its balance sheet was hastily abandoned when it became clear that all the post-Lehman liquidity had simply vanished.

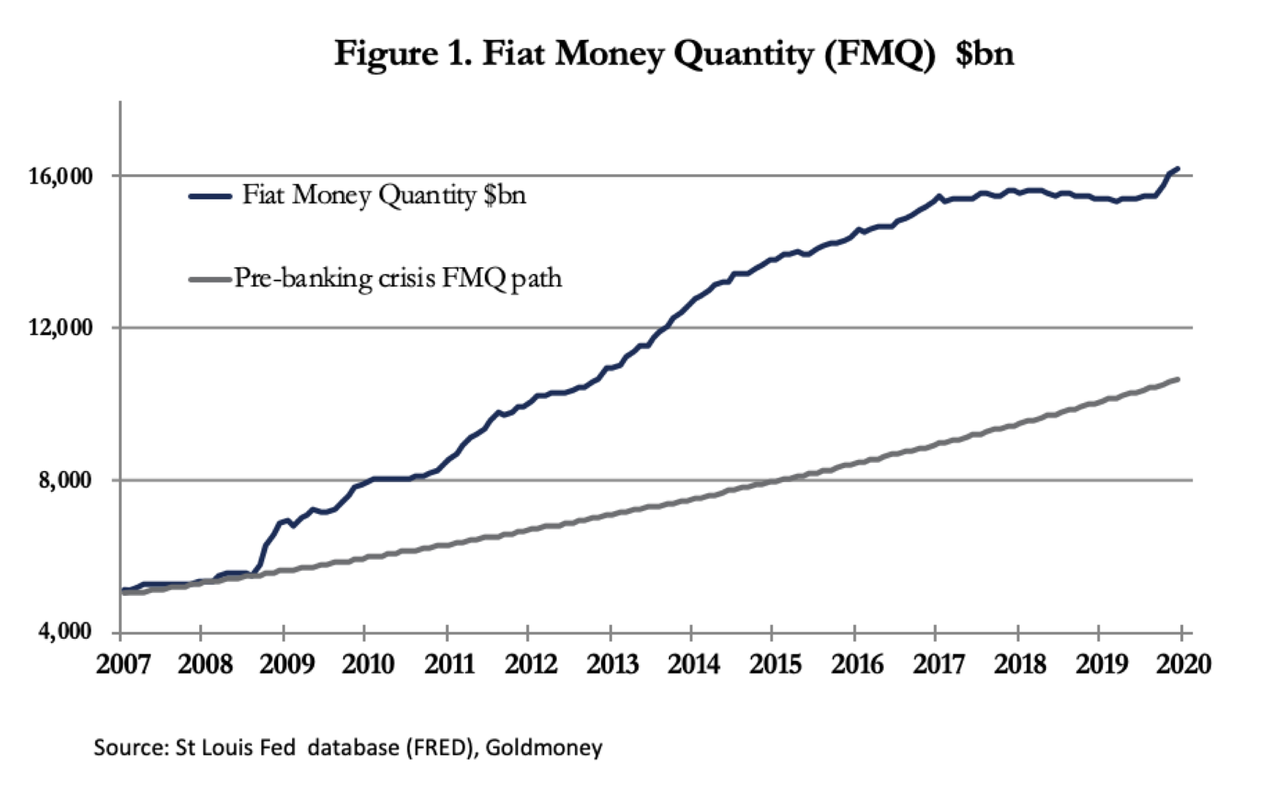

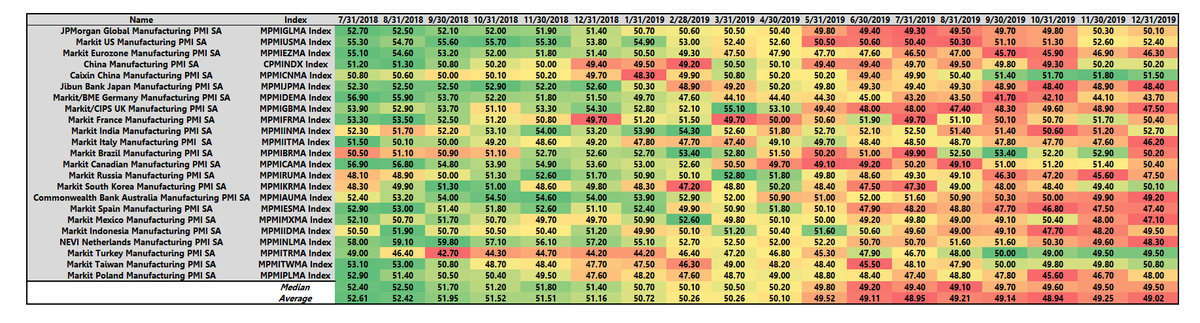

The fifty-year history of the money quantity is illustrated in Figure 1, which is of the fiat money quantity, a measure that includes bank reserves not in public circulation but is fiat money nonetheless.

The pre-banking crisis FMQ path had been growing at a long-term average rate of 5.9%, while the average rate of growth subsequent to it has been 9.6%. Despite the extra $5.6 trillion of money in the system arising from this divergence, there are signs of severe liquidity stresses with the Fed having to inject tens of billions of dollars daily into the banking system through repo operations. This is reflected in the sharp upturn in FMQ in recent months, visible in the chart.

It should be noted that before Lehman failed, FMQ was roughly one third of GDP; today it is three-quarters. There is therefore a substantial quantity of money in the US economy surplus to normal requirements, a factor which might be crucial to the dollar’s future.

That notwithstanding, the pressure is now on for a further increase in the acceleration of money creation, with growth in FMQ likely to rise well above 10% annualised. Instead of demands for money from the productive private sector, it has been the US Government and financial speculators who have demanded excess money in recent years. The government deficit is now officially expected to increase to over a trillion dollars while according to US Treasury TIC data foreigners appear to be losing their appetite for buying more US Treasuries.

The drain on wholesale liquidity imposed by the government’s financing demands now combine with demands on liquidity from very large hedge funds. They have provided artificial support for the dollar by gearing up their interest rate arbitrage positions, whereby they are short of euros and yen with their negative rates, and long of the dollar and short-term US government Treasury bills and bonds to capture yield differentials.

It is therefore becoming apparent that without further monetary expansion interest rates and government bond yields will rise, with devastating consequences for the US Government’s finances. The hedge funds would be forced by the banks to unwind their positions, selling dollars and buying euros and yen, for lack of available balance sheet reserves. Limited by Basel III rules, the shortage of dollar liquidity would drive up overnight interest rates at a time when the Federal Reserve Board would wish to reflate the economy.

Consequently, sub-10% annualised growth in broad money is no longer tenable, without triggering a widespread government funding and financial crisis. We now stand on the edge of an acceleration of monetary inflation, leading in time to a significant fall in the dollar’s purchasing power, measured not against other currencies facing similar difficulties, but against commodities and ultimately consumer goods and services.

Financial asset values

Central to how a financial crisis develops is the progression of asset values. Since the development of the Greenspan put in the 1980s, it has been assumed that the Fed would always put a floor under equity markets by lowering interest rates sufficiently to do so. Starting with the containment of the 1987 stock market crash, increasing numbers of methods have been deployed, including interest rate manipulation, open market operations, and quantitative easing. Changing the level of required reserves for commercial banks has also been an important monetary tool but is no longer an option due to overriding Basel III regulations for global systemically important banks. This is why the Fed removed the distinction between required and excess reserves a few years ago.

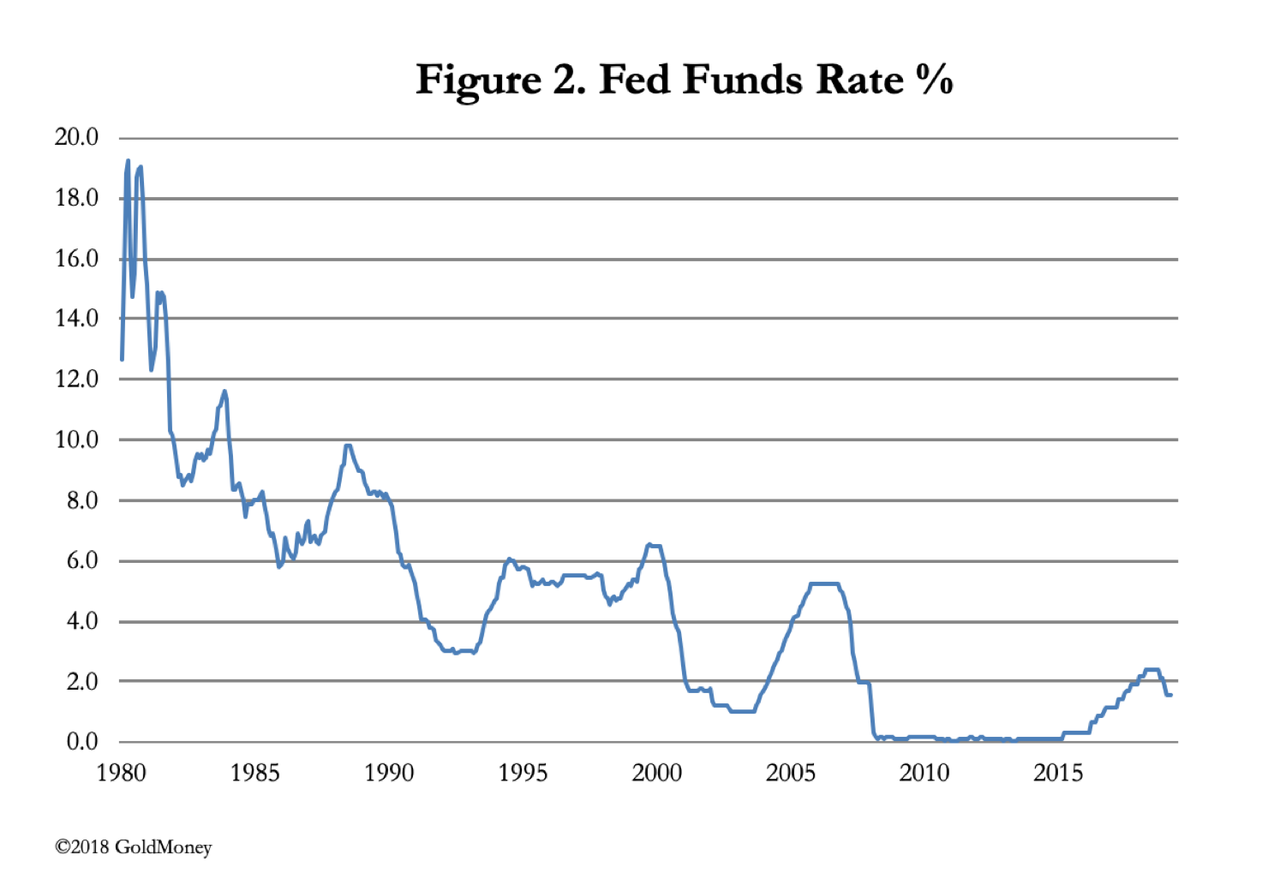

The principal method of monetary and asset price control remains reducing interest rates, and through them bond yields, thereby increasing the relative attraction of equities. But with the zero bound there is a theoretical limit to reducing interest rates, and dollar rates are already close to it as shown in Figure 2.

With the Fed Funds Rate under two per cent and the market already beginning to discount further declines, interest rate policy is unlikely to be sufficient to underwrite asset values in the next systemic and financial crisis. For this reason, many commentators think that negative rates for the dollar are increasingly likely.

That would not necessarily help stabilise the US economy, as evidence from the Eurozone’s ECB attests. Furthermore, by putting all commodities into permanent backwardation, not only would the purchasing power of the dollar be badly undermined, but so would those of the fiat currencies that take their cue from the dollar. As a matter of fact, even current Fed Funds Rates fully discount a general time preference for goods, meaning that interest rates are at zero in real terms, or even negative already. The only piece of the monetary puzzle missing is an appreciation by complacent investors of how close markets are to a currency cliff-edge.

Understanding how and why markets are on the brink of a significant erosion in the dollar’s purchasing power is crucial, because it defines the limit of how low interest rates can be pushed without triggering an immediate monetary crisis. We already know that current levels of interest rate suppression require the effect on prices to be suppressed by statistical method. Tip the relationship between fiat dollars and commodities just a little further, and the result will almost certainly become catastrophic for the dollar and all other currencies that sail with her.

If the dollar suffers this fate, then an initial dip in interest rates will be followed by a significant rise, forced on a reluctant Fed by global markets refusing to fund the US deficit and choosing to liquidate their dollar positions instead.

It would therefore appear that there are two opposing forces for investors in financial assets to consider. Currently there is a bullish hope that the current economic deterioration can be contained and an ongoing reduction in interest rates will help preserve asset values. Against that there is the threat of Fed policy failing to improve economic prospects, leading to US Treasury yields rising as markets become aware that budget deficits are spiralling out of control, to be financed entirely by monetary expansion. Muddying the waters is direct and indirect statist purchasing of equities by central banks and sovereign wealth funds, effectively binding financial assets more tightly to fiat currencies.

How the road ends

From the foregoing it should be clear that not only is there a financial and systemic crisis in the wings, but it cannot be resolved by central banks using the tools available to them. We can easily deduce that there will be the usual end of credit cycle systemic and financial problems, likely to involve the rescue of one or more major banks. Furthermore, the monetary debasement by central banks will be significantly greater than that following the Lehman crisis, not only because the scale of the banking problem is likely to involve far larger numbers, but because of the impossible position the US government finds itself in with respect to its own finances.

The cliché following the Lehman crisis was kicking the can down the road. The end of that road is no longer over the hill or around a bend but is coming into view. That being the case, we can rule out the first of the three options in the introduction to this article, the playbook outcome. That leaves either a wider systemic breakdown or a total collapse. The difference between them will require success in stemming the former from evolving into the latter.

There can be little doubt a wider systemic breakdown will lead to a fall in the purchasing powers of fiat currencies which will be impossible to conceal by statistical method. At this juncture, a political leader with a true understanding of the situation and how to resolve it will have the opportunity to do so, because the alternative to not doing so will be far worse and obvious to the wider public. But such a leader must have guts and be surrounded by others willing to take his lead. It will require the abandonment of socialising money and markets, denying responsibility for future welfare in all but the most needy cases, and a return to sound money. While things can change, there does not appear to be a ghost of a chance that such a leader exists and that he or she would be able to carry his or her colleagues.

This leaves us with the last possible outcome, a total collapse of the neo-Keynesian paradigm and its principal tool, the fiat currency.

The likely sequencing is as follows. After an initial easing of interest rates and fall in government bond yields, which is already under way, it becomes clear that the economy is in a far worse condition than previously thought, the productive sector and those employed in it having been impoverished of their income and savings through monetary inflation.

Economic recovery becomes wishful thinking, followed by a realisation that government finances are deteriorating rapidly. With savers gone and consumers maxed out, the only means of financing budget deficits is by inflationary means. The currency begins its decline in either of two ways: foreigners sell it and refuse to help finance the budget deficit, or domestic depositors decide to reduce their cash in their bank accounts and buy goods instead. In the latter case, the damage comes from the public dumping of the currency, the effects of which heavily outweigh the apparent increase in demand from the rush out of money.

If the government is lucky, its people continue to use the currency as money, despite its purchasing power continuing to decline. Even at ten times its current rate of issue seigniorage still gives the government some income. Attempts to stabilise the currency, such as by introducing price controls, only make things worse. These are the conditions that have allowed certain Latin American countries to suffer high inflation rates for prolonged periods.

Alternatively, the currency is driven towards worthlessness. We shall dismiss a comparison with Venezuela or Zimbabwe, where corruption has been a major factor. The German experience after the First World War is a better model, when inflationary financing of government spending commenced before the war and led to the final collapse of the currency in November 1923. This suggests that a final collapse reflected in the destruction of a fiat currencies will take several years to evolve. But there are differences between the European hyperinflations of nearly a hundred years ago and the situation today.

In America and Britain as well as in some Eurozone countries, the majority of bank deposits are not owed to individuals, because consumer credit predominates. With eighty per cent of employees in these countries typically living from paycheck to paycheck and credit card borrowing being the norm, there is a greater weighting of institutional deposits in today’s banking system than in the past. In the case of the US dollar, total checking and savings accounts of $12.15 trillion includes about $4 trillion of foreign-owned deposits through correspondent banks. Credit card issuers and other finance companies accumulate significant cash flows, and therefore deposits. Financial speculators, such as hedge funds in the interest arbitrage business also maintain significant balances as repo collateral.

In short, deposit holder classifications are very different from those of yesteryear, so their collective attitude to money is likely to be very different. They are not in the business of spending it on goods and do not make relative value judgements in this basic sense. They are more likely to be spooked by purely financial developments. It leads us on to consider another possibility, a John Law bubble deflation and currency collapse as the model to examine.

Law’s financing model

John Law was a prototype Keynesian, who in 1716 obtained permission from the Duc d’Orléans, acting as Regent for Louis XV in his minority, to establish the Banque Genérale in Paris’s Place de Vendome as a private bank, capitalised with discredited state debt as a basis for issuing banknotes. He took in deposits of specie, mostly gold and silver coins. By September 1716 the bank had become so successful that it was driving other bankers out of business.

The relationship between the Regent and Law was based on Law’s plan to restore royal finances which were in considerable difficulties. Put crudely, his plan was to profit from the inflation of his own notes in order to pay down the royal debts. Furthermore, by introducing modern banking into a financially backward France, the improvement in the economy from more effective monetary circulation in the form of his notes compared with clumsy coinage would also help restore the royal finances through higher tax revenues.

The use of Law’s banknotes to settle taxes ensured their circulation, and specie continued to be deposited at Banque Royale in exchange for them. In accordance with Law’s plans, Banque Genérale’s balance sheet was rapidly inflating and beginning to dominate financial affairs in Paris. Law took in more discredited state debt which promised to pay a doubtful 4%, substituting it for his own notes, paying an apparently more certain 4% and including a bonus kicker of claims on Louisiana and the Canadian fur trade in France’s American colonies.

Law’s use of discredited state debt as the foundation for his affairs had similarities with the basic functioning of today’s central banks, issuing money through quantitative easing for government debt. And it came to pass that in December 1718 Banque Generale became Banque Royale, evolving from a private bank into the state’s bank. Law now had a monopoly on France’s money.

Concurrently, Law had acquired all the rights to trade with France’s American colonies, which became the Mississippi venture. He capitalised it by the use of partly paid subscriptions which by giving quick and substantial profits to early subscribers ensured the Mississippi shares got off to a strong start, and he further used the Banque Royale’s note issues to boost share prices even further.

And so a bubble was born. But by late-1719 Law found it increasingly difficult to sustain the bubble. The best part of a billion livres had been created and spent in ramping the Mississippi shares. Following his appointment as Controller-General in 1720, he decreed that his banknotes were to be the only permitted currency except for small transactions and all old coins were to be handed in or seized. Clearly, he was plugging holes in an increasingly leaky vessel.

On 22 February 1720, the Mississippi Company and the Banque Royale merged. The King sold 100,000 shares at 9,000 livres, and the shares of the merged entities subsequently began to sink. By November that year they had fallen to 3,200 livres and many of them faced further unpaid calls. In the last three months of 1720, there was no sterling price for French livres, because Law’s notes had also collapsed in value along with the Mississippi bubble.

Today’s similarities with the Mississippi bubble

There are important similarities developing today with the events in France almost exactly three hundred years ago, the salient points being:

-

Law implemented a similar inflation scheme to that proposed by Keynes. Both had an initially favourable economic impact, followed by a failure to sustain earlier promises. Having progressed through a number of credit cycles, Keynes’s scheme is yet to fully collapse.

-

Law used state debt as the foundation for his scheme, as do today’s central banks. The difference is the public knew Louis XV to be bankrupt. Today, markets are yet to realise this fact about modern welfare-driven economies.

-

Supported by the state, Law used the powers given to him to manipulate asset values to support his scheme, an objective now openly pursued by modern central banks and their allied sovereign wealth funds.

-

In Banque Royale Law established a prototype central bank whose twin objectives were to finance government borrowing and to issue currency. The support offered to today’s commercial banking system by central banks is ultimately intended to achieve the same end.

-

Law banished the circulation of specie as money and any other alternatives to his own banknotes. Today’s central banks exercise exactly the same monopolies in their respective jurisdictions.

-

Law was an early user of derivatives in the form of partly paid stock and options to promote and sustain asset values. The global financial system today similarly uses derivatives to support and encourage bullish speculation in financial assets.

-

By linking rising financial asset values to the purchasing power of his livre, Law ensured that the collapse of financial asset values undermined faith in the currency as well, causing it to collapse entirely in a short six-month period. Today, both central banks and sovereign wealth funds are active investors in bonds and equities, with the effect of creating a similar linkage across government bonds, equities and fiat currencies.

Given different times and different methods, there are dissimilarities between Law’s scheme and the way those of Keynes are playing out. But it is the similarities which should ring alarm bells. Critics of inflationary financing generally assume the end of a fiat currency is marked by the general public eventually discarding it. The similarities between Keynes’s and Law’s schemes suggest a different outcome.

By tying in financial asset values to currencies, if one fails the other will too. A loss of confidence in one immediately undermines the other. The sequencing is that a failure to sustain bond and equity prices occurs first, followed by their collapse, closely accompanied by the erosion of all faith in the currency.

With this framework we can propose a future for both financial markets and the dollar. The Fed in a similar role to Banque Royale continues with its attempts to manipulate US Treasury bond prices higher, and therefore equity markets, as has been the situation the case since the Greenspan put. In February 1720, the King sold 100,000 shares for 9,000 livres each, netting 900,000,000 livres. It marked the top of Law’s bubble. The question is who or what will ring the bell this time.

Today, we cannot see who outside the US banking system is going to buy ever-larger quantities of US Treasury stock, because foreigners are stalling in their appetite and domestic savers hardly exist. We should bear in mind ownership of foreign currencies is justified by trade volumes, and evidence of declining international trade firmly points to the dollar being sold. Consequently, the banks acting as agents for the Fed are going to be the only buyers, being paid by the Fed through crediting their reserves.

At the last count foreigners and their governments owned $19.4 trillion in US securities and had about $4 trillion in bank deposits. The bubble will surely burst when the dollar begins to decline against other currencies, creating doubled losses for foreign investors and a funding crisis for US government debt. With US Treasury bond yields then rising the dollar seems certain to accelerate its decline due to mounting portfolio losses faced by foreign investors.

That, perhaps, is where the similarity with the ending of Law’s scheme exists today: a combination of circumstances based on an official tie between financial assets and the fiat currency. Like the collapse of Law’s scheme, we can expect it to be measured in the soaring price of specie, physical gold and silver, and today perhaps decentralised issue-limited cryptocurrencies.

This being the case, the collapse will not be drawn out as even the most bearish bears expect but could be completed by the end of this year.

Tyler Durden

Fri, 01/31/2020 – 18:25

via ZeroHedge News https://ift.tt/2vGMU4n Tyler Durden