Submitted by David Stockman via Contra Corner blog,

The robo-machines and perma-bulls are at it again, delivering another volumeless dead-cat bounce in a market that has churned sideways for 600 days now.

That’s right. The S&P 500 first crossed the 2060 threshold around mid-November of 2014, and has made upwards of 40 attempts to rally since then—-all of which have failed to be sustained.

^SPX data by YCharts

Nevertheless, there is a reason for the churn and there is a culprit behind the abortive rallies.

As to the former, it’s all about the cycle peak. The profits cycle peaked six quarters ago when S&P 500 reported earnings came in at $106 per share for the LTM period ended in September 2014. For the LTM ending in March 2016, by contrast, reported earnings were $87 per share.

So profits are down by 18%, and even that has been flattered by upwards of $700 billion of share repurchases in the interim.

Likewise, almost every measure of the real business economy peaked at about that time, too. For instance, non-defense CapEx orders are down 12% since September 2014, rail and trucking shipments are off by 21% and 6%, respectively, and export shipments are down by 13%.

But the most comprehensive measures of economic activity—total business sales and the inventory/sales ratio—– tell the real story. Total sales are down by nearly 5% from their August 2014 peak, and the inventory sales ratio has climbed steadily higher into what historically has been the recession zone.

Moreover, not only is the current 84 month-long simulacrum of a domestic business cycle expansion coming to an end, but so is the global super-cycle.

We are referring here to the unprecedented central bank fueled credit boom of the past two decades, which elevated the world’s debt mountain from $40 trillion to $225 trillion. Not only has that become a tremendous burden on current activity, but it also caused a massive spree of wasteful, inefficient capital spending and infrastructure building which can’t be sustained and which will eventually generate staggering losses of real capital.

The heart of this super-cycle, of course, was China’s Red Ponzi and the monumental digging, building, investing, borrowing and speculating campaign that was unleashed by the People’s Printing Press of China after 1994. But the incendiary hot house economy which resulted is now pinned under $30 trillion of unserviceable debt and the greatest eruption of malinvestment, excess capacity and sheer investment waste in recorded economic history (the Pharaohs perhaps wasted more building the Pyramids).

It was all fueled by endless state supplied credit and a build it and they will come predicate. As noted in a nearby post, for example, it appears that China even built massive wind farms on that predicate. But, alas, the winds didn’t come.

In short, the world economy is fundamentally changing gears. A two-decade long credit-fueled crack-up boom which was centered in China and which cascaded throughout its EM supply chain and its DM base of capital equipment and luxury goods suppliers, such as Germany and the US, is coming to an end. We are now entering the crack-up phase and a long twilight era of deflation, liquidation, stagnation and payback.

So the stock market desperately needs to correct and correct deeply. Today’s closing valuation at 23.8X earnings is just plain ludicrous—given that corporate profits are falling sharply and have no prospect of recovering as far as the eye can see. Even 15X or 1300 on the S&P 500 would be a sporty valuation in a world heading into the economic dumpster.

And that gets us to the culprit—-the ship of fools domiciled in the Eccles Building. The stock market and other risk asset markets cannot correct because honest price discovery has essentially been destroyed by what amounts to wealth effects central banking.

That is, under conditions of Peak Debt interest rate repression and massive expansion of central bank credit are pointless relative to the main street economy. That’s because the historical credit channel of monetary policy transmission is broken and done.

Other than mobilizing the last auto buyer that can fog a rearview mirror and the last young person who can scratch a signature on a student loan, cheap interest rates have done nothing to stimulate the old Keynesian “borrow and spend” gambit among 90% of the US households. The latter are either not credit worthy or have already borrowed up to the limits of their stagnant real incomes.

At the same time, the business channel of cheap credit transmission—-the cycling of borrowed funds into enhanced fixed asset investment—-has been even more badly impaired. The speculative financial market casino enabled by the Fed has turned America’s corporate C-suites into stock trading rooms and business strategy into an endless exercise in financial engineering.

Accordingly, even though non-financial business debt has risen from $11 trillion on eve of the great financial crisis to $13.5 trillion today, the entirety of that gain has been recycled into the inflation of secondary markets for existing assets, not primary investments in plant, equipment, technology and other avenues of capital enabled real investment.

In short, the Fed’s massive monetary stimulus has never really left the canyons of Wall Street. It has not rejuvenated and reflated the main street economy, but only inflated an even more gargantuan financial bubble than the two earlier busted bubbles of this century.

This week’s update of the tepid 1.1% “growth” of Q1 real GDP provides one more example of how monetary “stimulus” has been reduced to financial asset inflation and wealth effects manipulation of the money and capital markets.

On its third revision, the BEA concluded that real GDP grew by $44 billion, but that Healthcare was responsible for $26 billion or 58.4% of total.

Stated differently, aside from the nation’s massively bloated and supremely inefficient health care sector—-a condition made decidedly worse by Obamacare—-real GDP grew by just 0.47% during the first quarter. That’s close enough to zero for even the paint-by-the-numbers hairsplitters at the Fed and among their megaphones in the financial press.

The point is this. How can anyone in their right mind think that 90 months of ZIRP or $3.5 trillion of government debt monetization has anything at all to do with the one sector of the US economy that has generated a vastly disproportionate share of the nation’s meager growth?

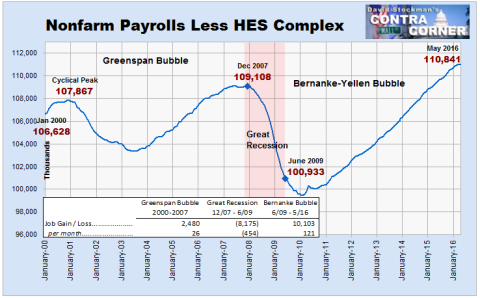

The fact is, virtually all of the new jobs created in the US since the turn of the century have been in what we call the HES Complex, or health, education and social welfare. Yet these are overwhelmingly enabled by the nation’s fiscal machinery and the entitlement programs and tax preferences which deliver it.

Indeed, it is upwards of $4 trillion of medicare, Medicaid, tax preferred employer health benefits, public education spending and tax subsidies and social welfare programs that drive the growth and the jobs. Monetary stimulus and ZIRP have done squat by comparison.

Yet outside of the HES Complex, the US economy has only generated 2.9 million jobs—-all of which have been in the marginal part-time sector—since Bill Clinton packed his bags in January 2001. That’s just 16,000 jobs per month in an economy that needs 150,000 per month, at minimum.

At the end of the day, therefore, monetary stimulus boils down to wealth effects pumping in the context of today’s debt besotted economy.

Since it was launched by Alan Greenspan in response to Black Monday in October 1987, there have been two fundamental consequences. To wit, the real incomes of the 90% at the bottom of the US economic ladder have been stagnant, real wealth levels are lower and its share of the pie has steadily declined.

In fact, the entire 13 percentage points of lost share has been captured by the 120,000 households at the tippy-top (0.1%) of the wealth ladder. This tiny slice of the nation has been the true beneficiary of wealth effects pumping by the Fed..

At the same time, financial bubbles and busts have become more frequent and violent because the Fed has destroyed the natural checks and balances of an honest financial market. The inability of the insanely over-valued stock market to correct itself, as demonstrated once again in the last two days, is proof positive.

It is also evidence of the extreme danger just ahead. Recession is fast approaching as indicated by virtually every measure of business activity. As shown below, even traffic at the fast food joints has ground to a halt during the past three months.

But when the fact of recession becomes undeniable, look out below. The Fed is stranded on the zero bound with no credible instruments of main street stimulus.

In fact, a desperate launch into negative interest rates would virtually guarantee a populist uprising against the Fed led by Donald Trump. In the alternative, a reversion to a massive new round of QE would surely cause a stampede for the exists in the casino; it would be a blatant admission that QE has been an abysmal failure.

At length, even the casino gamblers—-after being battered for the third time this century—–may belatedly grasp the truth. Central banking has been reduced to wealth effects pumping, and that is an unmitigated curse.

via http://ift.tt/29c9BAc Tyler Durden