Ukraine’s Former Energy Minister Charged With Money Laundering As ‘Operation Midas’ Expands

Months after Ukraine was shaken by a sweeping corruption probe into state nuclear giant Energoatom, and subject of international embarrassment given it even touched Zelensky’s office, former Energy Minister Herman Halushchenko has now been formally charged – after authorities detained him while he was allegedly attempting to leave the country.

Halushchenko had been suspended by Zelensky in mid-November, when news of the scandal first hit global headlines. On Monday, Ukraine’s National Anti-Corruption Bureau (NABU) and the Specialized Anti-Corruption Prosecutor’s Office (SAPO) announced that Halushchenko faces formal charges of money laundering and participation in a criminal organization tied to what investigators call the Midas case or Operation Midas.

“The former minister of energy (2021–2025) has been exposed for money laundering and participation in a criminal organization,” the joint statement said, adding that investigators have “expanded the circle of suspects.”

The investigation is focused on members of the alleged network which established an investment fund in Anguilla (the British Overseas Territory in the Eastern Caribbean) in February 2021. The vehicle was marketed as raising roughly €118 million in “investments” – with Halushchenko’s family listed among the contributors – after which millions flowed directly into accounts controlled by the family.

For example, authorities claim part of the funds paid for the education of Halushchenko’s children at elite Swiss institutions, while other sums were deposited into his ex-wife’s accounts, also with a big portion of the money allegedly invested further, “earning extra income for the family’s personal use.”

Halushchenko was energy minister from 2021 to 2025 before being appointed justice minister in July 2025. In November, NABU agents conducted raided offices and properties connected to him as the investigation intensified.

Western mainstream media had almost immediately launched into damage control in the wake of the massive energy scandal, with one op-ed in Bloomberg having tried its best to say it’s not at all Ukraine’s fault, but is actually somehow… the Kremlin behind it(!). Here’s how it began:

There are at least two legitimate responses to allegations that a group of highly placed Ukrainian officials have skimmed $100 million from contracts to repair and protect their nation’s critical energy infrastructure, even as Russian attacks plunge the nation into darkness and cold. One is to despair, the other to celebrate. The second, strange as it may sound, is more logical.

This episode goes to the heart of why Ukrainians are fighting at all. The war began in 2014, after then President Viktor Yanukovych was toppled by mass protests against the epic scale of his corruption and the captivity to Moscow this created. Graft was the glue with which the Kremlin had held…

So even with high officials in Zelensky’s government are caught red-handed by a Ukrainian internal investigation, the ultimate fault lies in Moscow, according to some MSM accounts.

It must be remembered that earlier last year, Zelensky himself found himself at the center of EU pushback and controversy when he attempted to eliminate NABU’s independence, sparking outrage in Brussels some sectors of the Ukrainian populace.

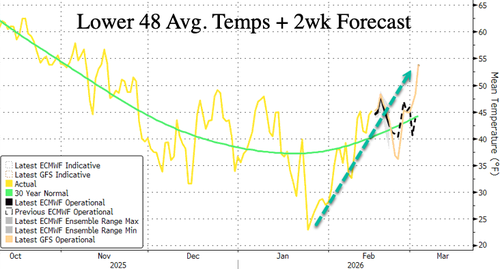

Ukrainians, currently enduring a harsh winter in subzero temperatures and with rolling power outages due to the war, are outraged. But Americans might also need to wake up and take note of how billions in US funds are going into the coffers of a deeply corrupt Ukrainian system.

Tyler Durden

Mon, 02/16/2026 – 09:25

via ZeroHedge News https://ift.tt/8qrh0Kp Tyler Durden