Authored by Steve Penfield,

Investing trust in the wrong people and policies can be ruinous. How much dishonesty does it take before the public stops putting blind faith in debt dealers, corporate crooks and the servile politicians who do their bidding? The widespread acceptance of ‘healthy’ inflation, monopoly patent rights, the ‘retirement’ trap and enslaving corporate ‘benefits’ would suggest we enjoy the abuse.

Throughout modern history, a perpetual quest among leisurely aristocrats, the entourage of corporate titans and their political suitors has been solving the mysteries of how to get paid for doing nothing and how to look good while doing it. The various means developed over the centuries by our mainstream banking industry—wearing a princely costume, shifting papers around a desk, funding corporate dominance along with ruinous wars and welfare programs, then lounging in the comfort of an expansive corner office—have neatly satisfied both elements of that royal endeavor. Enslaving the public to endless financial servitude just adds an unfortunate side-effect of the primary mission.

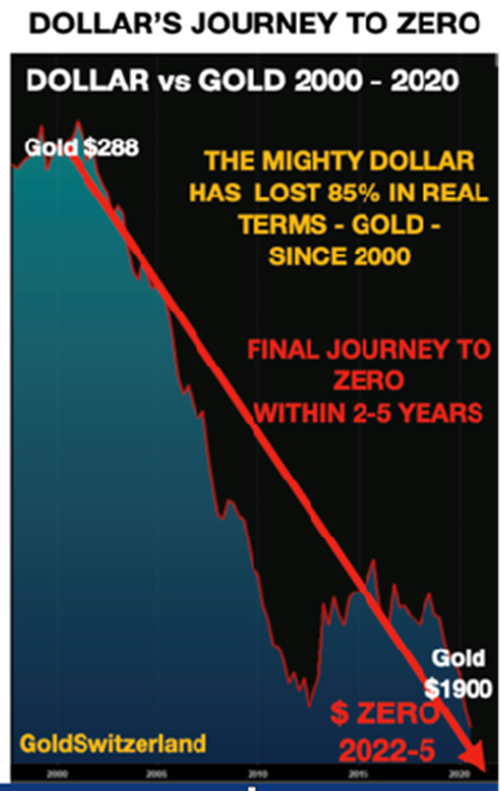

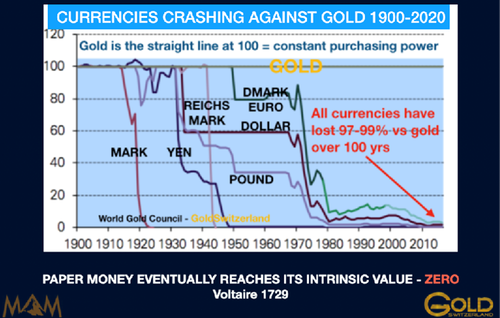

In America, that economic bondage presently amounts to over $80 trillion in public and private debt that thousands of businesses and millions of citizens cannot possibly pay off. Political banking privileges have also created about 4,000% real inflation (using historical government accounting methods) since the U.S. fully abandoned the gold standard in 1971—turning $100 of savings into a paltry $2.50 of original value. (From the 1790s to 1933 in America, various gold standards—poisoned with fractional credit creation—failed to prevent about a dozen major banking collapses that many still mischaracterize as emotional “panics.” But those somewhat fixed standards did provide resistance to systemic monetary debasement.)

It almost goes without saying that high-striving politicians will stretch the facts when it serves their purposes—especially on financial matters. But only within the last three or four generations has a broad segment of the U.S. population accepted this gross economic abuse—along with many related cultural distortions—as unquestionable necessities.

By this late stage in Western society’s unraveling, the falsehoods protecting the chicanery are almost too many to fathom. So for this essay I will focus on the most prominent fictions of the financial world and some associated fables that bankers eagerly sponsor.

This essay will consider the claims of “good” inflation, the natural market tendency of deflation and the reality of money multiplying that few insiders dare to admit. It will likewise expand on the issue of bank counterfeiting and introduce a suggestion for broadening that “stimulating” privilege to the rest of us. The false sense of security of trying to “regulate” corrupt banking activity will get some overdue attention. Along the way, I’ll briefly address some problems of monopoly patent “rights,” since easy bank money funds this corporate welfare racket that hurts actual innovators (noting once again, our mainstream media’s refusal to do their job on this important topic as well). Then I will venture into uncharted waters of critically reviewing the popular new traditions of relying on corporate “benefits” in lieu of intact families and financial interdependence, along with the practice of quitting your job and handing your life’s savings to empty bank vaults and Wall Street gamblers.

A condensed table of contents for the section headings of this essay is provided below.

Part 1

-

A Few Experts with Something Useful to Say

-

Money Multipliers and Empty Banks

-

A Minor Fib on the Fed’s Virtual ‘Printing Press’

-

Of Course, the Feds are Lying about Unemployment

-

Five Sections on Inflationary Myths

-

Sidebar on Monopoly Patents: More Corporate Welfare that Everyone Loves

Part 2

-

False Sense of Security: Trying to ‘Regulate’ Corrupt Banking Activity

-

Four Sections on Retirement

-

Corporate ‘Benefits’

-

Monetary Monotheism

-

Conclusion and Post Script

In researching and writing this three-part financial series, I frequently sat in amazement of the dismal state of economic understanding in America today. If our media did any honest reporting or our schools provided any challenging education, more people would already know just about everything to be discussed herein—as most of it is fairly easy to comprehend. But based upon our runaway debt, inflation and other catastrophic economic failures, that doesn’t seem to be the case. And it doesn’t appear to be an accident.

Catering to the desires of our insular financial, corporate and political classes, a subsidized clique of mass media and institutional soothsayers would have us believe that the system is not rotten to the core. Their false narrative maintains that private bankers did not conjure any of the roughly $80 trillion in total outstanding U.S. credit from thin air—debt that keeps the elites on top and the vast majority trapped in stagnation. The manufactured inflation that turned “penny candy” of 1913 into similar treats costing well over a dollar today gets whitewashed as either a conspiracy theory of “gold bugs” or a productive policy we need to extend indefinitely (or somehow both). The “thought leaders” of society proceed to insist that the historically and mathematically demonstrated “credit cycle” is actually a natural “business cycle” of the reckless marketplace, and that fiat “legal tender” mandates divinely write themselves, thus can never be unwritten.

On top of that, the skyrocketing cost of healthcare (a side-effect of easy money and World War II wage controls) associated with joining a corporate insurance pool is sold as “benefits”—always “your benefits”—to falsely impute personal ownership where none exists. Quitting your job, forever, and relying on altruistic Washington benefactors gets the double honorific—repeated ad nauseum—of being both “social” and enhancing “security.” Monopoly patent privileges and other barriers to market competition (medical licensing, legal guilds, teachers’ unions) must never be questioned, because they too are “beneficial” for society, we are frequently told.

Yes, there is quite of bit of mind-numbing disinformation to sort through in our daily attempt to carry on. While the general public seems to have an increasing awareness—thanks to the liberating nature of the internet—that something doesn’t quite make sense, all cylinders are not yet firing in any movement for economic progress that I’m aware of.

Part of the problem is the unnecessary distractions tossed out regularly by professional political experts—almost all of them lacking financial independence and thus prone to pandering to their base. Liberal/socialist pundits assure us that “unregulated” private-sector activity (although extinct since at least the 1970s) is to blame for every social ill; just a few thousand more rules and a few trillion more dollars for new centralized programs and we’ll be safe from those lingering free-market barbarians. Conservative/liberty types insist that the Federal Reserve is the root of all financial evil; never mind the numerous devastating banking collapses that occurred before the Fed was created (such as 1784, 1792, 1796, 1819, 1837, 1857, 1873, 1884, 1893, 1896, 1901 and 1907) and also ignore the inflationary debasement inherent to fiat banking.

Thanks to the empty nature of both partisan messages—and the many important gaps conveniently left out—politicized banking elites and fascistic corporate cartels have been corroding the social fabric of the West for centuries, with virtually zero effective opposition.

No matter how much we may claim to recognize the dishonest nature of our ruling authorities and their clandestine corporate masters, we just can’t seem to stop obeying all their foolish and harmful temptations. (Two such deceptive enticements will be explored at length in this essay, breaking tradition with conventional norms of tossing raw meat to the audience. Like most Americans, I thankfully have a full-time job outside of writing. So while I welcome any interesting feedback… I don’t need your financial support.)

In accordance with the title of this piece, considerable attention will be given to the many enduring myths that keep our financial system in its perpetual state of dysfunction. To offset part of that inevitable negativity and economic gloom, a few sections of more sensible and/or positive material have been included towards the beginning to start on a brighter note. These should also help dispel some of the false narratives I’ll be addressing later.

A Few Experts with Something Useful to Say

For a good overview on the economics profession, I’ll refer to a comment by RoatanBill in a previous article (not one of mine) published in April on this website:

It all starts with Economics. Economics is a fraudulent profession. Economics can’t prove anything, economists can’t predict anything without another economist saying the opposite and economists can’t even come up with why past events happened with a consensus OPINION.

In short, Economics is just BS OPINION spread around by people with degrees that shouldn’t exist. If you can’t PROVE something, then that ‘profession’ shouldn’t be able to hand out PhD’s. Having a PhD in an opinion is worthless to society and does real harm.

On a more upbeat note, I’ll add one of the best educational offerings I’ve found on the topic of economics. This starts with the important concept of a bank balance sheet. (Over the years, I must have read well over 100 economic essays by familiar names and from critical “outsiders” that manage to bypass this crucial topic.)

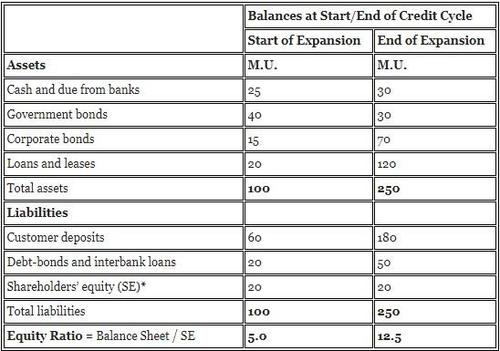

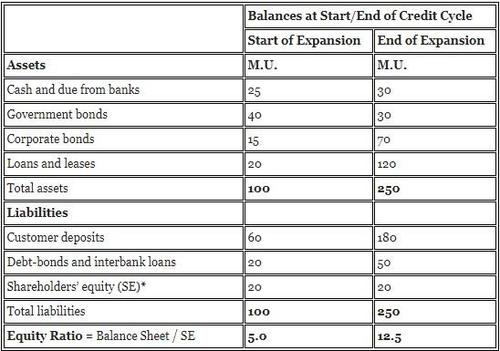

The example balance sheet below comes from an article written by Alasdair Macleod, a former stockbroker and banker who is now a Senior Fellow at the GoldMoney Foundation. I did some formatting to change his two tables into a single chart and added footnotes at the end to help explain some banking terminology. Mr. Macleod’s tables illustrate how modern banking activity results in “lending money into existence” as he aptly puts it.

Example Bank Balance Sheet

M.U. = Monetary Units. Above data and labels are from Alasdair Macleod, except for the “equity ratio” which is discussed in his article but not shown directly in his tables.

Additional notes by Steve Penfield:

Due from Banks = deposits from “my” bank into other banks to expedite future transfers.

Interbank Loans = short-term loans “my” bank receives from other banks for daily balancing.

Debt bonds are issued by banks and sold to investors (pension funds, etc.).

*Another way to view “shareholders’ equity” is to consider it the principal deposit.

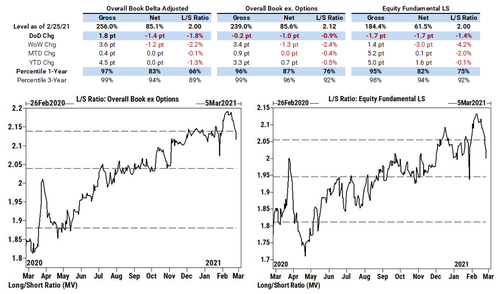

His chart shows a true Balance Sheet to Equity Ratio with a proper focus on the money multiplier effect. Conversely, the politicized “reserve ratio” at the end of expansion would be 30 (cash) / 250 total = 12%, which passes the Fed’s historical 10% minimum (dropped to zero on March 26, 2020) for state-chartered banks, with federally chartered banks always allowed to hold less reserves. So under the existing labyrinth of federal regulation, the 12.5 money multiplier is perfectly legal.

Understanding a bank balance sheet also helps us recognize the common myth that only the government can create money out of thin air. Prior to the financial collapse of 2008, the only significant instances where fiat currency emanated directly from the U.S. federal government were the political rebels in 1775 who issued paper Continentals to fund their war against England and Lincoln’s Greenback stunt of the 1860s to wage battle on the South. Other than that, fiat credit creation—with its inevitable boom/bust cycles—throughout American history has been overwhelmingly accomplished by private bankers.

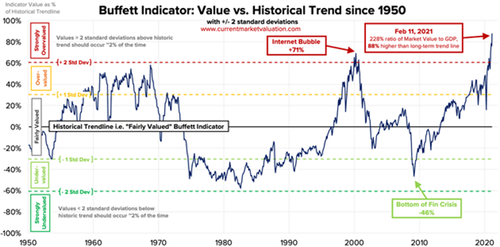

This manufactured boom/bust dynamic helps explain why the top 0.1% of Americans now own more wealth than the bottom 80%—an achievement suited for a banana republic led by a military dictator.

Blaming the current wealth gap on the Fed (or worse yet, “capitalism” itself) is just a cop out from people trying to attract attention to themselves or with some ideological axe to grind. Let’s recall that J.P. Morgan (1837–1913) at the end of his life had officers sitting on “the boards of directors of 112 corporations” and as of 1921 Andrew Mellon (1855-1937) served “on the board of more than 150 corporations,” as noted in my first essay of this series. Not bad for a couple of money manipulators with no useful job skills. (Fed-bashers take note: Morgan died before the Federal Reserve was created.)

For a more recent look at the riches of high finance, the ten largest banks in the U.S. have accumulated nearly $10 trillion in assets (as of December 2019)—mostly by loaning and investing “money” they never owned in the first place. Mostly by exploiting political privileges that ordinary people cannot access. Mostly from the safety of air-conditioned offices like these ones.

Of course, banks also provide the vital function of facilitating millions of transactions every day—with their check clearing, ATMs and credit card processing. Legitimate bankers can continue to play this important role in keeping consumer interactions secure and liquid without their fiat counterfeiting privileges. But why settle for an honest living when you can get rich on legalized alchemy?

Money Multipliers and Empty Banks: The Best Kept Secrets in the Financial Industry

While lingering just a bit longer on the positive side of the ledger, here’s a couple more sensible economic experts with important things to say about some rather villainous activity. These crucial topics tend to get obscured by so much heavy breathing over the Fed, the ogre of “globalism” or just vague denunciations of the “vampire squids” of finance.

It turns out, the very concept of the “money multiplier” that bankers have been using for centuries is so embarrassing to the financial industry that many simply deny it. Wikipedia provides a decent entry on the Money Multiplier concept, reflecting some of the controversy with their statement:

Although the money multiplier concept is a traditional portrayal of fractional reserve banking, it has been criticized as being misleading. The Bank of England, Deutsche Bundesbank, and the Standard & Poor’s rating agency have issued refutations of the concept together with factual descriptions of banking operations.

Legacy media, banking executives and their support staff at the Federal Reserve would much rather talk about “consumer protections” and “deposit insurance” from the minimal reserves they hold—or just prattle on about “stimulus” and “quantitative easing” to put people at ease.

Better yet, the major banks like to run advertisements in corporate media showing smiling parents walking into a sparkling new house (after signing a 30-year mortgage) or a college loan recipient clutching their precious diploma (not a care in the world over the debt they just incurred). The financial services industry spent nearly $16 billion in 2019 just on digital advertising to advance such blissful narratives. The overall theme of most financial promotions (that professional newsmen are glad to embellish) is that smothering debt equals pure joy.

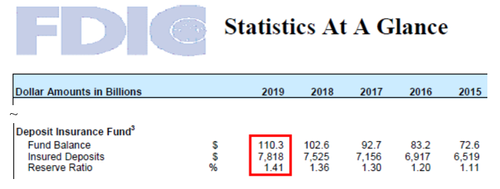

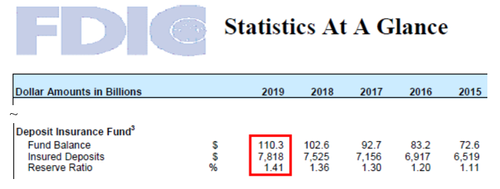

Images of paid actors pretending to be happy homeowners and ecstatic college students in flowing graduation robes help distract from the shocking fact that as of December 2019, the FDIC reports a $110 billion insurance fund balance to cover $7.8 trillion in insured deposits—a paltry 1.4% reserve ratio.

For sake of completeness, their footnote #3 by the word “Fund” deals with accounting methods before 2006, thus is irrelevant for current data.

To the glaring obscenity of the naked emperors in Wall Street and Washington D.C. (as well as London, Paris, Berlin and other financial centers): their banks are all nearly empty.

As in the classic children’s story about a similarly exposed monarch, legacy media and leashed academics just tag along for the parade, pretending that the banking imperials are adorned in the finest of fashions.

Cutting to the heart of fiat credit creation, U.K. economics professor Richard Werner authored an essay in the International Review of Financial Analysis in 2016 that summarized various viewpoints on the “money multiplier,” with over two dozen prominent economists cited in lengthy excerpts. As commenter RoatanBill asserted, the professor’s essay confirms there is nothing close to a consensus within the pseudo-science of economics.

Werner’s essay investigates the three competing theories on the central question: “How do banks operate and where does the money supply come from?” In his words, with his groupings of economists into their respective categories shown in [brackets]:

-

The currently prevalent financial intermediation theory of banking says that banks collect deposits and then lend these out, just like other non-bank financial intermediaries. [J.M. Keynes, Ludwig von Mises, Ben Bernanke and Paul Krugman support this theory]

-

The older fractional reserve theory of banking says that each individual bank is a financial intermediary without the power to create money, but the banking system collectively is able to create money through the process of ‘multiple deposit expansion’ (the ‘money multiplier’). [Friedrich von Hayek, Joseph Stiglitz and Paul Samuelson support this theory]

-

The credit creation theory of banking, predominant a century ago, does not consider banks as financial intermediaries that gather deposits to lend out, but instead argues that each individual bank creates credit and money newly when granting a bank loan.

The latter theory prevailed until the mid-1930s when famed economist Irving Fisher offered mild approval to that concept—and the more flamboyant Keynes sneered contemptuously otherwise. More recently, Hans-Hermann Hoppe, Basil Moore and Richard Werner ignored the academic scoffing and support the credit creation theory of banking, to which I would agree.

The fact that this core question is still viewed as controversial—and not remotely settled—just reinforces how far backwards the entire field of economics has regressed since the 1930s political takeover of the U.S. economy. Since that era, fiat credit creation became a moral imperative that dare never be publicly admitted by the vast majority of professional economists, politicians and media spokesmen. In Werner’s carefully measured words:

the economics profession has singularly failed over most of the past century to make any progress in terms of knowledge of the monetary system, and instead moved ever further away from the truth as already recognised by the credit creation theory well over a century ago.

Adding to the confusion, among the more vocal critics of the credit creation theory was MIT professor and author of the most popular economics textbook since World War II, Paul Samuelson (1915–2009). In the 1948 first edition of Samuelson’s famous economics textbook, he went to great length to insist it was “impossible” for a single bank to create money through the lending process. However, Samuelson conceded (for his example 20% reserve scenario) that:

the whole banking system can do what no one bank can do by itself. Bank money has been created 5 for 1…”

Rather than dwell on which of the three monetary theories is most accurate, I’ll just reiterate that the author of the leading college economics textbook of the 20th century (with over 4 million copies sold according to Wikipedia) admitted that the “banking system” creates money out of thin air. However, I will also note the acrobatics that Samuelson and others employ to fully absolve any individual banker of guilt.

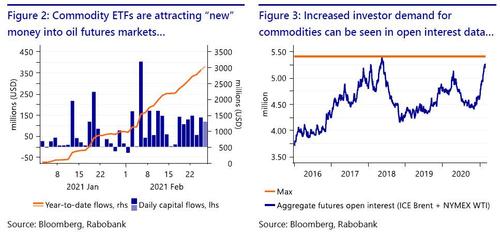

It may be a sign of progress that the home of the conservative Fed-bashers, ZeroHedge, allowed a brief moment of clarity to invade their otherwise puerile platform of pro-banking mythology. Financial pundit Travis Kimmel explained in an August posting on inflation picked up by ZeroHedge (since moved behind their paywall) that:

A dollar is ‘born’ when a loan is made against collateral on a bank’s balance sheet. Banks can issue multiples of dollars for every dollar of collateral they have. … As banks lend more, more dollars are created and the money supply increases. This multiplicative lending is the chief driver of total dollars in the system.

Simple wisdom you will never find from a federal broadcaster shilling for corporate advertising dollars. So far, this isolated exception has apparently not been repeated in any conservative or libertarian publication that I can find. (Most liberal publications are too busy raging against “capitalist greed” to offer anything sensible on financial education. But that’s to be expected.)

With the internet lowering barriers to communication as not seen since the early 1920s advent of commercial radio (nationalized in 1927), useful information is now increasingly available to any person willing to look for it. But entrenched members of state media, corporate cartels and public schooling still hold a firm grip on institutional power. Those forces continue to wield enormous sway over who may speak on coveted broadcast airwaves, who receives a platform among censorious tech utilities and who gets pushed to the sidelines.

This vast influence further dictates who receives praise as trustworthy “experts” and who gets mocked and ridiculed with pejorative slurs and epithets to invalidate their message. In virtually every case, the “winners” favor arbitrary centralized power, while the “losers” do not.

A Minor Fib on the Fed’s Virtual ‘Printing Press’

To begin addressing the central “lying” theme of this essay, I’ll ease into it with a popular distortion that maintains a nugget of truth. When it comes to pointless diversions, it’s hard to beat the incessant right-wing and libertarian denouncements of the Fed’s legendary “printing press.” Anti-government extremists need a villain with the word “federal” in its title. And conservative demagogues have milked this trope for decades to sell their books and newsletters and to fill seats at weekend seminars (while not helping the public one bit).

The “printing press” meme grossly oversimplifies what the Federal Reserve does and distracts from the rampant counterfeiting of private fiat credit bankers whom the official Right cannot stand to criticize. As for the alleged Fed “printing,” banks conjure loans to the U.S. Treasury to buy government bonds (i.e., “financing the national debt”). When governments get desperate to spend new money they don’t have—and don’t have the integrity for transparent payment via unpopular tax increases—the Federal Reserve buys these bonds back from the banks, freeing up the banks’ balance sheets to create more loans (possibly) or buy more government and corporate bonds (more likely) or simply award lush C-suite bonuses (also likely). The latter option is exemplified in this 2009 clip from the New York Times (credit to Armstrong Economics):

The Fed’s convoluted money processing machine—problematic as it is—only amounted to a relatively small $4.2 trillion balance sheet at the end of 2019. (All of that was owned by opportunistic banks and other institutional investors, by the way. The Fed can’t “print,” or more accurately buy back government bonds, without eager bankers willing to finance that shell game.) Much worse than that, as of the same time period the banking industry had created a total of $75.5 trillion in government, corporate and household credit (same as debt). Whining about the dastardly Fed running its non-existent “printing press” isn’t just misleading, it reflects willful ignorance or intentional deception among right-wing and libertarian ideologues who apparently want private bankers to be free to fleece the public without any accountability.

Financial writer Travis Kimmel again gets it right, noting: “the Fed ‘printer’ … only increases the collateral banks have to lend against. It does not directly ‘birth’ dollars, only *potential* dollars.” But his sensible voice is presently drowned out by anti-Fed fanatics.

Of Course, the Feds are Lying about Unemployment

Warming up for more serious economic fabrications, we have the ongoing underreporting of unemployment. I’ll keep this section short since it’s pretty obvious that a country of over 330 million people, with less than 164 million civilian workers, cannot possibly have an unemployment rate of under 4% as reported for all of 2019. As is now common, some creative accounting helps make our staggering economy seem vibrant.

Since 1994, the BLS has achieved their bogus unemployment figures by omitting “discouraged workers” who have given up looking for work for more than one year. This army of the downcast has grown, thanks in part to the natural comforts of not working, and also the smorgasbord of entitlement offerings Americans can now choose from (financed mostly by debt).

For more realistic unemployment estimates that include these long-term “discouraged” Americans, ShadowStats data put the average unemployment rate for Jan 2010 through Dec 2019 at a whopping 22.4% compared to the official BLS reported rate of 6.2% for that period. That is, the entire decade of the 2010s experienced Depression-era unemployment numbers.

Even the figures from ShadowStats are generous, since they omit tens of millions of seniors who follow the tradition of permanently quitting work since the New Deal convinced them to get out of the way. Millions of college-aged students—lured into classrooms to memorize dogma while they accumulate debt—are also overlooked by employment bean-counters. Both groups were overwhelmingly part of the workforce in the 1930s.

Moving on to a much bigger pack of prevarications, we have the intentional debasement of our mandatory “legal tender” known quixotically as “inflation.” Owing to the enormity of this collection of falsehoods, I’ve broken this topic into five subsections.

Many Big Lies on Inflation

-

The myth that passive inflation ‘just happens’

-

The natural state of beneficial deflation

-

Inflation is much worse than the Feds are admitting

-

America in the 19th century: progress with no net inflation (refuting left/right extremism)

-

Why not inflation and counterfeiting for the masses?

The myth that passive inflation ‘just happens’

Any discussion of “inflation” needs to begin with an understanding of what it is. Here again, we see the spectacular success of the financial community to convince the public that inflation means rising prices. Bankers, government officials and their institutional supporters now openly espouse this risible nonsense. And it just so happens that—“oopsie”—the false definition of passive inflation conveniently masks the problem of active fiat counterfeiting. (Hat tip again to Caitlin Johnstone as cited in Part 1: this too seems to be “manipulation… not incompetence.”)

Actually, for centuries inflation was understood to mean the intentional act of pumping more government currency or bank notes into the money supply, which then caused prices to rise. As recently as 1919, the Federal Reserve was basically admitting as much:

Inflation is the process of making addition to currencies not based on a commensurate increase in the production of goods. [as quoted in “On the Origin and Evolution of the Word Inflation,” Federal Reserve Bank of Cleveland, 1997]

That same year just over a century ago, Cambridge economist J.M. Keynes was openly denouncing the “process of inflation [by which] governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” He added “There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency”(longer quote available at Wikipedia). By 1936, Keynes’s influential book The General Theory of Employment, Interest and Money, as reviewed in my last essay, would contain no such criticism of this powerful tool.

Within a few generations of that semi-lucid 1919 Fed statement and the young Keynesian critique, our educational and media gatekeepers had debauched the language to make “inflation” into a passive result of unruly “market forces” that need to be tamed by wise central policy makers. (For a third piece of supporting evidence, the 1913 Webster’s Dictionary definition of “inflation” also focused on expansion or increase of currency, with no mention of resulting prices, as Peter Schiff recently pointed out.)

When government officials now boast of their “efforts to curb inflation,” they are deflecting attention away from their own misdeeds and the mischief of their financial overlords.

Inflationary raids on public money are nothing new, of course. When Roman emperors became aware they could issue more currency by mixing in cheap copper or iron in their valuable gold or silver coins, this was an early form of monetary inflation that we now call debasement. Economist Martin Armstrong provides a useful chart of the Collapse of the Roman Silver Monetary System from 280 B.C. to 518 A.D. that depicts this process. His chart reflects the centuries of relative monetary stability until a “waterfall event” around 250 A.D., when silver content of coins was reduced about 90%. Silver content of the Roman denarius stabilized again (to some extent) for about two centuries at the new debased levels, then finally collapsed entirely in the early 500s A.D., ushering in five or six dreadful centuries of public squalor we know as the Dark Ages.

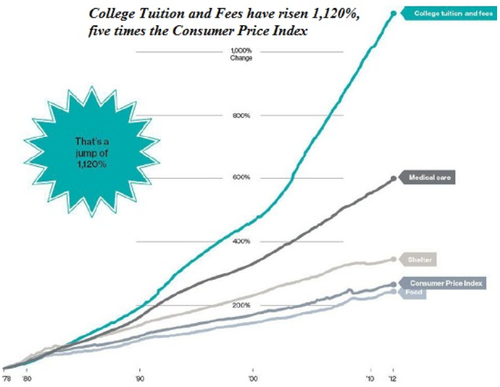

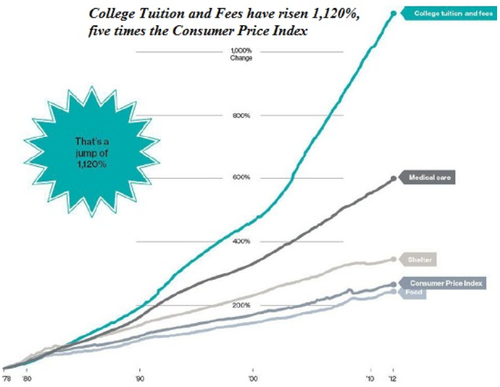

Prior to the ultimate collapse of the Roman denarius, as more and more worthless coins flooded the markets (allowing emperors to pay for wars and “bread and circus” social programs) prices of common goods also increased. But this didn’t mean the food and clothing of the era was more valuable or that people were getting richer. It meant that people had an abundance of cheap money they were willing to part with in exchange for real stuff— as we see today with skyrocketing prices for college and medical care and major cost increases for land, housing, automobiles and other essential items. And none of this is accidental.

The natural state of beneficial deflation

Whereas inflation enriches those first in line for the debased currency (fiat bankers, corporations and bloated bureaucracies), deflating prices inherently benefit consumers or those who save and invest their own money. Nevertheless, for all the talk of “democracy” helping the little guy, you’d be hard pressed to find any public figure saying anything positive about deflation. The problem is that habitual debtors (farmers, corporations and our federal government) actually want—and beg for—constant inflation to make their debts less burdensome. Monetary or price deflation is economic poison to that unstable mindset.

While few admit this, the Fed’s magical 2.0% inflation target has little to do with “taming market excesses” or “protecting consumers” and more to do with overcoming the natural pressures of deflation, all for the benefit of wealthy debtors. If economic progress means anything at all, decreasing consumer prices should almost always be the norm. That is, every year businesses find more efficient ways of providing their products or services. In an open and competitive marketplace with a stable currency, this leads to lower (not higher) prices.

For instance, industrial efficiencies brought down the price of British steel from $80 a ton in 1873 to under $20 per ton in 1886, according to Henry Hazlitt in his book Economics in One Lesson. These innovations (particularly the Bessemer process) would be adopted by Andrew Carnegie to aid America’s booming economy at the time—causing a price drop in steel railroad rails from $100 per ton in 1873 to $50 two years later, then down to $18 per ton in the 1890s, according to the prior Wikipedia link.

America’s automotive manufactures produced similar growth and consumer savings. Henry Ford’s Model T automobile “sold for $600 in 1912 but its price had fallen to $240 by the mid-1920s” as noted in Robert Murphy’s P.I. Guide, page 71. Over at General Motors, a “Chevrolet six-cylinder touring car cost $2,150 in 1912; an incomparably improved six-cylinder Chevrolet sedan cost $907 in 1942,” according to Hazlitt.

Contrary to the notion that deflation will harm workers, Hazlitt points out that U.S. automotive employment increased from 140,000 in 1910 to 250,000 in 1920 and then 380,000 in 1930—all while car prices were declining.

Market efficiencies have driven down costs of essential products from food and clothing to computers and long distance calls—once AT&T’s patent-fueled monopoly was finally broken up in the 1980s. Financial blogger Mike “Mish” Shedlock adds other logical defenses of deflation and the sensible observation that “The very essence of rising standard of living is more goods at lower prices thanks to innovation and rising productivity.” Yet in state media and subsidized education, the myth persists that rising prices are both natural and beneficial for the public.

Inflation is much worse than the Feds are admitting

As many economic observers in alternative media have asserted, official CPI data as tracked by the Bureau of Labor Statistics (BLS) have been manipulated for decades to under-report inflation. The Chapwood Index helps provide useful background on why the BLS altered its own Consumer Price Index calculations in the 1980s, including this excerpt:

prior to 1980 [the CPI] was accepted universally as an accurate measure of how the cost of living increased. Fast forward to 1983-1984, when the government realized that the cost of living was growing more than 12% – 13% per year. It was determined that if the cost of living were lower the government would save money.

It turns out that the CPI has been around since the 18th century and it worked well when it “was a measure describing a basket of goods that defined the same items of goods applying the same weight during the same time period,” as Ed Butowsky of the Chapwood Index puts it. We could also call this using honest “weights and measures” or maybe just “responsible government.” But that’s not what we have today.

The longstanding CPI calculation went haywire soon after Nixon took the U.S. off the international gold standard in 1971, to help finance the Vietnam War and also pay for LBJ’s lingering “war on poverty” that most of Washington was terrified to scale back.

Official Consumer Price Index figures over the last two decades show average annual inflation at about 2.2%. Historically consistent (1980-based) CPI measures tracked by ShadowStats put average inflation from 2000 to present at 9.4%. This is a huge difference and also a major injustice.

For a $20 trillion economy, causing a mere 2% net inflation steals at least $400 billion from consumers and savers each year. (That ignores natural deflation, which makes the issue even worse.) At 9% real inflation, the annual theft is more like $1.8 trillion—mostly going to rich bankers and Wall Street executives, as the system was designed. It also allows deficit spending for military adventures and social programs without unpopular tax increases or Congressional accountability.

To put it mildly, politicians, bureaucrats, bankers, colleges, farmers, financial planners and public corporations all really LOVE inflation. They all enjoy the free lunch at someone else’s expense—namely those that don’t have a front row seat to the banking industry’s liquidity hydrant.

For a graphical view of recent U.S. inflation, economics writer Charles Hugh Smith provides the useful chart:

One common thread on the worst of the skyrocketing prices (college and medicine) is that the delivery systems are all politicized, with massive federal interference and mandatory state licensing cartels that minimize competition, intensify vanity and maximize cost. Home building and automotive manufacturing are also highly restricted by government rules, limiting market efficiencies and artificially raising costs in both cases.

American banking in the 19th century: progress with no net inflation (refuting left/right extremism)

Here’s an area of monetary history where Fed-bashers and Fed supporters both trip over themselves in differing ways on their missions to spin false narratives on inflation, resulting in the extremist myopia of choosing No Government or Totalitarian Socialism, no other options.

First, to solely blame the Federal Reserve for today’s persistent inflation—implicitly pushing for no banking oversight whatsoever—is both foolhardy and disingenuous for multiple reasons. Besides the inherent fraud of fiat banking itself, one powerful evidence of “End the Fed” absurdity is that U.S. inflationary booms and busts were also rampant in the 19th century during periods when there was no central bank.

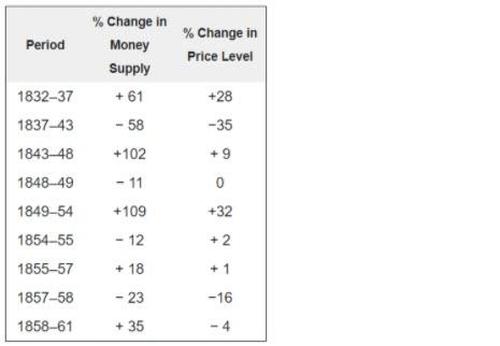

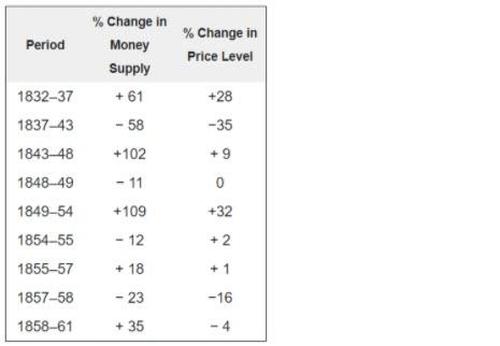

Wikipedia’s entry on the “History of central banking in the United States” provides the chart below along with a description of the “free banking” era of 1837–1862:

In this period, only state-chartered banks existed. They could issue bank notes against specie (gold and silver coins) and the states heavily regulated their own reserve requirements, interest rates for loans and deposits, the necessary capital ratio etc. …During the free banking era, the banks were short-lived compared to today’s commercial banks, with an average lifespan of five years. About half of the banks failed, and about a third of which went out of business because they could not redeem their notes.

Wikipedia fails to mention that banks were free to issue bank notes many times the amount of actual gold and silver holdings—i.e., the enduring practice of counterfeiting. This careless “printing” of notes and loans caused the instability, as it does today in a more gradual fashion.

Monetary Chaos of the ‘Free Banking’ Era

The “free banking” credit sprees caused the wild up/down changes in the money supply and price levels, hurting consumers and wrecking thousands of businesses. Mere numbers on a chart don’t capture the suffering inflicted by such reckless banking behavior.

On the other hand… Fed supporters cling to the notion that their beloved central bank is actually helping to curb inflation. This too is false.

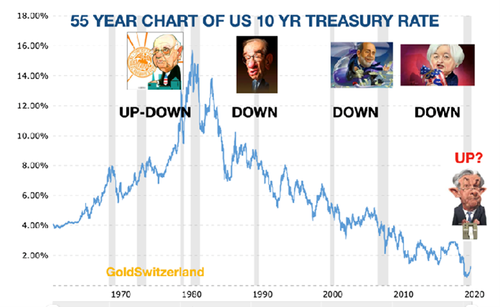

Before 1914 when the Federal Reserve came into existence, painful boom/bust credit cycles eventually leveled off to a relatively stable position—until the next cycle soon started up again. Subsequent maneuvering by the Fed and the U.S. Treasury over the last century (artificially suppressing interest rates, selling then buying Treasury bonds to and from banks, using bond proceeds for illicit government spending, creating the false sense of security with sham regulations and deposit insurance, etc.) just postpones a full correction—which will be excruciating.

Since the Fed and the Treasury Department have jointly worked to prevent a proper recovery, the cumulative inflation using original Bureau of Labor Statistics methods (as tracked by ShadowStats) for 1913 through 2019 is about 16,000%, as detailed in my last essay. This means that anyone who saved a dollar back in 1913, if they were still living today, would now have under 1 penny of equivalent purchasing power. That’s an over 99% loss of value and evidence of incompetence on the part of federal politicians as well as proof of malevolence among their financial masters.

Prior to the Fed’s creation, matters were much different. The federal agency that officially tracks inflation, the U.S. Bureau of Labor Statistics, even admits to an absence of *net* inflation during the 1800s, if you can sort through thousands of words of bureaucratic fluff. The BLS states:

The limited price data from the 19th century also show no pattern of consistent inflation; indeed, evidence suggests that there was net deflation over the course of that century, with prices lower at the end than the beginning.

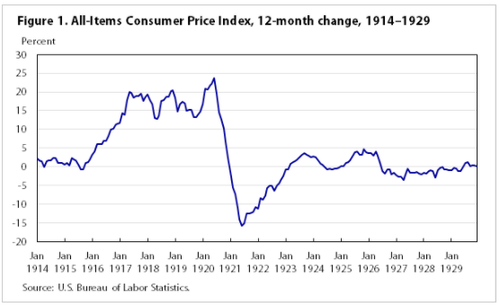

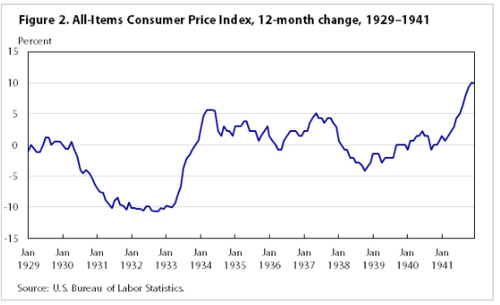

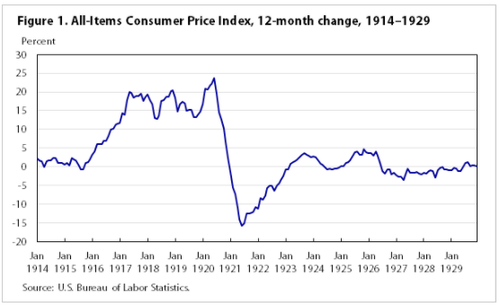

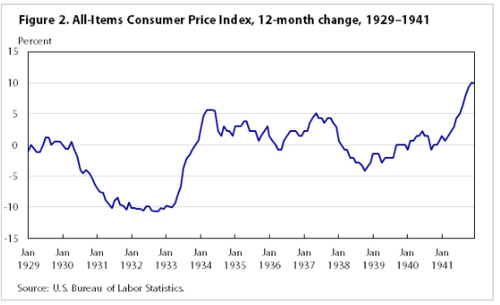

I’ll note again, the above quote is from the federal government. The very same federal government now insists that persistent inflation is both normal and healthy. That informative BLS website also provides useful charts (their data, my descriptions) of what:

- A rapid market correction during a depression looks like…

- What a prolonged, politically “stimulated” non-correction looks like…

In figure 1, we see a sharp deflationary correction during the 1920-21 depression following World War I. For the next eight years, Americans experienced “roaring” prosperity across all income brackets.

In figure 2, we see the effects of massive “stimulus” spending and other market interference—precisely to avoid a deflationary correction that politicians and corporations fear. The result was more than a decade of economic squalor, business closings and high unemployment.

Why not inflation and counterfeiting for the masses?

At some point (probably reached long ago) all the data and history and charts and graphs stop having an impact on the public psyche and just fade into background noise. When businesses and politicians have a vested interest in believing nonsense—that fiat credit and inflation are somehow good for society—and diligently promote such gibberish, it becomes more practical to simply call their bluff.

If credit creation, money multiplying and price inflation are all beneficial… then why not extend those privileges to the general public? (In a “well-regulated” manner, of course.)

For instance, instead of the universal basic income that many liberals now advocate, we could just allow people in selected income ranges to periodically withdraw ten $20 bills (a responsible 10% equity stake) and add an extra zero in the corners, transforming each one into a $200 bill—a net gain of $180 for each note. Assuming roughly 200 million poor or middle-class U.S. adults, changing a stack of ten $20 bills into $2,000 would create $360 billion in new “credit” for each iteration.

This new money would then be pumped into the economy—in accordance with reasonable guidelines on proper spending (e.g., not cigarettes, junk food or alcohol, etc.)—to “stimulate” business growth and hiring, thus paying for itself according to prevailing monetary theory. We could hold such Universal Credit events a few times a year to give working families a much-deserved “hand up, not a handout” as social welfare activists often say.

Let’s remember that George Floyd was arrested and killed in Minneapolis for alleged “credit creation” involving a couple fiat $20 bills found in his possession. To commemorate this unnecessary loss of life—and enhance monetary equity—I propose that Universal Credit be established on currency designed in Mr. Floyd’s honor (with added markings left to public discretion):

Under such a program, store owners would naturally be compelled by Legal Tender statutes to accept such $200 bills at face value. To maintain order, participants would just stop by the nearest Social Security or Food Stamp office and have trained Monetary Agents scan and record the serial numbers on the altered bills to prevent too much “bad” inflation, which skilled federal workers would watch out for. Many social problems from food insecurity to lack of affordable housing to schools without band instruments could be quickly solved or greatly diminished with such an influx of liquidity.

Except, no one would fall for such an obvious display of monetary manipulation. A crucial feature of inflationary debasement has always been to obscure the damage to the greatest extent possible, in order to extend the process. After all, the #1 goal of any con-artist is not getting caught. For the last two decades, this has meant rigging the stats to pretend that 8 to 10% annual inflation is only 2 or 3%. Since long before that, inflationary graft has relied on a stable of academic cranks and pro-government journalists who adamantly insist inflation is good.

My proposed program of Universal Credit faces an even greater obstacle, in that ruling elites don’t like their special privileges being shared with the masses. So inflation and counterfeiting “rights” are fiercely guarded by the powerful banking cartels with help from their agents in mass media and politics.

* * *

SIDEBAR: Monopoly Patents: More Corporate Welfare that Everyone Loves

While on the topic of corporate banking privileges, another major form of corporate welfare worth considering is what politicians call the “patent system.” With so much misguided angst circulating about “globalism” and private-sector “greed”—and with commercial media usually shilling for corporate favoritism—I think it’s overdue to figure out how those evil “oligarchs” actually empower themselves.

In the U.S., politicized corporate boards (seldom a real “innovator” in sight) rely on monopoly patent “rights” to protect their fiefdoms from open competition. I have never heard any member of the Official Right or the Official Left even meekly question this legal monopoly scheme—arguably the second most significant example of corporate welfare after fiat banking, and a strategy that requires international policing to even pretend to function. (Hence, the fierce hatred of China, which bucks the global patent cabal and dares to compete with Western industry.)

In keeping with the old British practice of granting Royal monopoly charters to preferred members of society, aristocratic heads of the Industrial Revolution (that began around 1760 in England) succeeded in extending Royal privileges to legally block competition to protect manufacturing concepts they officially “patented.” Wealthy American Founding Fathers continued this tradition when they imposed their new national contract on the public in 1787.

In America, this particular gift from the Founders of owning an idea—somewhat like their other Constitutional handiwork of “owning other people”—allows companies to hire patent lawyers to dress up applications to convince other federal lawyers that some idea is such a novel, unique and beneficial “flash of genius” that it deserves legal protection in federal courts.

The 12,600 attorneys and support staff at the U.S. Patent and Trademark Office (and the cottage industry of private lawyers to help inventors navigate the process) do nothing to foster the innate creative desire of humans or to protect the “small inventor” from corporate vultures. Instead, such federal maneuvering allows corporations to claim absolute and exclusive “ownership” to the original ideas of their employees or competitors, and prevent them from starting new businesses.

The fact that every “new” innovation is built on thousands, if not millions, of prior innovations should cast doubt on this murky field of juris probity. But corporate supporters insist all human progress will come to a screeching halt if Big Business ever loses its lucrative patent protections. Anything else, they cry, is just not fair!

How well has this worked? Just great for well-financed corporations. Not so well for actual inventors. For example, the federal patent and copyright system has allowed Microsoft to clone ideas from true software innovators (Windows from Xerox, QDOS operating system, Lotus spreadsheets, Netscape internet browser) then bundle them with other monopoly products, get juiced up with Wall Street capital, surround themselves with a phalanx of patent attorneys, then crush the competition.

Similar situations of corporate abuse include the notorious “current war” where Thomas Edison and General Electric used patent litigation to harass and copy alternating-current electrical developments from Nikola Tesla and Westinghouse, after failing to implement Edison’s less efficient direct current. Marconi radio stole radio transmitting technology from Tesla (Marconi got caught, then still was awarded a patent). The Radio Corporation of America filed and appealed bogus lawsuits starting in 1932 against television inventor Philo T. Farnsworth, ultimately succeeding in delaying TV’s development for over 15 years.

More recently, the world witnessed the boom in fiber optics, cellular service and other telecommunications only after the stifling AT&T monopoly was broken by Reagan in the early 1980s. For most of the prior four generations, Ma Bell and her legions of corporate R&D minions were too busy looking for small inventors to rout and guarding their own strong “patent portfolio”—with 12,500 active patents as of 2016—to think beyond their starched white lab coats.

No doubt thousands, perhaps millions, of other small inventors with less financial resources have been caught up in the buzz saw of royal monopoly charters that weaponize industry to the advantage of large corporations. A more detailed exploration of that abusive system of arbitrary justice will be left for another day. For now, suffice to say that any policy supported unanimously by both major parties in Washington along with apparently all voices in Legacy media deserves far greater scrutiny.