Just a week after DoubleLine CEO Jeff Gundlach warned of the risks emanating from the corporate bond market, Europe’s largest asset manager is building a credit fund centered around a ratings category maligned as a catalyst for the next global economic downturn – fallen angels.

As Gundlach explained, the increasingly leveraged BBB companies could be on the verge of a destabilizing crash as ‘fallen angels’ drop out from investment-grade indexes after being downgraded once the ratings firms can no longer ignore their worsening leverage ratio.

To amplify the risk surrounding the corporate bond market, Dodd Frank banned proprietary trading, which it said could make it more difficult for brokers to offer some support for the market that could soften the blow of a selloff.

“I think Jay Powell has his eye on the credit markets…broker dealer balance sheets don’t have the cushion they used to have…there’s no capacity in the financial system for a run on bond ETFs,” Booth said.

“In the old days, when retail would sell…dealers would balloon up their balance sheets…it was actually a great money maker. They can’t do that anymore – this shock absorber has been destroyed,” Gundlach added.

And this is where Amundi Fund Solutions SICAV, the Paris-based firm that oversees 1.425 trillion euros ($1.6 trillion) of assets, comes in – potentially as the new shock absorber.

Bloomberg reports that the fund will buy bonds with an average rating of BBB-, the lowest investment-grade rank, in currencies including euros, dollars, and sterling from high grade to high yield.

As Jean-Marie Dumas, head of fixed income solutions at Amundi, said in a statement this week:

“In a world of persistently low interest rates, investors are looking for new ways to get attractive returns on their investments.’’

The fund is capitalizing on a sudden turnaround for debt pegged as the next source of financial havoc by the likes of Scott Minerd, Jeff Gundlach, and Deutsche Bank’s Aleksandar Kocic who fear the wholesale prolapse of the BBB-rated investment grade space, a tsunami of “fallen angels” that would obliterate the junk bond market as it more than doubles in size overnight from $1.1 trillion, and catalyzes the next financial crash.

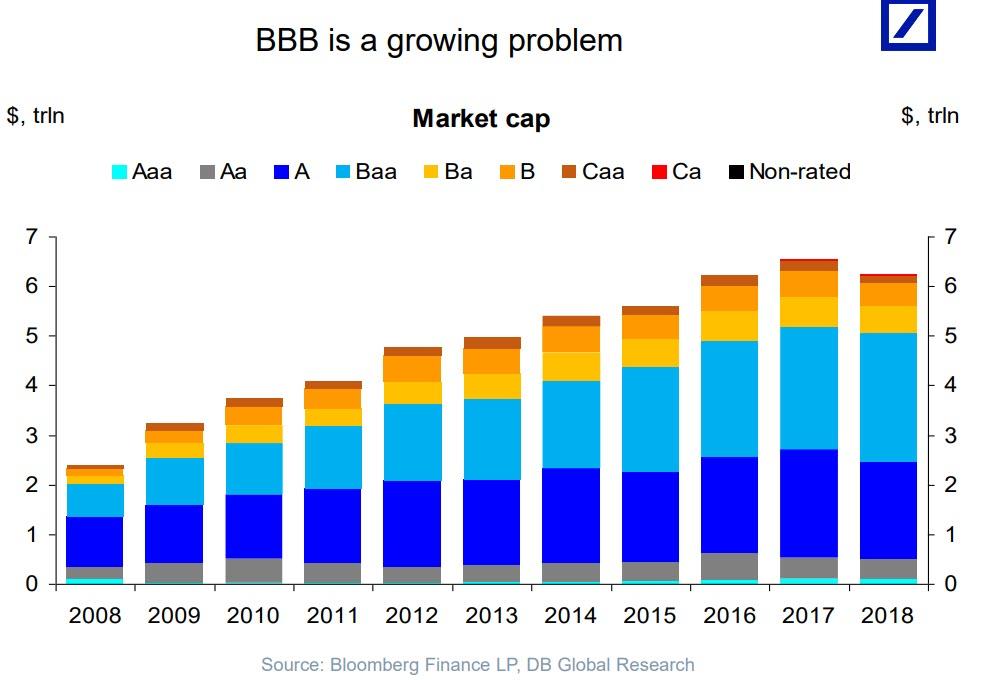

Or, as Kocic puts it, “the global hunt for yield has encouraged investors to move down the credit spectrum to enhance returns. Within the IG universe, BBB issuance has grown significantly.” This is shown in the chart below, which shows that more than 50% of the entire IG index is now BBB-rated.

To Kocic, this is also the most negatively convex sector which is sensitive to spread wideners in steepening sell off. In other words, a possible wholesale downgrade to BB or lower would result in disorderly unwind of positions of the IG money managers which would be capable of raising volatility significantly. From there it would promptly spread to the rest of the market, and global economy, and lead to the next financial crisis.

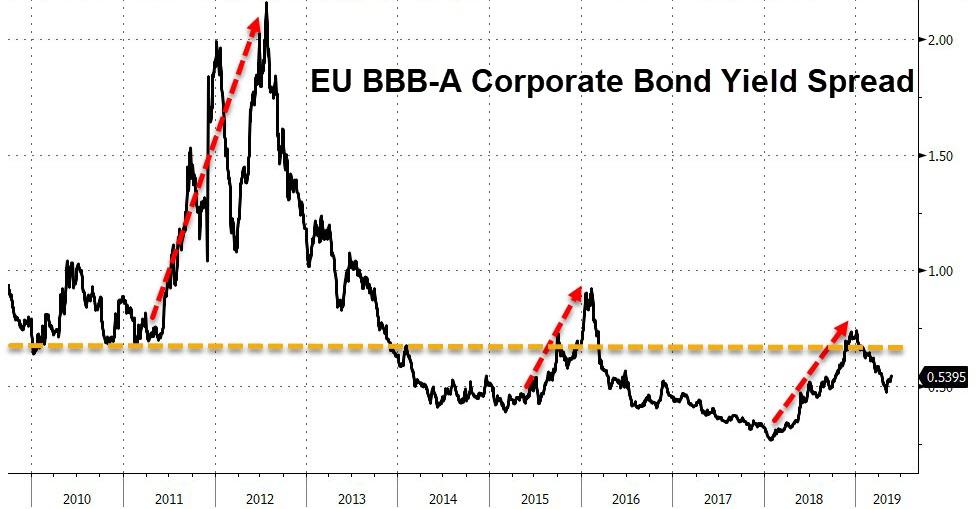

But, for Jean-Marie Dumas’ new fund, it’s worth catching those falling knives angels, despite one glimpse at the level of yields on corporate bonds in Europe suggests there isn’t much downside to those yields…

And the gap between BBB and A spreads in euros now stands at 53 basis points after approaching 70 basis points at the start of 2019. Again, not a lot of ‘cheapness’ to profit from?

To sum it all up is simple – one of Europe’s largest asset managers (likely with billions of risky EU debt on its books just as the EU looks set to re-enter recession, despite “whatever it takes” monetary policy) is creating another vehicle to use other people’s money to buy said corporate debt before it falls off a ratings cliff – in other words – It’s a leveraged bet on The ECB (and Draghi’s replacement) going full-whatever-it-takes-er…

via ZeroHedge News http://bit.ly/2wjGQM8 Tyler Durden