What If Central Bankers’ Prayers Are Answered And Inflation Surges

Tyler Durden

Mon, 12/14/2020 – 18:20

By John Buttler, submitted by Macro Hive; John Butler has 25 years experience in international finance. He has served as a Managing Director for bulge-bracket investment banks on both sides of the Atlantic in research, strategy, asset allocation and product development roles, including at Deutsche Bank and Lehman Brothers.

‘Take care for what you pray; for the Gods may one day grant it to you,’ is an old proverb with similar variations across many cultures and religious traditions. Thus it seems reasonable to pose as a possible Grey Swan for 2021 that central bankers around the world finally get that for which they have long been praying: inflation.

As 2020 draws to a close, most of the developed world remains mired in various stages of lockdown, attempting to pre-empt what many experts believe is a seasonal surge in Covid-19 infections. But with much positive news on the vaccine front, it is highly likely that, as fears recede, pent-up demand for all manner of economic activity will be released.

While impossible to model, the amount of pent-up demand could be unusually large for a variety of reasons. Many people, feeling a sense of existential relief, are likely to spend more than they normally would following a typical downturn. And given the amount of stimulus still circulating through the system, the necessary credit and liquidity is likely to be on hand for those who may have developed a ‘live for today’ mentality during 2020.

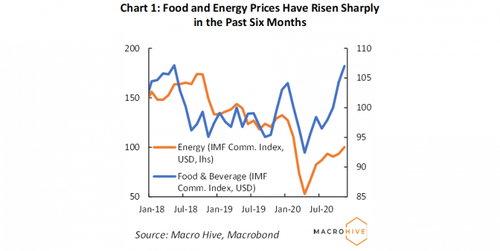

But consider the widespread evidence of lingering supply backlogs and bottlenecks, signs energy prices have hit bottom, rapidly rising food prices and huge excess liquidity. If pent-up demand is released in 2021 amid this backdrop, prices may be driven much higher and faster than would be the case under more normal economic recovery circumstances.

Food prices deserve a special mention here. This is because, while food represents only a small part of the developed world’s official inflation baskets, it takes a large share of those in the developing world, where much of the world’s manufacturing infrastructure and workers are now located. Should food prices rise enough, those workers are going to demand higher wages. In turn, those higher costs will be at least partially pushed through the production chain into exports.

This is a recipe for a surge in inflation. The possible ‘Grey Swan’ for 2021, however, is that not only does inflation rise, but it rises to above target in multiple large economies. What then? How will central bankers react and, more important, what will be the impact on financial markets?

The Fed has already made clear that they would allow for a temporary overshooting in order to raise the multi-year inflation average to around 2%. However, were inflation to rise above 2%, no doubt Fed rhetoric would begin to prepare markets for higher rates. But on what timescale? Market memories may be short, but certainly they are long enough to remember the repo crisis of late 2019, when the anticipation of only slightly higher rates led to a near seize-up of the US repo (i.e., money) market. The Fed acted swiftly to flood the system with fresh liquidity and rates then fell, although under the cover of the Covid scare. Thus even if rhetoric begins to change during 2021, the Fed may well not raise rates at all.

In the euro area, the policy response is likely to be more complex. There is already dissent at the ECB regarding the scale and structure of the existing QE programme, and at the EU level with respect to joint financing initiatives, which Hungary, Slovenia and Poland had been particularly vocal on. Such disputes are likely to escalate if inflation picks up in the inflation-phobic northern bloc of countries, including Germany.

Amid such developments, peripheral bond spreads are likely to widen again and the Target2 imbalances grow further. This will only increase the political tension within the European institutions as the ECB leadership pushes for ever-more disproportionate peripheral bond buying and the EU Commission threatens Poland, Hungary, Slovenia and any other dissenting members with some form of rebuke.

Although for somewhat different reasons, both the Fed and ECB will therefore have reason to be cautious in tightening policy, as will other major central banks. But consider now how financial market psychology might begin to change: it is one thing for the Fed (or any other central bank) to blink on the road to rate normalization when inflation is still below target; quite another when it has already risen through it. It is one thing for the ECB to justify aggressive, disproportionate (and so legally questionable) QE with inflation near zero. But at 2%? Higher? What then?

Inflation is, Always and Everywhere, A Psychological Phenomenon

While inflation is ultimately a monetary phenomenon, it is also one with a highly complex, unstable and consequently unpredictable transmission mechanism. Economists have attempted to model velocity (i.e., transmission) through the decades, with no success. Even in the 1980s under the Volcker monetary-targeting regime, money velocity was highly unstable. But it is worth revisiting why that regime succeeded in bringing inflation down sharply: Inflation is not merely a monetary phenomenon but also a psychological one.

Consider the behavioural dynamics of the classic ‘smoke in the movie theatre’ example. As one patron after another smells smoke and rises to leave the cinema, others remain seated in what is a ‘linear’ change. But when those who remain seated begin to rise to leave the cinema even without having smelled smoke themselves, the change becomes non-linear. Such ‘tipping points’ are impossible to predict in their specifics or timing, but we know they exist.

Applied to inflation, non-linear shifts in expectations can become a self-fulfilling prophecy as economic actors begin to change their behaviour, for example, by reducing holdings of cash balances and front-loading consumption – or ‘hoarding’ if you prefer – instead. Removing goods from circulation (a reversal of the ‘just-in-time’ production+consumption associated with advanced economies) represents a negative supply-shock in of itself, aside from whatever might have caused prices to begin rising in the first place. Returning to the analogy above, it is akin to people leaving the theatre without themselves smelling the smoke.

Confronted with such developments on assuming the Fed chairmanship in 1979, Paul Volcker immediately set about addressing inflation psychology. First, he needed to get his colleagues on side, which he famously did at the first opportunity, the FOMC meeting of August that year. What follow are a few Volcker excerpts from the transcript:

This is a meeting that is perhaps of more than usual symbolic importance if nothing else.

When I look at the past year or two I am impressed myself with an intangible: the degree to which inflationary psychology has really changed.

Nobody knows what is going to happen to the dollar but I do think it’s fair to say that the psychology is extremely tender.

[E]conomic policy in general has a kind of crisis of credibility… If we can achieve a little credibility both in the exchange markets and with respect to the [monetary] aggregates now, we can buy the flexibility later.

Psychology and credibility are not quantifiable economic aggregates. But they are absolutely essential when it comes to inflation expectations, which are ultimately a psychological phenomenon.

Unlike in Volcker’s time, today central banks are aiming for higher inflation. So if they do indeed succeed in ‘lighting the fire’, as it were, what are the likely market implications?

- First, breakevens are likely to rise, and not only merely to keep pace with the rise in actual inflation but to reflect the change in inflation psychology.

- Second, nominal yields are likely to follow along, as real yields are already near historic lows and so have limited room to decline.

- Third, curves are likely to steepen as central banks have made clear that they intend to accommodate higher inflation for a sustained period of time.

Turning to equities, in general they are likely to hold up better than bonds, as corporate profits tend to rise with inflation. However, the sectors performing best will be those in defensive industries with strong pricing power. Value will outperform growth. Strong balance sheets will once again be in vogue, as will dividends.

If the 1970s are any guide, commodity prices are likely to rise and, in many cases, commodities and basic industrials will outperform both bonds and stocks generally. Metals are likely to do best of all, especially precious. Whether cryptocurrencies would join this particular party is unclear, but they certainly have the potential to do so given current market sentiment.

Beyond a certain point, central banks might decide they have created too much of a good thing. Reversing such expectations is indeed possible, but remember: Once inflation psychology shifts, this will only be possible by raising rates in excess of whatever is already priced in, perhaps significantly so.

This worked for the Volcker Fed after all. But the market consequences of such action could well be severe, as indeed they were in the early 1980s. That particular Grey Swan, however, is unlikely to take flight already in 2021; rather a year or two further out.

via ZeroHedge News https://ift.tt/3gJQ9eM Tyler Durden