The Word “Rotation” Is Now Justified

By Jim Reid, chief credit strategist at Deutsche Bank

Risk assets are just about hanging in there at the moment in the face of rising yields. Much of this is due to the winners continuing to do spectacularly well and thus offsetting more high profile losers largely in the tech space.

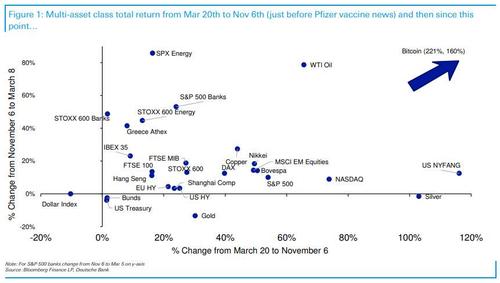

Today’s Chart of the Day updates a graph I adapted from DB’s Alan Ruskin last year where we looked at the returns of various global assets from the March 2020 lows to November 6th – the Friday before the spectacular vaccine efficacy numbers were released from Pfizer/BioNTech the following Monday – and also from this point onwards.

Since the vaccine news, anything related to banks and oil have done extremely well with many other cyclically exposed assets/indices also very strong.

The NASDAQ and NYFANG+ index are also up over this four month period even if they’ve both struggled over the last 3 weeks. They are now down -8.3% and -11.1% respectively from their mid-February peaks with Tesla’s -32.3% decline from it’s late January highs the highlight. Over the same mid-Feb to current period, US and European Energy are up +18.4% and +9.4% respectively with US/EU banks +9.0% and +9.7%.

Before mid-February I was reluctant to call this a rotation trade as everything was going up, albeit at differing speeds. However since mid-February there is absolutely no doubt we’ve seen a genuine rotation.

Given how large tech is, in spite of a huge cyclical rally, the S&P 500 is now -2.4% over this 3 and a bit week period when cyclicals have done so well. So without tech leadership the headline index can suffer in a rising yield, return to work environment.

All eyes might be on how much stimulus checks go into favored retail tech names again even if the same stimulus causes rising yields. These markets are not going to be dull this year.

Tyler Durden

Mon, 03/08/2021 – 15:20

via ZeroHedge News https://ift.tt/3c7GvAI Tyler Durden