By: Chris Tell at http://capitalistexploits.at/

The first wave of modern globalization took place during 1870-1913, when both capital and labour moved freely across international borders. Things have changed a lot since then as ever increasing restrictions have emerged for capital mobility, due in part to a surge in nationalism and increasing levels of government interference in both domestic and international capital flows.

Ever since the Bretton-Woods system, which emerged out of World War II, abandoned the dollar-gold standard, capital mobility has surged.

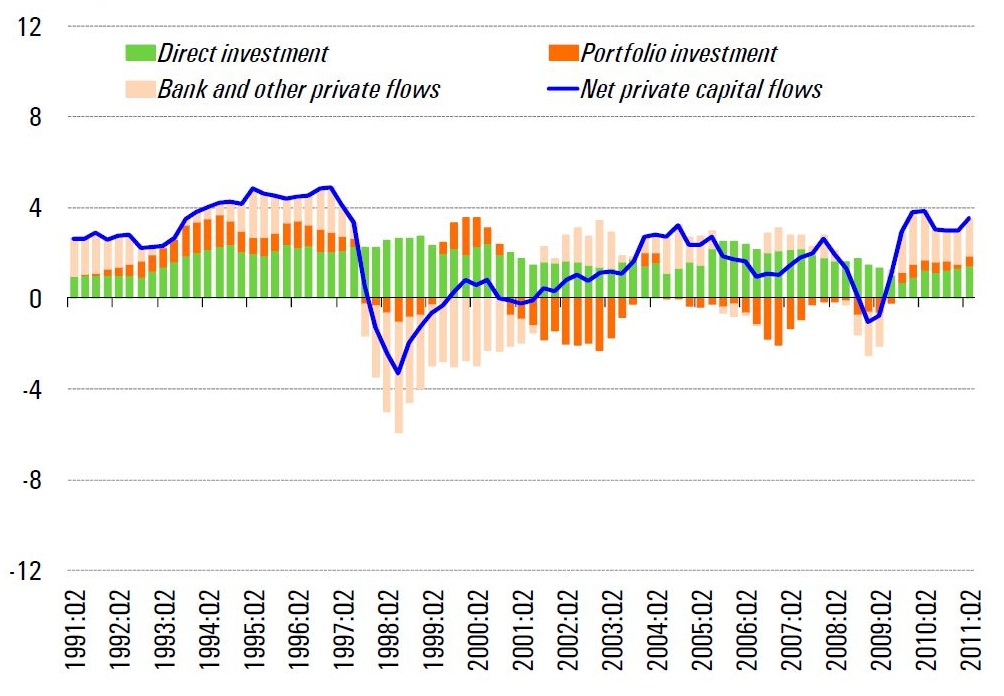

Figure 1: Net Foreign Private Sector Capital Flow in Asia (Percentage of GDP, Q4 moving average)?Source: IMF, Balance of Payments Statistics

During the last decade net capital flows from the developed economies in Europe and North America have flown into emerging economies in Asia at a record pace. Beside the brief dips during the Asian Financial Crisis and the Global Financial Crisis, starting in 1997 and 2007, capital inflows to Asia have remained constant (Figure 1).

The “cheap money” generated by the U.S. Federal Reserve’s Quantitative Easing, and European Central Banks Long Term Refinancing Operations have found better returns in emerging economies in Asia, including the NIEs. Amid low interest rates offered by the Central Banks across developed economies, the trend has only solidified in recent years with capital inflows in Asia reaching an average of 4 percent of GDP in 2010. This is the first time since the start of the Asian Financial Crisis that such levels have been reached.

Also, as developed economies are slowing down, the risk adjusted rate of return of capital in these countries is low. Compare this to the high growth potential in the emerging Asian tigers.

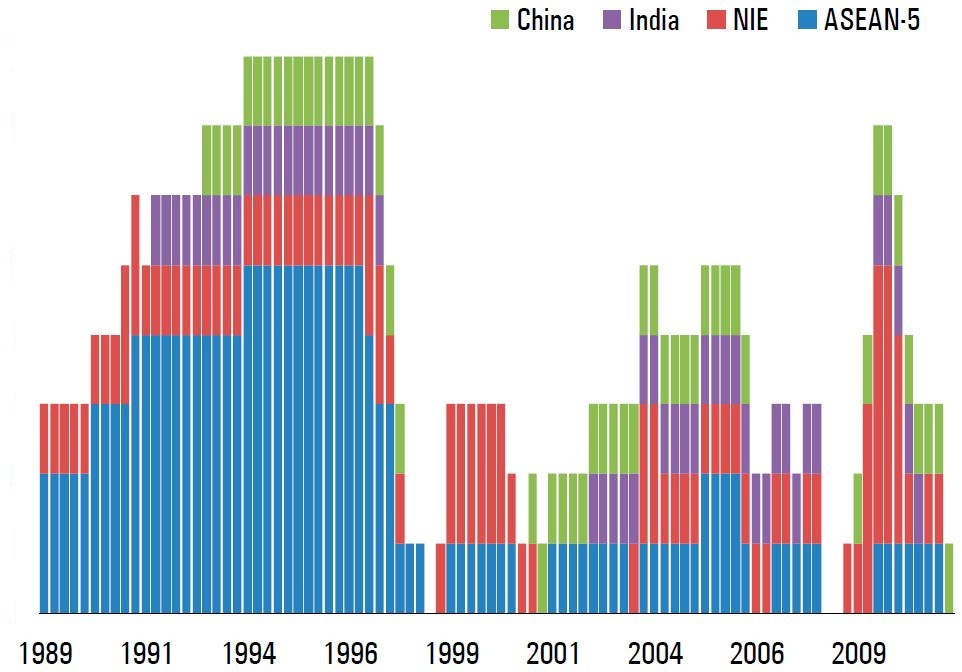

Figure 2: Distribution of Capital Inflows by Country

Source: IMF, Balance of Payments Statistics

While the composition of capital flows are obviously different among Asian countries, as a basket (Figure 2), Asean-5 economies and NIEs have attracted the bulk of the disruptive capital flight after the global economic crisis. Also, these inflows serve different purposes in different economies. For example, Hong Kong attracted a large portion of banking flows while India’s inflows mostly went into portfolio-centric investments.

In order to minimize risk, the majority of the inflow funds in Asia are being invested with portfolio centric asset classes such as real estate and equity markets instead of Greenfield operations; witness the now unbelievable real estate values in Hong Kong, Singapore, Malaysia’s cities and to a lesser extent Bangkok. This has created concerns regarding how to minimize the inflow spillover into asset markets in Asia in order to prevent another bubble.

Too late for that I’d say.

Additionally, these inflows are creating synthetic demand for local currencies in Asia which in turn have an effect of eating into the competitiveness of these economies as foreign exchange rates surge against global major currencies such as the US Dollar, Yen and the Euro.

The problems arising from these abnormalities of capital inflows in Asia has created its own set of problems, and regulatory restrictions are being imposed across the region to curb the externalities, such as diffusing asset bubbles.

Malaysia for example is imposing a 30% tax on real estate, which is seeing a rush to exit by domestic players. Interestingly I’ve still seen western investors continue to rush in. I can only guess they don’t read the tax codes when deciding if they want that nice villa in Kota Kinabalu.

On the other hand, central bankers in the developed economies are living with a looming fear of a liquidity trap as these Asian economies are booming at their expense instead of creating sustainable growth at home.

Rocks and hard places…and the music plays on.

– Chris

“There are few options for emerging market countries to control the impact of capital inflows.” – Kristen Forbes, MIT Sloan School of Management

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/Ov4mWgwbsb4/story01.htm Capitalist Exploits